What’s a Zippyloan?

ZippyLoan is a free online service which matches customers with lenders for different types of loans depending on customers’ financial needs. The service works with numerous credit institutions that provide loans to clients with good and bad credit score. The company is available 24 hours a day 7 days a week.

ZippyLoan is an OLA accredited company. It complies with the highest standards of business and regulations of Online Lenders Alliance and does its best to protect clients from fraud, which means customers can trust this company.

| Loan types | Min. amount | Max.amount | Period | APR | Documents required | Bad credit |

| Payday loans, Installment loans | $100 | $15000 | 6 – 72 months | Depends on the lender | Driver’s License/State ID #, Social Security Number | Yes |

Zippyloan Credit Options

The online service offers two types of loans:

- Short-term loan (payday loans, cash advance) – this loan is repaid on the next payday (within one month) and ranges from $100 to $1000. These credit options are developed to help borrowers in an emergency situation. The online application for payday loans process is fast and easy;

- Installment loans – this is a larger amount of money that can hardly be repaid in one payment. Zippyloan lenders offer an extended repayment period, which allows customers to repay the loan in small installments over a couple of months (up to 72 months ). This loan variant is more flexible and popular since the monthly repayments are a fixed amount of money. It is easy to manage the loan and plan the repayment scheme because the amount of money repaid is the same throughout the entire loan term. The customers can use the loan for any purpose. The installment loan amount starts from $1000 but cannot exceed $15,000. It can be repaid within 12 months to 60 months.

Zippyloan guarantees to provide the quick access to the funds for you to manage your emergency financial needs on time. Once the client is approved in the lender network, money is usually transferred to the account as soon as the next business day.

Terms of Use

Using Zippyloan, clients can get between $100 and $15000. The approved loan amount will depend on some factors, including income amount, state of residence, employment, credit score, and the lender that you are matched with. However, the service wants you to know that not everyone is approved for $15000 loan. If the customer is not approved for a big loan amount, he is still eligible to apply for a smaller amount. He just needs to follow the instructions provided on the website. The application is sent to more than 100 reputable online lenders ad the client will be offered several options that suit his needs. He can choose the best one.

To apply for a Zippy loan online, customers will need to provide name, address, income and employment information.

The service does not guarantee the approval of all loans. To be approved, a client has to match some criterion:

- Income;

- State of residence;

- Employment status;

- Credit history.

We remind you that Zippyloan.com is not a lender, that is why the exact loan terms will be known to the customer by the lender (such details as interest rate, repayment information). Each lender in the network has his own policies and terms which also depend on the client’s personal information.

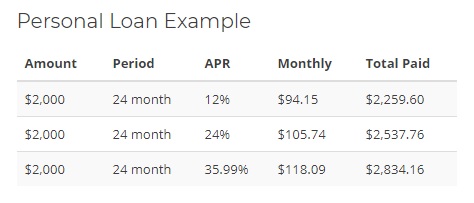

The website presents a representative example of loan terms offered by one of the lenders:

A client should be carefully read the lender’s terms and conditions and bear in mind that Zippyloan interest rate may change if he missed paying the loan.

Application Process on zippyloan.com

At zippyloan.com, the online application process is purely online. After the customer submits his loan application, he will be offered over a hundred trusted online lenders. They offer loans that suit the borrower’s financial needs, at the same time they are safe and reliable. The lending service offers 24h access and the ability to fill in the application from any place which has an access to the Internet. Once approved, the borrower will receive instructions on how to get a loan with the lender.

All in all, the customer has to follow 3 simple steps to get a loan:

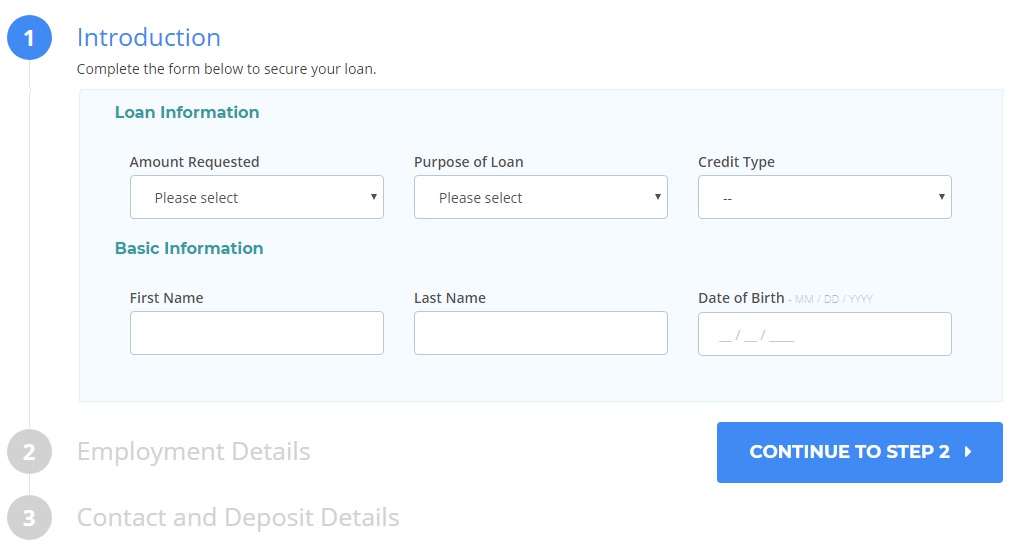

Step 1: Fill in an application online

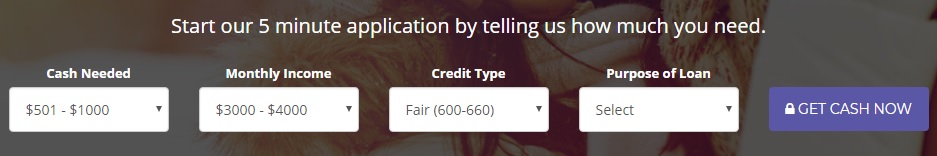

Zippyloan offers an online applying form that will take only a few minutes to fill. Customers appreciate it since they do not need to stand in a queue, just do it at home or any other place with an Internet connection. They can apply through a computer or a smartphone. The application can be started on the main page and looks a follows:

Step 2: Choosing the lender and funds transfer

Step 2: Choosing the lender and funds transfer

Once the client submits his online application, the system automatically connects his with a definite lender based on the personal information provided. As soon as the lender is found, the borrower will be informed on the website. Then he will be directed to the lender’s website for getting detailed instructions on how to get fast cash. If the system is unable to connect the client with a lender, Zippyloan engine will direct him to additional options to help cope with his financial needs. As soon as the final loan is approved, the funds will be transferred to the user’s personal account as soon as the next day.

Step 3: Loan Repayment

The loan repayment information is clearly explained in the loan agreement. Most online lenders offer beneficial and flexible repayment terms, customers you can repay the money within a period of 6 – 72 months. If the system is unable to find a lender who matches the client’s installment needs, it can offer a short-term loan to cover his emergency cash needs.

Loan Repayment on zippyloan.com

Most of the Zippyloan lenders provide flexible loan repayment periods, and borrowers can repay the money in several equal installments. Payday loans are usually repaid on the next payday. Installment loan repayment period extends up to 72 months. It also depends on the amount of money demanded by the client. If borrowers require a smaller amount of money, they can use short-term online lenders.

Does Zippyloan Offers Loan Extension?

Most lenders from Zippyloan system offer loan extensions and alternative beneficial repayment options in some cases. The borrower should contact his lender directly to learn the available variants.

Zippyloan.com Bad Credit

Zippyloan says that everyone deserves the access to online loans, that is why it serves equally for all customers, no matter they have a good, average or bad credit score. The most important factor is to confirm eligibility and employment. So all people are treated equally. Even borrowers with bad credit can be approved for a Zippy loan.

Moreover, the company offers a chance to improve the client’s credit score by taking a payday loan and repay it on time. This will positively affect the user’s eligibility for a loan in the future. All you need is a steady income and personal details to get an approval.

Technical Characteristics of the Website

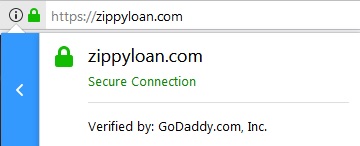

Is Zippyloan Safe in Terms of Connection?

ZippyLoan promises to protect all data and privacy online. For this, the website provides a 128-bit SSL encryption, which is verified by GoDaddy.com, Inc:

This encryption is considered a minimal one, which can guarantee the highest protection of personal data. It would have been much safer if the service used 256 bit SSL encryption: In general, 128 bit might be enough to protect your data, but the service should not misguide the users by saying they are having a 256 bit SSL encryption (as indicated on the website).

Checking Mobile Version

This website is considered a Mobile-Friendly by Google online checking service:

A mobile website makes the life of customers easier. All mobile pages look good and function properly. We noticed no horizontal/vertical scrolling, all information is displayed correctly. The structure and functionality of the mobile website’s version are a little changed, but the information and style remain the same.

We conclude that ZippyLoan.com mobile version can fully perform all issues on this website.

Checking Antivirus

Zippyloan claims to be highly safe and secure due to modern technologies. However, we found no antivirus on the website.

With antivirus, borrowers would have felt more secure when visiting this online service: an antivirus program guarantees that user’s devices will not be infected with dangerous viruses and unnecessary software. With an antivirus program, Zippyloan would be a more trusted company.

Convenience of Using Zippyloan.com

The online service guarantees an easy and quick application process. The client can start an application right on the front page by clicking “Get Cash Now”. Borrowers do not need to register on the website.

Zippyloan online application is really simple and requires only a few minutes to fill in. Users have to provide the standard personal information like:

- Full name, date of birth, address, phone number, email address;

- Driver’s License number, Social Security Number;

- Income information (amount of salary and how frequent you receive it);

- Employer’s name and his phone number

- Account number.

Once you finish the application, the service will match you with a suitable lender from the system for your needs.

Finally, you will be referred to the lender’s website. Here you can get acquainted with all loan details: interest rate, terms, and conditions. The online lender will make a loan offer, and you have to decide whether you agree or not.

Zippyloan service seems to be really useful, as it helps people to find the best option for short-term and installment loans online. But you have to be ready to fill out an online application without knowing the exact loan terms, interest rates, and other fees. So you just have to provide the personal details and hope that the lender will offer a good loan option. Sometimes the offers prove disappointing since they have unexpectedly high-interest rates or short repayment terms.

What we like about Zippyloan.com is that this service is informative and has a detailed FAQ page (of course, with general questions).

Is Zippyloan.com Legit?

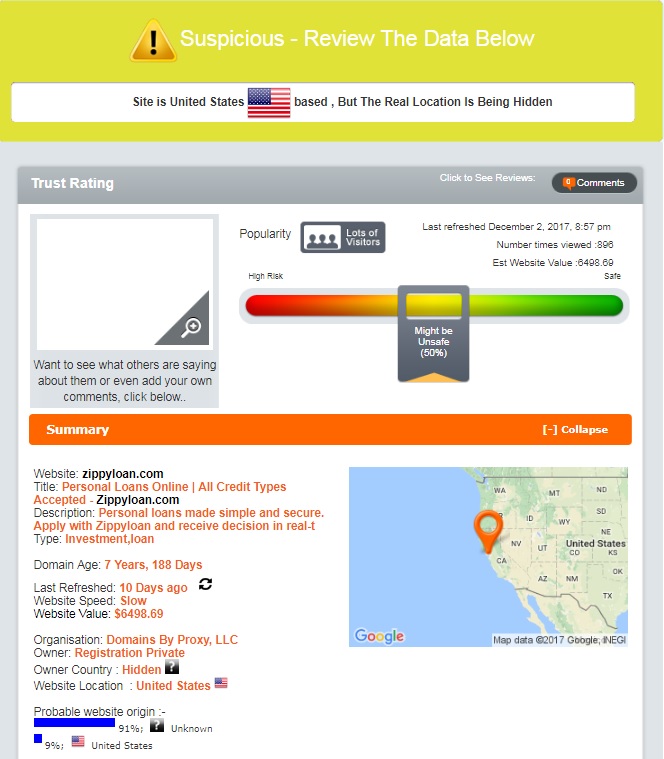

ScamAdviser.com is an online service that gives borrowers the ability to quickly check a lender-matching website before applying for a loan. People need to know that the service is reliable and can be trusted. The analysis results indicate that Zippyloan.com has a medium trust rating – 50% out of 100 and looks suspicious:

The domain age is 7,5 years which is a good age for the online lender. Now we know that the website is not a newcomer and was not banned for a long period. The website is located in the USA but the owner of the website could not be determined because the owner of the website uses an anonymous service to hide its identity. Zippyloan.com has many visitors but the unknown owner country is a good reason for Scam Adviser to give only 50% trust to the service. We suggest borrowers may have a successful deal with this matching service but we strongly recommend to check the physical address of the company before applying.

Zippyloan.com Reviews

On-site Testimonials

Zippyloan.com does not have a special page where borrowers could share their experience with this website. We expected to find at least some reviews since it is the best way to check the website’s popularity and performance. For obvious reasons, we can’t judge about the company’s reliability basing on customer reviews. The only way to search for user comments on review sites for online lending companies

Zippyloan.com Reviews on Third-Party Websites

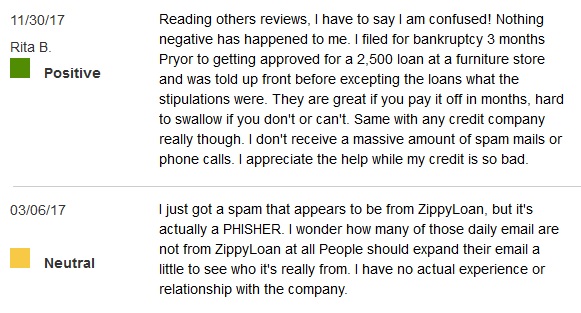

We were able to find some Zippyloan.com reviews on BBB.org. The lending service has received 1.33 out of 5-star rating based on 6 user reviews. All in all, there are 6 reviews: 1 positive, 1 neutral and 4 negative:

So the overwhelming number of testimonials are negative and we were greatly interested in what people say about this service.

One user says Zippyloan are liars who sell personal information to other people. According to the borrower, the company doesn’t approve loans to users who have less than 659 credit score, though the website advertises loan approval to all people regardless of their credit history.

Other disappointed customers complain of getting spam from this “failing” company with no option to unsubscribe.

However, there is one customer who had a good experience with Zippyloan company. One of them was approved for a $2500 loan in a difficult financial situation and paid it off successfully. He says it’s a great company if you repay your loan on time. He does not receive any phone calls or spam.

One more user received an email spam which seemed to be from Zippyloan company but proved to be from another. He had no history with this service and has no idea how they found him.

So, we do not really like what was revealed about Zippyloan services. Obviously, they have real problems with spam and advertise the conditions they can’t actually fulfill. One happy user is just not enough to trust this lender. We hoped the company received more positive responses during 7 years of operation.

Contact Us section

Zippyloan.com Contact Information

Unfortunately, we found no Zippyloan contact information on the website: no physical address, no email, no Zippyloan phone number. Probably, they did not give any contact details because they only match the borrower with the lender. However, in some situations, users may need to reach the manager of this online company. Zippyloan.com can’t be considered a transparent website and this some customers may refuse using its services because of this fact.

Zippyloan.com Locations

Zippyloan operates in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, Wisconsin, Wyoming

Zippyloan services are not available for people living in West Virginia, New York, and District of Columbia.

The broad availability is a undeniable advantage of this online service.

Customer Support Service

The website contains no contact information, which means Zippyloan customer service is not available (perhaps due to the fact that this is not a lending company). Still, we believe there may appear some questions to this very company. Borrowers should be ready to solve all the questions with the lender, not with the matching service.

Conclusion

Zippyloan seems an easy, flexible and convenient service if you need up to $15,000 urgently. It offers both installment and payday loans. It does not look like a scam service but a legit company who connect customers with the trusted lenders out of its network. The website has a simple and quick application process and you can get cash very quickly if you are meeting all the criteria for the company. We could not find a huge number of reviews from borrowers who had any experience with this service but there is at least one client who is fully satisfied. Zippyloan promises to offer loans to customers with different credit history, however, several customer reviews disprove this fact. Another disadvantage is that the service does not approve loans to the unemployed people. Customers should also bear in mind that this service does not provide customer support – that is another reason for us to lower the final rating. However, in our opinion, Zippyloan.com is a quite safe way to find the suitable lender online at the fastest speed. The company deserves 3,2 stars out of 5.

Ready to Apply?

Ready to Apply?