Icash.ca Self-Introduction

Icash.ca is an online money lender granting short-term microloans to all citizens of Canada and provinces. The company own all necessary licenses required for payday loans in every province. The company offers attractive and affordable terms without any additional charges.

Icash.ca is an online money lender granting short-term microloans to all citizens of Canada and provinces. The company own all necessary licenses required for payday loans in every province. The company offers attractive and affordable terms without any additional charges.

The company operates online, so you don’t need to wait in long queues. You only send application online and receive money on you account on the same day. The terms are clear and simple, all necessary information is given on the website, but you can contact the support group to get consultation.

| Types of loan | Min amount | Max amount | Interest rate | Terms | Documents required | Bad credit history |

| advance loans flexpay loans | $100 | $1500 ($750 for first-time customers) | depends on province | 7 – 45 days | none | yes |

Types of Loans

There are two types of loans:

- Secure loan – has a complex application and approval process and variable interest rates. It is tied to property or personal assets, and failure to repay the loan results in consolidation of property or assets. Loan amount is larger and is given out for longer periods of time, often years. Secured loans are often used to pay off large items such as tuition or mortgage;

- Unsecured loan – has a quicker application and easy approval process. No property or personal assets are tied to the loan, so an unsecured loan has a higher interest rate. An unsecured loan is for smaller amounts of money, and the loan is short-term, meaning that the money is borrowed for a small amount of time such as weeks or months. Failure to repay the loan may affect your credit rating.

Icash.ca offers only unsecured loans. There are two kinds of unsecured loans that customers can take at Icash.ca:

- advance loans – repaid with your next pay check;

- flexpay loans – have a more flexible repayment schedule, spanning 34 days.

The company issues money on your bank account on the same day as application, there is no information about in-store services, so possibility of getting cash is unknown.

Terms of Use

Icash.ca offers to take from $100 to $1500. The first-time customers can take only $750, but if the loan is repaid on time, next time these customers can take up to $1500. The interest rate depends on the province you live in and are as follows (per $100 borrowed):

- Alberta – 15%;

- British Columbia – 17%;

- Ontario – 18%;

- Nova Scotia – 22%;

- Saskatchewan – 23%.

To qualify for a fast online loan from iCash, you must the following several requirement:

- be at least 19 years old;

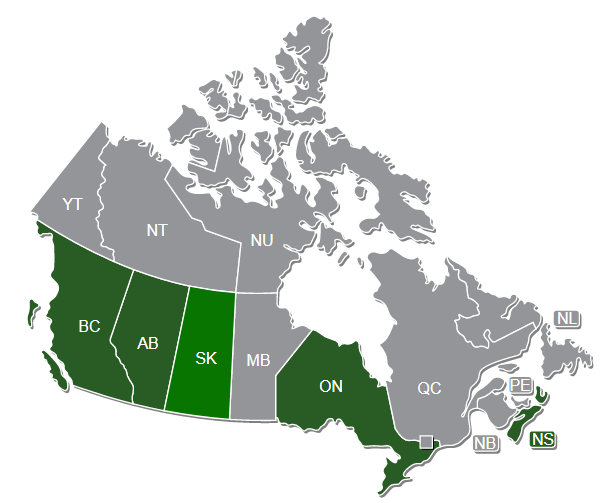

- be a Canadian citizen and a resident of British Columbia, Alberta, Saskatchewan, Ontario, or Nova Scotia;

- be employed with the same employer for the past 3 months;

- have a Net income of at least $800/month;

- receive your pay by direct deposit;

- have a Canadian bank account that is open for at least 3 months;

- have a valid phone number, address, and e-mail address;

- not have filed in the past or have intention to file bankruptcy.

As you can understand from this list, unemployed customers can’t get a loan here, as their solvency is doubtful and can’t be confirmed. In other aspects, it can be said that the company has basic requirement as most similar companies do. Most customers can easily meet these conditions and be approved.

For application you will have to provide some personal information to the company, such as:

- full name;

- address;

- phone numbers;

- employment information;

- your bank account details for direct deposit of funds.

This information is required in order to make instant decision. To increase chances of being approved, be sure to provide as much information as possible during online application and make sure that everything is well-written.

Application

Icash.ca clearly states that no documents or guarantors for application are required. All you need to do is to fill in application and submit it. The company will check solvency of the customer basing on information provided in the application.

There is no clear information about how long the application is reviewed, but the company claims to issue money if approved on the same day. So we can conclude that application is reviewed within several hours or even minutes. Some customers claim to get money within an hour after filing an application.

Of course in case of some troubles in reviewing you application the company may ask to verify some information, but iCash has completely refused from e-mailing or faxing any papers, everything appears online only.

Repayment

In order to make repayment process as easy as possible for you, the company automatically charges your bank account on the due date for amount specified in the contract. On your due date, make sure you have enough money available in your bank account for payment in order to avoid any additional late fees.

There available 2 repayment plans according to the type of loan you chose:

- cash advance: repayment between 7 – 45 days after approved;

- flexpay: 2 repayments between 7 – 45 days after you approved.

If you have opportunity to pay off you debt early, the company encourages such actions and charges no additional fees for early repayment. Early repayment helps to improve your credit score and save on interest.

If you miss payment the company charges additional fees the size of which is determined by the province you live in:

- Ontario – $48;

- Nova-Scotia – $40;

- Alberta – $25;

- Saskatchewan – $50;

- British-Columbia – $20.

In case of non-repayment of your debt the company will be forced to transfer you loan to external collections which will apply more additional charges, so the company sincerely recommends to repay your loan on the due date, to avoid any troubles. Besides non-payment of your loan will adversely affect your credit history which will in future lower you chances for any other loans you will be willing to take in other institutions.

Extension

If you can’t make payment on the due date the company asks to contact the support group at least 3 days before the due date to avoid any troubles and late fees, but the company claims that they do not offer rollovers, so plan you expenses carefully to repay your loan on time.

The company sticks to the policy of «one loan at a time», so there is no opportunity to increase amount of the loan you have takes, as well to take another loan while the first one is not paid off yet.

For the first time in Icash.ca you can apply for up to $750. If you pay back your on time, you will gradually be eligible to borrow up to $1500. If another situation arises and you need to borrow money again, loan application process will be quicker than the first time. Since most of your information are saved in your account, you can simply log in, confirm existing information and apply for another loan. The company considers each application on individual basis, so repeat borrowers are not guaranteed approval because they have borrowed from this company before.

Icash.ca Bad Credit History

Icash.ca claims to approve loans even to customers with poor credit score. The company focuses on repayment capacity of the customer rather than on credit history, so if you are concerned about not getting approval because of the past poor history, be sure that you application will be attentively reviewed despite bad credit.

Still remember that good credit score increases your chances for approval. Besides if you repay you loan from iCash on time without any troubles, your credit history will be improved, which in future will allow you taking loan in other banks and lenders.

Technical Data of Icash.ca

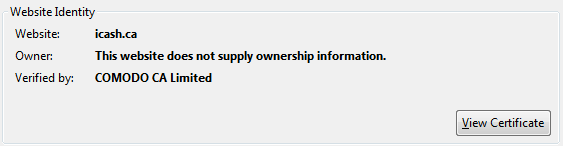

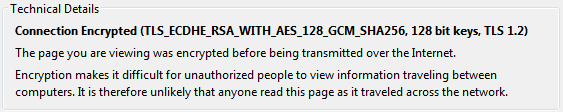

Secure Connection

Most responsible organization in the Internet do their best to provide their customer the best services. This applies also to the security level on the website. Secure connection is very important as it protects customers’ data from theft and unauthorized access. You can see that many popular and proved services have «https://» protocol which ensure data protection on the website. If you see the green lock near URL address and it is sais «Safe», than be sure that you found a reliable place to cooperate with.![]()

Icash.ca is also in the list of such organization. The company uses data encryption when sending it to the server and safe storage of it. By the way, on the website you can find information that the company uses 256-bit encryption to make sure that personal information is 100% secure on the website. We can easily check this statement. All we need to do is view details of the certificate of safety on the website.

As you can see the company gives us false information, as they only use 128-bit encryption, which is also a good indicator, but not the best. Besides, information about certificate owner is hidden, which doesn’t inspire trust to the reliability of this document. So we can conclude that level of security here is not the highest as claimed on the website.

As you can see the company gives us false information, as they only use 128-bit encryption, which is also a good indicator, but not the best. Besides, information about certificate owner is hidden, which doesn’t inspire trust to the reliability of this document. So we can conclude that level of security here is not the highest as claimed on the website.

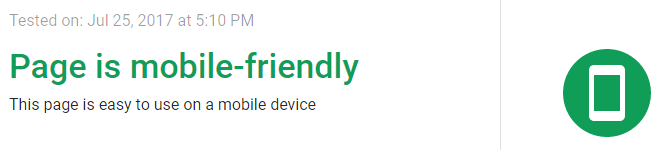

Mobile Version

The website has well organized mobile version, so the customers can apply not only from home, by from any place. All they need is their mobile devises and Internet connection. The mobile version has attractive interface as well as desktop. The test is readable, all links are clickable and there are no noticeable errors. All function are the same as in the desktop version, however there are some changes in the interface for better convenience of use from mobile devises.

Test by Google confirms that the version is mobile-friendly. Though there are some page load issues, they are insignificant, and in general we can say that mobile version is very well worked though and this will help to attract even more customers in present and future.

Antivirus Protection

There is information about antivirus protection on the website. There is no icon or even statement that the website is protected. This means that customers are not protected from malwares and can get in trouble while using this service. We recommend people to avoid using such unsecured services and get their own antivirus program on the device. This will prevent any risk of «catching» something of the device. Consequences can be very sad – your data can be stolen or you device can break. For the company absence of antivirus is a great drawback, so we advise customers to be extremely cautious with this website.

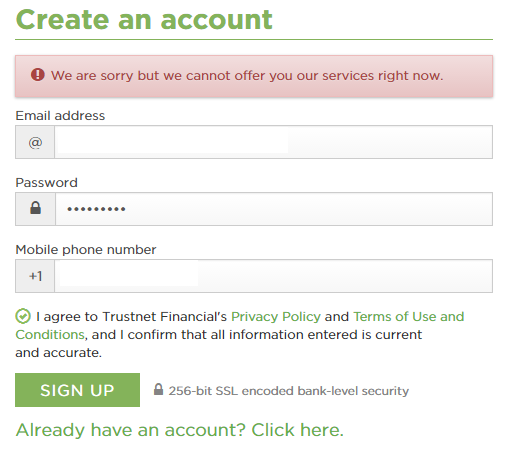

Convenience of Application

To apply for a loan you first of all need to create an account on the website. This can take you a couple of minutes but in future will help to save time on filling n another application.

Unfortunately, we didn’t manage to see how the whole procedure appears to be. There are some problems on the website, so we couldn’t even sigh up.

This is a great disadvantage, the longer such problems are not eliminated, the more customers will be lost. The administration must immediately fix this problem in order not to loose all customers to another more effective service.

In this situation we can only assume that the procedure is similar to other lenders. You will need to provide some personal information and submit application. After that your application will be reviewed and if approved money will be transferred to your bank account indicated in the application.

There is no information about how long reviewing will take, but as the company claims to issue money on the same day, it can be concluded that decision is made during several hours. However there is a statement about pre-approval which takes place in several minutes. So in general the procedure won’t take long and you can solve your problems on the same day as you apply for money at Icash.ca.

Is Icash.ca Legit?

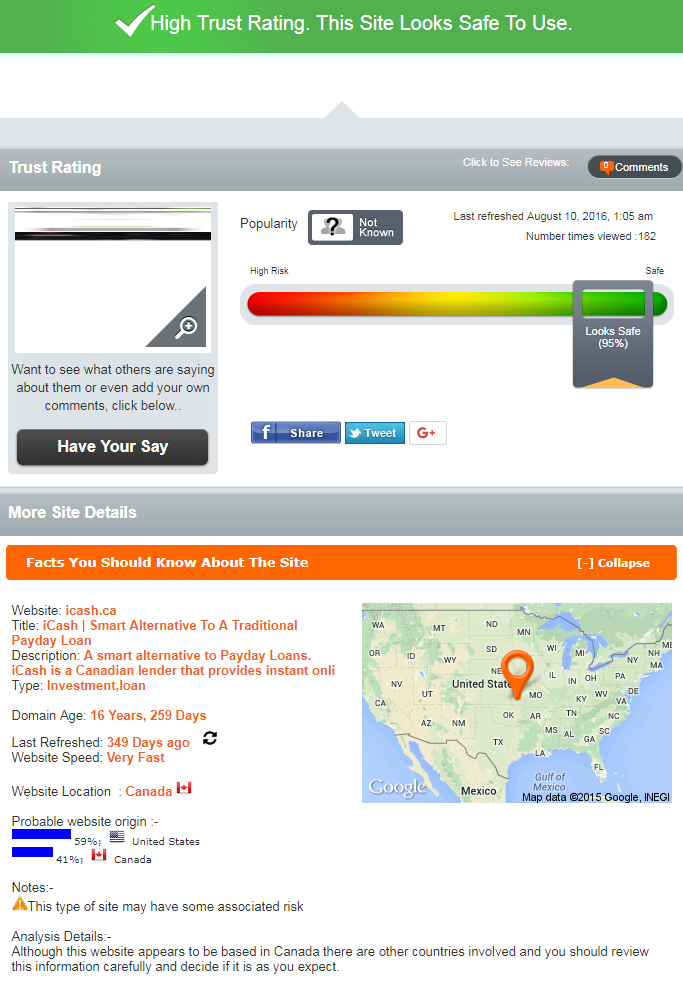

According to ScamAdviser.com, iCash is a very reliable service. Its safety rate is – 95%, however its popularity is unknown for some reason. The domain age is very impressive – more that 16 years, but it was last refreshed almost a year ago, which means that no changes or improvements were made for such a long period of time.

The location of the company is controversial, it is most probably US based, but the company claimed to be located in Canada. Besides, the most strange thing is that no address is indicated in the report. Seems like the company doesn’t have any physical location, but on the website you can find its office address in Ontario.

So despite so high results of the test by ScamAdviser.com we cannot claim that the company is legit and safe to use. There are lots of strange and controversial facts, so review everything again before using services of the website.

Icash.ca Reviews

Reviews on Icash.ca

Unfortunately there is no reviews on the website. We didn’t manage to find any page or section devoted to people’s testimonials. This is a significant drawback for the company, as most customers prefer to read others people’s opinions and experiences with the company before applying for a loan.

There is no special form for leaving comments or complaints. However, in the «FAQ» section you can find information that to report a problem or leave a feedback you can send a letter to their e-mail or call to the support group. But since no comments appear on the website, we can conclude that your feedback is used to solve some problems, but nor for sharing it with other customers.

Reviews on Foreign Resources

We looked through the Internet, but all we managed to find is 1 positive comment on some website, which says that the company is very helpful. Nothing else was found on numerous pages.

It’s a great flaw, that the company doesn’t have any comments on both the website itself and other websites and forums. Looks like the company has no satisfied customer or any customers at all. No one who had ever used this services was willing to share his impressions and experience.

So it is hard to see the true picture of the service quality without any feedback from clients. The company doesn’t encourage customers to leave more feedback and positive reviews, so when other clients look for some information about the company, they will find nothing and will be forced to either take a risk and try the service or find another company.

Contact Center

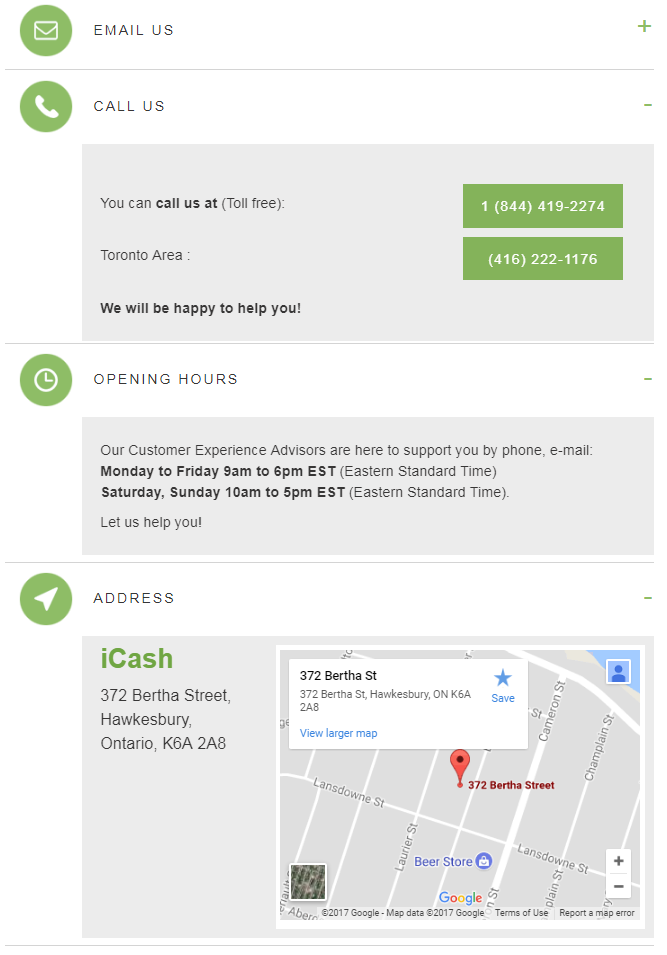

Contact Information on the Website

There is a special section on the website devoted to all contact information that may be necessary to the client. Here you can find contact for, phone numbers, address and operating hours of the support group.

The page itself is attractively organized and all information is maximally detailed to allow any customer come in contact with the company and get consultation. Unfortunately, no live chat option is provided, so there is only 2 choices: call or e-mail the support group. As ScamAdviser.com gave no information about company address, we can’t compare if they match.

Also in the footer there is a button to subscribe for the newsletter to be informed about all special offers directly on your e-mail. This will allow you get information about new options personally for you without visiting the website or calling the support group. If you change your mind for some reason, you may unsubscribe at any time.

Locations

Icash.ca grants loans only to Canada residents, so it is evident that the company is located in Canada. There are 5 provinces listed on the website, where Icash.ca runs its activity.

For each province there is a special page on the website. You can easily find them in the footer. On these pages you will learn about rates and terms set for this particular province. How to repay the loan, the size of late fees and interest rate. Everything is short and informative, chose your province and read all about available conditions for your location.

For your information, we composed a comparative table of rates and fees for all provinces, so you can quickly get idea about the cost of the loan for you personally.

| Province | Rate (per $100 borrowed) | NSF |

| Alberta | $15 | $25 |

| British Columbia | $17 | $20 |

| Ontario | $18 | $48 |

| Nova Scotia | $22 | $40 |

| Saskatchewan | $23 | $50 |

Support Group Service

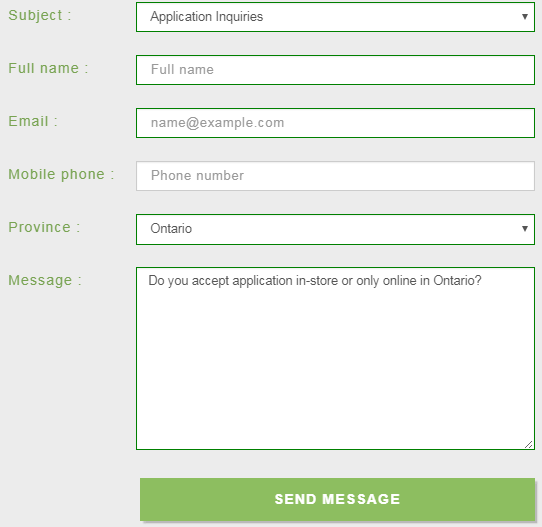

To find out how effective the support group is, we decided to send an inquiry to their e-mail with general question concerning application process. On the page with contact information you can find special contact form for e-mail inquires of customers. We filled in necessary information and sent a request. We got message that the request was successfully sent. All we have to do now is wait for the answer.

After waiting for 24 hours, we still didn’t get information we needed. From this we may conclude that customer service is poor and not client-oriented. Most customers will choose to use another service with more efficient and useful support group.

Conclusion

From everything analyzed above, Icash.ca can be considered quite a reliable service, though there are some moments you need to pay attention to and be cautious about. Though the company offers quite affordable terms, there absent some important options, such as increasing amount of present loan, no delayed payment option, etc. However its legitimacy indicator are very high and the company is considered very reliable.

Information presented on the website is comprehensive and detailed, any question that may appear will be answered on one of the pages of the website. Security level is also decent, though there are some moments tat require to be improved. The support group turned out to be ineffective and this is the main and significant disadvantage of the company.

Ready to Apply?

Ready to Apply?