What is Nation21loans.com?

Nation21loans.com is an online matching service for borrowers and lenders which helps to get quick loans up to up to $10000 even to customers with a bad credit score. Nation 21 Loans is not a lender and does not provide money itself. It works with the most trusted lenders providing payday loans and installment lenders across the United States. Using this website, people have a high chance of loan approval with less paperwork. The lenders from the network of Nation21loans are ready to offer generous loan amounts and acceptable rates. The company guarantees that the borrowers’ personal information will remain 100% secure. The automatic system helps customers to find the beat nearest loan offer within a few minutes. As mentioned, all lenders offer financial services that fully comply with all current state and local regulations and laws.

Nation21loans.com is an online matching service for borrowers and lenders which helps to get quick loans up to up to $10000 even to customers with a bad credit score. Nation 21 Loans is not a lender and does not provide money itself. It works with the most trusted lenders providing payday loans and installment lenders across the United States. Using this website, people have a high chance of loan approval with less paperwork. The lenders from the network of Nation21loans are ready to offer generous loan amounts and acceptable rates. The company guarantees that the borrowers’ personal information will remain 100% secure. The automatic system helps customers to find the beat nearest loan offer within a few minutes. As mentioned, all lenders offer financial services that fully comply with all current state and local regulations and laws.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad Credit |

| Payday loans, installment loans | $100 | $10,000 | 2 weeks – 12 months | from 200% to 1825% | SSN, driver’s license number | Yes |

Types of Nation 21 Loans

Using this website, you can get installment loans and payday loans online.

Payday loans are designed specifically to get people out of an emergency situation. They are a short-term solution, not a long-term problem. Payday loans are usually smaller amounts of money that are to be repaid on your next payday. Such loans have high interest rates and a high rate of approval. Payday Nation 21 Loans are also called cash till payday, high-risk loans, nest day loans, personal loans, 24-hour loans, instant approval payday loans, and so on:

Payday loans are designed specifically to get people out of an emergency situation. They are a short-term solution, not a long-term problem. Payday loans are usually smaller amounts of money that are to be repaid on your next payday. Such loans have high interest rates and a high rate of approval. Payday Nation 21 Loans are also called cash till payday, high-risk loans, nest day loans, personal loans, 24-hour loans, instant approval payday loans, and so on:

Installment loans are larger amounts that have lower interest rates and larger repayment terms. Such loans are repaid in several monthly installments spread across a defined period. Usually, installment loans are paid within 12 months

Installment loans are larger amounts that have lower interest rates and larger repayment terms. Such loans are repaid in several monthly installments spread across a defined period. Usually, installment loans are paid within 12 months

Some lenders from the network of Nation21loans may approve more than one type of loan at a time.

Besides, it was mentioned that some lenders may allow taking an auto loan. Lenders offering such loans don’t require you to stop using your car when you are repaying the loan. You just give the lender the car title while you continue using the car. If you repay the loan in a timely manner, you will get your title back but if you fail to repay the loan, you will have to give up the car.

The funds are usually transferred in one business day either to your checking account or your debit card. Some lenders also offer to make a check in your name.

Terms of Use

In general, the lenders from the network of Nation21loans.com require borrowers to meet the following qualifications:

In general, the lenders from the network of Nation21loans.com require borrowers to meet the following qualifications:

- Legally reside in the United States;

- Have an active checking account;

- Have a minimum income of $2,000 per month;

- Be at least 18 years of age (however, some states require that a borrower is at least 19 or 21).

The lenders work with all credit scores, but a good credit rating may improve your chances of a loan approval and the terms. Bear in mind that each lender has its own criteria for a loan approval.

Most of the lenders require you to have a job with at least $2000 monthly income. However, you can have alternative sources of income that would allow you repaying the loan on time. You may have the following sources of income: Disability Income, Social Security Income, Pension, Income from self-employment.

Also, a serving in the military usually prevents you from getting a loan with Nation21loans.com.

The exact terms of any loan offer are determined by the specific lender. These terms will be stated in the loan contract upon approval.

Nation21Loans.com cannot specify an APR because it is not a direct lender, however, it mentions that the APR may range from 200% to 1825%. The various lender from its network have unique APRs and they depend on the lender’s policy and the loan terms. Besides, there are other factors that can influence the APR:

- The information about your finances;

- The loan amount you want to get;

- The period over which you want to repay the loan;

- The amount paid every month;

- The state you live in.

Using this website, you can request up to $10,000. The final loan amount will be determined by the lender based on your credit history, income, and other factors. If you have used this lender before, this may increase the chance of getting a larger loan amount.

Application

At Nation21Loans.com, you can apply from any place which has access to the internet. The company guarantees a quick and easy application process which takes only a few minutes. Borrowers also have the right to use the money for any purpose since there are no restrictions on how to spend the amount received.

As mentioned, some lenders work 24/7 even on weekends and holidays. However, it’s better to apply in usual business hours.

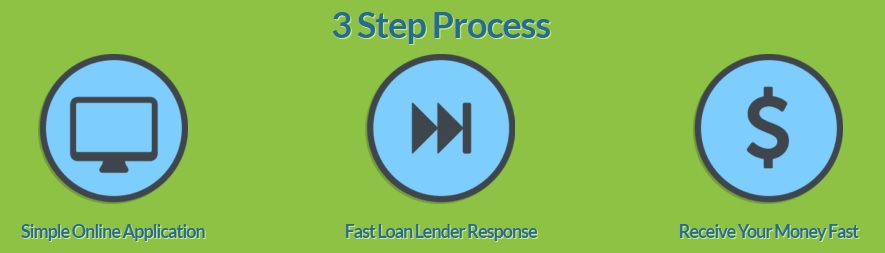

To get Nation 21 Loans, customers need to fill in a 3-step online application which can be started right on the main page:

Once you submit the application, you will receive a decision from the lender within a few minutes. If you are approved for a loan, the online matching service will redirect you to the website of the lender automatically. If the service can’t match you with an online lender, you can still get a chance of getting a loan from financial partners of Nation21Loans.

While you are applying, you can choose from a variety of loan options, repayment terms, and rates. When you receive an offer, you can take as much time as you need to review each option. The lender will never demand that you accept an offer if you do not like its terms and rates. When you accept a loan offer, you only need to sign the contract electronically.

Once you complete the agreement, the company will transfer the requested funds to your bank account or a card the next business day.

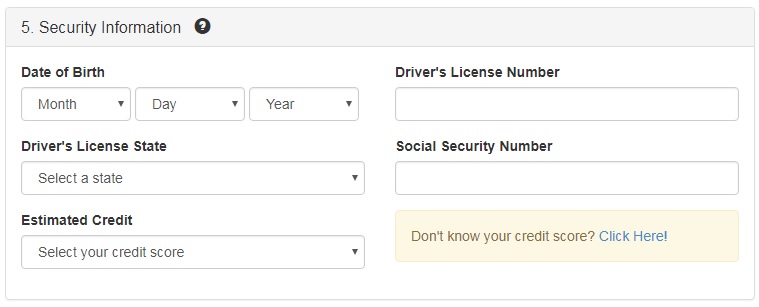

When you fill out an application, you will need to fill in the following requested information: your name, address, email and phone numbers, bank account, income information, SSN number, driver’s license number, and some more. See an example of a Security Information section:

At Nation21Loans.com, there is usually no need to fax any copies of documents to the lender as all transactions are online.

Loan Repayment

As mentioned, different states have different repayment terms. The paying schedule is one of the main factors that affect the loan rates. In most cases, you are to repay the loan in two to four weeks. Depending on your income, you can choose the best lender for your needs. The repayment amount is usually taken from your account on the next day you get paid or on the specified date. You will need to return the loan amount and the additional fees. If you do this, you will have good relations with the lender and avoid fines. Some lenders allow you to pay off the loan through e-money transfer. The automatic cash withdrawal is a good option because it excludes risks of late payments. Some lenders from the network also accept payments over the phone.

If you fail on a loan repayment, you need to contact the lender as soon as possible to discuss the available options. Otherwise, the lender has a right to charge additional fees and penalties, increase interest rates or report non-payment to a Credit Bureaus. Such report may ruin your credit score or make loan very expensive. Besides, the lender may involve a collection agency to get the money. All possible actions in the case of non-payment or late payment are described in the loan contract. You should read this information very carefully. Remember that Nation21Loans is an intermediate service only and never intervenes if you do not repay a loan on time.

Loan Extension

According to the website, some lenders are ready to extend the existing repayment period if you have difficulty repaying the loan but these options require an immediate action. You’d better contact the lender as soon as you understand you cannot repay the loan on a due date.

Besides, Nation 21 may approve you several loans at a time, but the company recommends that you request only the sum you really need, take only one loan at a time and return it before taking another credit.

Nation21Loans.com Bad Credit

Many lenders from the network of Nation 21 Loans works with all categories of borrowers, even those having a bad credit history. Nation 21 is not a lender and does not perform any credit checks, but the lenders may check your credit rating, but that is not the key factor in determining a loan approval. So you have a high chance of approval even if you have a bad credit or no credit history at all.

Technical Characteristics of the Website

Checking Encryption

The company guarantees that the website of any lender you use protects all of your personal information and has a green lock at the left side of the address bad – it is a sign that the website is encrypted. The URL https// means that nation21loans.com is using a secure sockets layer (256-bit) and can guarantee total security of borrowers’ sensitive data. The website is using up-to-date SSL certificates verified by GoDaddy:

In general, I’m satisfied with the encryption level provided, however, a 256-bit secure sockets layer is not the best security measure.

Checking Mobile Version

According to Google, the number of requests from mobile devices has exceeded the number of similar requests from stationary PCs. And over time, this trend only increases. Websites like Nation21Loans.com should be adapted for use on smartphones and tablets. The site should be displayed the same way on all devices.

The website’s mobile version, however, looks a bit different: the content is reduced, there are different buttons. This site is adapted to mobile devices: for example, its download speed is optimized for a certain “gadget”, from which it is opened.

Now let’s talk about the advantages of Nation 21 Loans mobile version:

- Speedy page loading;

- You can easily scroll the page with one finger;

- Convenient layout of the page;

- More convenient design. The test is not small, you do not expand/narrow the screen.

All these advantages simplify the work with nation21loans.com.

Checking Antivirus

Regretfully, this website does not use an antivirus which increases the chances of getting viruses and malware programs to your computer. Some dangerous viruses can steal borrowers’ personal details.

We advise the website’s owner to improve nation21loans.com security to attract more customers. It’s nice to feel you are safe while screening the site.

Convenience of Using Nation21Loans.com

The website is purely online and available 24/7. Potential borrowers do not need to register to start an application. You just need to press the “Start Now” button and complete a questionnaire containing basic fields like name, address, email, phone number, driver’s license, social security number, checking account number, name and phone of the employer, pay frequency, type of income, and so on.

Once you fill out an online application, the service will try to match you with a suitable lender who is able to offer you a loan.

As we have already mentioned, Nation 21 is not a lender and does not specify loan rates and terms – all these details will be provided by the specific lender you are matched with.

In general, an application looks convenient and requires you to provide standard information.

Except for the loan terms and rates, the website is quite informative – the company provides a detailed information about online loans, their types, general features, advantages, and disadvantages. New visitors can find answers to common questions on an FAQ page.

Nation21Loans.com will easily help you find the nearest lender available in your state who is able to make you a loan offer.

Is Nation21Loans.com Legit?

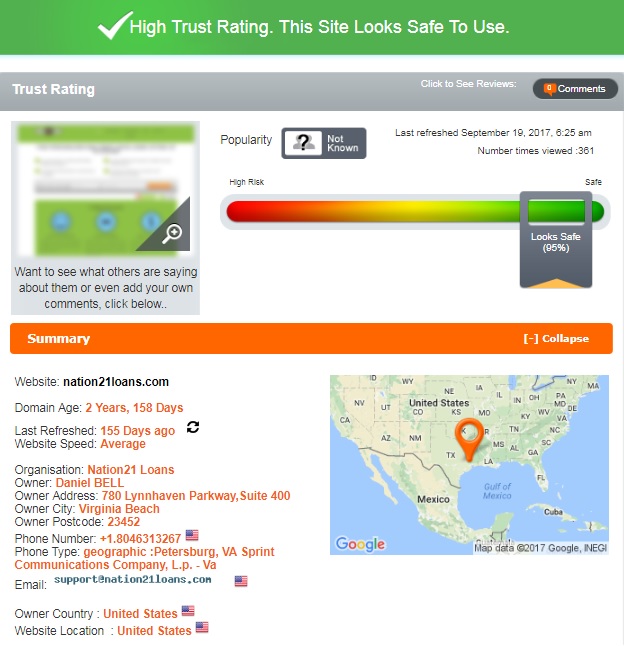

I checked the trust rating of Nation 21 Loans at ScamAdviser.com – it turned out that the company’s rating has reached 95% out of 100%, which means that this service is legit and can be trusted.

According to ScamAdviser, the website is safe to use. The domain age is over 2 years. Both owner country and website location are the United States. However, the verification service was not able to specify the popularity of this website. Obviously, this was the reason why Nation21 received 95% rating out of 100%.

Nation 21 Loans Reviews

On-site Reviews

Positive customer reviews are the best proof that the company provides quality financial products and services. I hoped that this site had a testimonial page but there wasn’t any. Users of this service do not have an opportunity to share their negative or positive experience. I had to look for Nation 21 Loans reviews on third-party websites.

Reviews on Other Websites

Unfortunately, there are NO reviews for this business on the Internet. If you ever use this service, leave a review for us! So far, it looks suspicious that a service with a high trust-rating did not receive any customer reviews during 2 years.

Contact Us section

Contact Information

Nation 21 Loans mentions that contact information of the lender will be displayed on its lender: physical address, email address, phone number. However, the matching service also provided its own contact information: address, phone number (1-804-631-3267), email ([email protected]).

The company mentions that this is a virtual address used generally to accept mails.

Locations

Right now, Nation21Loans.com cooperates with of the lenders in the United States only. In the future, they may include abroad lenders in its system to extend its service to the international level.

So, you can get a loan through Nation21 if you live in: Alabama, Arizona, California, Missouri, Florida, Illinois, Iowa (IA), Kentucky, Maryland, Minnesota, Nebraska, New Mexico, North Carolina, Ohio, Oklahoma City, Rhode Island, South, Carolina, Tennessee, Idaho, Utah, Oregon, Georgia, Michigan, Washington, Colorado, Delaware , Indiana, Mississippi, Kansas City, Louisiana, Nevada, Wisconsin, Texas, North Dakota, Pennsylvania, Virginia.

Getting a Consultation

To find an answer to commonly asked questions, Nation21 recommends to visit a FAQs section, review Privacy Policy and How we work pages. But if you still want to contact a manager of Nation 21 Loans, you can get help by calling 1-804-631-3267 or email at [email protected]. The company promises to help any customer with loan application process.

But if you have any questions regarding loan terms and rates, you should address them to the lender directly. Besides, you should know that Nation21loans will never contact its clients in any way.

I tried to contact the customer support via email to find out how many lenders includes its network. Unfortunately, the answer did not come as soon as I expected.

This means that you should be ready to wait for many hours to get an answer to your question, or you may try to call the specified phone number. Probably, you will be luckier than I.

Conclusion

Nation21loans.com is a matching service which has many advantages: a high trust-rating, an easy online application, bad credit is ok, less paperwork, a quick lending decision, you don’t need a collateral, loan amounts up to $10000, a quick turnaround time, no lengthy contracts. But I still have some doubts about this service since I found no customer reviews about Nation 21 Loans. I give this website the rating of 3,7 stars out of 5 and recommend you weight all risks and benefits of this service before applying for a loan online.

Ready to Apply?

Ready to Apply?