What is Lendgreen?

Lendgreen.com is an online lender which allows customers to get up to $1500 in their account as soon as tomorrow. Lendgreen is owned and operated by the Lac du Flambeau Reservation. It’s a tribal lender, and the funds generated through loans support government projects. They guarantee secure transactions and quick application process, which make it easier than getting the money from a local lender. Lendgreen is an accredited lender and a member of the Online Lenders Alliance (OLA), which means, you can trust this company committed to the highest standards of operation, ensuring the best possible experience for customers, fully compliant with the federal law, and doing their best to protect consumers from fraud.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Poor credit history |

| Installment Loans | $400 | $600 (first time customers), $1500 (returning customers) | 3 months up to 18 months | 720% – 795% | SSN, driver’s license or ID number, Account Number, Routing (ABA) Number | Yes |

Lendgreen Loans

Lendgreen.com provides Installment loans. These loan terms vary from a minimum of 3 months to a maximum of 18 months, depending on the loan amount and the customer’s ability to make a payment amount each due date.

Customers are able to make additional payments and repay their loan at any time by contacting Lendgreen customer support service least 3 business days prior to the next due date.

The lender deposits the money from the loan directly into the customer’s designated bank account. The majority of clients receive the funds within 24 hours or the next business day, the delivery range may vary depending on banking requirements.

With Lendgreen, customers can also choose to get the money the same day using their wire transfer service for a $12 transfer fee.

Terms of Use

Lendgreen lending requirements vary by state. The common criteria for getting a loan from this company are the following:

- Be a U.S. Citizen;

- NOT reside in the following states: Arkansas, California, Georgia, Maryland, Minnesota, New York, Pennsylvania, Virginia, West Virginia, and Wisconsin;

- Not be a member, spouse or dependent of the military.

- Be at least 18 years of age;

- Have a source of steady income that meets Lendgreen (minimum $1100)

- Have a checking account that is ACH accessible.

The first-time borrower can borrow between $400 to $700 with Lendgreen. The approved loan amount depends on the information provided in the online application. Returning customers can get up to $1,500.

The lender offers variable loan term. Lendgreen loan terms can vary from 3 to 18 months, depending on the amount customers borrow and their ability to repay the loan.

According to the website, the average APR varies from 720% to 795%. The longer customers take to repay, the more it will cost, because the interest will continue to accrue until the end of the loan period. The lender recommends to pay back the loan as quickly as possible in order to save money.

Loan repayment dates are predetermined based on the details in the loan contract. So customers need to read this carefully before signing to make sure they can really afford the specified payment schedule and the high interest rate. The company advises not to sign the contract if the customer feels like he will not be able to successfully repay the loan.

Application Process on Lendgreen.com

With Lendgreen, the entire application process is done online. All applications are processed in the head office of the company – Wisconsin. Clients must complete an application form that takes a few minutes to complete.

If you are a new client you must click on the Apply Now button and fill out an online application. After you press Submit you will be notified if your online application has been pre-approved by the lender. If you are a returning customer, you can log in to your personal account and take advantage of Lendgreen express application:

The lender guarantees that customers will find out if they’re approved in seconds:

As specified on the website, a Lendgreen manager will contact the customer and guide him through the rest of the application process, or he can speed things up by signing the loan agreement electronically. The company will then transfer the funds to the borrower’s bank account, typically by the next business day.

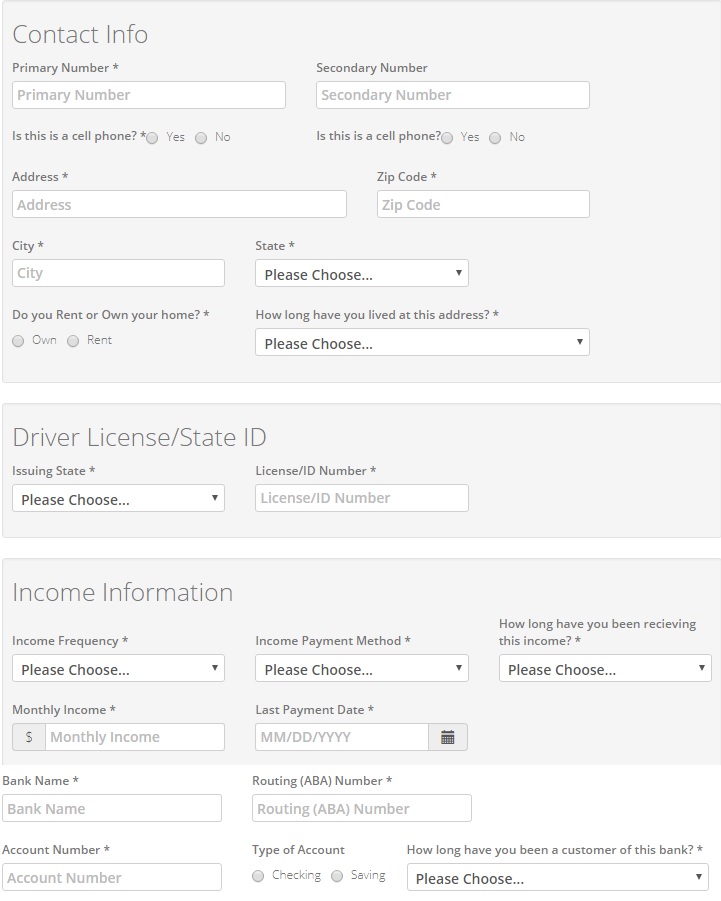

- With Lendgreen’s application process, customers need to provide the following information:

- Name, contact details, date of birth and SSN;

- Details from a valid form of ID (Driver’s license number or ID number);

- Income details and pay schedule;

- Banking information (Bank, account number, routing (ABA) number).

In some cases, the lender may require borrowers to send copies of recent bank statements or pay stubs. In this case, they can fax the documents or scan and send them via email.

Loan Repayment on Lendgreen.com

With Lendgreen, customers will be able to repay their loans in installments based on how often they get paid (unlike payday loans). Customers can take benefit of repayment flexibility. They can make payments towards their loans automatically via direct debit, or send money orders, cashier’s checks or certified checks via mail. This lender allows making additional payments at any time. Thus, clients can reduce the total cost of the loan by repaying the loan prior to the last due date on their payment schedule or by making additional payments on or between their payment due dates. This means that borrowers control how soon they wish to pay off the loan. Lendgreen charges no fees or penalties for early repayment.

Lendgreen offers two payment methods:

- Automatic money withdrawal from the borrower’s checking account using an Automatic Clearing House (ACH) direct debit system each scheduled date;

- Money Orders, Certified checks, Cashiers by mailing the funds to the address below. If customers are mailing in payments, Lendgreen recommends they mail the customer support service 5 business days prior to the scheduled date to ensure it is received on time.

All repayment dates will be determined before signing in the loan agreement. Customers should pay attention that failure to pay for a loan can result in a $30 fee + an NSF fee. In addition, the loan can go into collection, which can result in even more costs. Avoid this by only taking out as much as you can afford and budget for the extra costs.

Does Lendgreen Offer Loan Extension?

The lender offers a repayment option for customers who are not able to repay a loan in the shortest time. The Multi-Pay Option prolongs loan repayment to up to 35 monthly payments. This option is more expensive than usual payday loans. Bear in mind that customers can get only one Lendgreen loan at a time. Once they repay this loan, they can borrow again and even get more money. This could take up to 5 business days.

Besides, when using Lendgreen a second time, clients will enjoy an even simpler application process when they log in as «returning customers”.

Lendgreen.com Bad Credit

With Lendgreen, bad credit history is OK. Of course, the lender takes your current financial situation into account before approving your loan. But if you have the minimum monthly income specified in the loan terms, you will be able to get a loan from this company. Unlike another lender, Lendgreen doesn’t perform traditional credit checks that could affect its decision, but it might use other credit checks to see the customer’s loan repayment history.

Besides, the website contains much useful information, including the aspects lenders usually pay attention to before taking a decision: the date you began taking loans, whether you had late payments and non-payments, whether you have any debts, information about bankruptcy. Here you can also find useful information on how to check your credit score and how to improve it.

Technical Characteristics of the Website

Is Lendgreen.com in Terms of Connection?

On Lendgreen.com, customers should provide much personal information, such as Id number, Social Security Number, and banking account. So, it’s very important to know that your personal data is secured. The Firefox browser indicated that lendgreen.com is secure, however, the security level is minimal – a 128-bit SSL encryption. However, this might be enough to protect borrowers’ information from identity theft. The browser address bar has a green lock which indicates that the SSL certificate is functioning correctly but the owner of the website is not indicated. All we can see is that encryption is verified by DigiCert Inc.:

In addition, the website is DigiCert trusted which confirms SSL certificate, registration, address and email address:

It would have been much better if the service has used the maximum encryption level of at least a 256-bit SSL encryption, however, in general, it seems that Lendgreen.com is a safe place for taking loans online.

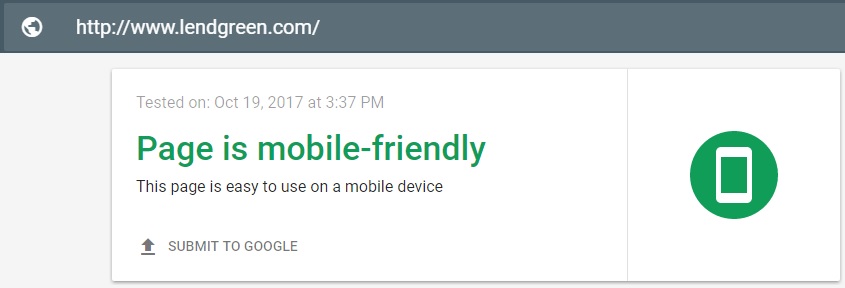

Checking Lendgreen.com Mobile Version

Lendgreen.com website is well adapted for mobile users. We noticed no scrolling, all information is displayed correctly. We would say that it’s even more convenient to use a mobile version because all secondary information is removed from the front page. In addition, Lendgreen.com has successfully passed a Google test:

No doubt, the presence of a mobile version is important and can be very useful for people who prefer using mobile devices for such purposes or can’t leave the house for some reason.

Checking Antivirus

Unfortunately, the website uses no antivirus, which is a big disadvantage, since the users’ computers become vulnerable to malware and viruses. All users want to feel secure when visiting websites, so it would be preferable to see the website uses an antivirus program. For now, Lendgreen.com is not the safest place to take loans.

The Convenience of Using Lendgreen.com

Lendgreen loan application is purely online, so customers can apply for a loan right from their mobile phone or computer. Customers do need to register and create a personal account if they do not want to, and this is a big advantage. But if you want to get a total control over your loan management or want to take Lendgreen loans for more than once, you’d better take some time and create a personal account (and do not forget that return customers can get bigger loan amounts):

The loan application requires only the necessary information and is very convenient: the form includes all the fields on one page: Personal details, Income details, Banking information, so at first glance, you can see which information is required:

In addition, the website is very informative: the lender has created a separate Rates page with Lendgreen details about rates and loan repayment, and representative examples. Customers can also get much useful information by viewing the FAQ page, which answers the most common questions the company receives from customers.

Regretfully, the website does not have a loan calculator which would have specified the fees, interest and the final cost of a Lendgreen loan.

In general, Lendgreen seems a convenient website for getting loans online. The entire process takes only a couple of minutes or less if you are return customers. Still, there are some things to be improved.

Is Lendgreen.com Legit?

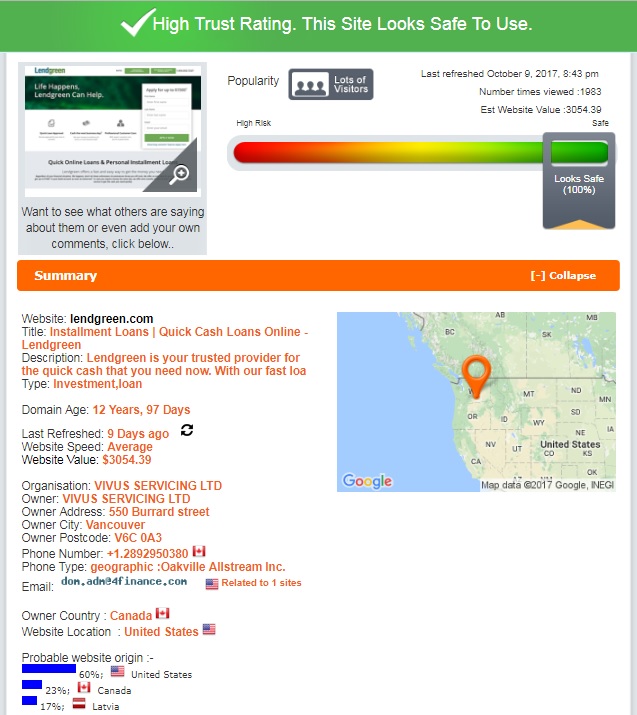

We used Scam Adviser – a reliable website checker – to determine the background information of Lendgreen company. According to the online service, the website has the maximum trust rating – 100% – and is safe to use:

We were quite satisfied with the information we revealed: the site has many visitors and shows a healthy online activity. The website owner is Canada. The domain age is 12 years. However, ScamAdviser was skeptical about the website origin: it could be the USA, Canada or Latvia, so borrowers should review this information carefully before using this lender.

Lendgreen.com Reviews

On-site Lendgreen Reviews

A lender like Lendgreen.com often suffers from poor reputation because such loan online usually have high interest rates and are often provided to people with bad credit history. So we were interested in Lendgreen customer reviews. Regretfully, the website does not have a special section devoted to customer reviews.

That is why we could not check the reputation of this lender from customer on-site reviews and search for any comments on third-party websites, which will be reviewed in the following unit.

Lendgreen Reviews on Third-Party Websites

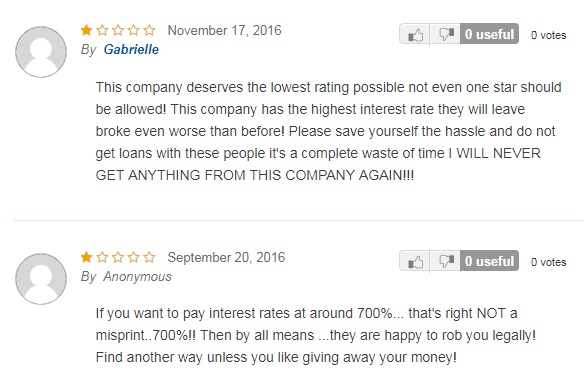

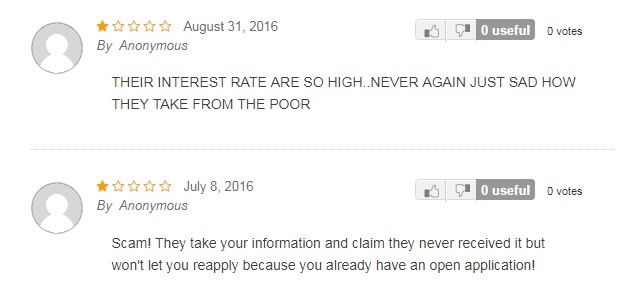

Since the lender has been operating for more than 17 years, we found many reviews on third-party websites and forums. supermoney.com contains 18 Lendgreen reviews. Unfortunately, most of them are negative. We found complaints about sky-high interest rates. One more complaint was about an application process: the lender does not allow you to reapply once your application was declined. The most complaints are dated 2016:

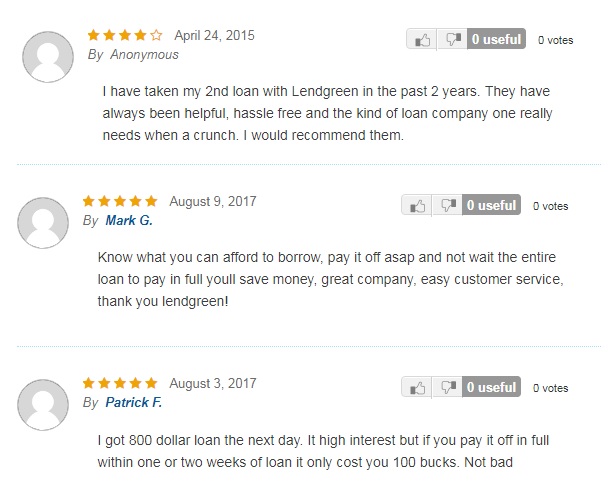

But some customers seemed to be happy with Lendgreen services. They say the lender does its job well and hassle-free. One user mentioned a helpful customer service, another said the lender was especially beneficial to those people who can repay their loans as early as possible. Look at some screen below we have selected for you:

Although we found some complaints about Lendgreen high interest rates, we did not find any reviews testifying that this company is engaged in an illegal business. Thus, the available customer reviews give us evidence that this online service is legitimate.

Contact Us section

Lendgreen Contact Information

The website Contact Us section contains all information customers need to know about the lender: phone number, email address, office address:

They also specified Lendgreen operating hours. We appreciate that the company is as transparent as possible.

Lendgreen Locations

The company has a large availability. They provide installment loans to people in over 40 states.

Bear in mind that Lendgreen is not available in the following states: Arkansas, California, Georgia, Maryland, Minnesota, Montana, New York, Pennsylvania, Vermont, West Virginia, Wisconsin.

Lendgreen mentions that availability of loans can be changed at any time at the sole discretion of the lender.

Customer Support Service

Customers can contact Lendgreen customer support service at any time Monday through Friday 7 AM to 12 AM, and Saturdays 9 AM to 5 PM or call 1-855-832-7227 or by sending an email at [email protected].

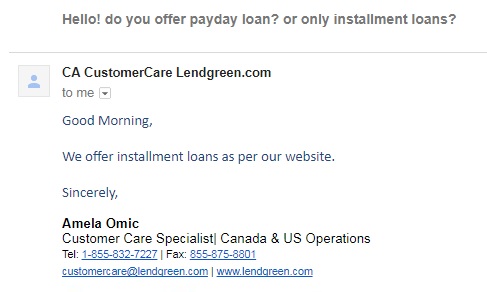

Live Chat is not available on the website, so we had to contact the lender by email. We wanted to find out whether the company provided only installment loans, or payday loans were also available. We received a feedback 1 hours later. Lendgreen representative informed us that they offer installment loans only, as specified on the website:

The reply wasn’t immediate, but it came within an acceptable time interval. Of course, we would recommend introducing a Live Chat for instant messages. In general, we were satisfied with the answer and customer support service

Conclusion

The advantage of Lendgreen is that this company provides fast cash to customers with bad credit. Besides, we like the application process – it is simple and short. The site is well-arranged and clearly specifies all rates and terms of Lendgreen loans – there is not a single detail left unclear to us. The rate for installment loans is acceptable, but not the lowest possible option on the net. We also appreciate that this lender is direct and has an encrypted application page. Scam Adviser is also satisfied with activities of this service and there are no reviews which would undermine the credibility of this company. Lendgreen flexible repayment schedule can also seem attractive to some customers. In general. Lendgreen is a legal service which could help you in a difficult situation, but it specializes on installment loans only, so if you are interested in other loan types, you will have to search for other lenders.

Ready to Apply?

Ready to Apply?