What is Check City?

Check City (checkcity.com) is a lending institution being in financial business for 14 years already been founded in 2003. Check City offers clients two main methods to take a loan: in-store and online. Check City has representation in the following US locations: Colorado, Nevada, Utah, Virginia. Check City is proved to be a member of BBB (Better Business Bureau), CashWise (Financial Services Software), CFSA and UCLA.

Check City has been present in the following social networks to make for clients to contact site administration quicker:

| Types of Loans | Min Loan Amount | Max Loan Amount | Interest Rates | Period | Documents | Bad Credit History |

| $ 50.00 | $ 2 500.00 | agreed individually | agreed individually |

| YES |

Types of Loans

CheckCity.com offers the following types of loans for clients living in Colorado, Nevada, Utah, Virginia exactly:

- cash advances – is used for short-term financial needs only, not as a long-term financial solution.;

- payday loans – is a superior alternative to late, overdraft, over the limit, and reconnection fees as well as the long-term affects that such fees can have over time due to changes in your credit score. A payday loan also gives you access to money you need to take advantage of great sales or limited time offers that you would otherwise miss out on if you waited till payday;

- check cashing – to cash a check, just bring your check and a picture ID into one of our stores, fill out a quick customer information form, and walk out with your cash;

- installment loans – with the new Installment Loan service, you can get the money you need, when you need it, now with a new more flexible payment plan;

- business check cashing – are you a business owner seeking immediate cash for supplies, payroll, and payables? Check City cashes checks made payable to your business;

- installment loans Colorado – with the new Installment Loan service, you can get the money you need, when you need it, now with a new more flexible payment plan;

- installment title loans Utah – fast, easy way to borrow against the value of your car;

- title loans Utah and Nevada – with a title loan you can choose from a variety of payment options;

- money orders – Western Union money orders at all of our Check City locations;

- prepaid debit cards – Visa or Mastercard—without a credit check or even the need for a checking account;

- prepaid wireless – prepaid phone card that’s right for you from the many different options and plans ;

- gold buying – a client can sell scrap gold, unwanted or broken jewelry, silver, platinum and more at many of our Utah, Nevada, Virginia or Colorado Check City locations;

- money transfers – authorized Agent Location with Western Union — which makes it convenient to send money anywhere in the world;

- tax services – Check City can file your federal and state tax return year round;

- insurance – help you quickly find affordable insurance you can trust;

- bill pay services – you can pay your bills at any Check City location.

As it was mentioned above, Check City offers two types of services: online and in-store that’s why a client is able to get money hand in hand in any Check City locations or money will be transferred on your active bank account. It takes 24 hours for Check City to transfer loan amount on client’s active bank account.

Terms of Use

To take a loan from Check City in-store, a client should meet the following requirements:

To take a loan from Check City in-store, a client should meet the following requirements:

- valid photo ID;

- proof of income (paystub);

- a check from your open and active checking account;

- ability to repay the loan.

If you want to file for a loan online you should meet the following requirements:

- employment;

- an open and active checking account.

There is no actual information about borrower age but in general, such services provide loans for clients over 18 years old.

Available loan amount in Check City is $ 100 to $ 2 500. But loan amount is dependent, first of all on the state you live in. Interest rates are also agreed individually depending on loan amount. The period during which a client should pay a loan back is individually discussed being dependent on loan amount available for a client.

It is necessary to be employed or provide Check City with evidence of your steady source of income. But if you apply online, you should be employed and nothing else. You should provide your monthly income to understand what loan amount you may get.

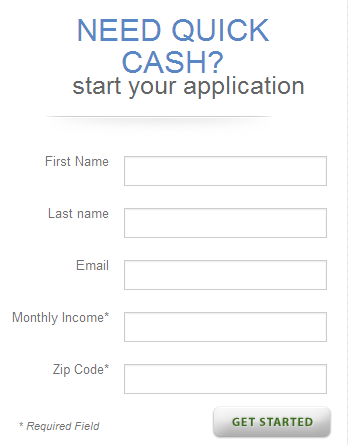

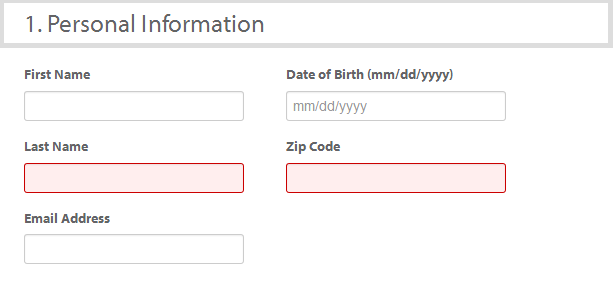

Application

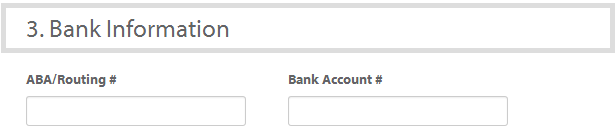

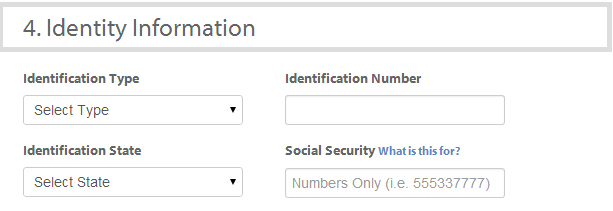

Checkcity.com requires the following document’s data which you should not send to site administration but should have them within reach:

- ABA/Routing #;

- Bank Account #;

- Identification Number;

- Social Security Number.

This information should be filled in in an application form to be approved for a loan. There is no actual information relating to whether a client should ensure data about guarantees or contact persons to take a loan online from Check City.

The application is processed within several minutes that’s why a client almost immediately will get the result. We remember you that funds will be transferred to an active bank account within 24 hours.

Repayment

The process of paying the loan back is automatic and convenient. An electronic withdrawal will be made from your account on the loan’s due date via ACH (Automatic Clearing House Transaction) transaction. If you decide, you may pay a loan back by means of a debit card by calling the customer service line by the business day before the loan is due.

After successfully completing your first payday advance loan, additional loans are easy to request. Simply login in CheckCity.com and request a new payday loan. Online service administration reminds clients that payday advances should be used for short-term financial needs only and not as a long-term financial solution. Consumers who are experiencing credit difficulties should seek credit counseling. In addition, some states require a cooling-off period between payday loans or otherwise restrict the frequent supply of payday loans.

If a client does not pay a loan back by a due date, Check City will attempt to contact you by means of one or more authorized methods, including phone calls, emails, and text messages to arrange for payment. In addition, the administration may represent any returned payments to your bank according to your loan agreement, applicable law, and regulatory requirements. If a client is unable to contact you or if cannot collect an undischarged balance, a notice may be reported to credit bureaus reflecting your late or nonpayment. Such action may influence your credit rating. Pursuant to governing law Check City may also seek legal recourse. Some delinquent accounts may be placed or sold to a third party collection agency that follows FDCPA. As mentioned above, late fees and returned item / NSF fees may apply as described in your loan agreement.

Loan Extension

Check City will not renew or refinance client’s loan without your express permission pursuant to your loan agreement terms. Check City administration strongly encourages you to decrease principal of your loan by making an early payment to potentially decrease the finance charges you may incur.

There is no opportunity to take a loan when the first is no paid back completely. In the majority of online credit institutions, there is no possibility to take a new loan but there is an opportunity to extend the loan.

CheckCity.com Bad Credit History

For CheckCity.com bad credit history plays no role. If a client is able to confirm his paying capacity, it becomes possible for him to be approved when commanding the service of Check City.

Credit history is an indicator by means of which a lender may see how different loans have been paid back but Check City stresses out that for them it is more important to see data proving client’s solvency and if they are satisfied with it, a client will be approved even having a bad credit history.

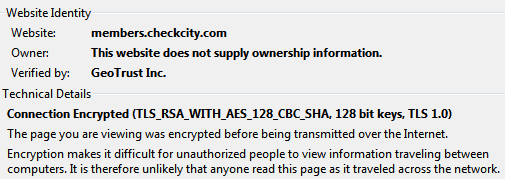

Technical Data

Secure Connection

It turns out that connection is secure on Check City only when a client opens the application form. Then there is no so effective but “better than nothing” security certificate provided by GeoTrust.Inc. But company owner is hidden that’s why we cannot estimate fairly whether this security is ensured by an authoritative company or not.

Check City utilizes 128-bit encryption which ensures that client’s personal data will be protected from unlegalized access. But there are more effective means to protect and encrypt personal data which are neglected by Check City online credit institution.

Mobile Version

According to service checking mobile versions of different websites, Check City mobile version is convenient and easy for use. This user-friendly mobile version simplifies the procedure of taking a loan for people who get used to making all the operations by means of the mobile device.

Front-page of checkcity.com is worked out in the way to decrease unnecessary information for clients and provide access to application forms of different loan types.

Mobile version has no noticeable drawbacks which may prevent a client from filling in the application form. CheckCity.com mobile version is adjusted to different mobile devices that’s why there is no problem to approve for a loan online.

Antivirus Presence

Antivirus is one more opportunity for a client to be safe from unwanted online threats. Viruses are the common thing when surfing the Internet. Check City is glad to provide a client with one more type of security – antivirus, exactly McAfee.

Antivirus will protect a client from online threats and viruses. A client’s devices are at safe hands with McAfee Security.

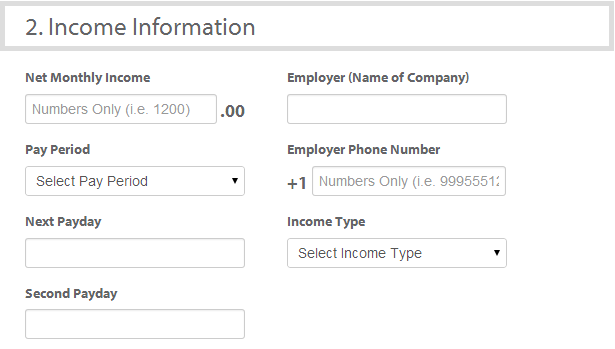

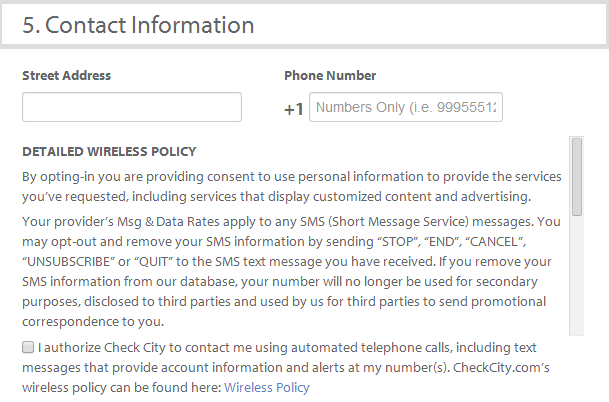

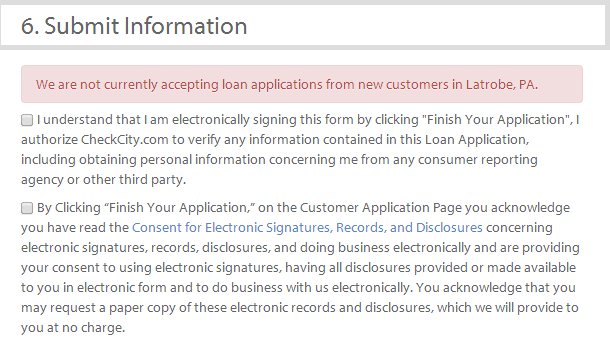

Convenience of Application

All the application procedure takes some time to be filled in. A client should undergo the following steps:

- personal information

- income information

- bank information

- identity information

- contact information

- submit information

After filling in all the required fields a client is welcome to press the button “Finish Your Application” which will be transferred your application to the next step where it will be processed.

![]()

In general, all the procedure is convenient, there are no captious questions relating to monthly expenses, for example. There is also decreased online application form with a limited number of fields:

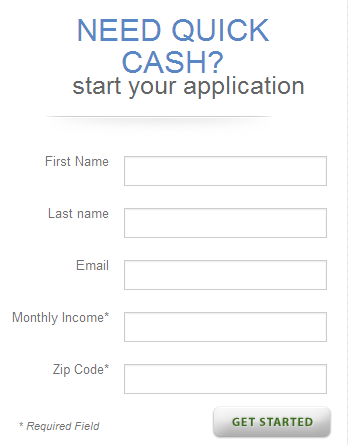

Is CheckCity.com Legit?

According to ScamAdviser.com, CheckCity.com is legit but we are going to grapple with it more carefully. ScamAdviser.com gives 96-% of security for CheckCity.com but in general, we may place in question this security rating. First of all, company owner origin is hidden. This site is utilizing an anonymous service – which prevents us from determining the site owner. This can sometimes be just so that the owner does not receive spam, but be aware that many scam sites use this as a method to hide their identity. If this is an e-commerce site – we would suggest you prove the business address contacting the website owners.

CheckCity.com appears to be based in the United States of America but in fact, there are other countries involved in its performance. Moreover, there is an enormous number of websites installed on the same server with CheckCity.com. If there is such an information, a client should, first of all, think whether this online service is fake or real. We should also point out that website based in the USA, has Canadian telephone number.

Domain age is 17 years, 339 days but its cost is too low. It is claimed that CheckCity.com has lots of visitors but we cannot be sure this fact is absolutely true. Website Speed is low and site administration should do everything to improve online service performance.

In general, we cannot understand why ScamAdviser.com gives such a high rating- 96-%. We recommend clients to get more information before applying for a loan.

Reviews about CheckCity.com

Reviews on CheckCity.com

It takes too much time to find reviews on CheckCity.com but in fact, we fail. We surf Google.com and find out that there is such a page but it seems to be in hard-to-reach place. We read reviews on CheckCity.com page, and they are positive where people speak about how clients are satisfied with overall online service performance. But we should point out that there are no dates and there is no contact form which helps people leave a review on checkcity.com.

They also make such an option to watch the video with satisfied clients but they do not perform its functions. They do not transfer us to another page with an available video that’s why it is “fraud”.

In general, we may not be sure that these reviews on Checkcity.com may reflect the real picture of this online facility performance. Be attentive when deciding to command the service of CheckCity.com.

In general, we may not be sure that these reviews on Checkcity.com may reflect the real picture of this online facility performance. Be attentive when deciding to command the service of CheckCity.com.

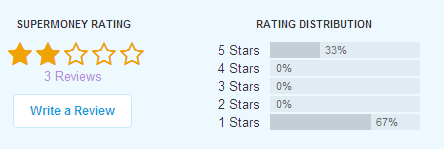

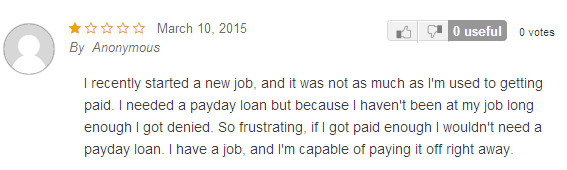

Reviews about CheckCity.com on Foreign Recourses

We have been surfing the Internet and find the website – supermoney.com with reviews about CheckCity.com. First of all, we should point out that the reviews about CheckCity.com are predominantly negative – 67-%.

It is unbelievable to see such an overall rating as 2 STARS. So many people leave negative reviews showing that they are not satisfied with the Check City performance. So that we cannot trust reviews left on CheckCity.com itself.

But this recourse cannot boost “fresh” reviews because they are dated 2016 or even 2015. This time is enough for Check City to change and improve its performance.

For example, there is a review sharing an opinion that I give only 1 star because I was denied. We cannot be able to estimate it fairly because there are cases when clients are denied in getting a payday loan.

You may read all the reviews and draw a picture by yourself of how reliable and effective Check City is.

Check City recommends reading reviews about Checkcity.com performance on shopperapproved.com. We cannot trust in such reviews because checkcity.com advises clients to read them. The rating on this third party resource is high and reviews are almost positive sharing people’s opinion and satisfaction.

The overall rating of CheckCity.com according to these reviews are 5 STARS.

This picture shows how satisfied all the clients are when commanding the service of Check City. We cannot fairly estimate these reviews because we have found one more site where there are a lot of negative reviews. This confusion prevents us from believing in this rating.

We recommend clients to read all the reviews on both recourses to draw a real picture of what is going on in CheckCity.com online credit institution. It will help you make a choice whether this online service is suitable for taking a loan or not.

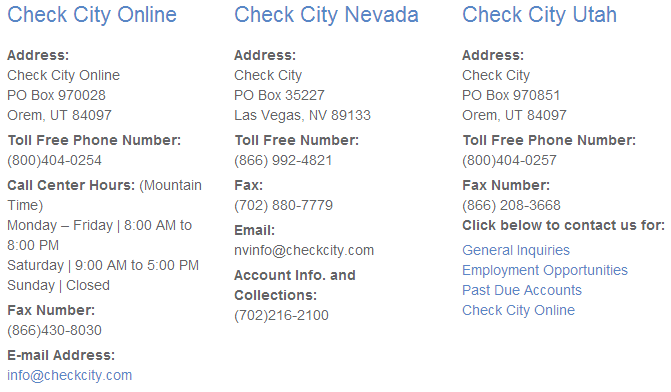

“Contact Us” Information

“Contact Us” Section

Check City provides clients with complete contact information. You may find everything you need to be sure this online institution is a real one.

As you can see there is complete information of:

As you can see there is complete information of:

- Check City online located in Utah;

- Check City in-store located in Nevada;

- Check City in-store located in Utah.

There are different ways by means of which you are able to contact site administration by means of:

- phone;

- fax;

- e-mail;

- life chat.

All this information will be useful for a client if he comes across with some technical or some other problems.

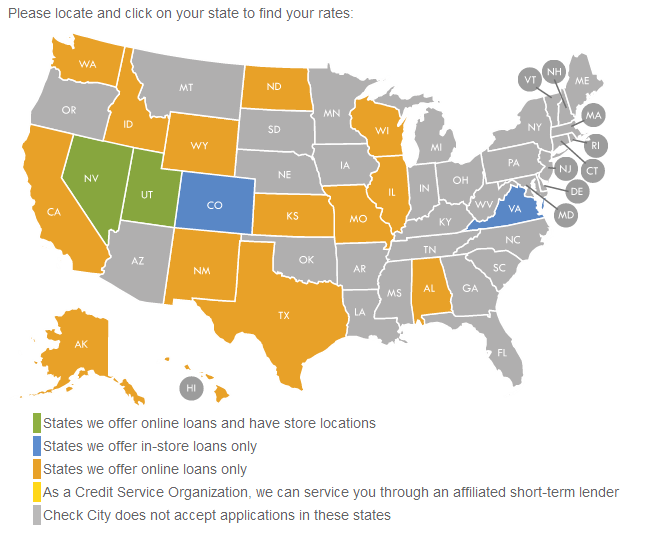

Locations

There are states in which Check City is present only in form of online institution. In an other-in form of in-store and online. We are going to provide you with information relating to locations and states in which you can take a loan by means of Check City.

Here is the map of Check City locations:

On this map, you will see in what states a client is welcome to take a loan from Check City. Depending on the state, loan amount, interest rates and period may be changed.

Table: Check City Locations

| Min Loan Amount | Max Loan Amount | Interest Rates | Periods | Locations Type | |

| Utah | $100.00 | no limits | $ 20 for each $ 100 | up to 36 days | online / in-store |

| Nevada | $50.00 | agreed individually | $ 20 for each $ 100 | max 35 days | online / in-store |

| Virginia | $100.00 | $500.00 | agreed individually | max 62 days | in-store |

| Colorado | $100.00 | $500.00 | agreed individually | agreed individually | in-store |

| Alabama | unknown | $500.00 | $ 17.5 | max 31 days | online |

| Alaska | $100.00 | $500.00 | $ 15 fee for each $100 | max 36 days | online |

| California | unknown | $255.00 | $17.64 per $100.00 | max 31 days | online |

| Hawaii | unknown | $510.00 | $17.65 per $100.00 | max 32 days | online |

| Idaho | unknown | $1000.00 | $22.50 per $100.00 | 14 days | online |

| Illinois | unknown | $850.00 | $15.50 per $100 | max 45 days | online |

| Kansas | unknown | $500.00 | $15.00 per $100.00 | max 30 days | online |

| Missouri | unknown | $500.00 | $17.00 per $100.00 | max 31 days | online |

| New Mexico | $100.00 | $2500.00 | $15.50 per $100.00 | max 35 days | online |

| North Dakota | unknown | $500.00 | $20.00 per $100.00 | max 60 days | online |

| Washington | $100.00 | $700.00 | $15.00 per $100.00 | max 45 days | online |

| Wisconsin | unknown | $1,500 | $30.00 per $100.00 | max 31 days | online |

| Wyoming | unknown | $2,500 | $30.00 per $100.00 | max 31 days | online |

| Texas | unknown | $1000.00 | agreed individually | max 45 days | online |

Customer Support Service

As Check City administration claims that a client is able to contact support group by means of life chat but it turns out this life chat seems to be constantly offline. Clients, if there is such a necessity, may come across with technical problems and have no opportunity to cope with them because it takes too much time to wait for the answer.

![]()

There is another contact form which may become a source of connection with customer support service. We are going to wait for the answer and will examine how effective this live chat is. We have got the response from Check City after 15 hours. It is normally when a response is given after 24 hours but we should remember that Check City claims they have live chat where the responses are given immediately but it is better than nothing really.

Conclusion: Ambivalent Reviews – Insecurity of CheckCity.com

Check City is a certified lender carrying out its activity on the territory of the United States of America. But Check City locations are different but in-store services are present in Utah, Nevada, Virginia and Colorado. Other states where there is an online Check City, you may read in point 5.2. Loan amount, interest rates and period are also dependent on the state you live in.

Check City is a certified lender carrying out its activity on the territory of the United States of America. But Check City locations are different but in-store services are present in Utah, Nevada, Virginia and Colorado. Other states where there is an online Check City, you may read in point 5.2. Loan amount, interest rates and period are also dependent on the state you live in.

ScamAdviser.com gives 96-% of security for checkcity.com confirming it is legit. But we have found a lot of discrepancies. Company origin is the United States of America but there are other countries involved. The telephone number is Canada based. Such drawbacks make us hesitate in checkcity.com legitimacy and security.

There are reviews on CheckCity.com itself and on foreign recourses. CheckCity.com provides clients with absolutely positive reviews, but its number is 4 and it is not understandable how they appear on Check City because there is no contact form for leaving a feedback. Reviews about CheckCity.com are controversial that’s why we cannot find out the common opinion about Check City capacity.

According to BBB, they were accreditated in 2003 but the license was given in 1994, we may come to a conclusion that license was given in 1994. They were certified by BBB in 2003.

In general, there is so much confusing information which prevents us from recommending this service to people. But people may grapple with all information and it is up to them to decide whether it is appropriate for them to take a loan by means of CheckCity.com.

Ready to Apply?

Ready to Apply?