Self-Introduction of Bright Lending

Bright lending is licensed lender approved by the Tribe’s Tribal Regulatory Authority. Bright Lending performs its functions within the limited area of the Fort Belknap reservation, a sovereign state based within the boundaries of the United States of America. This online lender is controlled by federal financial consumer lending laws and regulations as determined by the Fort Belknap Tribal Regulatory Authority. This lender offers its customers small-dollar credit products devoted to coping with financial troubles as fast as possible. It is a logic question that we have a desire to get to know more about this online lender – is it legit or whether reviews are present on the foreign resources.

Bright lending is licensed lender approved by the Tribe’s Tribal Regulatory Authority. Bright Lending performs its functions within the limited area of the Fort Belknap reservation, a sovereign state based within the boundaries of the United States of America. This online lender is controlled by federal financial consumer lending laws and regulations as determined by the Fort Belknap Tribal Regulatory Authority. This lender offers its customers small-dollar credit products devoted to coping with financial troubles as fast as possible. It is a logic question that we have a desire to get to know more about this online lender – is it legit or whether reviews are present on the foreign resources.

| Loan types | Min Loan Amount | Max Loan Amount | Period | Interest Rate | Documents | Bad Credit History |

| short-term loans | $ 300.00 | $ 1000.00 | individually | individually | no documents required | Possible |

Types of Loans

As Bright Lending points out they offer its customers small-dollar credit products in case if a client is not eligible to address bank institution to arrange a loa there. The main method of funds transferral is online transactions directly to your bank account. You have no demand to visit an office to get money in cash. Compared with other US online lenders, there is no great difference in funds transferral time because people will get its loan amount the next business day. Of course, each state has some limitations or restrictions but several hours will not spoil imagination from online service. Unfortunately, Bright Lending doesn’t provide the same day funding because this option is out of service right now.

Terms of Use

There is no accurate information about borrower’s age but only Americans over 18 or 21 age-old have a legal permission to arrange a loan online or in a banking institution. But we cannot make a concrete decision relating to this online lender as this information is absent. Moreover, short-term loans should be paid back as fast as possible that’s why under 18 years old people cannot gain an ability to follow the due date.

Min.loan amount for brightlending.com clients is $ 300.00 when the max loan amount is $ 1000.00. Loan interest rate is described in details for new customers. Your first planned payment of loan should be a minimum 7 days from your funding date. If you have any additional questions or want to discuss any loan specification, you should read attentively your actual loan contract. As Bright Lending administration stresses out that they foster to pay a loan back as fast as possible to reduce the daily fee for a loan.

Min.loan amount for brightlending.com clients is $ 300.00 when the max loan amount is $ 1000.00. Loan interest rate is described in details for new customers. Your first planned payment of loan should be a minimum 7 days from your funding date. If you have any additional questions or want to discuss any loan specification, you should read attentively your actual loan contract. As Bright Lending administration stresses out that they foster to pay a loan back as fast as possible to reduce the daily fee for a loan.

The period for a loan use is not definitely determined but to our mind period depends on the loan amount. You may contact the customer support group and clear out this bothering question. When reading the main requirements for been approved customers should confirm his payment solvency by providing data on the reoccurring and verifiable source of income. It means that you should not have a constant working place but, first of all, a lender should gain evidence and confirmation that you are able to pay a loan back.

Application

To qualify for a loan, you have to meet the following requirements. They are not enormous but important:

- reoccurring and verifiable source of income;

- meet external and internal underwriting requirements taken in whole or in part;

- legally meet all requirements to enter into a contract;

- have an open and active checking account.

It is a common practice when applying for a loan online, you are not required to ensure any guarantors or contact persons necessary to contact you if you are off-line. A speed of loan processing is not defined that’s why we may suggest that it takes not so much time to process and even fill in your application form. When registering you will gain access to an application but reduced form. But we fail in search of time necessary for a loan application processing.

Repayment

The most popular way to pay a loan back – automatically debited cash from your bank account on the due date. You have to refill your balance to avoid possible delays in payment because when missing or late in payment you have to pay additional charges. But you may pay your loan back by sending a personal check, cashier’s check, money order, or certified check to the address below on or before your due date.

![]()

We do not have any information about partial loan repayment but Bright Lending organization encourages its customers to pay a loan back earlier because this is the main method to reduce the interest rate for the left period of time.

Extension

Unfortunately, the lender ensures no information about such an option as an extension. If you face such a problem, you’d better inform your lender online by means of e-mail. There are online lenders what provide such an option as refinance a loan. It means that a lender may issue one more loan for you to pay the first one back. Then you have to pay the second loan debt. As a result, you have an opportunity to break out of the funk.

Bad Credit History on BrightLending.com

Brightlending.com is not able to say categorically that they deny in a loan for people having a bad credit history. They underline that they check credit history but it is one of the points for meeting that’s why if you prove your paying capacity, you may be approved for a loan in Bright Lending. But you cannot improve your credit history by means of this online lender because they do not provide any information to three main score matching organizations. We get acquainted with main required information by foreign providers who help in deciding whether this client can be eligible for a loan or not.

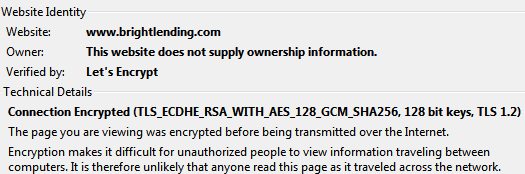

Technical Data

Secure Connection

Bright Lending tries to make some secure connection on brightlending.com but it is not enough to ensure absolute security when commanding this eCommerce service. Company owner information is hidden when certificate verification is carried by Let’s Encrypt. This certificate implies 128-bit encryption. Of course, it performs its functions but there are more efficient means to protect customers’ personal data.

Internet swindlers are professionals able to gain access to various resources containing people credit card details.

Internet swindlers are professionals able to gain access to various resources containing people credit card details.

Mobile Version

Brightlending.com makes the mobile version of this online website. It makes service more convenient devoted to simplify the process of making orders online as much as possible. You may visit mobile version right now and fill in an application form. There are no obvious drawbacks which may prevent you from utilizing this online lender service. There is only one disadvantage: the front picture of all these service pages are cut down. It means you may see only a part of picture upfront. But to our mind, this drawback has no influence on site performance.

Antivirus Presence on Bright Lending

Unfortunately, Bright Lending provides no antivirus for customers’ security. When commanding this service, you may “catch” viruses and other online threats. If you are afraid of being “infected, it is better to avoid this service. Usually, lenders install McAfee, as one of the most reliable antivirus ever. But Bright Lending administration has no presence of antivirus at all.

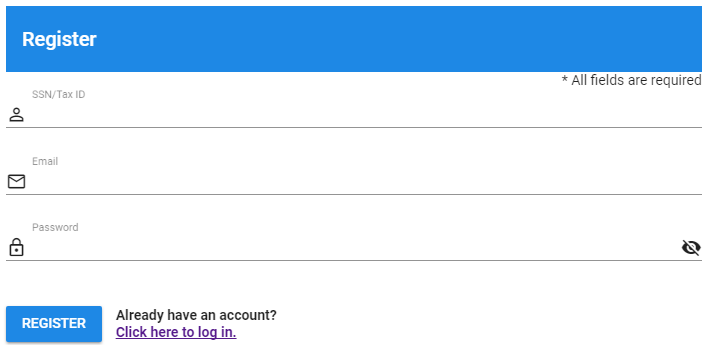

Convenience of Application

The first drawback of Bright Lending is mandatory registration. If you do not undergo this procedure, you will not be eligible even to see the detailed application form. The registration form looks like:

When registering you will be transferred to the reduced application form where you have to fill in the following fields:

When registering you will be transferred to the reduced application form where you have to fill in the following fields:

When looking at the detailed application form, you have to enroll the personal information (date of birth, phone number, address), financial information about your banking account and then you have to sign an agreement for loan issuing. No special information is required but remember that registration is a left step you have to make that’s why we may estimate Bright Lending not high enough but in general, application form seems to be convenient.

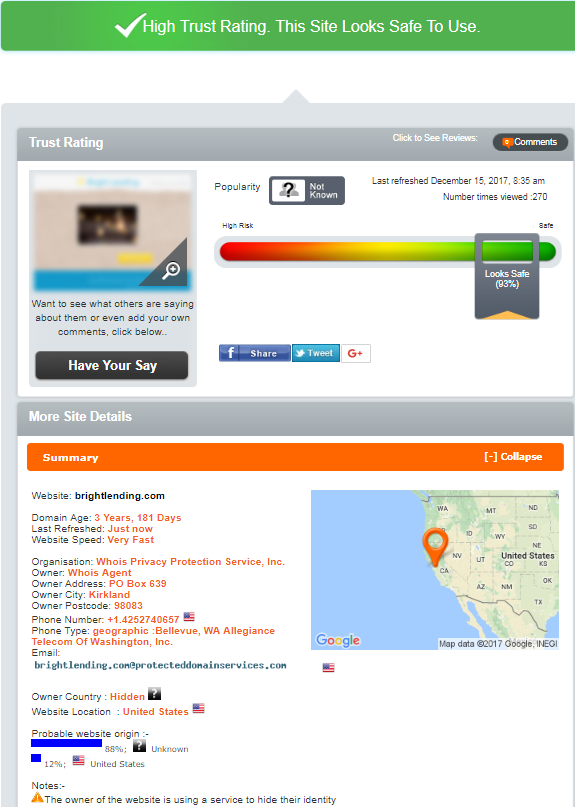

Is BrightLending.com Legit according to ScamAdviser.com?

According to ScamAdviser.com, Bright Lending organization has 93-% of legitimacy rating which shows its trustability and reliability. The website has the following status: “High Trust Rating. This Site Looks Safe To Use.” It is colored in green. But everything seems to be no so bright as this company wants to draw because there is hidden information which prevents us from 100-% believing in them. Probable website origin is the United States of America, but the greater percent is hidden. The company owner is also hidden. We cannot make a fair conclusion that this company is fake because sometimes eCommerce websites obtain hidden information not to get spam or some other blackmailing issues sent on the Internet.

Domain age is 3 years 181 days but Bright Lending attendance rate is unknown. For this period of time, it is logical that this company has to gain a plenty amount of customers from all the United States. We remember that website provides the address in Montana state but telephone number checked by ScamAdviser.com is located in Washington.

There is so doubtful information which spoils general perception from brightlending.com. Users have better to specify all information in details to be sure you won’t meet any hindrances when commanding this service online.

Reviews about Bright Lending Facility

Reviews on BrightLending.com

Regretfully, Bright Lending online provides no reviews about this online company performance. Each online company should have several reviews to make people think that this online service is really functioning. As a result, bright lending reviews play a major role in reputation taking away. If you have ever commanded this lender you are welcome to leave the review becoming a pioneer in this sphere.

Reviews about Bright Lending on Foreign Resources

Having surfed the Internet, we failed in finding reviews about Bright Lending company, so that we cannot believe in the fact that no one states and shares its opinion relating to Bright Lending performance. The absence of reviews cannot help people make a decision about trustability and overall company performance. If you have any idea of how to work with this financial online lender, you are welcome to be the pioneer in this business. You may visit various foreign resources and leave reviews about Bright Lending there.

Customer Support Service

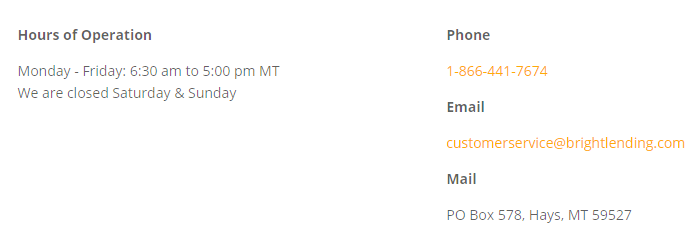

“Contact Us” Section

Contact section is full of all the required for this page information. You have an opportunity to contact customers support service over phone, email and mailing. The mailing address is defined for special reposts. The phone number is also available but be attentive when looking at hours of operation. This company is closed on Saturday and Sunday.

Locations

Unfortunately, Bright Lending provides no concrete list of states where they have a license to work. It is stated that brightlending.com is cooperating under the control of Tribe’s Tribal Regulatory Authority. When filling in an application, you should enter state and ZIP code. We try to do it and enter New Jersey and were approved to undergo the next step in an application form. As a result, we cannot make a strict conclusion about the area this online lender has a right to work along.

Customer Support Service

To contact customer support service, clients may utilize contact form where there are mandatory fields for enrollment. When sending a letter, you should wait for the indefinite period of time. We have no response from this company, unfortunately. So that we may come to a conclusion that this company has no customer support or if it is present, its performance leaves much to be desired.

Conclusion: Undefined Reputation of Online Lender from Montana

Bright Lending is online lender controlled by Tribe’s Tribal Regulatory Authority. They offer customers short-term loans from $ 300.00 up to $ 1000.00. Periods and interest rates are determined individually but we cannot understand why. In the majority of cases, lender encourages clients to pay a loan back earlier because in such a way it becomes possible to reduce interest fee.

According to ScamAdviser.com, this online lender is very safe for use but we cannot support this idea. There is too much-hidden information which prevents us from trusting in it 100-%. Website and company’s origin is hidden and the United States of America has less percent for proving its origin.

There are reviews anywhere left by customers – it doesn’t matter satisfied them or not. You cannot find reliable opinion relating to Bright Lending performance. That’s a pity because there are cases when reviews can help make a decision whether this online service is reliable or not.

Ready to Apply?

Ready to Apply?