What is WhoNeeds500?

WhoNeeds500.com is an online referral service which connects you with direct trusted lenders who are able to offer you $100 – $1000 cash loans that are perfect in emergencies and help solve your temporary financial problems. According to the website, the company provides a fast and professional service and users can get the funds the next business day, even if they have a bad credit.

| Loan types | Min.amount | Max.amount | Average term | APR | Items required | Bad credit |

| Payday loans | $100 | $1,000 | 2 weeks | 390% – 782% | SSN, driver’s license or state id, bank statements (in some cases) | Yes |

Types of Loans

WhoNeeds500 cooperates with a network of lenders who can provide consumers with payday loans – short-term solutions to users’ financial problems. Such loans can be obtained at any time of the month but you will need to repay the borrowed funds + interest right after your next payday. People prefer payday loans because they are short-term and easily approved. It’s a perfect way to get some extra cash if you have gone over your budget. The funds can be spent on whatever you wish: vacation or urgent purchases, car repair, house improvement, and so on.

Lenders typically transfer the money to your bank account the next business day but if you have made an inquiry on Saturday or Sunday, you may have to wait until the Monday.

Terms of Use

Who Needs 500 guarantees that all its lenders comply with state laws and regulations relating to payday loans.

When you apply for a loan via this website, the referral service will match you with the best lender for your case who is ready to offer your $100-$1,000, depending on your personal information provided. The average lending period is 2 weeks. The decision will be influenced by your current income and credit score, though people with poor credit can also be approved for a loan. The lender will not ask you what you are going to spend the borrowed funds on.

In order to get a short-term loan via WhoNeeds500.com, you must comply with a few requirements: you must be at least 18 years of age, be a legal US resident and live in a state that allows payday loans. You must also have an address where you can be easily found and an open bank account in your name with some history so the lender can deposit the funds and withdraw them on the specified date. Besides, you must have a steady income. You do not necessarily need to be employed, but you must prove that you will be able to repay the borrowed money on the agreed upon date. Most lenders from the network of Who Needs 500 require that your monthly income is $1,000 or more.

The company mentions that since payday loans are unsecured, an interest rate will be rather high. You will have to pay more for the opportunity of getting an easy loan. They mention that the expected annual percentage rate will range between 390% and 782%. To have a better idea of what you are getting into, the company gives you an example of interest: a $500 payday loan will cost $60-$150. This rate applies to those borrowers who are able to repay the loan in full on the due date, without delays.

Once the lender has approved your application, you can review the full rates and terms so you will understand your obligation clearly. Lenders will give you access to the rates and terms before you e-sign the documents, so you need to read them thoroughly. The loan contract will include the details about the repayment date, finance charge, interest rate, penalties for missed or late repayments and so on.

If you agree to the loan offer, you need to e-sign the contract. The lender guarantees to transfer the funds into your account as soon as possible – in most cases, customers get their money within 1 business day.

Remember that you not obliged to accept a loan offer until you sign the contract. There is a certain period of an offer validity. If you are not satisfied with the offer, you can reapply – the offer may change the second time.

Bear in mind that not all lenders have the same terms and rates, so you need to fully understand the specifics offered to you.

Application

The whole application process is online, WhoNeeds500.com does not conduct any transactions over the phone.

Filling out a form will not take more than 3 minutes. After that, you’ll be matched with a suitable lender and be approved for a loan in just 5 minutes.

In order to get a loan, you will need to provide some basic personal information, such as your address, phone number, email, SSN number, driver’s license, state-issued ID and other relevant details, which WhoNeeds500 will then direct to the lenders in its network. The lenders will also ask you to provide your employment status, income, and bank account details.

They mention that usually faxing is not required but in some cases, the lenders may ask to fax some additional verification documents. However, they promise that this process will be still much faster than at the bank.

Using this website, you can get payday loans without collateral.

Loan Repayment

The borrowed funds are automatically taken from your account on the due date. So you need to make sure you have enough money in your account a day before that date.

The repayment date will be specified in your contract. If you make a late payment, you will be charged additional fees. The contract will contain the information about how much you will need to pay in the case of late repayment.

Even if you contact the lender in advance to inform him that you will make a late payment, you will still have to pay late fees. If you fail with your payment, the lender will finally pass your debt information to a collection agency, who will try to recover the failed payment. The longer you leave you debt unpaid, the more fees and interest rates you will have to repay in the end.

WhoNeeds500 did not mention whether lenders allow early loan repayment without ant penalties.

Loan Extension

Some lender will allow an extension on your loan. However, this is not guaranteed. Lenders cooperating with Who Needs 500 have different terms and policies relating to extensions or renewals. Even if your lender allows extending a loan term, you will still have to pay a fee for this possibility. This will mean that means you will be allowed to repay the borrowed funds a bit later.

After you have cleared the debt, you will be able to apply for a new loan in the next month. Lending companies only allow having one payday loan within a month.

WhoNeeds500.com Bad Credit

Neither Who Needs 500 nor its lenders perform a credit check to learn your credit history, however, in some cases, the lender can check your credit score. In general, bad credit is not a reason for loan declining.

![]()

The company warns its clients that missed payments or non-payment will negatively impact their credit score, making it difficult to get another loan in the future, while repaying the loan successfully may improve your credit history, as it proves that you are a responsible borrower.

Technical Characteristics of the Website

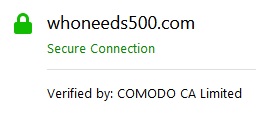

Encryption

According to the website, visitors of WhoNeeds500 website can be calm as their personal information is safe and secure. They claim to use the latest technologies to encrypt users’ sensitive data, including bank account number, phone number, and address. They assure their clients that their sensitive information will not get into the wrong hands. It turned out that this website uses a 128-bit SSL protocol verified by COMODO CA Limited:

However, such an encryption level is out-fashioned. Modern large online companies prefer to use 256-bit SSL protocols with an extended verification certificate. Still, it’s nice to know that there is at least minimum encryption level provided.

Mobile Version

WhoNeeds500.com mobile version is specifically targeted at the user with a smartphone/tablet. It’s is a smaller basic version – it has only the functionality that will be necessary and useful for users of mobile devices and tablets. The whole structure of the site automatically adapts to different screens. The mobile version does not have redundant, unnecessary functionality.

The mobile version is much simplified compared to the desktop version, so the user will not need to go far beyond the information he needs. Because of the simplification of the site, the mobile version is loaded faster. This is significant for users who are still using GPRS or weak 3G. Besides, you can always go to the main version of the site.

Antivirus

Although the website’s owner takes some steps to secure users’ sensitive information by using SSL protocols, I’m not sure that your personal details will always remain secure because WhoNeeds500.com does not use antivirus programs. This increases the risk of being hacked or infected with viruses and malware programs. I recommend the company’s owner to provide users with a higher level of security.

Convenience of Use

WhoNeeds500.com seems a convenient website. Instead of searching suitable online lenders on the web or visiting various in-store lenders in your city, you can fill out a simple online loan application and be connected to the right lender. The whole process is quick and easy, so you will not have to do much paperwork or spend many hours trying to find the best loan provider for your financial needs. All you need is to choose the amount you need, type in the zip code of your city and your email address:

The whole process only takes a few minutes. When the referral service receives your personal information, the system will check it to make sure that you qualify for a loan and meet the common requirements. If you fit all the criteria, you’ll be connected with a suitable lender who can make you a loan offer. After that, you need to wait a minute for the decision. Although the lender may not offer you the loan amount you have asked for, but it will be as close as possible. If necessary, the lender will call you to get more information and specify the rates and terms of your loan. If you are approved for a loan, you will be able to review all the terms of the contract before e-signing the contract. The contract will include the information about the loan due date, fees, possible penalties in case of late payment or non-payment, and other essential points. After you have e-signed the documents, the lender will deposit the money into your bank account as soon as the next business day.

Is WhoNeeds500.com Legit?

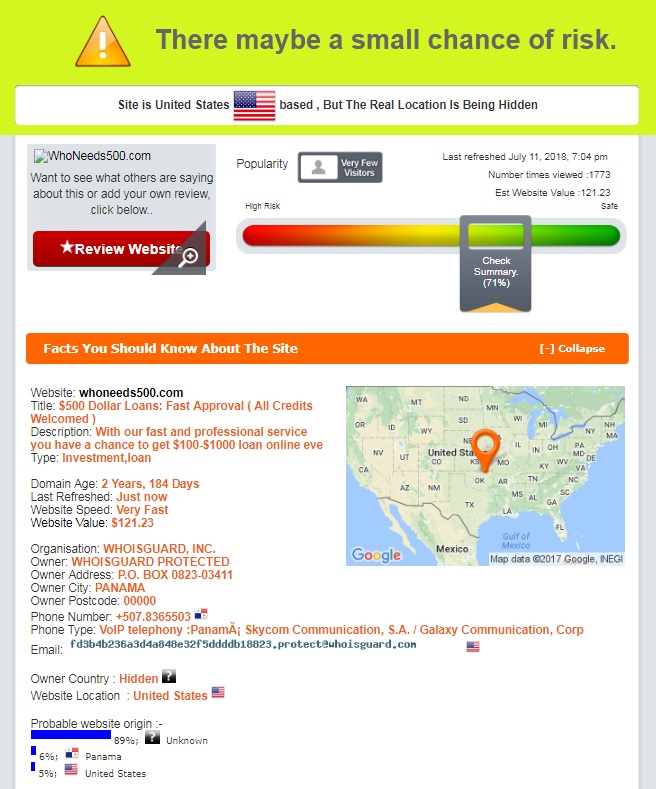

ScamAdviser is not 100% sure of WhoNeeds500 legitimacy. The company has a 71% trust-rating out of 100%. According to the analysis, there may be a small chance of risk since the website owner country is hidden but it is probably Panama or the United States.

Besides, the website’s life is relatively short – 2,5 years. ScamAdviser had no doubts about the site’s location – the United States. However, it turned out that the site is not very popular and has a very few visitors. The fact that they use an anonymous service to hide its identity worries me but I found not enough evidence that WhoNeeds500.com is not safe.

Customer Reviews

WhoNeeds500.com Reviews of the Native Website

I was very interested in what previous clients say about this online company. Regretfully, the website does not have a testimonial section with customer reviews. Clients will not be able to share their experience with this matching service. I hoped to find some comments on independent third-party sources.

Who Needs 500 Reviews on External Sources

Unfortunately, I was not able to find any WhoNeeds500 reviews on third-party websites so the reputation of this company remained questionable. This looks strange because this website has been active for 2.5 years. If you ever come across any comments or complaints related to this referral tool, please let us know.

Customer Support

Contact Information

Unlike other intermediate services, this company does not hide its contact information. The Contact Us page contains their address: 1125 E Broadway, #545 Glendale, CA 91205, United States, and email: [email protected]. Regretfully, WhoNeeds500 phone number was not given.

WhoNeeds500.com Locations

There is no list of states in which WhoNeeds509 services are available. They only mention that various states have different terms, rates and policies. So before you start an application process, check the availability of online payday loans in your location.

Getting a Consultation

If you have general questions about payday loans or services of this referral website, you can contact WhoNeeds500 customer support group via email [email protected]. There is also their legal address but you will unlikely send them regular letters. Neither phone number nor live chat is available on the site.

If you have questions about rates and fees of your existing loan, you will need to contact your lender directly since the lender-matching service does not possess the specific information about your loan.

I tried to reach the company’s representative via email to specify the information about their availability across the USA. I received an auto-reply reporting that their representative will contact me within 48 hours. Unfortunately, I could not wait that long. Their customer support is not speedy enough.

Conclusion

WhoNeeds500.com is an intermediatory and does not make any loan decisions. They only connect consumers to a network of over 100 direct lenders who are able to offer a loan of up to 1,000%. It’s nice that most lenders from the network do not require faxing and approve loans even if an applicant has a bad credit. The website has a limited specialization – payday loans so if you are interested in long-term credit solutions, this tool is not for you. ScamAdviser reports there is a small chance of risk when using this site because it’s relatively new and has a hidden owner country. In addition, there is only 1 way of contacting the customer support which regretfully did not work for me. Lack of customer reviews was another concern. In general, Who Needs 500 seems a convenient service which helps people to find the best lender in no time but I would recommend you choosing another matching service with a well-established reputation.

Ready to Apply?

Ready to Apply?