What is TrustedPayday.com?

TrustedPayDay.com is an on service working with a network of over 70 lenders who can offer customers perfect payday loans for all their needs! This company does not actually provide loans online. Instead, it acts as an intermediate party and connects potential borrowers with suitable lenders. The fast and easy application process will help customers save time and efforts. All lenders from the network of TrustedPayDay practice responsible lending and provide quality financial products. The company es not charges for its services and never asks clients for money. The website is OLA-sealed, which means this company can be trusted, has the highest standards of activity, ensures the best experience for their clients, works in the accordance with federal law and does its best to protect people from fraud.

TrustedPayDay.com is an on service working with a network of over 70 lenders who can offer customers perfect payday loans for all their needs! This company does not actually provide loans online. Instead, it acts as an intermediate party and connects potential borrowers with suitable lenders. The fast and easy application process will help customers save time and efforts. All lenders from the network of TrustedPayDay practice responsible lending and provide quality financial products. The company es not charges for its services and never asks clients for money. The website is OLA-sealed, which means this company can be trusted, has the highest standards of activity, ensures the best experience for their clients, works in the accordance with federal law and does its best to protect people from fraud.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Personal loans | $100 | $1000 | Up to 31 days | Depends on the lender | Social Security number and state-issued ID | Yes |

Types of Trusted Payday loans

The website helps people get personal loans – small unsecured amounts of money usually not exceeding $1,000. Such loans are a short-term financial solution.

Personal loans provided by Trusted Payday are also known as short-term loans, payday loans, cash advance, cash loans, bad credit loans, deferred deposit, fast cash, fast loans, installment loans and so on.

Personal loans are usually repaid as soon as a client gets the next paycheck. They are intended for handling emergency situations such as unexpected bills, car repair or other emergency financial needs.

Trusted Payday loans are typically processed immediately so that the funds will be available on the next business day. If borrowers apply on a weekend or holiday, they should get in touch with the lender and ask when the loan will be available. The funds are deposited into the customer’s bank account, although the lender may offer other options including receiving the money via a wire or getting the money at the office. Clients need to contact the lender regarding the ways to receive the loan.

Terms of Use

If you’ve already signed the agreement, you should contact your lender directly with any questions regarding your loan.

To get a loan through TrustedPayday.com, clients will need to meet the basic requirements:

- Be at least 18 years old

- Be an American citizen or legally reside in the USA

- Have a steady source of income

- Have an active bank account.

With TrustedPayday.com, you are able to receive an amount of $100 to $1000. Each lender has different loan amounts available, and the amount depends on the personal details that you provided during application. Some lenders may offer larger amounts if you have already used this service and paid off your loan successfully.

The APR and repayment term will also be determined by the lender on the basis of your income and the state you are living in. Usually, the lending period does not exceed 31 days – this is enough time for a client to get a paycheck.

With this online service, your salary is not relevant – of course, the more you earn, the better are your chances to be approved for a loan, but a stable income is more important. So, even if you currently have no job but do have another source of income, you have a good chance that you will be approved.

Application Process on TrustedPayday.com

You can submit your applications online 24 hours a day 7 days a week. However, some lender from the network of TrustedPayday.com are not available 24/7, so you will have a higher chance to find a suitable lender if you apply during normal business hours. Besides. not all companies are available on weekends and holidays.

An application process is online and does not take much time – you will need only 5 minutes to fill out the form. In addition, customers can use an alternative way of applying and call at 888-270-4110 which is available 24/7.

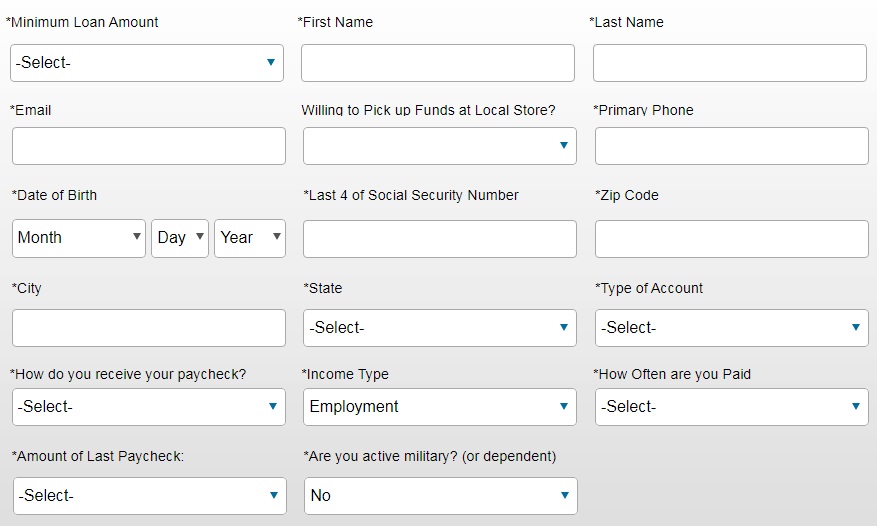

The application process can be started by choosing the loan amount that you want to get. You also need to indicate your name, date of birth, address, phone number, ZIP code, city, and state.

Later, you will have to specify Social Security number, state-issued ID, employer’s name, address and phone number, information about your income and bank account. You will also need to specify whether you receive a paper paycheck or the money are deposited into your bank account. In the end, you will need to state how often you receive a salary. Just like other lenders, TrustedPayday.com does not provide loans to the active members of military or dependent individuals. You will also need to choose whether you pick up the loan amount at the store or the funds will be transferred to your bank account. If you opt for a store, the funding will be made almost immediately. The second option may take no longer than 24 hours.

If you’re receiving a pension, disability, or other benefits, you still may be approved for a loan. The main thing is to have a steady source of income.

It’s important to answer all questions clearly and accurately. False or inaccurate information can reduce your chances of receiving a loan.

As soon as you finish, the service will try to connect you to the lender based on the details you have typed in. Of the service finds a suitable lender for you, you will be redirected to the lender’s website where you can get the detailed information on the loan terms and conditions. However, sometimes the online service is unable to find a lender for you. In this case, a client can be connected with a partner network of lenders.

Loan Repayment

When you apply for a loan through TrustedPayday.com, you typically need to repay a loan on your next pay date. However, some lenders from the network may allow a loan extension. The repayment terms will be determined by the specific lender you are working with. The loan period will depend on several factors, including the lender’s state, local laws, the amount required, and other things.

If you fail to repay trusted payday loans on a due date, your lender has a right to:

- Charge you late fees;

- Direct your account to a collection agency;

- Report non-payment to the credit bureaus, which may spoil your credit history;

- Offer to extend your loan, which will imply additional fees.

If you fail to pay the full loan amount on the specified payment date, you will probably be charged a late fee and the due date may be extended until you receive your next paycheck. The late payment policy will be included in the contract that you sign, so read the terms carefully before agreeing to the terms.

TrustedPayDay.com never enforces payment. If you fail to repay a loan, the direct lender may take legal action against you. Information regarding your defaults may be reported to a consumer reporting agency and may spoil your credit score.

Loan Extension

Some lenders from the network of TrustedPayDay.com can offer a loan extension – and the loan repayment date may be prolonged until the client’s next pay date. The client should be ready to have additional charges that also depend on the lender.

If you have an emergency and need more money right now, you can apply for another loan the same day. However, the online service recommends you to repay your existing loan first.

TrustedPayday.com Bad Credit

As we have already mentioned, TrustedPayDay.com is not a direct lender and does check your credit. However, the lenders from its network may perform a credit check, verify your SSN number, and check your score in national databases (DP Bureau, DataX, and others) that collects data on a person ‘s transactions with lenders.

![]()

In general, this online service tries to help you get the loan regardless of your credit score.

Technical Characteristics of the Website

Checking Encryption

TrustedPayDay.com guarantees the safety of your personal data and uses a 128-bit SSL encryption technology provided by DigiCert – a popular provider of SSL certificates. It’s actually a reliable and safe encryption, however, I’d prefer to see more advanced encryption – 256-bit and an extended verification.

Checking Mobile Version

TrustedPayDay.com has a mobile version which seems convenient and meets the needs of all customers who use their smartphones for applying. Google confirms that the website is mobile-friendly. Google test loaded all page elements successfully.

We noticed no problems or bags in its functioning: the content is readable, the clickable elements are enlarged and not so close to each other, no scrolling detected.

So if you want to apply for a loan from your smartphone, you will likely not have any problems.

Checking Antivirus

Websites like TrustedPayday.com must provide the highest level of security. Regretfully, this website does not have protection against viruses. I think that an antivirus is important for such website. Using this site, you have high chances of infecting your computer with online threats. Risks of hacking are also high.

Convenience of Using TrustedPayday.com

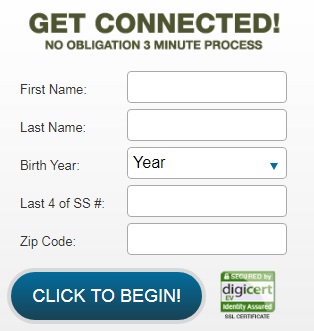

At TrustedPayday.com, you do not need to register or create a personal account. You can starts with typing in your name, last name, birth year, last 4 of SS #, zip code.

After clicking on the “Click to begin” button, you will have to fill out a short and easy application and provide some basic personal details: address, phone number, SSN number, city, state, income type, type of account, and others.

Although TrustedPayday.com cannot specify loan terms and conditions in advance, the website is quite informative. Here you can find the description of personal loans, a detailed FAQ page with answers to all questions you may have to this online service. I have no difficulty filling out an application.

Is TrustedPayday.com Legit?

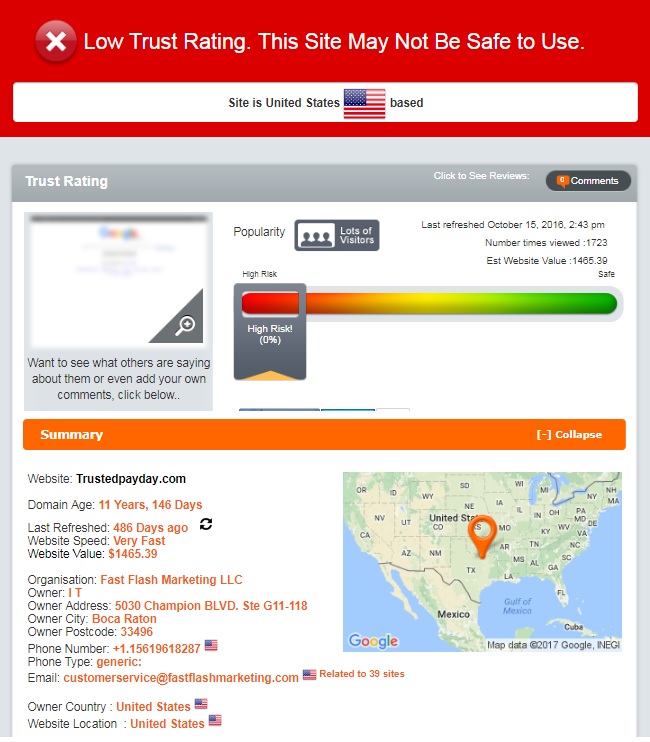

According to ScamAdviser (an online verification service), TrustedPayday.com trust rating is 0% out of 100% and it may not be safe to use:

The analysis revealed that the domain age is over 11 years, the site has lots of visitors, the website owner and location is the USA. However, Scam Adviser doubts the service’s legitimacy due to the fact that TrustedPayday.com is possibly related to a high-risk country and was included in the list of suspicious websites on this server. So ScamAdviser was not able to prove the website’s reliability.

TrustedPayday.com Reviews

On-site Reviews

I expected to find at least some TrustedPayday.com reviews on the website – this is a quick and reliable way to check the performance of this lender-matching service. Unfortunately, the website has no reviews from customers and I was not able to assess their experience with trusted payday loans. So I decided to look for testimonials from third-party sources.

Reviews on Third-Party Websites

Unfortunately, I was not able to find any TrustedPayday.com reviews on third-party websites. This seems strange because ScamAdviser claims that the website is very popular. In additions, I can hardly believe that nobody mentioned this service for the period of 11 years! Is it possible that the website did not receive any feedback over such a long period? I will appreciate if you share feedback with us about TrustedPayday.com reviews.

Contact Us section

Contact Information

TrustedPayday.com provided the following contact information: address and phone number. Obviously, the company is owned by Fast Flash Marketing, LLC:

Fast Flash Marketing, LLC

5030 Champion Blvd. Ste. G11-118

Boca Raton, FL 33496

Regretfully, we found no email address which could cause difficulty contacting the customer support service.

TrustedPayday.com Locations

Getting a Consultation

The website boasts of a fantastic customer service support who can provide detailed and timely answers to any questions by email or phone. Before calling or sending email, TrustedPayday recommends reviewing the Frequently Asked Questions. For any questions regarding the existing loans, customers should contact the specific lender directly since the online service does not have any control over loans.

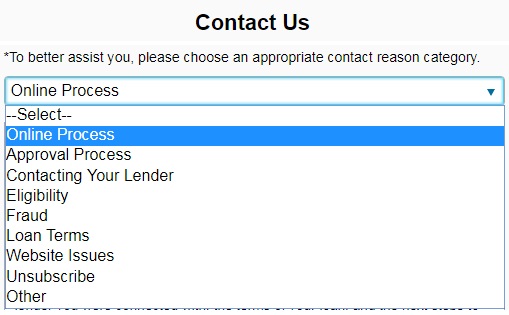

If you want to get help online, you will need to choose a contact reason category first.

Besides, customers can contact the company through postal mail writing a letter to Fast Flash Marketing, LLC, 5030 Champion Blvd. Ste. G11-118 or by calling at 877-678-3059.

We appreciate that the company offers various ways of contacting the customer support service. I decided to reach the representative of the company by filling out a contact form: I was interested in the question “In what states does TrustedPayday provide its services?”

Regretfully, I did not receive feedback within the specified period and the question remained unanswered. Obviously, the company needs to improve its customer support service.

Conclusion

TrustedPayDay.com us a lender matching online service that has a number of benefits: a vast network of lenders, quick and easy application process, money for any purpose, bad credit is OK. However, there are some drawbacks: TrustedPayDay.com is a third-party but not a direct lender, so it neither approves loans nor has knowledge of the specifics terms and rates. For this reason, customers will have to complete several applications which take extra time. In addition, I found no proof that this service is legitimate – it has a 0% trust-rating on ScamAdviser. I was also disappointed that this company does not have any reviews left by previous clients. All these aspects give the impression that you’d better choose a more reliable service for getting personal loans. The website receives 2,8 stars out of 5.

Ready to Apply?

Ready to Apply?