nknownSpeedycash.com Self-Presentation

Speedy Cash (SC) is a credit organization that provides short-term loans and financial services in the US, Canada and the UK. This organization is a member of The Community Financial Services Association of America (CFSA), which confirms their legitimacy and reliability. All members of this community are licensed and their activities are regulated by applicable law.

| Type of loan | Min amount | Max amount | Interest rate | Terms | Documents required | Bad credit history |

| payday loan; installment loan; title loans; online loans; fast-cash loans | $50 | $26000 | Should be agreed | Should be agreed | valid ID number, checking account number, routing number | Unknown |

Types of Loans

Speedy Cash offers its clients the following types of loans:

- payday loan;

- installment loan;

- title loans;

- online loans;

- fast-cash loans.

A payday loan is a microloan, for which cash is received the next business day. Microloan must be repaid after a certain period of time at once.

An installment loan is a large amount of money, which is repaid in parts.

A title loan is a microloan issued on the security of a car. Customers show their car to a loan specialist who calculates required amount and period for which clients would like to receive money. The loan is issued for up to 50% of the estimated value of this car. Valuation is based on the market value of the car. Clients receive money on hands, right after the signing of corresponding documents or organization transfers money to a bank card.

With the help of online loans, it is enough for clients to send an application to this credit institution and get money at their disposal without leaving home. You can receive money in several ways:

- to the bank account on the same day;

- in Speedy Cash office;

- to the debit card.

A fast-cash loan is a microloan, application for which is considered within a few minutes. If a client applies at the office, cash is issued immediately, if online – then the next business day.

Speedy Cash also offers the following in-store services:

- money orders;

- wire transfers;

- prepared debit card;

- check cashing;

- cash for gold.

Money order service is a money transfer for a certain amount (similar to checks) used to pay bills and purchases online.

Wire transfer is a bank transfer of non-cash means.

A prepared debit card is an alternative to credit cards or cash. Any types of payments can be made using this card, in places where Visa debit card is accepted.

Check cashing is a method of obtaining small amounts of cash on the personal check when making a purchase in a supermarket or other store.

Cash for gold is a service offered by the organization for the exchange of gold for money. Customers will be able to make the most profitable transaction, especially if the product is in perfect condition and has all necessary stamps, documents and certificates. Depending on condition, the organization will offer a different price.

Terms of Use

In order to receive a microloan, the client must meet the following requirements:

- valid identity card;

- a constant source of income;

- active bank account.

Title Loans Requirements

Requirements may be different, but the main ones are the following:

- vehicle must be in driving condition;

- proof of insurance;

- clear title or proof of 1st lien;

- proof of address;

- valid ID;

- proof of vehicle insurance.

Exact information on the employment of the client is not indicated, but if the client is able to confirm his solvency, then he has more chances to receive approval.

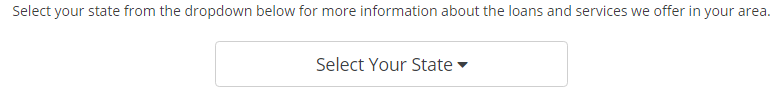

Amounts, terms, payment and interest rate depend on client’s region of residence and are determined individually.

Application

To file your application, you will need to provide the following information:

- basic personal information (phone number, valid ID number, home address, email address);

- income information (pay cycle, income type, income amount);

- banking information (checking account number, routing number).

There are three ways to apply for Speedy Cash loan:

- in-store;

- online;

- over the phone.

The convenience of Speedy Cash’s service is that you can get a microloan without guarantors. Depending on the type of loan and state, the speed of consideration of application can vary from a few minutes to a couple of days.

Repayment

Loan repayment terms are determined individually, depending on several factors:

- amount;

- income;

- location.

Speedy Cash gives its customers opportunity to repay microloans ahead of schedule, which is a significant advantage and allows to save on interest rate and fees.

In case of unforeseen circumstances, Speedy Cash can meet the needs of clients client and grant delay in payment with balance recalculation. These procedures are individual and agreed with the management of the organization.

Different lenders may have different pay for options including:

- debit card payment;

- cash payoff;

- automatic payment from your bank account;

- post-dated check.

The website speedycash.com does not provide any information about penalties applied in case of delay in payment, but we can assume that this organization adheres to the same policy as any other credit institution, namely, apply penalty fees.

Loan Extension

The client can extend the term of microloan payment online or in the mobile application. With regard to the extension of a microloan, the client needs to contact the manager of this credit institution to settle all issues.

Information about whether a customer can get a microloan without paying the previous one is not provided by Speedy Cash.

Speedycash.com – Bad Credit History

The website does not provide specific information on the possibility to apply for microloans to customers with bad credit history. But, based on feedback, it can be assumed that clients basically need to provide information about credit history, and this information can be a decisive factor in approving an application for microloans.

Technical Characteristics of Speedycash.com

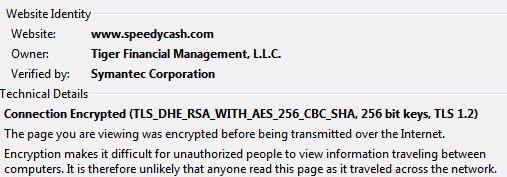

Secure Connection on the Website

Speedy Cash provides its customers with the protection of all transactions using 256-bit data encryption. The security certificate is issued by Tiger Financial Management, L.L.C., confirmed by Symantec Corporation. In addition, in the left corner of address bar, we can see the name of the certificate owner.

From this we can conclude that Speedy Cash cares about the safety of its customers, prioritizing all efforts to ensure the highest degree of protection of personal data.![]()

Mobile Version

Speedy Cash website has a mobile version, adapted for various types of mobile devices.

The mobile version complies with all standards necessary for using website’s services via mobile devices. The client will not have any difficulties with using website and application. In addition, Speedy Cash has developed a mobile app that you can download from Google Play and App Store on your mobile device for free. This mobile app is designed to make it as easy as possible for clients to use the website via their mobile phones and tablets.

Antivirus Protection.

To create an even higher level of security, the company’s website uses Norton antivirus. This program protects clients from viruses and other unwanted malware. You can freely service the website not being afraid to “catch” something on your computer or that your data will be stolen.

Convenience of Application

In order to leave a request for a microloan, you must complete a simple registration procedure and fill out the application form. Registration is mandatory for obtaining a loan online. The application form includes a large number of points that need to be filled out before getting a loan. This procedure can take an average 15 – 30 minutes.

There is also an opportunity to get advice and loan in-store. For those customers who do not have access to the Internet and can not visit one of the company’s offices, Speedy Cash provides an opportunity to take a loan by phone.

As for the information you are interested in on the website, a number of difficulties can arise. The fact is that the content of the website is organized in a chaotic manner and there is no systematization and structure. Moreover, the website lacks such important information as:

- minimum age of the borrower;

- credit history of the borrower;

- penalties in case of delay;

- there are no clear min and max loan amounts, etc.

Is Speedycash.com Legit?

ScamAdviser.com estimates Speedy Cash’s safety at 70%, which is a good indicator of the reliability of the company. According to ScamAdviser.com, a website is located and carries out its activity from America, which coincides with contact information indicated on the website. Also, the website is popular, has many visitors and is constantly updated. The age of domain according to statistical data is more than 15 years, which is also an impressive term.

For reasons unknown to us, the service does not give 100% to Speedy Cash rating, however, 70% is higher than an average indicator, which is an undisputed advantage of the company among other similar services.

Speedycash.com Reviews

Reviews on the Website Itself

On the main page of the website, there are reviews presumably left by customers of this organization but there are only 3 of them. We can not trust these reviews 100% because there is no guarantee that they were left with real clients, and not fabricated by website administration. In addition, there are no negative reviews, since administration would not publish them, even if they existed.

Unfortunately, reviews for Speedy Cash are not dated, so we can not judge how good the service is at the moment. Especially on three positive reviews of unknown origin, it is impossible to make a completely objective picture of the performance of this company.

Reviews about Speedycash.com on Foreign Recourses

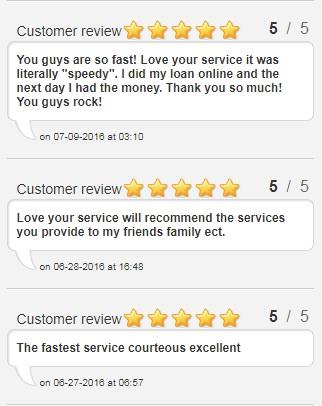

Since we did not find enough reviews on the website itself, we decided to search for them on third-party resources. Especially the company itself offers to get acquainted with customer feedback on www.ekomi-us.com. Here there are 36 reviews, and Speedy Cash rating is 4.5 out of 5.

Most reviews are positive (92%). Basically, these reviews point to the fast processing speed of application, the speed of cash receipt. Most customers come to this company on the recommendation of friends, which indicates the high quality of services and high popularity of the company.

There are also some negative reviews about the customer service. Some clients had to wait for a long time to receive money. But each complaint is considered by the company individually to improve quality of service.

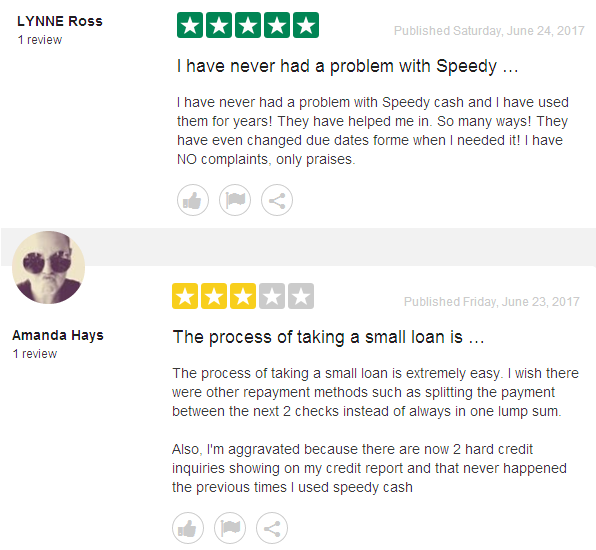

If you have doubts about the reliability of these reviews, since the company itself recommends this website, you can find reviews on many other websites, for example, TrustPilot (reviews have been left in the last 3 years). The website rating here is 8.8 out of 10, and there are also positive and negative comments.

As a whole, having read feedback on third-party resources, the customer can objectively assess the quality of Speedy Cash service.

Customer Support of Speedycash.com

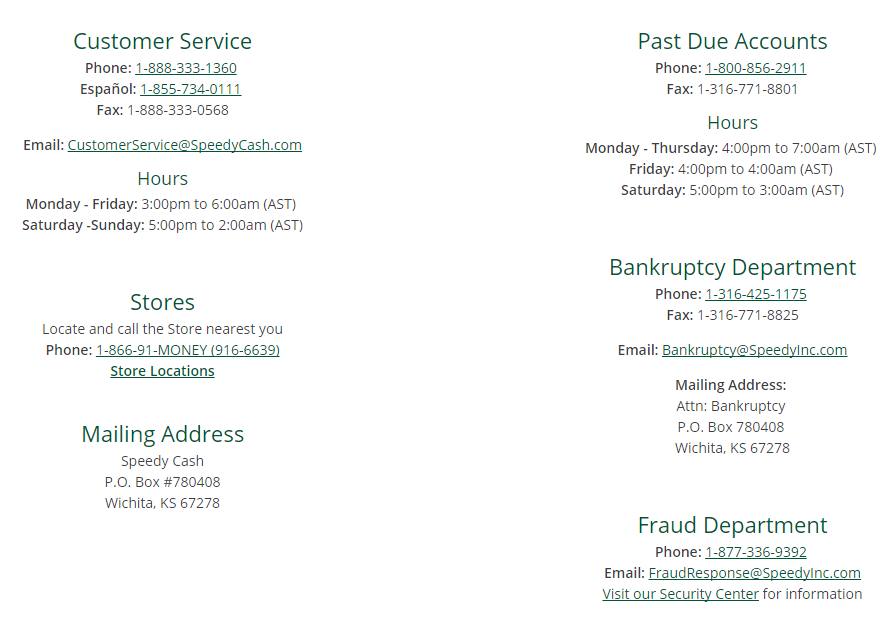

Contact Information

The company provides detailed contact information (telephone, fax, email), through which client can contact various departments of the company to resolve their issues: Customer Service, Past Due Accounts, Stores, Bankruptcy Department, Fraud Department. The section with contact information also informs the client about working hours of Speedy Cash.

Also, the company provides information about the actual location of the head office (which was confirmed by ScamAdviser).

Locations

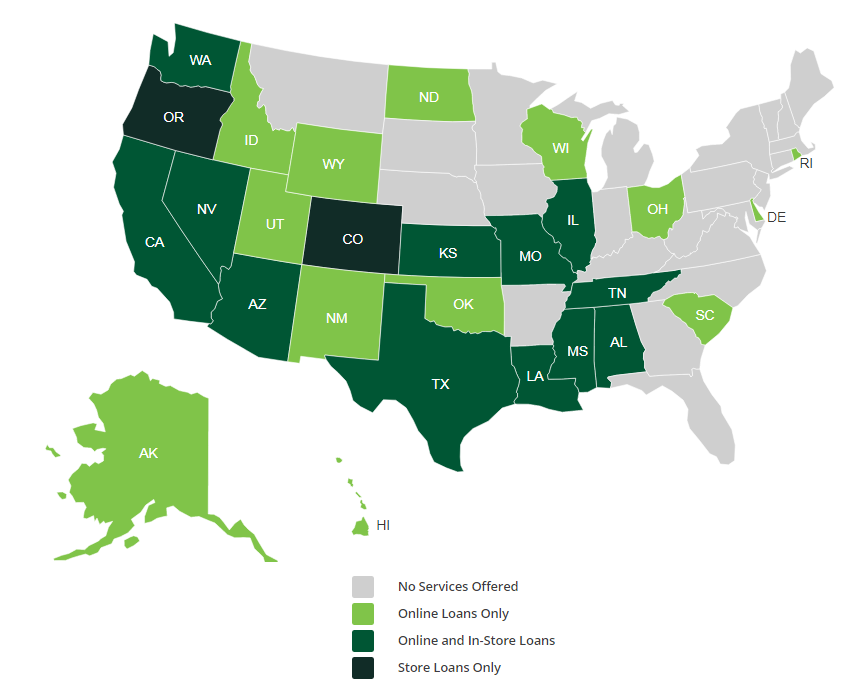

SpeedyCash website provides visual information about the availability of services in various US states in the form of the graphics card. All states are subdivided into colors according to the type of services provided.

After analyzing the map, we came to the conclusion that Speedy Cash services can be used by customers from 28 US states.

| Online Loans Only | Online and In-store Loans | Store Loans Only |

| Idaho Utah Wyoming New Mexico Oklahoma North Dakota Wisconsin Ohio South Carolina Rhode Island Delaware Alaska Hawaii | Washington Nevada California Arizona Kansas Texas Missouri Illinois Tennessee Alabama Mississippi Louisiana | Oregon Colorado |

Trying to Get a Consultation

Since we found feedback from customers who were dissatisfied with Speedy Cash customer support service, we decided to test it personally. We decided to contact the support group and find out moments that remained unclear to us, namely the borrower’s age, minimum / maximum loan amount and opportunity to get a microloan with bad credit history. These questions were sent to the support team via e-mail and a contact form.

Unfortunately, these questions remained unanswered during 24 hours, which means that customers will either have to wait for a long time to get help, or the support group is completely useless on this website.

Conclusion

Analyzing all the above facts, we can make the following conclusions. Speedy Cash looks like a fairly reliable service with many years of experience. Another advantage is that the website administration provided the highest level of security for its customers.

Another plus in favor of company’s reputation is that the company received a large amount of positive feedback. Negative reviews are also present, but their number is insignificant compared to positive ones. We assume that the company enjoys great popularity because of a wide variety of services provided. According to information provided on the website, we can assume that Speedy Cash is doing everything possible to provide customers with better conditions.

Ready to Apply?

Ready to Apply?