What is SnappyPaydayLoans.com?

Snappy Payday Loans is a lender-matching service which helps to find customers a variety of online loans to suit their individual needs. The company works with a network of trusted direct lenders who are ready to make you a loan offer even if you have a bad credit or no credit. They say their loans are “simple, fast and hassle-free” and claim that you can trust the professionals working at this company.

| Loan types | Min.amount | Max.amount | Period | APR | Required documents | Bad credit |

| Installment loans | vary by state | vary by state | 12 months | vary by individual and by state | driver’s license or state ID, SSN | yes |

| Payday Loans | $50 | $1,000 | up to 30 days | vary by individual and by state | driver’s license or state ID, SSN | yes |

| Payday installment loans | $50 | $1,000 | 4-6 months | vary by individual and by state | driver’s license or state ID, SSN | yes |

| Lines of credits | vary by state | vary by state | agreed individually | vary by individual and by state | driver’s license or state ID, SSN | yes |

Types of Loans

Snappy Payday Loans can help you find a variety of loan types:

- Payday loan (a short-term loan which is typically repaid on your next payday or within 30 days. With a payday loan, you can typically be approved for up to $1,000. Payday loans are perfect for short-term money troubles, such as unexpected bills and other incidentals. It’s easy to obtain a payday loan);

- Payday installment loan (a short-term loan with greater flexibility which is repaid in several installments over the period of 4-6 months. Such loans are also perfect for short-term money troubles and unexpected expenses like car or home repairs, medical bills and others. These loans are only available in certain states. Unlike regular payday loans that allow you to get the limited amount based on your paycheck, payday installment loans allow you to borrow more funds, so you can cope with emergencies effectively;

- Installment loan (a long-term loan which is repaid over a longer period – usually 12 months – in several installments);

- Lines of credit (a loan which you repay at any time. With this cash advance, you can get multiple loans up to your credit limit. You can continue to borrow the necessary money up to your credit limit for as long as your account remains open.)

According to the website, the lender will deposit the funds directly into your bank account as soon as the next business day after your application is approved.

Terms of Use

Snappy Payday Loans offers payday loans ad payday installment loans in the amounts ranging from $50 to $1,000. The minimum and maximum amount of lines or credit and installment loans will depend on your state and ability to pay off the loan.

To get approved for a loan, you must meet the following eligibility criteria:

- You must have an open checking account;

- You must have a regular and reliable source of income;

- You must legally reside in the USA;

- You must be 18 years old or older.

Requirements may vary depending on your state and the lender that approves your loan request.

The rates and terms are not disclosed on the website of the referral service. It’s mentioned that they will vary by an applicant and by state, so you need to review your loan contract carefully before signing it.

The company reminds that you are not obliged to accept the terms of a loan if you dislike them. Besides, you and will not be charged any fees until you accept a loan offer and sign the contract.

Application

You can apply for a loan by filling out a simple online application on SnappyPaydayLoans.com. The process is 100% online.

First of all, you will need to check whether you meet the eligibility criteria to get approved for a loan (see the unit 1.2). If you do, you can complete an online request form.

After that, a specialist from the referral service will try to match you with a suitable lender from its network. If you accept the rates and terms of a particular loan offer, you need to sign the contract. Finally, the lender will deposit the money into your banking account.

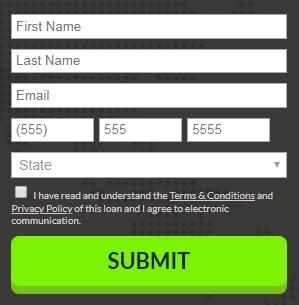

During application, you will need to provide some basic information:

- Name, address, email, phone number, date of birth;

- Social security number, driver’s license or state-issued ID;

- Employment details: employers’ name, address and phone number;

- Your income: amount, frequency;

- Banking account details.

However, applicants from some states may not be approved for loans immediately. The will be asked to fax additional documentation. The list of such states is not provided.

Repayment

You can make payments through the lender’s website. Payday loans are repaid on the day you receive your wages or within 30 days. Installment loans are paid off in several equal installments over a specified period of time (usually several months). Lines of credit are open-ended and don’t have a due payback schedule.

If you fail to make a payment on the due date, you will be charged NSF fees and collection related costs. Besides, non-payment or late payment may negatively affect your credit score.

Extension

Lenders from some states are able to offer you a loan extension, however, this will involve additional fees. Bear in mind that your loan cannot be extended automatically. If you need a loan renewal or extension, you need to contact the lender as soon as possible (at least a few days before the due date).

SnappyPaydayLoans.com Bad Credit

According to the website, applicants with bad credit can still be approved for a loan.

However, they mention that some lenders may verify client information via national databases, such as Tele-Track, Factor Trust, CL Verify during the approval process. Bear in mind that if you failed on your past loans, you may be declined for a loan. Most lenders from the network of Snappy Payday Loans do not report your activity to the three major credit bureaus (Equifax, Experian or TransUnion) but may report it to other reporting agencies, including DataX, Mircobilt, FactorTrust, and others.

The company recommends customers with credit problems seeking out professional financial advice.

Technical Characteristics of the Website

Encryption

The loan-referral company claims that their website fully secures your sensitive information. They add that all transactions are always private and confidential. Indeed. The website uses a 256-bit encryption to ensure that customers’ personal information remains secure through a transmission. The encryption certificate is verified by GoDaddy:

Regretfully, SnappyPaydayLoans.com does not use an Extended Verification Certificate, which is considered the highest possible encryption level.

Mobile Version

The majority of applicants are smartphone users and this should be taken into account. If a website is not mobile-friendly, it is difficult for a user to find and view the content that interests him. Besides, there may be a problem with the fonts – medium-sized letters are easy to read on the computer monitor, but they look tine on smartphones. In addition, if a site is not adapted for mobile devices, you can accidentally click the wrong link. You will not have such a problem on a desktop or notebook because you use a PC mouse for navigation. But it will be quite problematic on a smartphone screen. If the website is uncomfortable to view from a tablet or smartphone, its rating drops dramatically. Fortunately, this website’s developers have taken into account the possibility of applying from mobile phones. Google Search Console confirmed that SnappyPaydayLoans.com is mobile-friendly:

The most important advantages of the mobile version:

- No horizontal scrolling when viewing the pages on the phone in a vertical mode;

- All content (text and pictures) are optimized for the screen size;

- No elements that do not work on mobile platforms.

Antivirus

Regretfully, this website is not screen for viruses and other vulnerabilities, so we cannot exclude your risks of being infected with some malware programs. The absence of an antivirus is a serious drawback because hackers can steal your sensitive information submitted to the website. I conclude that this website is not able to provide 100% security to its clients during transactions.

Convenience of Using the Website

To apply for a loan through SnappyPaydayLoans.com, you need to follow 3 simple steps:

- choose the desired amount;

- choose your state so that the matching service can connect you to a suitable lender from your state;

- fill out an online application form. Start with a short form available on the front page:

Once approved, you will need to sign the contract and wait for the money transfer. The funds will typically be available on your account the next business day. Some lenders from the network are even able to deposit the money same day.

After you receive your loan, you will be able to create a personal account to make payments, check your balance and so on.

In general, the website is convenient, however, it’s not very informative. The company did not specify many relevant details that interest borrowers before application: approximate interest rates, late fees, minimum and maximum amounts for some loan types and some others. I conclude that this website requires optimization.

Is SnappyPaydayLoans.com Legit?

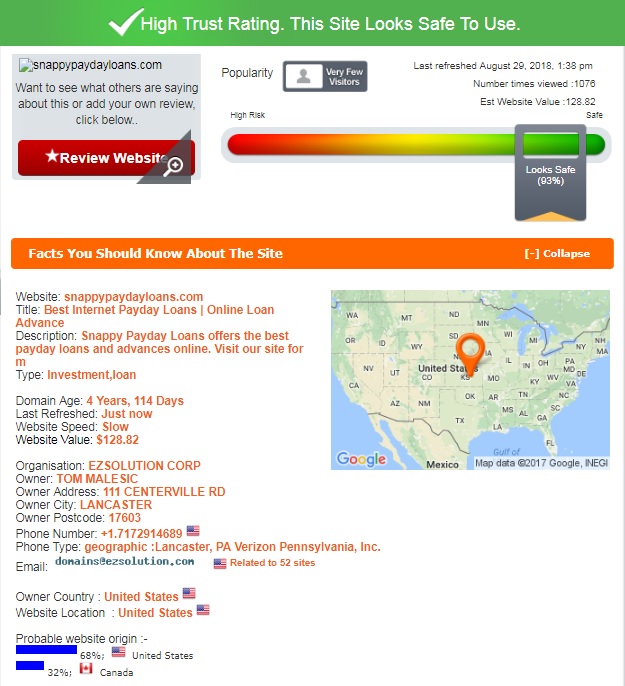

Before using any website providing online loans or connecting you to direct lenders, it’s important to check its trust-rating from ScamAdviser – a reputable online verification service. It turned out that SnappyPaydayLoans.com received 93% out of 100%, which is a very good indicator.

According to Scam Adviser, the site looks safe to use. The owner country and website location are the United States, however, it also may involve Canada. The domain was created 4 years ago, which is considered a relevant age. Regretfully, the website has very few visitors, which means it’s not very popular. In general, Scam Adviser did not reveal anything suspicious or illegal about this online service.

SnappyPaydayLoans.com Reviews

On-site Reviews

Customer reviews would help throw a light on its real performance. I expected to find some Snappy Payday Loans reviews left by their former clients. It would be the best proof of the service’s reliability. Unfortunately, there are no testimonials posted on the native website of the company. Since I did not manage to find any on-site reviews, I decided to look for some external reviews on third-party websites and forums.

Reviews on Third-Party Websites

Regretfully, customer reviews on third-party web sources were not available. Obviously, this loan-matching company has failed to gain any reputation over 4 years. Should you ever come across any Snappy Payday Loans reviews on the net, please let us know by leaving a comment below!

Customer Support

Contact Information

Snappy Payday Loans claim to be a fully US-based company. However, they did not provide any information about themselves: no phone number, no email, no address.

Of course, it is much more important to know contact details of a direct lender you are connected to, still, I would feel more confident if I knew the address and phone number of this matching service too because they ask customers to submit too many personal and sensitive information. I conclude their “Contact Us” page requires significant optimization.

SnappyPaydayLoans.com Locations

Snappy Payday Loans are available in many states across the United States: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico, New York, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.

However, if you are a resident of Georgia, New Jersey, New York, or North Carolina, you will not be able to get a loan through this website.

How to Get a Consultation?

If you have any general questions about loans or the services of the referral service, you can contact Snappy Payday Loans customer support by filling out a contact form:

But if you have any questions regarding your loan application status or loan terms/rates, you must contact your lender directly.

Unfortunately, there are no other ways to reach the customer support of the matching company so I had to send my question using the one available option: a contact form. I asked them to specify approximate interest rates for payday loans. Regretfully, I never received a reply. So do not expect a speedy assistance. I conclude that their customer care department leaves much to be desired.

Conclusion

Snappy Payday Loans is an online matching service which serves as a bridge between a customer and a direct lender. Unlike other lenders, this company offers to get a payday loan with an extended repayment schedule will allow borrowers to manage their budget correctly. Besides, they have an easy application process, which is purely online. This means you can apply for a loan from any place. Besides, lenders promise to deposit funds very quickly, sometimes even on the day you apply. If you have a bad credit, you may not worry since you still have high chances of being approved for a loan. You only need to prove that you will be able to repay your loan on time. Another advantage is that you don’t have to provide any kind of collateral. Finally, the website has a high-trust rating from ScamAdviser, which means it’s legit. However, some aspects prevent Snappy Payday Loans from being the best lender-matching service. The website does not have any important details associated with loans: lending terms, rates and fees, non-payment charges, and some others. Most clients prefer to know such relevant details before applying. Besides, I found neither customer reviews nor contact information, and their customer support service needs to operate faster. Considering all these aspects, I cannot recommend you using this referral service. If you, however, decide to apply for a loan through this website, I strongly advise you to confirm the company’s address.

Ready to Apply?

Ready to Apply?