What is Same Day Payday?

SameDayPayday.com is an online free-of-charge referral service cooperating with a network of 58 direct lenders who are ready to provide people with online payday loans. This company is not a lender and does not make any credit decisions. Its goal is to match a person with a suitable lender who can help solve short-term financial difficulties as quickly as possible.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans | $50 | $10,000 | 2 weeks | 260.71% – 1825% | SSN, state-issued ID, income verification | Yes |

Types of loans

The website helps people find lenders who are able to offer payday loans. These are short-term unsecured loans and generally, do not exceed $1000. They are to be repaid within a short period (usually two weeks). These loans can help you cover unexpected expenses which can’t be postponed until the next time you receive your wages.

Payday loans are not suitable for long-term financing since they can become very expensive in a long run. Same Day Payday encourages customers to borrow funds responsibly.

According to the website, money can be transferred the same day but generally, borrowers receive it within 1 business day. Transfer time depends on a borrower’s banking institution and the time he applied for a loan. To get cash as quickly as possible, the company recommends customers to apply during normal banking hours, complete application without mistakes and remember about bank holidays, which can delay money transfer.

Terms of Use

SameDayPayday.com does not lend money but purely collects information which a person provides and forwards it to 58 lenders in its network, such as MyCashTime, National Cash Advance, National Payday, Paycheck Today, Payday OK, Payday One, PaydayHawaii, Paydayloan.com, Personal Cash Advance, Prosper, Quik Pay, Rapid Cash, RISE Credit, Sonic Payday, Speedy Cash, SuperPawn, ThinkCash, TitleMax, United Cash Loans, United Check Cashing, We Give Loans, and many others.

They claim that applicants are not required to do much paperwork or wait for several days to be approved for a loan.

Payday loans usually range from $100 to $1,000 but some lenders from the network are able to provide up to $10,000. But there is no guarantee that you will be approved for the amount you are asking for. The decision will be influenced by your income, credit score, and current debts.

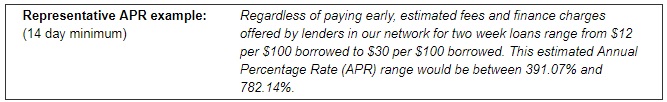

APRs for a payday loan will be specified by your individual lender but generally, it can range from 261% to 1825%. You will be able to check your individual APR after you submit your loan request. The terms and rates will be also specified in your contract.

Same Day Payday provides a representative APR example for a 2-week-loan:

The company mentions the general requirements you must comply with if you want to get a payday loan via this referral service. You must:

- be a U.S. citizen;

- be at least 18 years;

- not be on active duty with the U.S. Military;

- have a stable income of at least $750 per month;

- have an open checking account in your name;

- be employed for one month or more;

- have home and work phone numbers.

Each lender has its own requirements and you should check them before applying for a loan.

You are not obliged to accept a loan offer. If you dislike the terms and rates offered by a particular lender, you may simply refuse and reapply for a loan. As a rule, you will be connected to a different lender.

If you are ready to accept an offer and obligations under the contract, you should e-sign the documents.

Application

The application process on SameDayPayday.com usually takes about 5 minutes or less. The approval time normally takes 2 seconds.

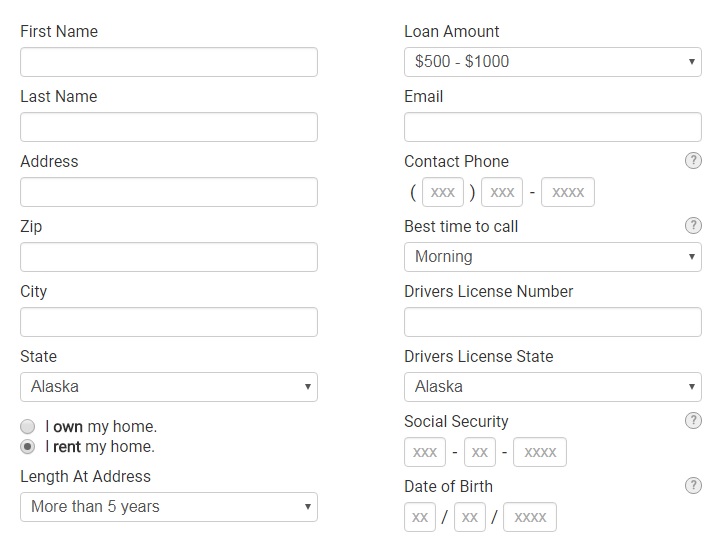

You are not required to provide a collateral to get a payday loan but you must fill in some personal and financial information including driver’s license, social security number, phone number, address, email address, military status, name and phone number of your employer, active bank account, ABA/routing numbers, information whether you rent or own a house, income, how often you get paid, length of employment at your current job, and so on.

Repayment

Payday loans should be repaid in a short period of time (usually within 2 weeks). You will be informed about repayment terms and conditions before signing the contract. Each lender offers different ways of loan repayment but usually, the money is withdrawn from your checking account electronically.

The lender informs that implication for non-payment or late payment may be serious:

- Late or partial payments may incur additional fees;

- Not-payment may also incur additional fees and collections (including phone calls and emails), which will negatively affect your credit score. However, the website mentions that all the lenders from the network act in accordance with the applicable laws.

Extension

Same Day Payday is not a lender and cannot extend any loans. Extension policies vary by lender and not every lender from the network will be able to offer a loan renewal. Bear in mind that extension fees could be significant so you’d better check your individual lender’s policies. The company also mentions that some states forbid renewal policies so you should be sure that you will be able to pay off your debt on the due date. If you have doubts, you’d better abstain from taking a payday loan.

SameDayPayday.com Bad Credit

Even if you have a bad credit score, you can still be approved for a payday loan, however, lenders may run credit checks to review your credit history. Lenders may also check whether you have repaid previous loans and if you have any current debts.

Technical Characteristics of SameDayPayday.com

Encryption

The website uses the average encryption technology – 128-bit SSL – to ensure that the personal information of borrowers remains confidential. The secure connection is provided by GeoTrust Inc.

128-bit SSL encryption technology is considered a sufficient encryption, however, modern consumers prefer websites with a more advanced encryption (256-bit SSL).

Mobile Version

The website seems to be adapted for mobile devices. The page structure is adjusted to the size of the device. Both mobile and desktop versions are the same site. All buttons are enlarged so that customers can click on them with a finger. In general, the page is cut down to the basic elements. Also, it is possible to switch to the full version of the site, if the visitor decides that mobile functions are not enough for him. The main advantages of this mobile version: large text, short forms, large clickable elements, fast speed of loading, no horizontal scrolling.

The best expert who will tell you whether SameDayPayday.com is mobile-friendly is Google Search Console, an official service from Google. It will show how the site looks on the average smartphone screen and will give recommendations for improvement.

The presence of a mobile version of the site is an additional bonus to the image of the company.

Antivirus

According to the website, they safeguard customers’ personal information from hackers and unauthorized access by using security measures that comply with applicable laws. They claim to use McAfee antivirus which daily scans the website for vulnerabilities. However, the website does not have a corresponding McAfee seal showing that SameDayPayday.com has passed necessary scans. I conclude that this site is not protected from viruses.

Convenience of Use

To apply for a payday loan, you do not need to register on this website. Here you will find a short and simple application form, which only takes a few minutes to complete. The referral service forwards your personal information to one or more lenders from its network and they decide whether they are able to make a loan offer or not.

The website asks to provide basic details that a lender wants to know. The whole application consists of 3 steps (personal information, employment information, financial information). You can see the 1 step on the screen below:

I appreciate that the website has a search tool which allows finding payday lenders in your city. This is convenient for users who want to review average loans terms and conditions before applying for a loan:

![]()

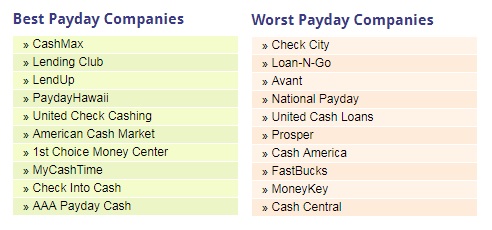

Besides, SameDayPayday.com has made up the rating of best and worst lending companies:

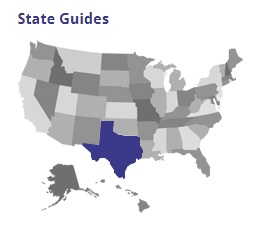

They have one more convenient tool – State Guides. You can click on the map and find the address and phone number of each payday loan lender available in your city:

I also like that this website has a detailed description of each lender’s policies, rates and terms. Most referral services do not provide such details and it’s impossible to find them out until you are matched with a particular lender.

Here you can also find informative articles about loans, lending and finances in general, and a comprehensive FAQs section. I think you will have no difficulty working with this website.

Is SameDayPayday.com Legit?

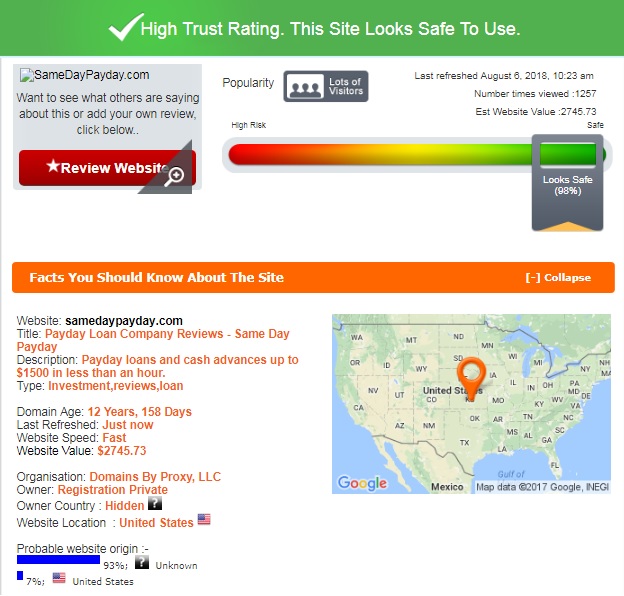

ScamAdviser gave Same Day Payday a trust rating is 98% out of 100% and claimed that this site is safe to use:

According to the report, the domain was created over 12 years ago and the website has many visitors every day. The site is owned by Domains By Proxy, LLC and located in the United States. Scam Adviser has some doubts about the site’s owner country but has no doubts about its legitimacy.

SameDayPayday.com Reviews

On-site Reviews

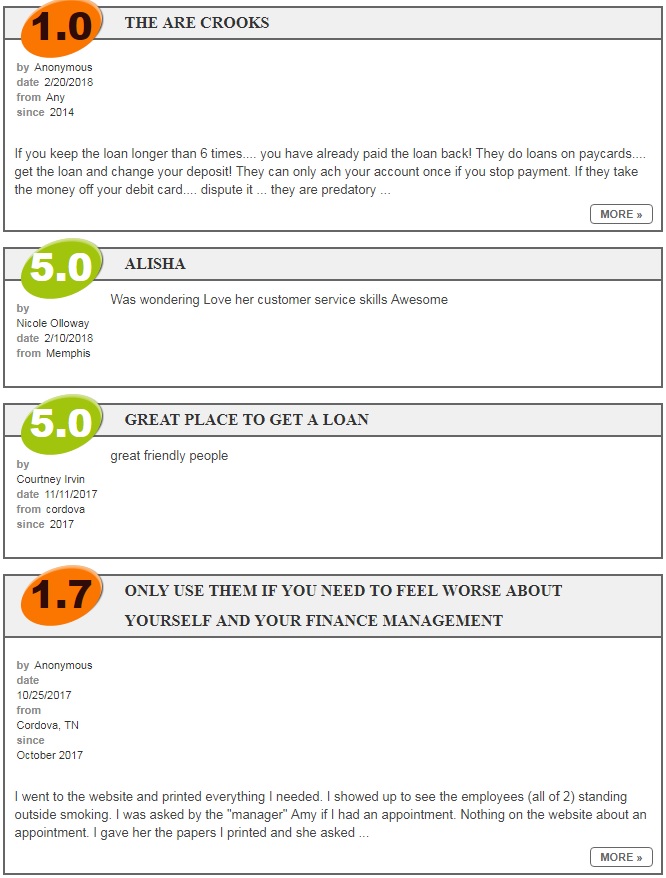

I found no Same Day Payday reviews on the official website of the company. Instead, they encourage visitors to read reviews for direct lenders they cooperate with. Below you can read what people think about 745-CASH, a lender from Tennessee:

There is an equal number of positive and negative reviews for this lender. Some customers had no problems with getting and repaying payday loans while others had some unpleasant issues. The situation with other lenders from the network of SameDayPayday is nearly the same. In fact, I was glad to see mixed comments which proved that they had been written by real customers. To get a better understanding of SameDayPayday reputation, I decided to search for any reviews on independent third-party sources.

Reviews on Third-Party Websites

Unfortunately, I did not manage to find any SameDayPayday.com reviews on independent websites. This may be because this company is purely an intermediatory between a borrower and a lender. Typically customers leave reviews for a direct lender, not for a referral service. However, I will appreciate if you let me know that you have found some comments related to SameDayPayday.

Customer Support

Contact Information

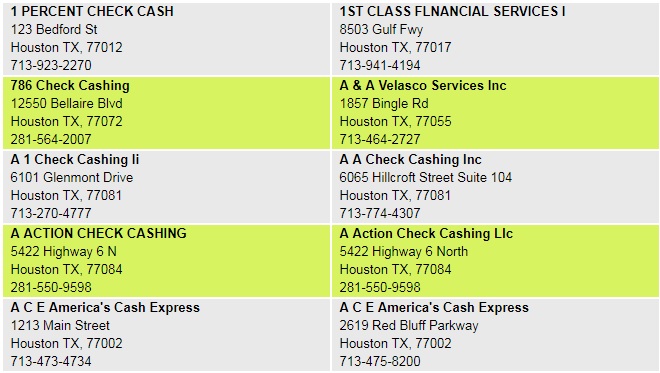

Regretfully, the company did not provide any contact information on its website. Instead, you can find here the physical address and phone numbers of all 58 lenders cooperating with this matching service. Below you can see how they arranged the contract information of lending companies:

Actually, I would be pleased if SameDayPayday had provided at least email address which could have been used to get in touch with their customer support team.

SameDayPayday.com Locations

This referral service is not available in all states. You will not be able to get such a loan if you live in Arkansas, Georgia, Oregon, Washington, New York, West Virginia or Vermont. The company informs users that loans availability may change without notice.

Getting a Consultation

The only way to contact SameDayPayday customer support is to fill out a contact form. If you have any questions, comments, complaints or concerns regarding your current loans, you should contact your lender directly.

I tried to reach the customer care department by filling out a contact form but regretfully an error occurred. No matter how hard I tried it was impossible to submit my question. I conclude that currently there is no way to contact their customer support and you should bear it in mind when submitting your personal details to this website. The company needs to eliminate all software bugs for customers’ convenience.

Conclusion

SameDayPayday.com is a referral service which has many advantages: a convenient application form, little paperwork, wide availability, a vast network of lenders, quick approval times, disclosed terms and rates, a comprehensive FAQs section. Besides, the company has an excellent reputation under the version of ScamAdviser. However, there are some issues that worry me: this company is an intermediatory but not a direct lender, and you should consider it before applying for a payday loan. In addition, there is no way to reach their customer support so if you have any issues with SameDayPayday, you will have to solve them on your own. Finally, I found no customer reviews for this online company. All these aspected prevented me from giving an excellent score to this lender-matching tool. I give them 3.3 stars out of 5 and recommend you to use this website with caution.

Ready to Apply?

Ready to Apply?