What is RPM Lenders?

Rpmlenders.com is a lender providing various loan types all across the state of California. The company is ready to lend you extra cash you need to cope with unexpected expenses. They claim to have convenient store locations and professional staff. The lender strictly adheres to federal and state regulations requiring transparency of interest rates, rollover limits, rates/fees, penalties and terms.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans, signature installment loans, title loans | $100 | $15,000 | Varies | Varies | Driver’s License or State Issued I.D. | Yes |

Types of Loans

RPM Lenders offer car title loans, payday loans and signature installment loans.

A signature installment loan is a short-term loan which can be easily obtained. Customers typically can get loans reaching $2,600 and repay them within 24 months.

A payday loan is a short-term loan reaching $1,000. Such loans are typically paid off on your next payday.

A title loan is a fast and simple way to get the amount of money based on the value of a vehicle that you own.

Once you have been approved for a loan, you can receive the funds in as little as 30 minutes in one of the company’s locations.

Terms of Use

If you want to get a loan with RPM Lenders, you must be 18 years of age or older.

Applying for a loan through the website is free of charge and implies no obligation. Once applied, a customer service manager will call you to discuss your loan.

Payday loans amounts range from $100 to $255. Title loans amounts reach $15,000, depending on the value of your vehicle. Signature installment loan amounts may reach $2,600.

- To qualify for a title loan, you need to own a vehicle and have a valid photo ID. You only need to bring your vehicle to the lender’s location, fill out an application, and receive the cash. After that, you keep and drive your vehicle. This whole process usually takes 20-30 minutes. With this loan, you do NOT need to have an active checking account, Besides, you do NOT need a driver’s license, but you do need a state-issued photo ID;

- To qualify for a payday loan, you need to be at lqast18 years of age or older, have an active checking account, show the recent pay stub, have a blank check and a valid photo ID. The total cost of your payday loan will be determined by the lender. Borrowers will be able to review the final rates, terms and fees before signing an agreement;

- To qualify for a signature installment loan, you need to have a driver’s license or a state photo I.D., a statement from your checking account and the recent pay stub).

Application

To get fast cash, you should fill out an online application form. The lender only requires you to provide the basic information, after which a friendly manager will call you and explain rates and terms in detail. Applications will be accepted in person at one of the company’s location.

Required items to get a title loan include:

- Your vehicle

- Driver’s license or state-issued I.D.

- Lien-free title to your vehicle

Required items to get a signature installment loan:

- An active checking account statement

- Driver’s license or state issued I.D.

Required items to get a payday loan:

- Driver’s license or state issued I.D.

- Most recent pay stub

- A blank check from your checking account

With RPM Lenders, you do not need any collateral and can be approved within 30 minutes.

Repayment

Installment and title loans are repaid within a specified period of time in several equal payments. Payday loans are repaid as soon as you receive your next paycheck. Repayment terms and conditions may vary so you should closely review your agreement.

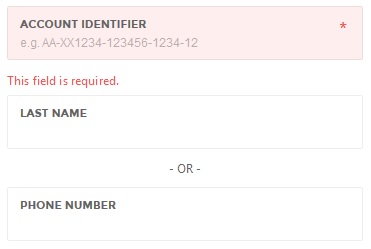

You can pay off your loan in one of the lender’s in-store locations or make a payment online through the website. For this, you should click on the “Make a Payment” button, enter your account number, your last name or phone number. This will give your access to your personal account:

Making payments online allows you repaying your loan anywhere, anytime and from any device.

If you have an unexpected emergency preventing from loan repaying on the due date, you should contact the lender as soon as possible and the managers will try to work with you to keep your account into good standing. If you fail with the payment for your title loans, your car will be repossessed by the lender and sold. Besides, non-payment may incur additional charges.

In addition, RPM Lenders may initiate a collection activity. They claim to keep to all applicable laws and regulations. In any case, the lender will NOT:

- call you before 8 a.m. or after 9 p.m.;

- call you with the intent to annoy/harass or using abusive language;

- collect the debt through deception or misrepresentation;

- threaten legal recourse when in fact no legal action is planned.

Extension

With a payday loan, you may be eligible for loan refinancing. To determine if you qualify for an additional short-term loan, you will need to consult a manager at the nearest RPM Lenders location since terms and conditions can vary.

The frequency of applying for loans can also vary based on your history with this lender and location.

Rpmlenders.com Bad Credit

This company welcomes all credit. A bad credit history will result in a higher interest rate. With this lender, your credit history does not negatively influence the interest rate or charges. They promise to help people with any credit situation. Besides, they do not report to credit agencies if you fail with your payment.

Technical Characteristics of the Website

Secure Сonnection

RPM Lenders try to keep the users’ sensitive information secure and confidential. Their website utilizes a128-bit SSL encryption technology, which protects your information from hackers and other third-party companies. The secure connection is verified by GlobalSign nv-sa:

It’s nice that the lender takes care about the users’ confidentiality and safety but I would recommend them upgrading the encryption level to a 256-bit SSL and using an Extended Verification Certificate – these technologies will be able to provide the highest security to borrowers.

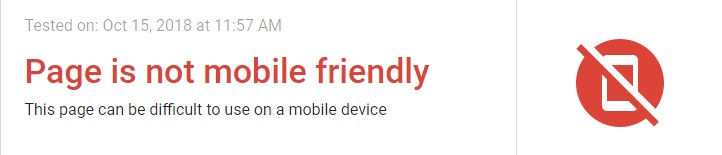

Mobile Version

Regretfully, RpmLenders.com does not have a mobile version, which was confirmed by Google test:

According to the report, the website’s content is wider than the screen and clickable elements are too close together. If you are an active mobile user, you will be surely disappointed since you have to scroll the pages and read the tiny text. I would recommend to use this site from your PC only or search for a mobile-friendly online company.

Antivirus

Unfortunately, the website does not utilize any antivirus, which means you will not be protected from viruses, spyware, identity theft, and other online malware. I would recommend the website’s owner to use an antivirus program. This will provide consumers with a reliable security level. Every online company must take efforts to make its website the safest place for customers.

Convenience of Use

Payday loans

To get a payday loan with RPM Lenders, you should just fill out a short online application form. It will instantly refer your information to the lender’s closest location and a manager will give you a call to discuss your loan terms and rates. After you have finished a phone conversation, you should visit the local RPM Lenders location to finalize your loan and receive the requested cash. When going to the lender’s location, you should take with you

the following documents: state-issued photo ID or driver’s license, most recent paystub, recent bank statement and a blank check from your checking account.

Title loans

To get a title loan, you need to complete an online application form. Once submitted, your information will be immediately referred to the lender, and a manager will give you a call to discuss your loan terms and rates. Your loan will be finalized in the nearest store. When going to RPM Lenders’ office do not forget to take with you a state-issued photo ID, the lien-free title to your car and the car itself. Once approved, it is possible to get the cash instantly on the spot. You will keep and drive your car the entire lending period while you are making payments.

Signature installment loans

To get a signature installment loan, you need to fill out our an online application form and you’ll soon receive a call from a manager. Then you will need to come to the office and finalize the approval process. For this, you will need the following documents: a checking account statement, driver’s license or a valid state I.D., your most recent pay stub.

The whole process is intuitive and clear, however, not all borrowers like going anywhere to get the cash. Many online lenders allow getting payday loans online. However, clients can get the cash on the stop immediately, while when using a bank transfer, they should wait for 24 hours or even more. Still, I think a customer should have a choice.

I also want to mention that the website has a convenient locator which helps users find the nearest RPM Lenders’ store. Besides, consumers can avoid online registration and proceed to the application immediately, which helps save much time and efforts.

Is Rpmlenders.com Legit?

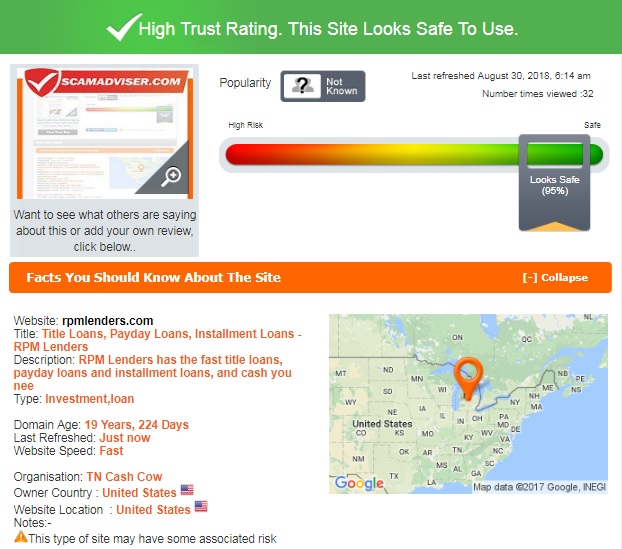

ScamAdviser reported that this website seems safe to use. Rpmlenders.com has a 95% trust-rating, which is a good indicator.

The background of the domain is outstanding – it has been active for over 19 years and is based in the United States. Regretfully, the website’s popularity is unknown. Although the website has a high trust-rating, Scam Adviser reported that it may have some associated risk, and you should consider this information before using this lender. But in general, nothing testifies that this company is risky or illegal.

Rpmlenders.com Reviews

On-site Reviews

More than 70% of customers read reviews of other people before using online services. User reviews are a necessary component for any modern online store. They help a potential client to get rid of doubts about a particular product or help in the final choice of a product from several similar options. 63% of users will most likely apply for a loan from an online lender that has customer reviews; 86% of consumers say they trust other people’s reviews as well as personal recommendations.

Regretfully, I found no RPM Lenders reviews on their own website. So, I recommend the lender to create a separate testimonial page since customer reviews are an important part of a modern online store and at the same time one of the indicators of the seller’s attention to customers.

Reviews on Third-Party Websites

Since RpmLenders.com has been active for over 19 years, I hoped to find many customer reviews on the web. However, their number was not as impressive as the domain age: I found about 20 reviews posted on third-party websites.

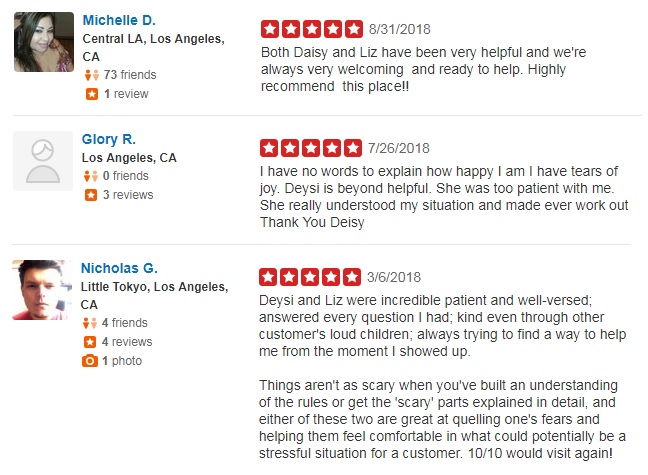

Michelle D. posted a review in August 2018 reporting that the representatives of this lender were very helpful and welcoming, She highly recommended this place. Glory R. left a comment in July 2017 saying that she has no words to explain how happy she was she had tears of joy. The women mentioned that the manager was very helpful and patient – she really understood her situation and tried to help. Nicholas G. reported that the customer support team was very patient and well-versed, answered every question, always trying to help him. He rated RPM Lenders 10 stars out of 10 and added he should use them again.

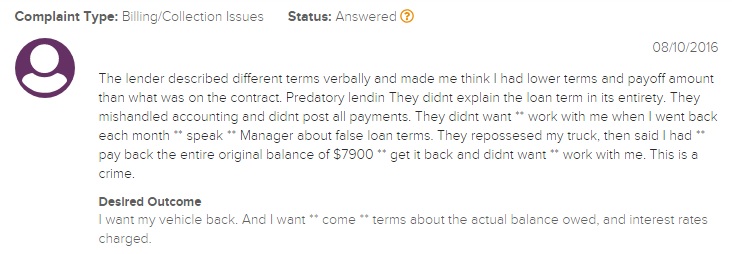

These reviews are impressive but regretfully, the number of RPM Lenders complaints was about the same. One user posted a complaint on BBB.org saying that the company described different terms and made him think he had lower terms and total due amount than what was on the contract. The lender mishandled accounting and did not post all payment. As a result, the customer lost his vehicle. He claimed it was a crime.

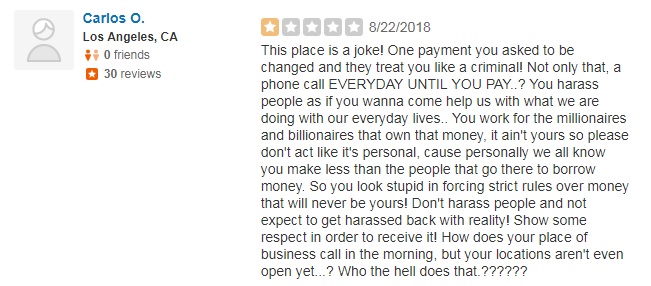

Another borrower, Carlos O., claimed that this place was a joke. The managers treated him as a criminal because he had asked to change one payment. Besides, they called him every day early in the morning until he paid. The user wanted them to show some respect.

Other customers also mentioned excessive charges interest rates that were beyond legal.

It turned out that this online company has a mixed reputation. Thus, conclude that this lender is not able to satisfy all consumers and you should bear this in mind.

Customer Support

Contact Information

RPM Lenders have disclosed the contact details on the website: all their stores are listed in the “Contact Us” section.

- Email: [email protected]

- Phone number: 1-800-922-8803

It’s nice to see that this lender is transparent and has nothing to hide. Typically, referral services do not provide any contact information.

Rpmlenders.com Locations

The lender is available in 12 in-store locations across the state of California: Fontana, Santa Ana, Norwalk, Bell Gardens, Long Beach, Los Angeles (3 stores), Inglewood, Sherman Oaks, Sacramento, and Oakland. If you live in any other state, you will not be able to get a loan from this company.

Getting a Consultation

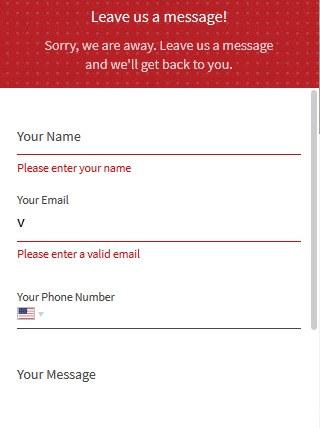

RPM Lenders guarantee to provide customers with the best customer service. They say their friendly representatives are ready to serve customers 24/7. If you need help, you can contact the lender by filling out a short online request form on the website. You can also reach the managers by sending an email to [email protected] or calling at 1-800-922-8803. I also noticed the Live Chat tool at the front page of the website, so I decided to use instant messages for getting help. Regretfully, this option was unavailable at the moment.

For this reason, this company earned a zero percent for its customer service.

Conclusion

RPM Lenders is a lender which offers generous loan amounts reaching $15,000. Besides, the company requires no collateral and welcomes all credit. Using this website, you can be approved in a couple of minutes and get the funds the same day. BUT for this, you need to visit the local store of the company, that is, the option os getting the funds remotely is not available. In addition, the lender has a high trust-rating by ScamAdviser, which means it’s working within the current laws and regulations. In general. Lendgreen seems to be a good service, however, the complaints posted by the previous users concern me. Read all the complaints before using this online service. Finally, I disliked their customer service and the lack of information about approximate interest rates. There are much more reliable lenders that are ready to transfer money online and you should take it into account.

Ready to Apply?

Ready to Apply?