Quickquid.co.uk Self-Presentation

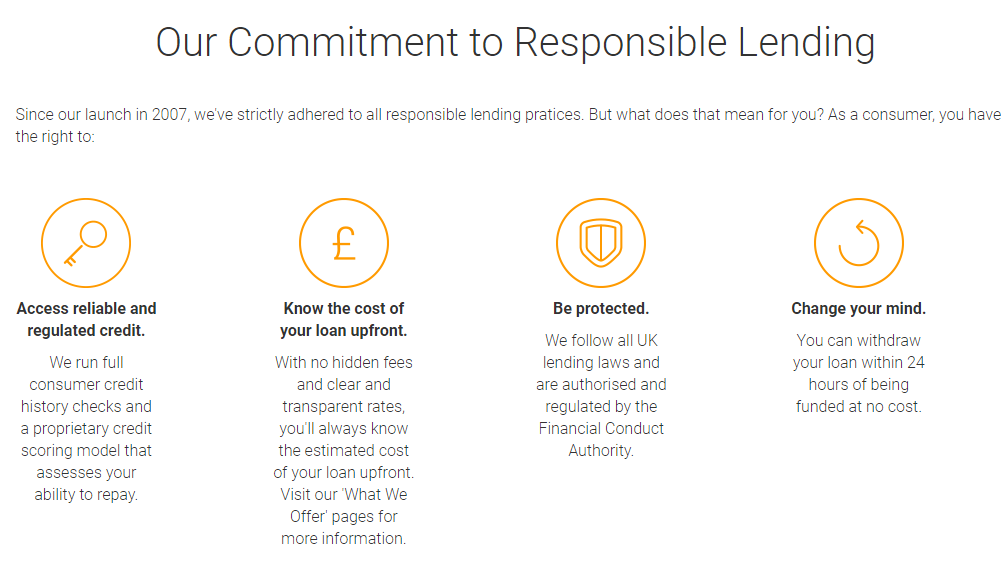

QuickQuid is a financial institution offering its customer to get a short-term loan on very favorable terms. The company runs its activity since 2007 and during this time has gained the reputation of reliable money lender is the UK. The company performs its services under applicable legislation and its activity is approved by trusted and reliable organizations, such as Financial Conduct Authority. On the website, you can find detailed information and numbers of licenses of the firm, as well as reasons to choose this lender on «About Us» page.

QuickQuid is a financial institution offering its customer to get a short-term loan on very favorable terms. The company runs its activity since 2007 and during this time has gained the reputation of reliable money lender is the UK. The company performs its services under applicable legislation and its activity is approved by trusted and reliable organizations, such as Financial Conduct Authority. On the website, you can find detailed information and numbers of licenses of the firm, as well as reasons to choose this lender on «About Us» page.

With QuickQuid you can count cost of your loan upfront, and know exactly your interest rate. Even before applying you can use special calculator on the website to see how much will you have to repay and decide whether you want to take a loan. Besides all customers may get a discount on interest by using special coupon codes (read how to get them on the website). You can also find all necessary information at easy access on the website, clarifying all issues of lending process.

With QuickQuid you can count cost of your loan upfront, and know exactly your interest rate. Even before applying you can use special calculator on the website to see how much will you have to repay and decide whether you want to take a loan. Besides all customers may get a discount on interest by using special coupon codes (read how to get them on the website). You can also find all necessary information at easy access on the website, clarifying all issues of lending process.

| Type of loan | Min amount | Max amount | Interest rate | Terms | Documents required | Bad credit history |

| payday loans; short-term loans; personal loans; understanding bad credit loans; wonga loans; cash loans; quick loans; payday loans direct lender; no guarantor loans; unsecured loans; short-term loans; best payday loans; small loans; £1000 loans; doorstep loans; overdraft. | £50 | £1000 (£1500) | 0.80% daily | 1 – 3 months | none | yes |

Types of Loans

There is no special list specifying which types of loan you can get here. In the footer you may see list of pages, where there are some names of loans:

- Payday loans;

- Short-term loans;

- Personal loans;

- Understanding bad credit loans;

- Wonga loans.

But if you visit the sitemap, you will find quite a long list of loans pages on this website with short descriptions:

- Payday loans;

- Cash loans;

- Quick loans;

- Payday loans direct lender;

- No guarantor loans;

- Unsecured loans;

- Short-term loans;

- Best payday loans;

- Small loans;

- £1000 loans;

- Doorstep loans;

- Overdraft.

After we have analyzed and looked through all these pages, we found out that basically, they all describe 1 type of loan. All conditions of getting a loan are given on the main page, and as we understood these conditions are applicable to all customers and they don’t change. However, all issues concerning terms of your loan must be discussed with the lender before signing the contract.

On the website, you can find information that money will be transferred to you as soon as 10 minutes after you get approval. This is a very short period of time, and it is very doubtful to be true. The approval process may take up to 30 minutes. Of course there a reference in the bottom of the page about money transfer procedure so make sure to read all information and ask the ender about terms.

Terms of Use

Services and products provided on the website are intended for customers over 18 years of age only, and information contained on the website is not an invitation to clients who are under 18 to buy any services or products.

QuickQuid provides loans from £50 to £1000 (£1500 for returning customers). The loan can be repaid in 1, 2 or 3 payment periods (a loan is granted for up to 3 months). The daily interest rate is 0.80%, and this rate is fixed – it will not change depending on the amount and the term unless other conditions are agreed. You can also pay early at no additional cost. This can help you save money by reducing the amount you pay in interest.

To be eligible to apply, you must:

- have a valid UK bank account;

- be employed;

- be a resident of the UK;

- be at least 18 years old.

To apply for a loan you have to provide some personal information about yourself. Here is some of the information QuickQuid asks for during the application process:

- address information – to verify your identity when your application is reviewed;

- employment information – the company will not contact your employer — instead, they use third-party services to verify employment;

- financial and monthly expense information – information about your income and expenses gives a picture of your financial circumstances, which helps to provide you with a suitable loan offer;

- bank account information – if approved, this information is used to send your money to your bank account within 10 minutes after approval.

As you can see from requirements, you have to be employed to get a loan, so unemployed customers have little chance to get money. However, you need to specify this information at your lender.

Application

As it is claimed on the website, usually customers are not asked to provide any papers. Information you provide while filling in the application is verified by the lender, but is some special cases the lender may ask to prove your income information, if there is no possibility to verify it themselves. There is no information about guarantor, but we can assume that if loans are granted online, there is no need in guarantors. In any case, remember that each situation is individual and these issues are discussed with the lender.

You application is reviewed up to 30 minutes according to information found on the website. When there appear some difficulties with verification of the information you may get «Under Review» status. The lender may need more information from you before making our loan decision. In this case approval process may take more than 30 minutes. The company guarantees to grant money at the same day, unless there are some problems with transactions in you bank.

Repayment

If your application is approved, you will be able to repay your loan over 1, 2 or 3 payment periods:

- 1 period – your loan amount and accrued interest are due on your repayment date;

- 2 period – your accrued interest is due on your first repayment date. On your second repayment date, you’ll pay your loan amount plus additional accrued interest;

- 3 period – your accrued interest is due on your first two repayment dates. On your third repayment date, you’ll pay your loan amount plus additional accrued interest.

You can repay your debt early at no additional costs and save money on paying interest.

QuickQuid offers two automated payment methods to its customers. When filling in the application, you will be asked to choose a preferred method and agree to its terms:

- Continuous Payment Authority (CPA) is a type of automatic payment that authorizes a lender to withdraw money from a borrower’s nominated bank account using debit card details. If you choose this method, QuickQuid will use your debit card details to set up the CPA, withdrawing your payments on their due dates without requiring express authorization for each withdrawal;

- Direct Debit Authorisation (DDA) similar to an electronic cheque. QuickQuid presents authorization to your bank and your bank sends specified payment amount to QuickQuid to satisfy loan agreement.

Remember that late repayment can cause you serious money problems. If you don’t have the opportunity to repay your loan on the due date, contact the company immediately to solve the problem and move your due date to another day. Quickquid.co.uk doesn’t guarantee that all lender will meet customers needs in this matter, but most of them treat such situations with understanding.

Extension

If you want to get another loan after repaying the first one, there is nothing easier than that. Depending on the way you choose to repay you a loan, money will be transferred in different periods. As soon as the funds are transferred to company account you may get another loan. But if you want to take another loan while the first one is not repaid, the company sticks to a policy of 1 loan per customer.

If you have an active loan with good history, you may be allowed to use Top-Up on your loan if you have principal remaining on your approval limit. If you apply for Top-Up, you will repay your original loan amount, plus a Top-Up amount, interest and fees, either according to your current repayment schedule or in conjunction with an extension.

If you need more than a few extra days to repay your loan, you may apply for an extension. You can see if you’re eligible to apply for an extension in your account. If your extension is approved, the interest you accrued on original loan must be paid on original repayment date. Amount of your loan will be moved to a later repayment date together with additional accrued interest. You may get only two extensions per loan.

Quickquid.co.uk Bad Credit History

The company provide a special page for describing details about «understanding bad credit loans». There you may find lots of necessary information about company policy regarding customers with bad credit history.

The company doesn’t grant «bad credit loans», but it reviews all applications regardless of credit history of the applicant. The most important for the lender is the possibility of the customer to repay a loan, so if the lender assesses the solvency of the customer and decide that he/she is able to pay for a loan, the application will be approved.

By the way, one way to improve your poor credit history is to take loans and repay them on time. But be careful and don‘t take too much loan, as it will be reflected on your credit history, and you may be considered as taking on debts you cannot repay. Read more details about bad credit history on the website.

Quickquid.co.uk Technical Characteristics

Secure Connection

To provide secure service and provide safety to personal data of the customer, most website use a secure connection. This helps to prevent data theft and other unauthorized use of personal information by frauds. The data you provide on the website are encrypted and safely sent to the server. To make sure that the website uses secure connection you need to check address bar. If you see https:// instead of http://, then you are protected by the company.![]()

More details on the protection level may be found in the certificate. This information is available to any user. As we can see, QuickQuid uses 256-bit encryption – the highest level of protection. This may prove you that your data are safely stored on this website.

Besides we can see information about the owner of the certificate, most companies prefer to hide this information, but here we can check the originality of the certificate and be sure that protection level is decent.

Mobile Version

The website has a very well organized mobile version. All functions of the website remain active, the test is readable and all links are clearly seen and clickable. The customers can easily apply for a loan from their mobile devices from any place. It is very convenient for customers who spend a lot of time out of their home or don’t have computers.

Interface of the website is attractive. The website is adapted for mobile devises so that it is conveniently used. According to the test the website is mobile friendly, which is a great advantage for the pharmacy. There are no issues that need to be urgently fixed. Which means that the company does its best to provide comfortable use of website from any device.

Antivirus

There is no information about antivirus protection on the website. No icon or indicator that customers can safely use the website no being afraid to get malware on their devices. This is a big drawback for the company, as security level is lowered by the fact that they do not provide protection from viruses. We recommend customers to avoid using such websites or do it with extreme caution, to prevent any problems with their devices or data theft.

Convenience of Application

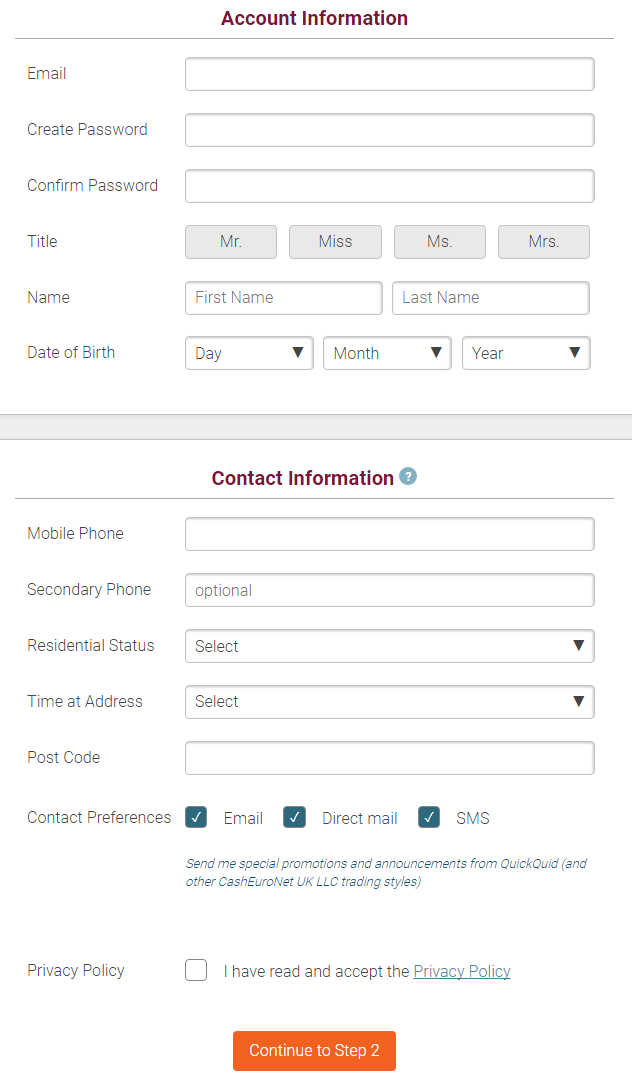

Before you apply for a loan you need to create an account on Quickquid.co.uk. This procedure is a part of the application, so there is no special steps you need to do before filling in the application.

After registering you need to provide details about your workplace, income, and expenses you have every month. This information will be checked and verified during 30 minutes as it is claimed on the website. Then the decision will be made, depending on which you will choose the amount of loan you want to take. Everything is quite simple and quick.

In general, the procedure will take you about 10 – 15 minutes, after which you only need to wait for a decision. As it was said before – no documents or guarantor are needed for your application, which allows saving time on sending papers and waiting for their consideration.

Is Quickquid.co.uk Legit?

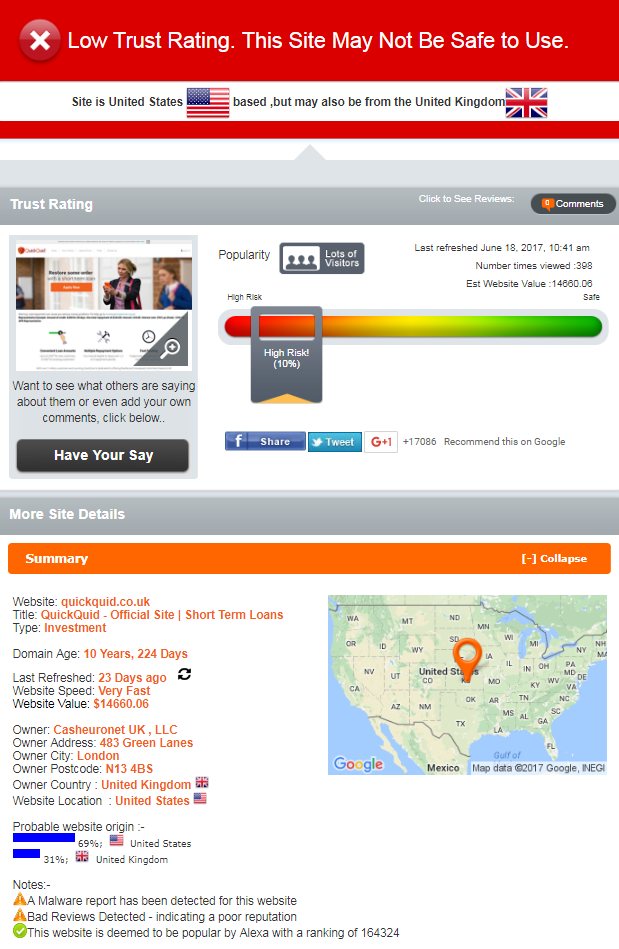

According to ScamAdviser.com QuickQuid has a very low trust rating. Its safety rate is only 10% but the website has lots of visitors (Alexa.com considers this website popular). Location of the website is doubtful it is claimed to be UK based, but most probably it is located in the US. The domain age is very impressive – more than 10 years, which add some trust to the reputation of the company, but the address indicated in the report doesn’t coincide with an address given on the website. This cannot but cause distrustful thoughts about the company legitimacy.

Besides, there is malware report on the company and there are lots of bad reviews which indicate poor reputation of the company among customers. So many negative facts about the company make us recommend you to check everything once again before using services of Quickquid.co.uk.

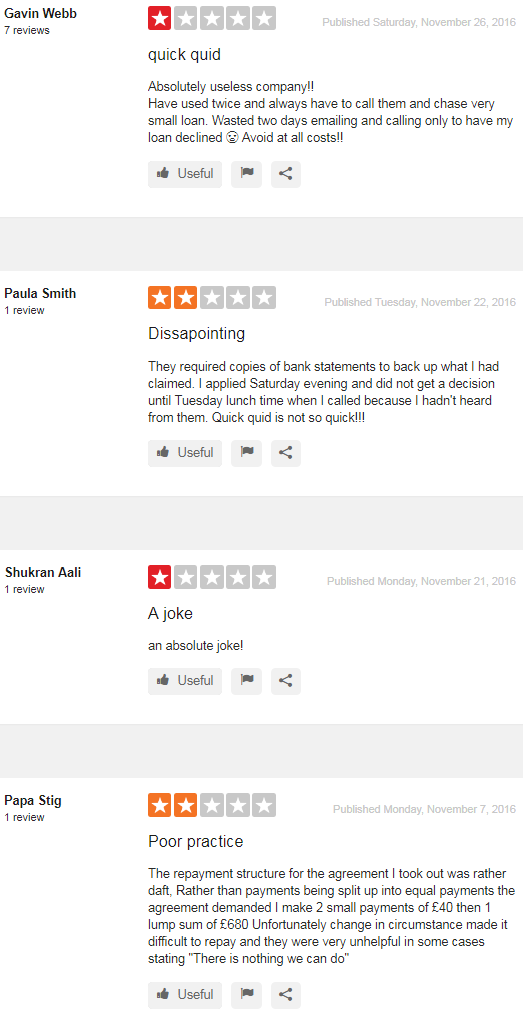

Quickquid.co.uk Reviews

Reviews on the Website

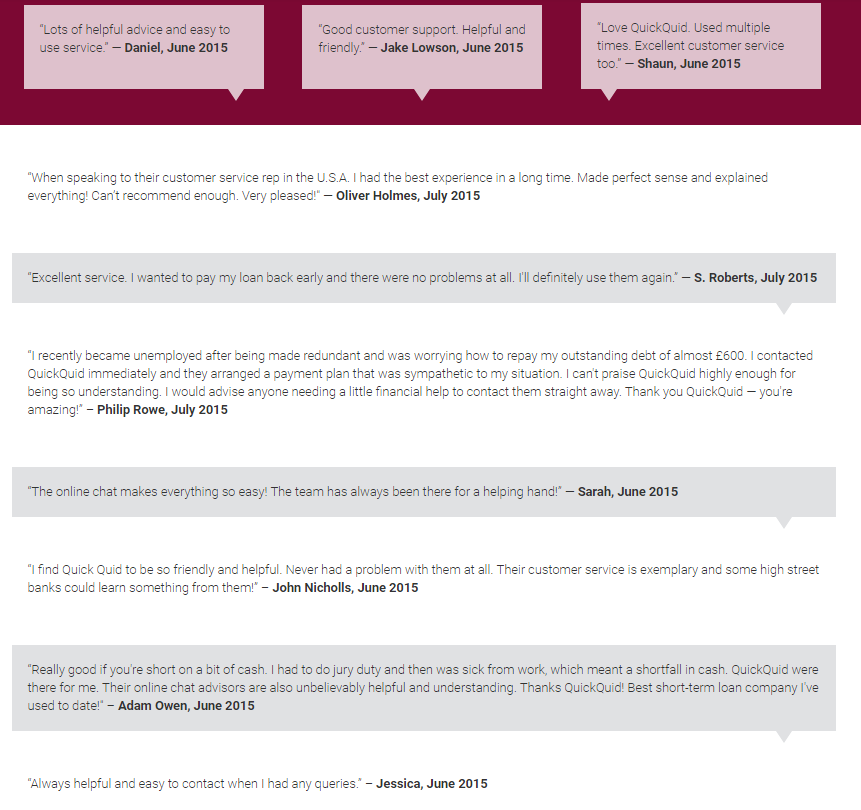

There is a special page on the website with customers reviews, but it is not easy to find. There is no button on the main page or in the footer, so the most customer won’t be even able to find it. The only way is to look via Google search or to check the sitemap. There you will see a link to a page with testimonials.

Comments are not numerous, and all of them are dated 2015. Since then the situation may have changed and these reviews are not actual anymore. Besides all of them are so positive and have the same date, that we acquire the idea that all of them were written by the administration of the website to make customers think that their reputation is great.

On the same page, you may find a link to another trusted forums with comments of the customer about the website. The company claims to have more reviews there and encourages the customer to read them.

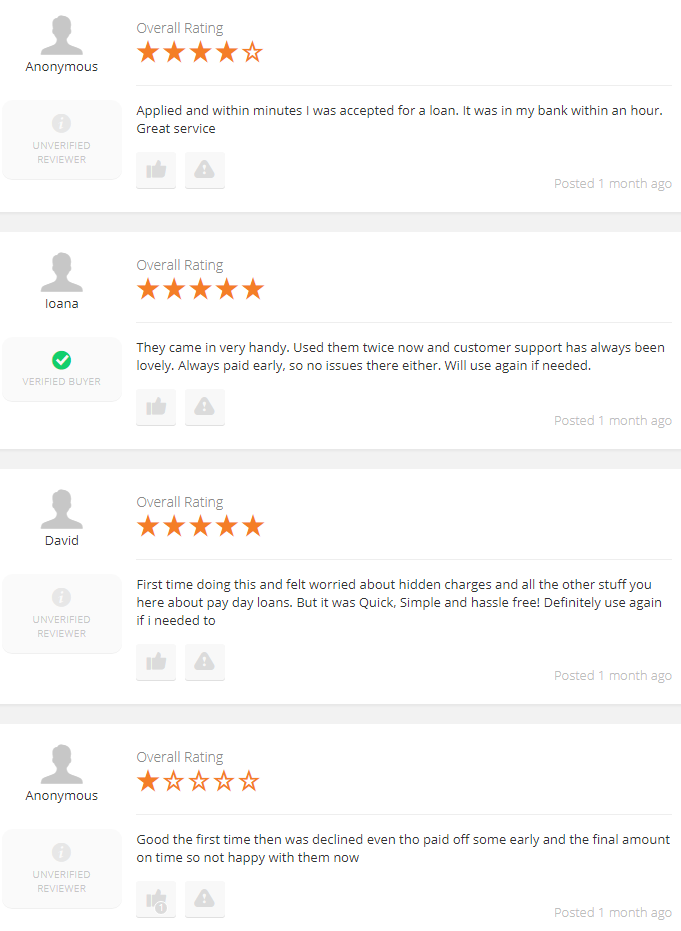

Comments on Foreign Resources

Having visited websites indicated on the website, we found a very controversial picture. TrustPilot.com – a very reliable source of reviews – shows us poor rating of the company – 3.6 stars. There are lots of negative comments and complaints of customers on the service. Most negative comments concern bad customer service and long waiting for money transfer. Many people say that all services they advertise on the website are not available and the company just tries to attract more people. They are scammers and people advise to avoid this company at any cost.

Anyway, TrustPilot has a lot of positive and neutral comments, which shows that some customers remained happy with the service. Another website that was advised by QuickQuid is Reviews.co.uk. Their situation is completely different – much more positive reviews, though negative ones are also present. According to everything we have read on this website, we can say that the company doesn’t have a great reputation, but as with any company is has bad and good moments in its performance.

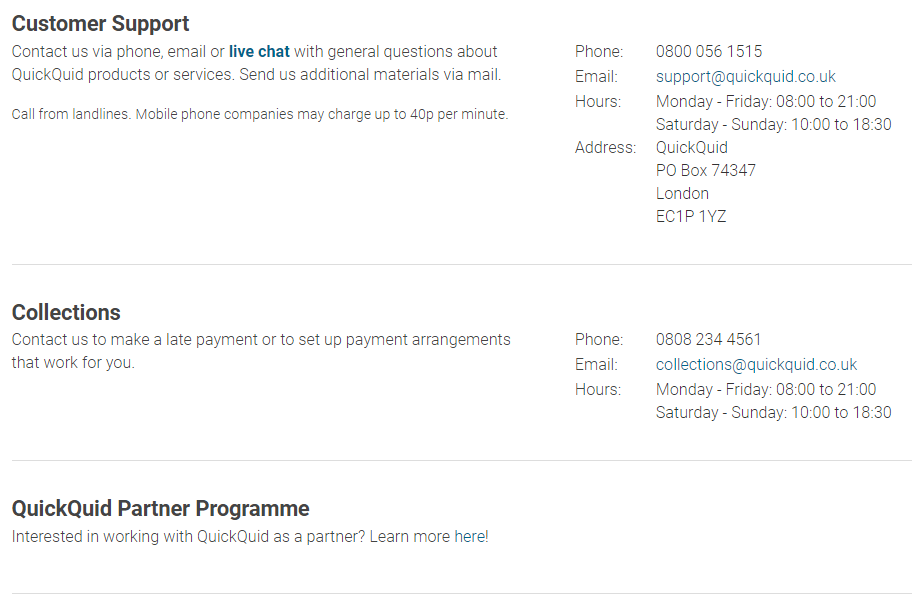

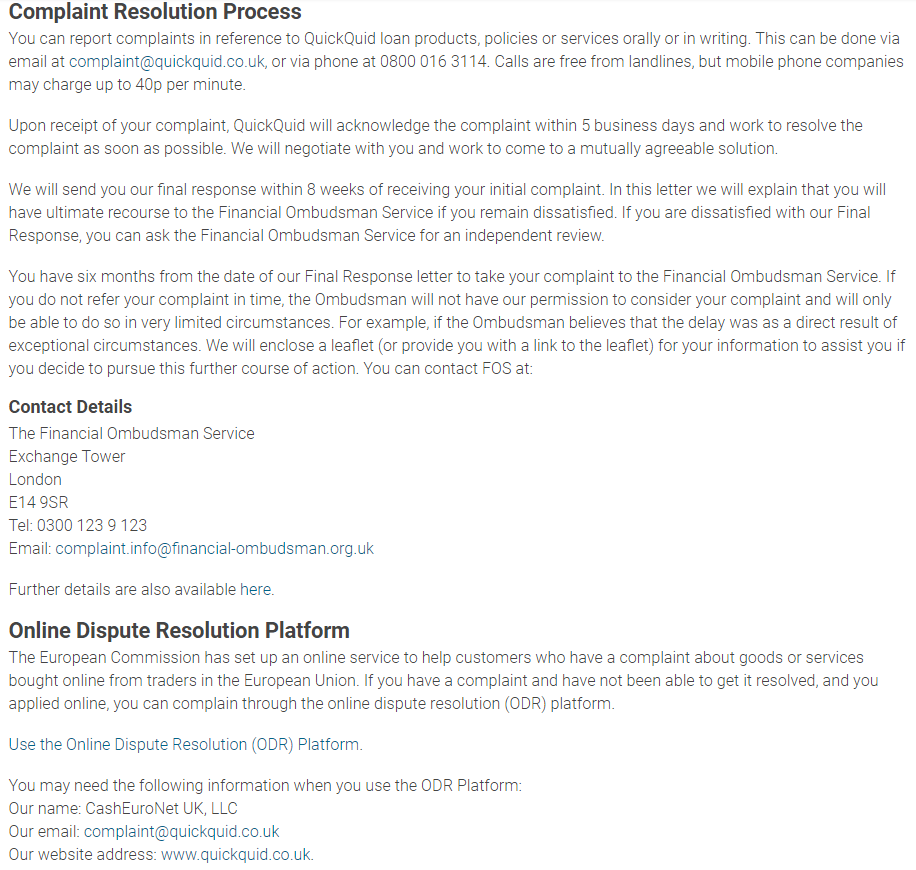

Contact Information

«Contact Us» Page

«Contact Us» page is very well worked out. There is all necessary information for customers. There are presented phones and addresses of different divisions for reviewing customers questions. You can contact the support group by phone, e-mail or live chat, which is a great advantage for the company.

Contact details are presented in such a way, that you easily find necessary information. Also, there is presented statistics on customers complaints in this company. From this page, you may easily contact the support group or any other division you want.

In general, the page is very informative and reveals all details the customer may look for here. Organization of the interface is pleasant and attractive. This section is one of the best in the whole website.

Live Chat with the Support Group

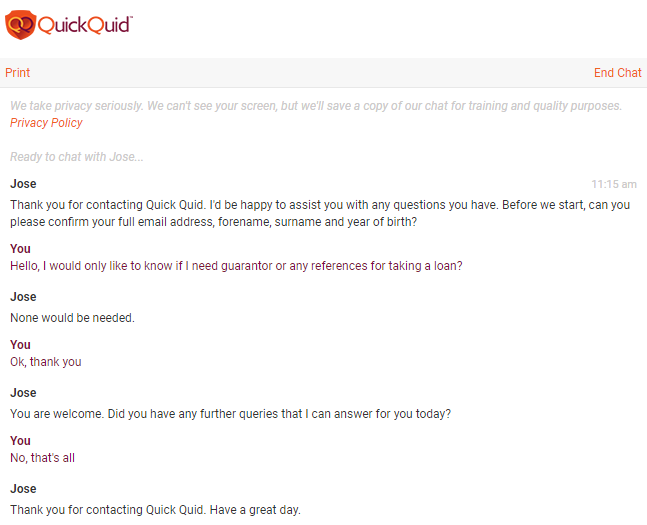

To clear up some questions and check the effectiveness of the support group, we decided you use live chat option. Though we had some difficulties with opening the chat, in 5 minutes we managed to contact the manager.

We wanted to know if they require any guarantors or references for taking a loan, as there is no clear information on this question on the website. Note, that as soon as you open the chat, they ask you to confirm your address, name and surname and date of birth. For a person that just wants to ask a question, have not decided yet if he wants to take a loan, this would be seen inappropriate.

We ignored this inquiry and send a message with the question we were interested in. The answer came immediately as we expected, and it was clear and simple, though there was no greeting from the manager which seems a little rude. After we got the answer, the manager asked if we had any more question and wished us a good day.

Well, it can be said that the work of the support group is effective and quick, but as there is a lot of information on the website, we didn’t find any hard questions to ask, to get a more detailed answer.

Conclusion

Summing up everything analyzed in this review, it can be said that Quickquid.co.uk is quite a reliable source to get extra money for a short term. But as there are some negative reports about their reliability and legitimacy, we recommend to be very cautious and check everything carefully before applying.

Technical indicators of the website are very good and security level on the website is quite high, however, legitimacy test gave us poor results, so we have very controversial information. But positive comments from satisfied customers show that the company can give good services and help people solve their financial problems, it just needs to work on its effectiveness.

Ready to Apply?

Ready to Apply?