Piggy Bank Self-Introduction

Piggy-Bank is a short-term lender located in the United Kingdom. 2012 is the year of piggy-bank.co.uk establishment. PiggyBank offers online applications only. It implies that clients can apply for a short-term loan at any time of day and night. System of PiggyBank is arranged utilizing approved, safe and authoritative software. We are going to understand whether piggy-bank.co.uk is legit and safe. For this we will register piggy-bank.co.uk login to find out all aspects relating to this online service performance.

Piggy-Bank is a short-term lender located in the United Kingdom. 2012 is the year of piggy-bank.co.uk establishment. PiggyBank offers online applications only. It implies that clients can apply for a short-term loan at any time of day and night. System of PiggyBank is arranged utilizing approved, safe and authoritative software. We are going to understand whether piggy-bank.co.uk is legit and safe. For this we will register piggy-bank.co.uk login to find out all aspects relating to this online service performance.

| Types of Loans | Min Loan Amount | Max Loan Amount | Interest Rates | Period | Documents | Bad Credit History |

| £ 100 | £ 1000 | depending on loan amount | from 7 to several months |

| yes |

Types of Loans

Piggy-Bank.co.uk specializes in providing customers with the following types of loans:

- short term loans;

- payday loans;

- instalment loans.

After been approved, Piggy-bank will transfer money on client’ s active bank account within 1 hour. For Piggy-bank there is no difference whether you take payday loan, short-term or installment loan, in all cases, money will be transferred within 1 hour. Everything a client needs is to provide Piggy-bank online with valid bank account number. This service is online only, that’s why a client is not able to get money on hand.

Terms of Use

To get a short-term loan on Piggy-bank.co.uk, clients should meet the following requirements:

- be a resident of the United Kingdom;

- be at least 18 years old;

- have a constant working place with steady source of income;

- have an active bank account.

All these may guarantee a client that he will be approved for short-term payday loan. People under 18 years old have no opportunity to take a loan because they cannot prove their paying capacity. Unemployed clients also will be declined in getting a loan. To be approved, clients should have constant working place or working at least 16 hours in a week.

Depending on type of loan, clients are able to get £ 100 – £ 1000. If a client is going to get a payday loan £ 100 – £ 1000 for period from 7 to 35 days, interest rate is calculated individually but piggy-bank.co.uk has the very useful option as by means of which people may choose sum of money and period and see immediately interest rate:

If a client desires to get short-term loan, available sum of money is typically between £100 and £1,000 lasting between 7 days to 5 months. If we speak about installment loan, available loan amount is £150-£500 for two months, £200-£600 for three months, £250-£800 for four months, and £300-£1000 for five months, and pay us back in monthly, fortnightly or weekly instalments.

Application

The following documents (information from these documents) are required to take a loan:

- sort code;

- account number;

- credit card number;

- CVV number.

There is no concrete information about guarantees. But in the majority of online loans organizations there is no need to provide guarantees and contact persons. A client may get a loan just filling in an application form and wait for approval. Loan status is known several minutes after application is processed.

Piggy-bank is interested to offer clients the most simplified way to take a loan because online popularity is included in this.

Repayment

There is only one opportunity to pay a loan back, exactly credit card. Loan amount will be written off on your due date. You should refill the balance beforehand.

If you decide to pay your loan back early, you can make it by means “My Account” section which is in free access 24/7. Unlike some other online lenders, Piggy-bank won’t write off any charge and any penalties. If you pay a loan back early you will save money because you only pay the interest for the time you take use of the loan.

There are cases when you face some problems to pay a loan back or you are over pay, what clients should do in this case? If a client is over or under pay a client’s agreed term amount could change. If a client underpays, he should pay for additional interest or charges. If a client is over pay, term will decrease, so final payment might be less as well.

It is possible to get a loan extension. A client can file for payment delay online or over the phone on free piggy-bank.co.uk contact number 0800 206 1560. If a client chooses to realize it online, simply login to piggy-bank.co.uk account and you can apply to defer your loan for up to 35 days. It will be a subject to a new assessment of affordability, to ensure you do not fall into any form of financial burdens. You will be capable to defer your loan two times maximum.

If you do pay a loan off in time, there may appear serious problems. If something wrong takes place and a client knows he is not going to be capable to pay a loan back, just get in touch with Piggy Bank online. If a client’s account falls three days delay, there will be a £15 late payment fee and interest will be added up to a maximum of 100% of loan amount.

Extension

As it is, in case of payday and short-term loans, Piggy-bank doesn’t provide any kind of extension. Any extension means deferral at which a client should pay for additional fee – £ 15 a day. If a client has taken out a monthly instalment loan, Piggy bank is unable to provide you with a loan extension at this time due to the fixed term loan agreement. However, if a client needs to discuss your loan agreement and see what alternative options are accessible, a client may call instalment support group on free phone 0800 206 1560 and they will be capable to explain all options available for you.

There is no information whether clients may take a loan when the first one is not paid back. But if they give no opportunity to extend a loan, then we may come to a conclusion that clients are not eligible to take a loan while you have any debt.

Piggy-bank.co.uk Bad Credit History

Bad credit history plays no role for Piggy-bank.co.uk because online service administration does understand that no one is perfect, so they don’t expect credit history to be ideal. PiggyBank loans are created for people having various credit histories but the simple answer is asked whether a client affords a PiggyBank loan or not.

For Piggy-bank.co.uk it is more important to estimate clients’ current circumstances, income, expenses and credit commitments than a late payment on a credit card three years ago!

But there are cases when Piggy-bank can deny your application exactly if a client has had a CCJ in the past 12 months, are on a debt management plan or have been declared bankrupt in the past year, a client will not be approved for a short term loan in PiggyBank facility.

Technical Data

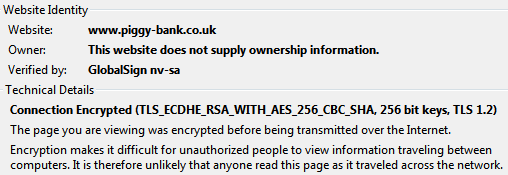

Secure Connection

All the connections and transaction are secure on piggy-bank.co.uk. Company owner is hidden but safety certificate is verified by GlobalSign nv-sa. This online organization protects clients’ personal data by means of 256-bit encryption. A client may be sure that his personal data is in safe hands.

Piggy-bank makes everything possible to provide clients with secure connection. To be sure, they do it, you should look at location bar where there is a lock informing customers with secure connection.

![]()

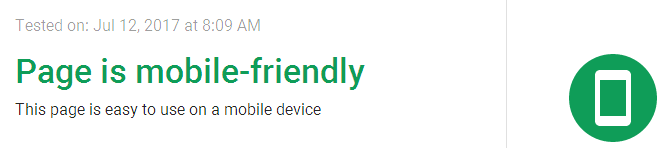

Mobile Version of Piggy-Bank.co.uk

Piggy-bank.co.uk has a user-friendly mobile version. This mobile version is adjusted to different mobile devices. It makes possible for clients to save time and fill in an application form by means of mobile device. There are no noticeable drawbacks which imply that performance of mobile version is on the high level arranged to simplify all the procedure. We may point out that front-page has the same look as desktop version that’s why it takes some time to find out information there.

Antivirus Presence

There is no antivirus on piggy-bank.co.uk. There is the greatest possibility to catch “viruses” and other online threats. People may not be sure that their devices (mobile or computer) are protected from viruses infiltration.

Convenience of Application

To take a loan via piggy-bank.co.uk, clients should undergo 5 steps to complete the application form.

The first step is devoted to personal information:

- first name;

- middle name;

- last name;

- date of birth;

- marital status;

- home telephone number;

- mobile telephone number.

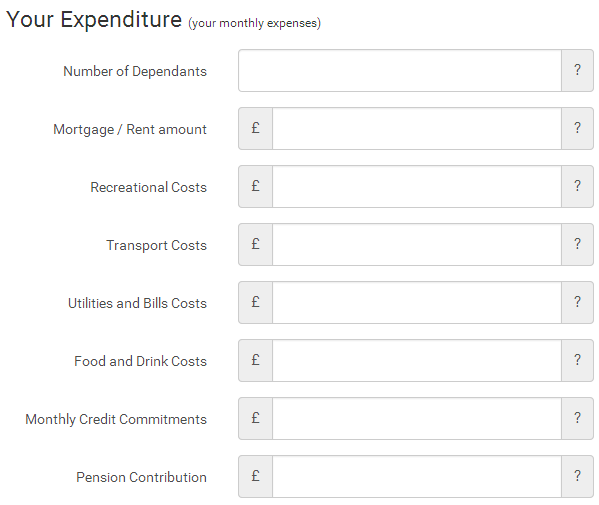

The second step is comprised of information related to financial status at which you should point out the following aspects:

- employment details;

- your income details;

- your expenditure.

Financial point includes complete information about your monthly expenses. You have to provide Piggy-bank administration with your expenses.

The third step includes bank information. This information should be valid and checked carefully because money you borrow will be transferred to this active bank account.

The forth step is comprised of information having relation to your concern to use your personal data. The forth step includes everything about legal terms. After your complete enrollment of data you are welcome to press the button “Get My Loan Decision”.

After pressing this button, you will see the status of your application.

After pressing this button, you will see the status of your application.

in general, application form is convenient, the questions asked are logical but there may appear some difficulties with expenses description.

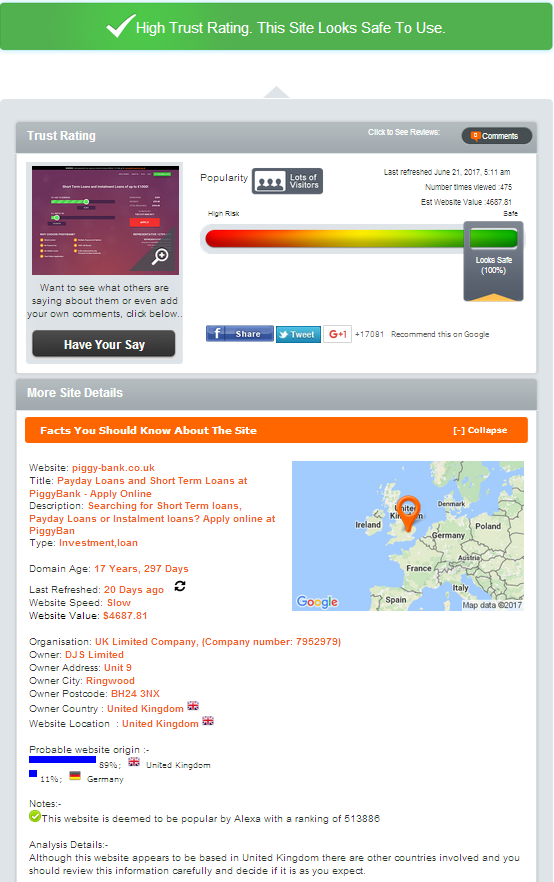

Is Piggy-bank.co.uk Legal and Safe According to ScamAdviser.com?

ScamAdviser.com is service estimating security level of different online services. Piggy-bank.co.uk takes 100-% security which gives a proof that this online service is the most confidential. ScanAdviser has no hesitation about company owner origin and website location – the United Kingdom but there is a little suspicion – 11-% that website location may be in Germany. The company owner is DJS limited.

Domain age is 17 years, 297 days, and its cost is high enough. This online service according to scamadviser.com is high trust and has lots of visitors. This website – piggy-bank.co.uk is constantly updated but has a slow speed of page loading.

ScamAdviser.com has also suspicion that there are other websites on this server involved. But it doesn’t play any role for Scam – why? We cannot find answer to this question. We may come to a conclusion that for ScamAdviser.com it is very important absence of hidden information probably that’s why piggy-bank.co.uk has the highest level of security – 100%.

Reviews about Piggy-bank.co.uk

Reviews on Piggy-bank.co.uk

There are no reviews on Piggy-bank.co.uk itself. It becomes rather difficult to estimate quality of this online service performance. They provide customers with an opportunity to read reviews about Piggy-bank.co.uk but on third parties recourses. It means that site administration gives no opportunity for clients to share their opinion. Clients need to search for other sources to leave a comment.

Reviews about Piggy-bank.co.uk on Third Party Recourses

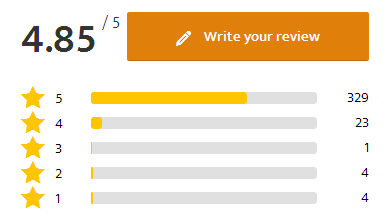

There are a lot of reviews on the following recourses: ww2.feefo.com and smartmoneypeople.com. According to feefo reviews piggy-bank.co.uk has rating 4,7 out of 5.

The majority of reviews are positive and share experience of satisfied customers. A client may read these reviews and make a decision whether it is suitable for him to take a Piggy-bank loan. Of course, all the reviews show that this online organization performance is great but we have some hesitation because everything looks so ideal.

Reviews on the second website have rating – 4,85 out 5. And as you can guess, reviews are predominantly left by satisfied customers.

Both websites provide clients with “fresh” reviews dated 2017. They are able to draw a real picture of what is going on Piggy-bank. Reviews help draw much more clients from all the United Kingdom.

We should also point out that piggy-bank offers clients to read these reviews that’s why clients are eligible to doubt their originality. But in general, the picture seems to be real and bright.

“Contact Us” Information

“Contact Us” Section

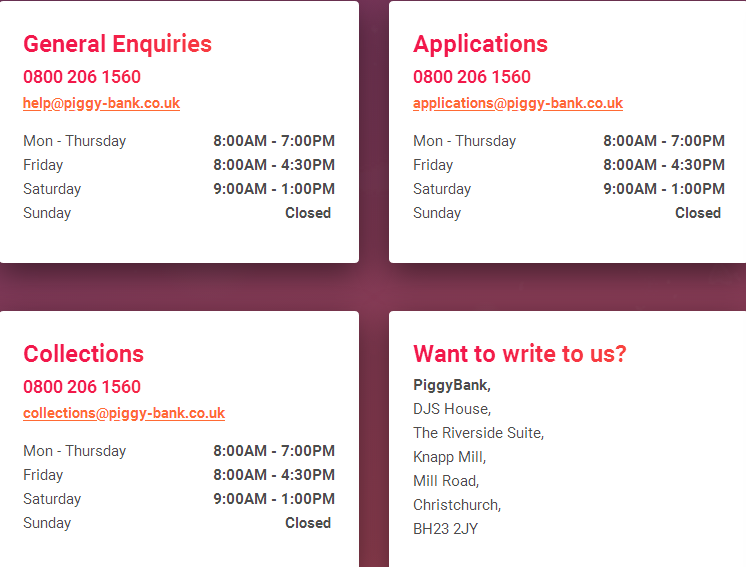

Clients may find all the contact information in “contact” us section on piggy-bank.co.uk. Factual address of Piggy-bank is in Christchurch. There is a piggy-bank.co.uk contact telephone number: 0800 206 1560. You may also see working hours of each department:

Each department has a telephone number and e-mail, but e-mail addresses are not workable. You cannot use them to come in contact with piggy-bank.co.uk support group. But we remember that Scamadviser.com doesn’t doubt about owner and website origin that’s why clients may believe that this online organization is really the United Kingdom based. If you cannot contact this service by means of e-mail, you may try your fortune over phone.

Customer Support Service

E-mails provided by piggy-bank.co.uk administration are not workable that’s why we were searching for long how to come in contact with support group. “Contact us” section has no contact form and life chat but on FAQ page we find a link helping us contact support group:

![]()

You will see contact form by means of which you may ask bothering questions. We ask the question about what they will do in case if a customer doesn’t pay a loan back in time. We are still waiting for the answer. Unfortunately, we get no response from customer support service.

Conclusion: Secure Financial Lender for UK Citizens

Piggy-bank.co.uk is a financial lender offering UK citizens an opportunity to take a payday loan, short-term loan and installment loan. According to Scamadviser.com gives 100-% of security for piggy-bank.co.uk which proves its reliability. This online lender also has a vast amount of reviews left by clients on third parties recourses. Rating of piggy-bank on such websites is almost 5 star.

There is a user-friendly mobile version by means of which clients may fill in application by means of mobile device. It is rather difficult for clients to contact customer support group because we find a link for contact form only on FAQ page. But these are little nothings of life.

In general, the service is reliable and has lots of visitors according to ScamAdviser.com. Piggy-bank reviews also prove its security and credibility. People may fill in an application form which doesn’t seem to be complicated and wait for “at once” approval.

Ready to Apply?

Ready to Apply?