What is Personal Money Store?

Personal Money Store is not a lender, it’s rather a large network of lenders and financial services offering personal loans, payday loans, cash advances and installment loans to customers in all 50 states. According to the information placed on the website, funds are transferred into clients’ checking. Using PersonalMoneyStore.com, clients you can have a loan direct deposited into their checking or savings from any location in the United States. The company strives their clients to meet the financial needs of their life.

As mentioned on the website, PersonalMoneyStore is an active member of The Community Financial Services Association of America (CFSA) and The Online Lenders Alliance (OLA), which is a good sign.

CFSA certification confirms the skills necessary to work in loan organizations. OLA provides protection and resources to both short-term lenders and consumers.

| Loan types | Max.amount | Period | Bad credit history |

| Payday Loans | Up to $1000 | Up to 45 days | yes |

| Installment Loans | Up to $5,000 | From 6 months to a year | yes |

| Cash Advance | Up to $1,000 | From 2 to 4 weeks | yes |

| Personal Loans | Up to $35,000 | Agreed with the lender | yes |

Personal Money Store Loan Types

The company offers a wide selection of credit solutions to its clients. Personal Money Store loans available vary depending on the location. The company offers two short-term loans: Payday Loans and Installment Loans. They also help clients get Cash Advance and Personal Loans.

- Short Term Loans is fast money which solves an immediate financial problem. Payday loans online are paid back in one amount on the next pay period, while installment loans require a fixed number of regular payments;

- Personal Loans can be large or small. Personal Money Store offers personal loans in the amount of $1000 for any reason – to pay off some bills, get through a tight spot, or any other reason. For larger financial needs, customers are offered personal loans up to $35,000;

- Cash Advance is a loan type which is deposited into the borrower’s bank account as quickly as possible, making the money convenient to access.

Once you fill in the application, it takes about 3 minutes to get a decision. If your inquiry was approved by Personal Money Store, you will be redirected to lender’s website where you will be able to see limits, interest rates, repayment terms, and other policies for your loan. Clients can have funds deposited into their account quickly, sometimes even the next business day – it depends on the lender.

Terms of Use

To get a loan from Personal Money Store, you need to meet the following requirements:

- Your monthly income needs to be at least $1,000;

- You must have a stable job or a steady source of income from benefits, retirement, etc.;

- You must be a U.S. citizen;

- You must be at least 18 years old.

Each lender has additional or more specific requirements if you are a member of the military.

Loan lengths can vary depending on the loan type. You can see the detailed information for every loan type in the table above.

Percentage rate for Personal Money Store loans can also have a very wide range and are based on the length of the loan and the amount of the loan. Clients need to make sure they understand all the terms and rates fully before signing a contract.

Application Process on PersonalMoneyStore.com

The application process on PersonalMoneyStore.com is entirely online. According to the company, filling out the application should take only 2-5 minutes and processing should not take longer than 3 minutes.

In the online form, the company request identification, employment, income, and banking data that the lenders require to process a loan. The company requires no faxing. All this personal information is transferred to the lender who processes a loan.

The clients should be ready to provide PersonalMoneyStore with Employment information, Income information, Your Bank Account, Social Security Number, Driver’s license or ID Number and some more details.

The company guarantees there are absolutely no hidden fees and no processing fees. When you request for a loan online through PersonalMoneyStore.com, money can be deposited directly into your banking account.

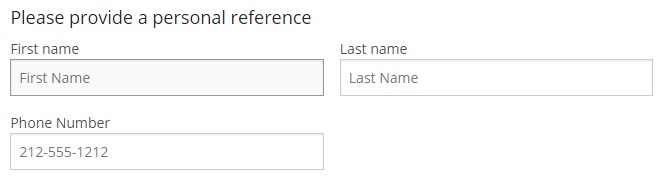

Clients should bear in mind that the company requires a Personal Reference for a case of emergency:

The most client can expect their funds as soon as the next business day. However, it depends on the lender.

Loan Repayment on PersonalMoneyStore.com

When the time comes to pay back the loan, the money is usually debited directly from the borrower’s account, with his permission. Clients payback PersonalMoneyStore short-term loans within a few weeks, so they have no long-term debt. They are repaid when the client receives the next paycheck in one lump sum.

Installment loans must be returned in either a lump sum or over time with an installment plan over a few weeks or months. For both payday loans and installment loans, the company charges a fee paid along with the loan repayment. The lender requires no cash or collateral up front.

If the borrower finds himself unable to make a payment on time, he should contact Personal Money Store and inform them of his inability to pay. The lender may meet the client halfway. State laws dictate what a lender may or must do. If the client does not inform the company about his inability to pay on time, Personal Money Store can start collection practices that will vary from state to state and from lender to lender. Some common collection methods include attempts at collections through telephone and other internal attempts. If all internal collection attempts have failed, the lender may send the loan to a collection agency in order to recover the funds, or the company may take other steps within their legal rights. So, the borrowers should check with his lender and his state regulations to be fully informed of the penalties and collection practices.

Does Personal Money Store Offers Loan Extension?

According to the information placed on the website, the clients can extend their loans if they have trouble paying their loans. The borrowers need to call Personal Money Store customer service several days before their due date to ask whether he can delay his payment. Some lenders may extend the loan term up to 4 weeks, but many lenders require that the loan is paid back within 2 weeks, except in the case of Personal Money Store com installment loans.

PersonalMoneyStore.com Bad Credit History

The company claims that it does not matter if clients have a good or bad credit history. Personal Money Store can approve a loan even if the client has been denied by others lenders or even had a bankruptcy in the past. Clients with bad credit history do not have to provide credit checks and fax anything in most cases.

The factors a lender reviews when approving or denying an online loan are solely at his discretion. The company also mentions that requests for installment loans with bad credit history for up to $5,000 can be decided in a few minutes! So, with this lender, clients can have access to the funds quickly and easy.

Technical Characteristics of the Website

Is Personal Money Store Safe in Terms of Connection?

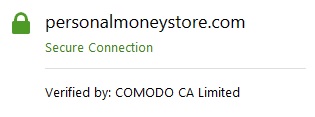

The website uses 256-bit SSL encryption which is an industry standard to encrypt users’ personal information (login, password, name, address, bank routing number, social security number). The company claims that clients’ information is safe with Personal Money Store. the security certificate is verified by COMODO CA Limited.

Unfortunately, the left corner of the address bar did not indicate the name of the website’s owner. This means that PersonalMoneyStore.com does not use the Extended Verification Certificate, which requires much more careful verification of who owns this website. So, the website provides the decent security level for its clients, but not the best one.

Mobile Version

PersonalMoneyStore.com has successfully passed a Mobile-Friendly Test:

But we can’t say the website is 100% convenient when visiting it from a mobile device: the images and text count are not enlarged. The text is too small and organized in such a manner that users can not click on the necessary loan type. Though we found no errors in the functioning of PersonalMoneyStore mobile version, customers will probably have some difficulties when visiting the site from mobile devices.

Checking Antivirus

The administration of PersonalMoneyStore.com provided no antivirus protection, which makes using this website unsecured – clients run risks to catch something unwanted on their computer. This is a large drawback, as trusted online websites usually use antivirus programs. This aspect needs to be fixed so that the company could have a better reputation. So far, this website can’t be considered a 100% safe place to apply for a loan online.

The Convenience of Using PersonalMoneyStore.com

Personal Money Store advertises an easy, fast and convenient online procedure of getting a loan. In fact, the procedure does not differ much from other websites that provide online loans.

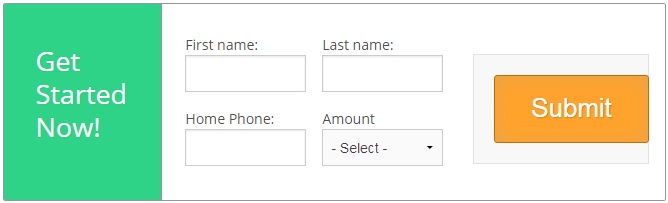

First of all, the client needs to register:

Personal Money Store clearly explains the peculiarities and differences between all online loan types it provides.

Regretfully, the client can’t see the precise interest rates and loan terms on the website: all these details should be agreed with the lender after the client gets an approval from PersonalMoneyStore. This is not very convenient from our point of view since the client wants to know at least approximate interest rates before he starts filling in the form. In fact, the user has to provide too many personal information to complete an application, and after all this paperwork it would be disappointing to find out the lender offers too high interest rates. The website does not provide any examples for loan terms.

The client can find some information he wants to know on the FAQ page, but this section seems incomplete. Some important information is missing, for example, penalties.

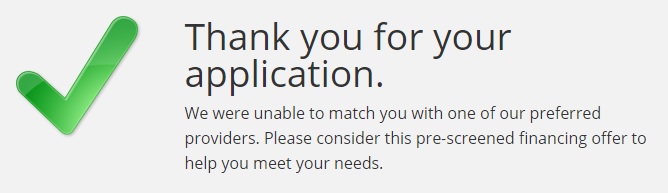

We decided to get an online loan through Personal Money Store and filled in all the necessary information. Unfortunately, the company failed to offer a lender to us with no explanation provided.

So, we conclude that the applying procedure is standard on PersonalMoneyStore.com, and the users can hardly have any problems with registration. However, it turned out that the user may be refused for no reason.

Is PersonalMoneyStore.com Legit?

We checked the reputation of PersonalMoneyStore on ScamAdviser.com, and the received analysis added more trust to this online service. The website has a high trust rating – 84% out of 100:

According to ScamAdviser, the website seems safe to use. The owner country and website location are both the United States. The domain age is about 9 years. The website has lots of customers and seems popular., In addition, it is constantly refreshed. However, ScamAdviser can’t give a 100% trust rating to PersonalMoneyStore, since there are negative online reviews detected. Scam Adviser recommends users checking the reputation of the website and the validity of the comments by searching on Google for personalmoneystore.com reviews. Still, 84% trust rating is a quite high indicator, so we may suggest that users can most likely have a good experience with this company.

PersonalMoneyStore.com Reviews

On-site PersonalMoneyStore.com Reviews

We found no personalmoneystore.com reviews or comments on the website itself. The website has no section where borrowers can leave their feedback. This may alarm some potential clients, as a reliable loan company always gives its clients an opportunity to share their positive or negative experience. Online lender websites without any reviews does not seem trustworthy if looking from a client’s perspective. People can’t evaluate PersonalMoneyStore credibility, so they can easily go to another lender website which has many positive comments.

PersonalMoneyStore Reviews on Third-Party Websites

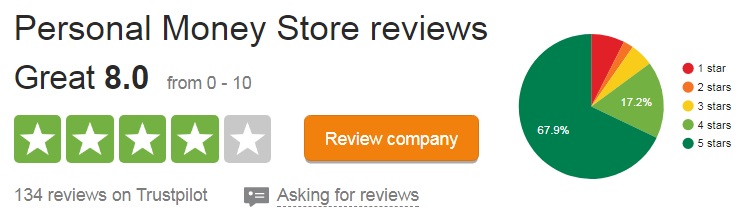

To understand the quality of the online services better, we decided to search for Personal Money Store reviews on independent websites. The only website which contained comments about the company was Trustpilot.com — an online scoring service that allows verified clients rate different companies. It turned out that the website contained 134 reviews about PersonalMoneyStore, and most of them were positive. The company has a total score of 8 stars out of 10 on Trustpilot.com:

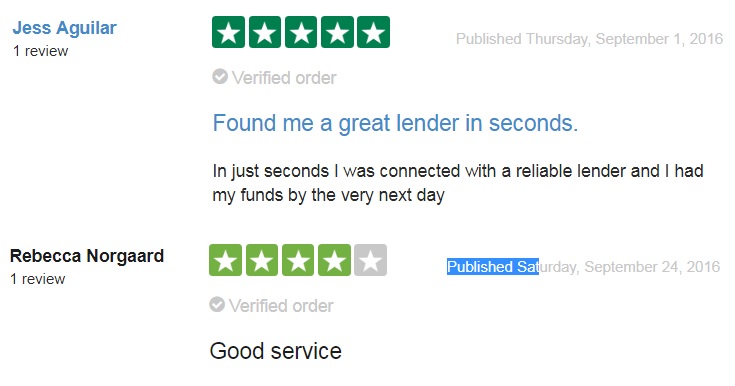

The last positive reviews were dated September 2016. The clients expressed their gratitude to the lender and appreciated that PersonalMoneyStore connected them to a reliable lender in just few seconds:

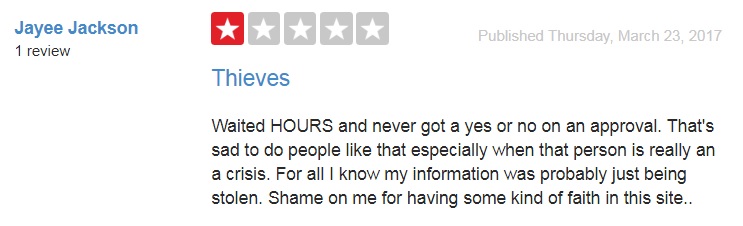

We noticed a strange thing: there is an abundance of positive reviews in September 2016, but NO positive Personal Money Store reviews in 2017. Is the company even active? The only available review dated March 2017 is negative – the user is completely disappointed with the company: she waited for several hours for a reply and did not get any. She suggests her information was just stolen:

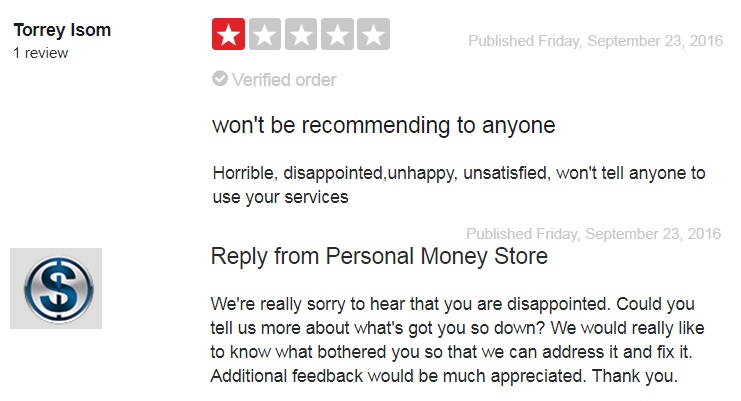

2016 also contained a number of negative reviews. One user scores the company only 1 star and does not recommend using this service. However, in 2016 Personal Money Store found some time to reply to the complaints of unhappy customers. The representative of the online company asked the user to provide more details on what has happened:

You can read all Personal Money Store reviews here: https://www.trustpilot.com/review/personalmoneystore.com.

So, it looks quite strange that the company has a good reputation ONLY on Trustpilot.com and only in 2015 – 2016. Since the company has only a negative reputation on outside websites in 2017, we may suggest that the company is not active any longer or has lost its popularity.

Contact Us section

PersonalMoneyStore Contact Information

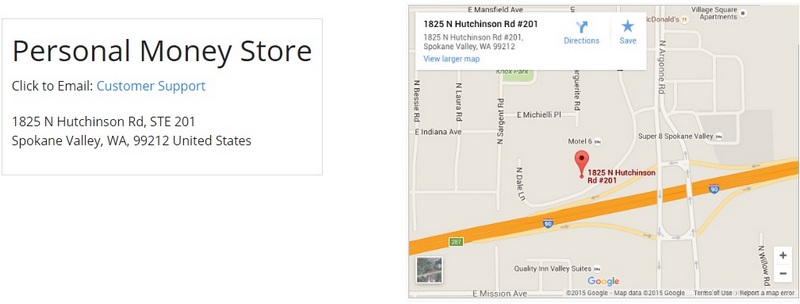

Even though the company operates in an online mode, the website specified Personal Money Store location. A user can even see the company’s location on the map. Personal Money Store phone number is also indicated on the website: 1-877-648-6471.

However, they do not mention the year when the company has started its business. This information is also very important to the borrowers. The online lender should be as transparent as possible to attract more clients.

Customer Support Service

Clients can contact Personal Money Store via email, contact form or regular mail. There is no Live Chat option on the website. The company promises that it can help its clients with any questions they may have. They guarantee that the customer support group is available 24/7. We decided to use the contact form to clarify min/max loan amount we could borrow. We wanted for nearly 5 hours but received NO reply. At best, clients need to wait much time to get any feedback from the lender. At worst, the website is not active. We can’t know for sure.

Conclusion

PersonalMoneyStore.com is an online service which helps find the best lender in a few minutes. The main advantages of the service are its availability in all 50 states and various loan decisions which limits, fees, extension terms, and repayment vary from state to state. We could not evaluate interest rates since they are not indicated on the website and differ from state to state as well. The online company has a high trust rating on ScamAdviser.com which means the company is legitimate. OLA and CFSA membership also adds trust to the service. We also appreciate that the website uses a decent encryption level which secures the users’ personal data. As you see, Personal Money Store has many positive sides, but it has no fewer disadvantages. First of all, there are no positive 2017 customer reviews about the company. The only negative review from 2017 undermined PersonalMoneyStore reputation. To date, we can’t assess the company’s credibility. It seems that the lender enjoyed popularity in 2015-2016, but for some reason lost its happy clients in 2017. Besides, poorly organized customer support indicates that the clients have to wait an eternity to get an answer though it was advertised the other way. Considering all the above, we suggest that clients should search for an online lender with a better reputation. If you still decide to request for a loan from Personal Money Store, make sure to contact the company’s administration first to know exactly the service is active.

Ready to Apply?

Ready to Apply?