What is PersonalLoans.com?

PersonalLoans.com is not a lender but a matching online service which connects potential borrowers with direct and trusted lenders providing different personal loans. The company is owned by Arrow Eagle LLC, a limited liability company which complies with the laws of the Ute Indian Tribe. The service was created in 1999 and has been operating for nearly Personal Loans has operated as an online matching network for 19 years. They claim they are designed to help people get needed cash in an emergency situation. Customers are encouraged to use this online service in order to have more credit options without having to apply to several lenders, which saves time and efforts. With Personal Loans, clients can find the most suitable type of loan in a few minutes. Besides, this company is proud to be a member of the Online Lenders Alliance (OLA), an organization which sets standards for online lending businesses.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Peer to Peer Loans, Personal Installment Loans, Bank Personal Loans | $500 | $35,000 | 90 days – 72 months | Ranges between 25% and 150% | Social Security number, state-issued ID, pay stubs / enrollment report | Yes |

Types of Loans

PersonalLoans helps you to get three different types of loans:

- Peer to Peer Loans

- Personal Installment Loans

- Bank Personal Loans

A Peer-to-Peer loan allows customers to borrow money directly from an investor – an individual or a company. This loan type is popular among clients with who need small loan amounts. Such loans may also require the client to pay an origination fee which ranges from 1% to 5%. Peer to Peer Personal loans have more requirements to a customer that 2 other loan options available. A borrower must have at least 600 credit score, earn at least $2,000 per month and be able to verify his salary with pay stubs. Customers should be necessarily employed or self-employed. The loan amount varies between $2,000 and $35,000.

The second loan type offered by PersonalLoans.com is an installment loan. To get such a loan, you need to have at least a 580 credit score and earns nor less than $2,000 per month. Customers can be approved for installment loans even if they are not employed or self-employed. Installment loan amounts range between $1,000 and $20,000.

The third type of loan available through this website is a Bank Personal Loan. This loan type is designed for customers who wish to get a loan at a local bank. Some local banks can approve you online but many require you to appear in person. In this way, this online matching service can be useful for borrowers who want to get a loan locally but who need assistance in the process. To be approved for a Bank Personal Loan, you need to have a credit score of at least 580 or higher and earn at least $3,000 per month. You also must be employed or self-employed. Just like other loan types, the loan amounts range from $1,000 to $35,000.

The lender claims that the funds will be sent to your bank account within one to five business days. The exact time will depend on several factors including the time of loan approval, your lender and eligibility.

Terms of Use

Using this website is completely free. To qualify for a loan, you must be at least 18, be a legal U.S. citizen or resident, have a social security number, a state-issued ID and regular income from employment/self-employment/ retirement/disability benefits, and have a checking account. PersonalLoans offers different loans ranging from $500 to $35,000. However, not every US citizen will qualify for the maximum amount – it will depend on his salary, credit score, and some other factors.

Because PersonalLoansi is not a direct lender, the APR will depend on the lender you are connected to and can vary greatly. On average, it is from 25% and 150%. The interest rate also depends on your credit score, the loan type, the amount you wish to get. Because of this, I recommend you to read your contract carefully prior to signing.

The company offers the flexibility of terms. The repayment period may range from 6 to 72 months, depending on the loan type, the amount borrowed and the customers’ credit score. Customers can make repayments once or twice per month.

Other PersonalLoans.com requirements vary by the loan type you choose. For a bank loan, for example, you need to have a credit score of at least 580 and earn at least $3,000 per month. A credit score of 600 or above is necessary for a Peer to Peer Personal loan while a Personal Installment Loans requires the minimum 580 credit score at least $2,000 in income per month.

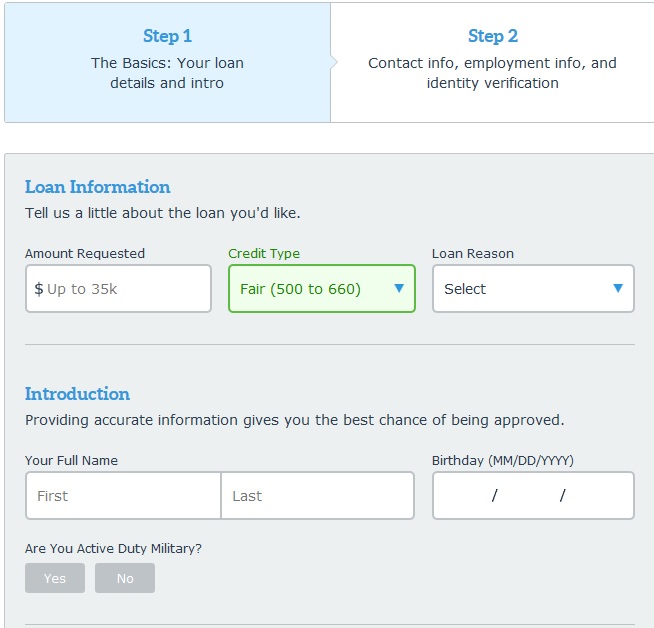

Application Process

When applying for a loan, the first step is to choose what kind of credit you currently have: excellent, good, fair, or poor. Then you need to fill out a simple online form, indicating the loan amount you need, the reason for taking a loan, and so on. These details are necessary for a lender to ensure that a customer is linked to a lender that can work for him.

During application, you’ll also have to provide some personal details about your work, income, social security number, and other details.

Once you request is submitted and you are matched with a lender, he reviews the information you provided. An approval is often given within 1-3 minutes. The lender may check the information you provided to ensure it is correct. For this, he may ask for additional proofs or he may deny the loan. According to PersonalLoans, the entire process takes less than one business day.

If you are approved for a loan, you get the loan details from the specific lender. You’ll be able to learn what amount you have been approved for, the repayment period, your payment amount every month, the interest rate, and so on.

If you agree to the terms and conditions, you need to sign the contract. Shortly after that, the money is sent to your bank account. You’ll then need to create an online account on the website where you can update and review information during the loan period. You can even apply for another loan from this account center using the personal information that is already provided.

Loan Repayment

According to the website, loan repayment is a very simple process. Repayment is generally made once every two weeks or once per month, depending on your preferences and your lender’s terms. An average lending period ranges from 90 days to 72 months.

PersonalLoans works with the lenders who are able to receive payment directly from a client’s checking account automatically every month. This is the easiest repayment option since borrowers may not worry about forgetting to make a payment. Some lenders also accept checks and payments by phone.

Customers will have to pay penalty fees if their payments are late. Failing to pay on time will negatively affect your score and make it difficult for you to be approved for another loan. If you feel that you will not be able to make a payment on the upcoming due date, you must immediately contact your lender directly and discuss other repayment options. If you do not inform your lender about a late payment, he will most likely use the services of a collections agency. Collection specifics will vary by lender, so you need to understand the loan’s terms and conditions before signing the agreement.

Loan Extension

Some lenders allow the loan extending if you are not able to make a payment in a timely manner. However, this will negatively affect your credit score and may incur additional fees.

Lenders from the network of PersonalLoans.com has 2 kinds of renewals:

- Unlimited renewals. With this option, a customer is allowed to renew his loan countless times. This is the riskiest option since it can make your loan very expensive;

- Automatic and borrower-initiated renewals. These type of extensions are not unlimited as well but allowed within the certain time limits.

Once a loan can no longer be extended, the lender will start a collection process.

According to the website, customers will not have to pay any penalty for repaying the loan before the specified date.

PersonalLoans.com Bad Credit

Lenders from the network of PersonalLoans may approve even those clients having a poor credit score.

However, to get matched with a lender, you must have:

- at least 580 score for installment or a bank loans

- at least 600 score for peer-to-peer loans

This service is designed for clients with various credit scores but before applying, you need to indicate what credit you have. This is required for a lender to ensure that you will not be late with your payments. The lender that you are connected with may even check your score with a credit agency. Loan rates can be higher for borrowers with bad credit. If you have a poor score but are able to make all payments on time, your credit score may improve.

Technical Characteristics of PersonalLoans.com

Encryption

PersonalLoans.com uses a standard 256-bit SSL encryption to protect customers’ personal data when applying for a loan. This means that the information you provide will not be viewed by a third-party. The secure connection is verified by COMODO CA Limited:

However, you should bear in mind that PersonalLoans shares your personal an financial information with its lending partners. This is standard for online matching services, but clients may sometimes receive unpleasant phone calls and emails from lenders even after they have repaid a loan.

256-bit SSL encryption is considered a reliable security option, however, I’d prefer to use websites using the highest encryption technologies with an extended verification.

Mobile Version

This website has a mobile version which works properly and seems convenient. Using it, clients can apply for a loan from mobile devices without any troubles. Google confirmed that PersonalLoans.com is mobile friendly and all elements are loading successfully.

I noticed no scrolling, no other bags in the site’ functioning: the test is readable, the secondary information is removed, the clickable elements are not so close to each other.

So if you wish you apply for a personal loan using your smartphone or tablet, you will likely not have any difficulties.

Antivirus

Websites like PersonalLoans.com must provide the advanced level of security. Unfortunately, I noticed that site does not have an antivirus installed. I think it’s a serious drawback which must be eliminated. Sor far, you have chances of infecting your PC with viruses and dangerous malware, or you may even be hacked.

The Convenience of Using PersonalLoans.com

The entire application process is online, so you will not have to leave your house to get money. Currently, the online form is the only way to apply for a loan with PersonalLoans.com but they hope to offer more options in the future. There are only two steps for customers and the whole process seems transparent.

You will need only to complete a simple loan application on PersonalLoans.com. During the process, you need to specify how much money you wish to borrow, how much you earn per month, your credit score, and loan reason. You will also need to provide some basic personal and banking information. This data will be used by the matching service to determine what loan type you may be eligible for.

Once the application is finished, you will be matched with a potential direct lender that will be able to offer you a loan.

Shortly after that, the specific lender will make a decision whether to give you a loan or not. Once you agree to the loan terms offered by the lender, the money will be transferred to your bank account.

Finally, you will be redirected to the Account Center where you need to log in. This is required for you to be able to your change basic information such as your contact details. This will also allow you to apply for a new loan using the existing information.

![]()

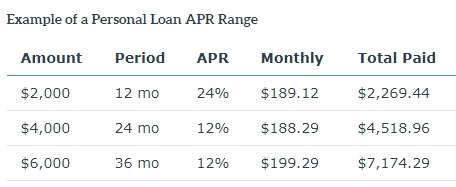

I like that PersonalLoans.com offers a table to help users understand the loan rates:

Although PersonalLoans cannot specify the exact loan terms and cost in advance, this website is very informative. The online service provided the average terms and conditions and their ranges. In general, this service seems a convenient option for borrowers. Instead of having to fill out numerous applications on different websites, you can fill out ONE application to find the right lender that you’re looking for. This can save you time and efforts and gives you the opportunity to compare terms of various lenders.

Is PersonalLoans.com Legit?

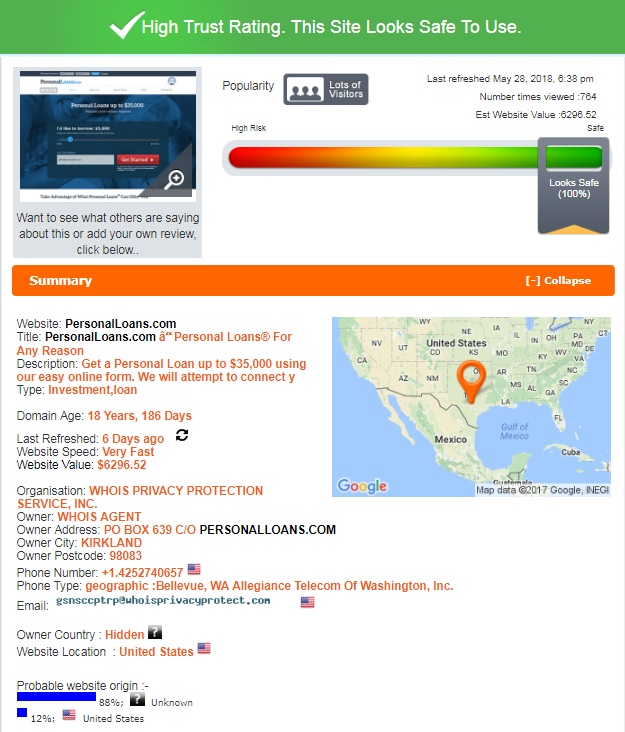

According to ScamAdviser, a reliable verification website, PersonalLoans can be trusted and has the maximum possible trust-rating: 100% out of 100:

The ScamAdviser analysis revealed that the domain age coincides with that one mentioned in the “About Us” section – it’s almost 19 years. Besides. The website has lots of visitors and is located in the USA. Regretfully, Scam Adviser was not able to determine the owner of the site due to the fact that it is using an anonymous service to hide its identity. However, this fact did not affect PersonalLoans’ rating. ScamAdviser is sure that this service is legit and safe to use.

PersonalLoans.com Reviews

On-site Reviews

I expected to find PersonalLoans.com reviews on its official website – this would have been a simple and quick way to check what people say about this service. Unfortunately, the site did not have a testimonial page and did not allow customers to leave their reviews about this company. I was not able to check the experience of previous clients who needed personal loans so I decided to search for external customers’ testimonials.

Reviews on Third-Party Websites

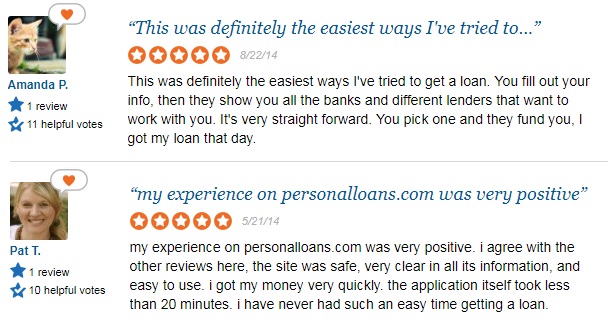

PersonalLoans.com has many reviews on independent websites and forums. Customers said that this website is intuitive and easy to use. They also rated this service 5 stars for the ability to get the funds quickly. Borrowers also appreciated that PersonalLoans offers more loan options than other lenders. The website has also received good reviews for its excellent customer support service. Users said that their questions were responded very quickly. Phone assistance was managers did their best to help solve all the matters.

The company has the best reputation on TrustPilot.com – 8.3 stars out of 10 based on 8 user reviews. ¾ of those users rated PersonalLoans services as “excellent”. Most customers are pleased with how quickly they received the money and the quality of customer care department.

Below you can see a few examples of what people think about PersonalLoans:

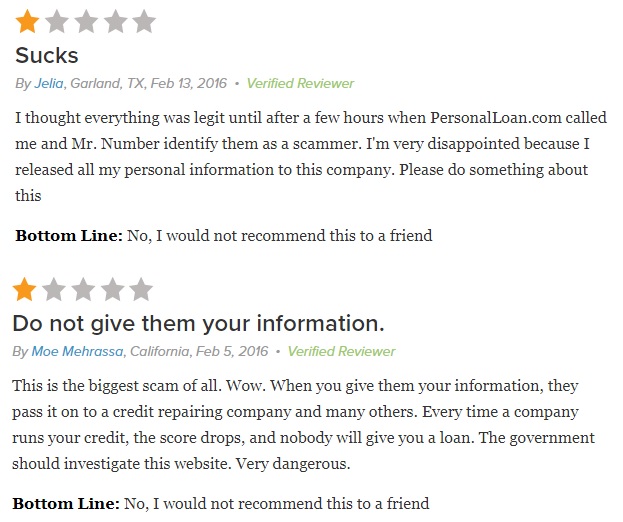

Regretfully, PersonalLoans.com reputation on BBB.com is not as perfect as that on TrustPilot.com. It turned out that this matching service was not BBB-accredited, which is a confusing discovery. The BBB did not explain the reasons for the distrust but usually, it bases on transparency, advertisement and customer complaints. There are no positive reviews on the BBB website, but there are several complaints. This shows that some borrowers had poor experiences with this company.

Some of the troubling customer reports were about the credit score being affected by the loan application. The reviews were not very detailed so it’s difficult to tell what exactly happened because this company may worsen your credit score only if you fail on your payments.

I found a few complaints about how PersonalLoans passed their personal information to credit repairing companies and many other third parties.

Customer reviews about Personal Loans are controversial. Many users called them “joke” or “scam” while others reported an excellent experience. This makes it difficult to assess the reputation and performance of this online service. But I found no evidence that PersonalLoans is a scam.

Customer Support

Contact Information

I found the following contact information on the website:

It’s nice to see PersonalLoans.com phone number and mailing address but they did not provide a legal address of the company. This information is very important since all lending services must be as transparent and possible.

PersonalLoans.com Locations

PersonalLoans.com operates in almost all 50 states. None of its loan types is available in North Dakota and Maine.

Borrowers from some other states do not have all three loan types available. For example, customers from Pennsylvania can only apply for Peer to Peer and Bank loans, and people living in Kansas can get either Peer to Peer or Installment loans.

Some borrowers can apply for only one loan type. For example, customers from Michigan and New York can only request Peer to Peer loans.

Getting a Consultation

According to the website, PersonalLoans do their best to satisfy customers. If you have any questions or comments about this online-matching service, you can contact the company via email, online contact form or phone, and one of their managers will respond to you as soon as possible. However, if you have questions about loan terms and rates, you need to contact your direct lender.

I like that the company offers several ways of contacting them. Of course, I would like to use a Live Chat option but I found none on the website. So I decided to contact the company via email. I was interested in whether PersonalLoans have a legal address. I waited for several hours but nobody answered. Obviously, their customer support is not 24/7 and you should be ready to wait until somebody answers your question.

Conclusion: Is PersonalLoans.com Safe?

PersonalLoans.com is a very popular online-matching service that has been active for nearly 2 decades. The company received mixed customer reviews, which, however, is standard for lending services. The loan application process is simple and fast, you are matched to the suitable lender in a timely manner. I like that this company offers large loan amounts of up to $35,000. Besides, they promise to make decisions in a few minutes and send funds within 1-5 business days. They also offer a variety of interest rates and flexible repayment terms depending on your credit history and location. On the other hand, PersonalLoans is not a direct lender but just a link between you and a lender. The company is operated by an Indian tribe and this means that this service does not comply with the U.S. laws, which may cause troubles if you become involved in a lawsuit with them. Besides, most lenders offering personal loans offer very high interest rates and sometimes you will have to pay almost as much in interest than the amount you have borrowed. If you are ok with all these nuances, you may have a good experience with this service.

Ready to Apply?

Ready to Apply?