What is Payday Money Centers?

Payday Money Centers is a company that has been providing financial services since 1997. Their first store was opened in Downey, California with the mission to help local people who are looking for urgent financial assistance. The company understands their customer’s needs and strives to serve them confidentially and quickly. They also claim to provide fast and professional customer service. Their goal is to exceed customers’ expectations. They promise that with them, people will not need to pay expensive late fees or charges. According to the website, you can be able o get the cash 15 minutes. The organization is licensed by the CA Department of Business Oversight and complies with the Deferred Deposit Transaction Law.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans, signature loans, title loans, auto equity loans | $50 | Not specified | Varies | Varies | Valid state issued photo ID, open checking account statement, proof of steady income | Yes |

Types of Loans

Payday Money Centers offer title loans, payday loans, signature loans and auto equity loans.

- A title loan is a loan in which you use your car as collateral. By pledging your car’s title, you can receive the funds you need and keep using your vehicle. The lender warns that every title loan is a bit different. With a title loan, customers will be able to make affordable payments each month;

- A payday loan is a short-term loan usually not exceeding $25. A payday loan is repaid on the day you receive your next wages. Such loans are used for short-term financial needs and cannot serve as a long-term solution;

- A signature loan is a loan with a longer lending period that you pay over a specified term through several equal installments. With a signature loan, users do not need to put up any property because their signature serves as collateral;

- An auto equity loan is a loan in which you can tap into the equity in your car without having to sell your prized asset. This loan is based on the value of your pledged vehicle. The lender stores the vehicle and gives you the funds.

Once you’ve been approved for a loan, the money is deposited to your checking account as soon as the next business day.

Terms of Use

When using this website, you will not be charged to apply for a loan, whether or not your request is accepted.

Payday loan amounts range from $50 to 255. Such loans are typically repaid within 2-4 weeks.

To apply for a payday loan, you need to:

- be at least 18 years of age;

- have a state-issued photo identification;

- show an open checking account statement;

- show a proof of regular income.

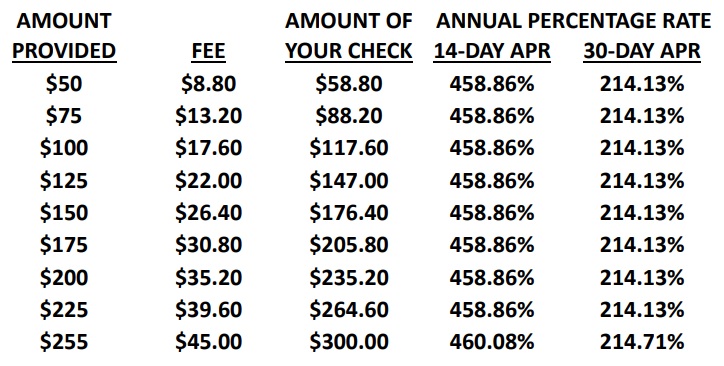

Fees and interest rates for payday loans offered by Payday Money Centers are clearly stated on the website:

The cost is calculated as a one-time fee. For example, a $100 payday loan has a $17.60 fee, while a $200 loan has a $35.20 fee. This is the equivalent of 214.13% or a 458.86% APR, depending on the loan term – 14 days or 30 days.

For all other loan types, Payday Money Centers may act as an intermediate and may not be a direct lender, that is why the website contains not soo many details about title loans, signature loans and auto equity loans.

They only mention that auto titles loan approval is subject to auto appraisal and credit standards.

To apply for a title loan, you need to have:

- auto title and registration;

- a state-issued ID;

- a proof of regular income;

- proof of insurance.

Signature loan amounts start from $2,500.

To apply for a signature loan, you need to have:

- a bank statement;

- a proof of income.

To get an auto equity loan, you need:

- own a car and provide information about its year, make, model, mileage, and condition;

- provide a photo ID, vehicle and title, proof of insurance.

To be eligible for any type of loan, you must be at least 18 years of age.

Application

To get a loan with Payday Money Centers, you must complete a short online application form. You need to fill in your name, address, employment status, income frequency and amount. You will also need to attach a recent bank statement, proof of stable income and proof of residence. Applicants can download this request form online but it must be completed in person at the nearest lender’s store.

The company requires no collateral for payday loans and signature loans. For title loans and auto equity loans, your vehicle will serve as collateral.

Repayment

Payday loans are repaid on the specified due date in one lump payment. Installment and title loans are repaid within a specified period of time in several payments. Terms may vary so you should carefully review your contract.

You can return your loan in person in one of the Payday Money Centers locations, the funds can be electronically withdrawn from your checking account, or you can make a payment online through the site. However, when I clicked on the Make a Payment button, the service has shown an error. This means you may have difficulty with online loan repayment:

If you are late with your payment, you will be charged a $15 fee.

If you feel that you will not be able to make your payment on the specified due date, you must call the lender as soon as possible to discuss the possible options.

Extension

In some cases, borrowers may be eligible for an extension. This information should be given in your contract but if you want to find out whether you can extend your loan, you will need to call the customer support service and discuss extension terms and conditions.

PaydayMoneyCenters.com Bad Credit

According to the website, approval for a loan is not based on your credit history. This lender welcomes all credit scores. They do not perform credit checks via the three major credit bureaus (Experian, TransUnion, Equifax) and do not report to them. However, the company uses data obtained from other credit reporting agencies such as Teletrack.

Technical Characteristics of the Website

Secure Сonnection

PaydayMoneyCenters.com values the privacy of their clients and protect their information with the help of a 256 bit SSL encryption technology. This means all information you submit to this website is protected from hackers and other unauthorized companies. The secure connection is verified by Let’s Encrypt:

I appreciate that the company has a responsible approach to the users’ safety but I advise the website’s developers to utilize an Extended Verification Certificate – this will provide the maximum security to consumers.

Mobile Version

PaydayMoneyCenters.com is a mobile-friendly website, which was confirmed by a Google Mobile-Friendly Test:

According to Google, the website’s content is adjusted to any mobile device and clickable elements are not close together so you can easily click the desired item. If you are a mobile user, you will not have any difficulties with the website because there is no need to scroll the pages and read small text. So you can easily apply for a loan using your PC, tablet or smartphone.

Antivirus

Unfortunately, there is no antivirus installed on this website. This testifies that users cannot feel 100% safe when using this online resource. You can infect your computer or mobile device with viruses, spyware, Trojans, and other online malware. I advise Payday Money Centers’ owner to install an antivirus program which would prevent an identity theft. It’s important to know that you are applying for a loan in the safest place.

Convenience of Use

The application process at PaydayMoneyCenters.com is not purely online. You can only speed up the whole process by downloading an application form from the website. But the form must be completed in person at the company’s office. Once you are approved for a loan, you should read and sign a contract that defines the loan terms. With a payday loan, you also provide the lender a payment item from your bank account for the original loan amount plus the fee. The company agrees to hold this item until the day you receive your next wages. You receive the cash and agree to repay the debt on the due date. It seems simple. So, no matter which loan type you request for, you need to visit the closest location of the lender to fill in the application form and get the cash. You can use a convenient locator which will help you find the closest store. When going to the store, you should take with you some documents (see “Term of Use”).

The process is simple but I think it would be more convenient for borrowers to get payday and installment loans online. Not all people like the need to go to the lender’s store to get the money. It’s important that a client has a choice.

Is PaydayMoneyCenters.com Legit?

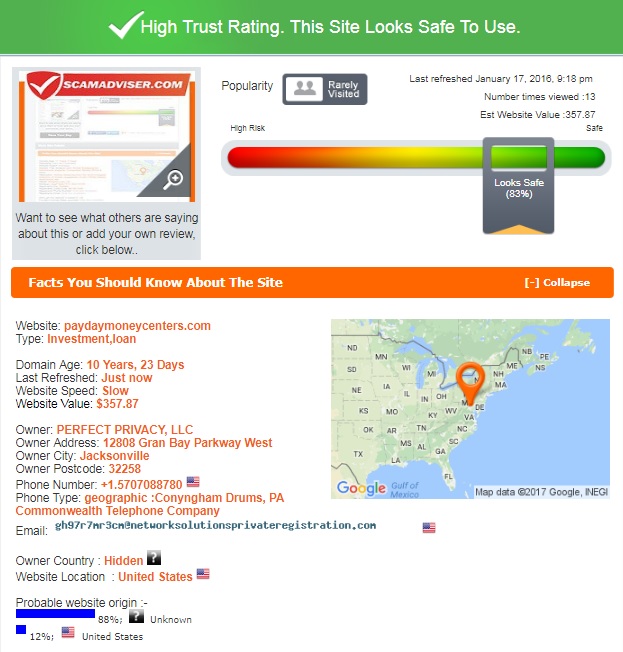

Knowing that you are using a legit lender is very important. To be sure users are getting a good deal, I check the reputation of this website with the help of ScamAdviser. The online verification service reported that PaydayMoneyCenters.com has a high trust-rating (83% out of 100%) and looks safe to use.

It turned out that the domain has been active for 10 years. The website is based in the United States but the owner country is hidden. Although the online company has a good trust-rating, it’s rarely visited. But in general, the lender seems legit and nothing testifies that they are criminals.

PaydayMoneyCenters.com Reviews

On-site Reviews

Users prefer to read reviews posted by the previous clients of a particular company. Customer reviews are a necessary element for any popular and reliable online lender. They help users to get rid of doubts and concerns about financial products and help in the final decision. People will most likely use an online company which received many comments.

I found only 2 Payday Money Centers reviews on the lender’s native website. They are placed on the front page and are not dated, which could mean they are not genuine. In fact, they look like a pure advertisement. Marissa H. said she had been using the services of this lender for many years and all the staff is super nice. She added that people would never have to worry about anything here and highly recommended this place. Cesar L. reported that this store was the best place to get fast cash in an emergency. He added that the staff was the best thing about this lender because the managers are friendly, professional and understanding. He also recommended this place for all users who needed emergency financial assistance.

Regretfully, I cannot trust these comments since they could be composed by the lender itself. I advise the company’s owner to create a separate testimonial page where people would be able to leave their comments and share the personal experience.

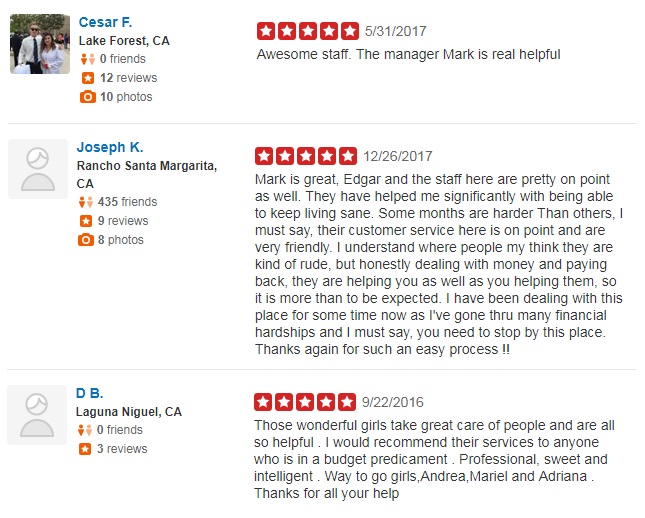

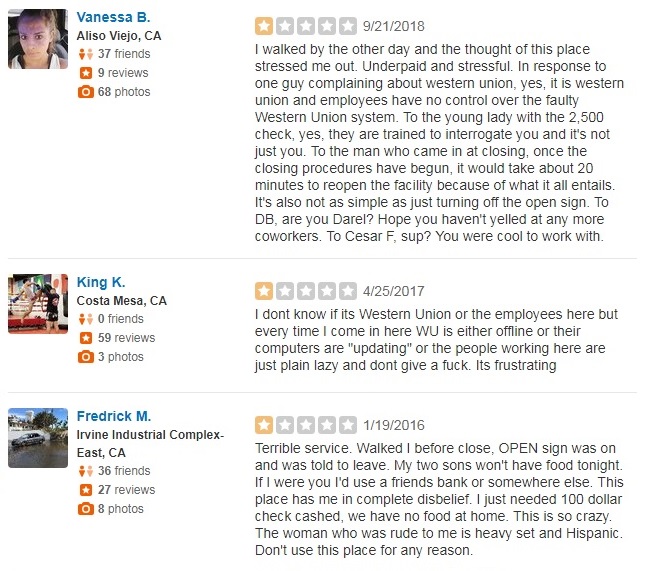

Reviews on Third-Party Websites

When looking for PaydayMoneyCenters.com reviews on the web, I came across a number of testimonials that could be useful to you. The majority of the comments was positive. Cesar F. Mentioned that the staff was awesome. Joseph K. also said the customer service was great and honest. The user with a nickname “D.B.” reported that the managers took great care of people and were helpful. He would recommend this place to anyone who has financial troubles:

Other people mentioned that they had never had any problems here and the staff was very nice. One client said Payday Money Centers was his favorite payday loan company with a great customer service and a beautiful location. Another borrower said that he used this location for sending money with Western Union for years and he always got a good price and impeccable execution of orders. One more consumer reported that the managers were “professional, sweet and intelligent”.

I also found some negative reviews on the net. One consumer said that every time he came to the lender’s location their computers were either online or updating, and people working there were “lazy” and not caring. One more user mentioned that the company had a terrible customer service and “rude” managers. He recommended staying away from this place.

Although the store has a mixed reputation, the overwhelming majority of the reviews is left by happy clients and I believe you have good chances of getting quality services here.

Customer Support

Contact Information

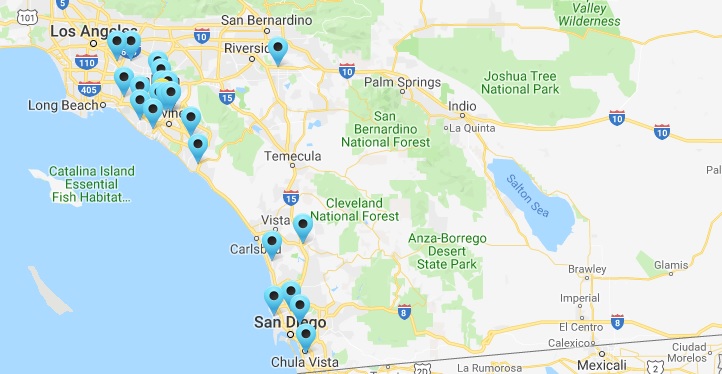

Payday Money Centers have gives the detailed contact information for each of their offices. You can see them all in the “Contact” section. They are also known as Transpacific Currency Services in some locations. The website also has a map showing every store:

Their headquarters office is located at 300 S. Harbor Blvd. Suite 500, Anaheim, CA 92805.

Their other offices include:

- Transpacific Currency Services, 1212 S. Bristol St #11 Santa Ana, CA 92704, (714) 549-4367

- Transpacific Currency Services, 1701 E. McFadden St. #E Santa Ana, CA 92705, (714) 835-4116

- Payday Money Centers, 445A S. Main Street Orange, CA 92868, (714) 516-2688

- Transpacific Currency Services, 14151 Red Hill Ave. Tustin, CA 92780, (714) 669-1657

- Payday Money Centers, 1450 El Camino Real #C Tustin, CA 92780, (714) 544-5899

- Payday Money Center, 221 S. Tustin St. Orange, CA 92866, (714) 771-7874

- Payday Money Centers, 2823 E. Lincoln Ave. Anaheim, CA 92806, (714) 632-8800

- Transpacific Currency Services, 2200 Harbor Blvd. #A120 Costa Mesa, CA 92627, (949) 642-2444

- Payday Money Centers, 13950 Beach Blvd. Westminster, CA 92683, (714) 899-5557

- Payday Money Centers, 18346 Beach Blvd. Huntington Beach, CA 92646, (714) 848-3533

- Payday Money Centers, 2448 E. Chapman Ave. Fullerton, CA 92831, (714) 526-4500

- Payday Money Centers, 3259 Katella Ave. Los Alamitos, CA 90720, (562) 799-2044

- Payday Money Centers, 23775B El Toro Road Lake Forest, CA 92630, (949) 452-0060

- Payday Money Centers, 13205B Whittier Blvd. Whittier, CA 90602, (562) 693-2696

- Transpacific Currency Services, 31952 Del Obispo #250 San Juan Capistrano, CA 92675, (949) 248-9827

- Payday Money Centers, 8516 Paramount Blvd. Downey, CA 90240, (562) 927-5000

- Payday Money Centers, 24893 Sunnymead Blvd. Moreno Valley, CA 92553, (951) 924-3300

- Payday Money Centers, 206 N. El Camino Real #B Encinitas, CA 92024, (760) 942-0566

- Payday Money Centers, 321 W. Mission Ave. Escondido, CA 92025, (760) 735-9404

- Payday Money Centers, 910 Grand Ave. #107 San Diego, CA 92109, (858) 274-5709

- Payday Money Centers, 4488 Convoy St. #E San Diego, CA 92111, (858) 565-6777

- Payday Money Centers, 4090 El Cajon Blvd. #B San Diego, CA 92105, (619) 563-6543

- Payday Money Centers, 860 Third Ave Chula Vista, CA 91911, (619) 425-2424

The lender is completely transparent and has nothing to hide.

PaydayMoneyCenters.com Locations

The company has 19 locations throughout California, so if you live in this state, you can choose one of their locations (see the previous unit).

Getting a Consultation

If you want to contact this lender and ask some basic questions, you can call at 1-877-293-0000 or 1-888-490-3311. There are no email addresses or a Live Chat option so these phone numbers are the only way to reach the lender. Or you can visit the closest location and ask your questions personally.

I prefer to contact online companies using a Live Chat of a contact form but if you like speaking to a real person, you can call at any of the listed phone numbers. I recommend the website’s owner to add more ways to reach the customer care department.

Conclusion

Payday Money Centers is a legit lender which operates in 19 states across the state of California. Although the company advertises 4 loan types, it actually acts as a direct lender for payday loans only. If you need an auto loan or signature loan, this company will serve as a broker and you should consider it. It’s nice that they require no collateral and work with bad credit. Another thing that may disappoint you is that you cannot complete an application and receive the funds online. Instead, you can only download the request form from this website and fill it in at the lender’s location, so should anyway visit their office. I appreciate that Scam Adviser gave a high trust-rating to this website, which means it’s working legally. In general. Customer reviews are good but a few complaints worry me. The disadvantage of this company is that they provided only one way of reaching the customer service. I can honestly say that I would probably recommend Payday Money Centers to other people but only those who need payday loans not exceeding $255 and do not mind visiting the lender’s location in person. But if you need other loan types/higher amounts and prefer to apply and receive the money online, you should pay attention to other websites.

Ready to Apply?

Ready to Apply?