What is Paydayloans.com?

Paydayloans.com is an online service connecting potential borrowers and the online lenders. The website partners only with lenders who provide the detailed terms and conditions about payday loans. One of the goals of the company is to always provide customers with up-to-date information about online loans. The service aims at helping people get needed money safely and securely. Paydayloans.com claims that all lenders from its network operate in full accordance with the Consumer Financial Protection Bureau (CFPB) and adhere to the policies stated in the Dodd-Frank Wall Street Reform and Consumer Financial Protection Act.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans | $100 | $1000 | 8-25 days | Depends on the lender | SSN, Driver’s License # | Possible |

Types of Loans

As the domain’s name implies, the company helps customers to find the best payday loans – relatively small amounts of money that have a high interest rate and must be repaid when the client receives his next paycheck. People usually take such loans to cover unexpected expenses without late penalties. These loans are intended to be used purely as a short-term financial help.

According to the website, paydayloans.com approve loans in minutes and transfer the cash as quick as the next business day.

Terms of Use

With paydayloans.com, people can get payday loans between $100 and $1000 into their bank accounts in one business day. The specific amount that customers can get will largely depend on the personal information they provide in the online application.

However, the company mentions that not all requests get approved, but the chances that a customer will be approved for a loan are very high if he has a regular paycheck deposited into his bank account.

To be eligible for small cash loans through this website, all customers have to meet the following criteria:

- Legally reside in the USA;

- Earn no less than $1000 per month after taxes;

- Have a valid phone number and email address;

- Have an active checking account;

- Be at least 18 years old.

If your loan is declined, you can submit another request later without any charge, as frequently as you want to.

Once a customer submits an application, paydayloans.com will try to connect him with one of the online lenders from its network. If a lender approves a customer, he will clearly disclose all rates, fees and other policies associated with the payday loan. After that, a customer can accept or decline a loan offer.

PaydayLoans.com is NOT a lender, and that is why it does not know the exact APR that you’ll be offered. APRs depend on the lender and can vary based on the personal information that the customer includes in his application. However, paydayLoans.com mentions that usually, the APR ranges from 250 to 2350%.

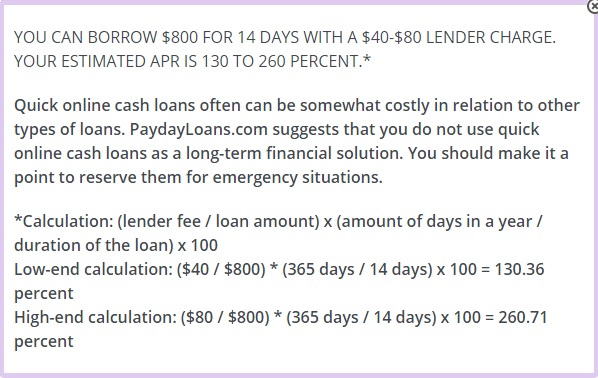

The website gives a representative example of the APR amount on payday loans:

Also, the website does not require any income verification.

Application Process on Paydayloans.com

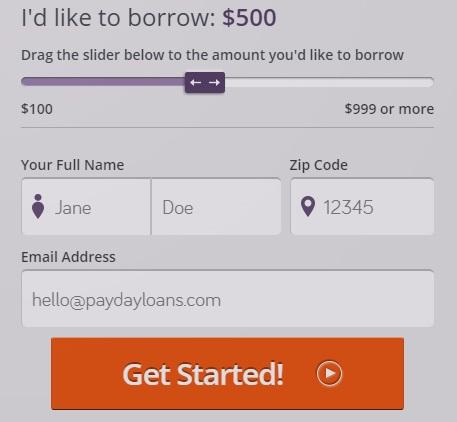

The website’s online loan application form takes only a few minutes. The whole process is online and free of charge. The details that a customer includes in his application will influence the decision on whether or not he will be approved for a loan with paydayloans.com.

The whole procedure is divided into 3 steps: loan details and self-introduction, contact information and employment information, financial info and confirmation:

When filling out an application, the borrower will be asked to provide his name, phone and address, social security number, and some more details.

Then, the website will connect the borrower with a lender of its wide network of lenders who can make a loan offer. As stated in the previous unit, PaydayLoans.com is not a lender, and that s why it cannot specify the exact interest rates and fees associated with the loan. Customers are never obliged to accept an offer if it does not suit him.

Loan Repayment

With PaydayLoans.com, a loan normally needs to be repaid on the customer’s next payday (between 8 and 25 days). The company mentions that each state has different policies and laws regarding the loan repayment terms.

The lender may incur extra charges if the borrower is not able to fully repay a loan or delays the payment. The online matching service is not able to predict what penalties the customer may be assessed as a result of non-payment, late payment, or partial payment. Also, this website doesn’t have any information of the loan details between the borrower and the specific online lender.

Loan Extension

According to PaydayLoans.com, lenders from its network are able to offer clients some loan extension options. Loan renewal policies largely depend on the state.

The company mentions that loan extension option should only be used in the case of emergency, as significant fees are usually added to the loan amount. The online service strongly recommends all borrowers to repay their loans on a due date so that they may avoid fees as a result to late payment or non-payment. If you think you may have difficulty repaying a payday loan, PaydayLoans.com recommends you to search for loan alternatives before you request funds through this site.

Paydayloans.com Bad Credit

Some lenders from the network of PaydayLoans.com may check the customer’s credit history in order to determine whether they can be trusted. But usually, lenders do not check credit score with the major credit reporting agencies (Equifax, TransUnion, and Experian).

You should also know that your credit score can be impacted by a particular lender. If you do not repay your loan on time, the lender may report to the major U.S. credit reporting agencies, and your credit history could be spoiled. PaydayLoans.com strongly recommends borrowers with credit problems to contact credit counselor’s services.

Technical Characteristics of the Website

Checking Encryption

PaydayLoans.com claims that all customer’s personal information is protected with extremely secure technologies. At the same time, the service mentions that it cannot absolutely guarantee that this sensitive information will not be decrypted by third parties. The website bears no responsibility for such decryption. PaydayLoans.com uses a 128-bit Secure Socket Layer protocol verified by Let’s Encrypt:

Generally, we are happy to see that the website’s owner protects customers’ personal information but that fact that PaydayLoans.com accepts no responsibility seems disturbing.

Checking Mobile Version

According to Google, paydayloans.com is adapted for mobile audience and can easily be used on a mobile device:

Using the website’s mobile version is even easier since it looks more convenient and all the menu units are located at the top of the page. In general, the mobile application process doesn’t differ from the desktop version. PaydayLoans.com mobile version neither has any annoying scrolling nor other problems. However, we noticed that the main page has too many secondary information.

Checking Antivirus

Regretfully, PaydayLoans.com does not use an antivirus program which means that there are high chances of infecting your computer with viruses and other online thefts. Malware programs can also steal customers’ sensitive data.

We’ strongly recommend the website’s owner to upgrade PaydayLoans.com for customers’ safety. Modern people prefer using websites with a high level of data protection.

Convenience of Using Paydayloans.com

PaydayLoans.com is available 24 hours a day 7 days a week. Borrowers do not need to pass registration to start an application process. They just need to click on the “Get Started” button and fill in the basic personal information: name, address, phone number, social security number, bank checking account, the name of the employer, income and so on.

Once the application is completed, the matching service will attempt to link you to the suitable online lender who is ready to make a loan offer.

As stated above, PaydayLoans.com does not have any detail on loan interest rates, fees, and other terms – all this information will be provided by the specific lender you are connected to.

In general, the website is quite informative – here you can read basic information about payday loans. In addition, new visitors can get answers to the most popular questions in an FAQ section.

The entire applying process is convenient – you can request and receive money from your home or anywhere if you have a device with access to the Internet.

Considering these aspects, we may conclude that PaydayLoans.com is able to help you find the best loan offer in 5 minutes.

Is Paydayloans.com Legit?

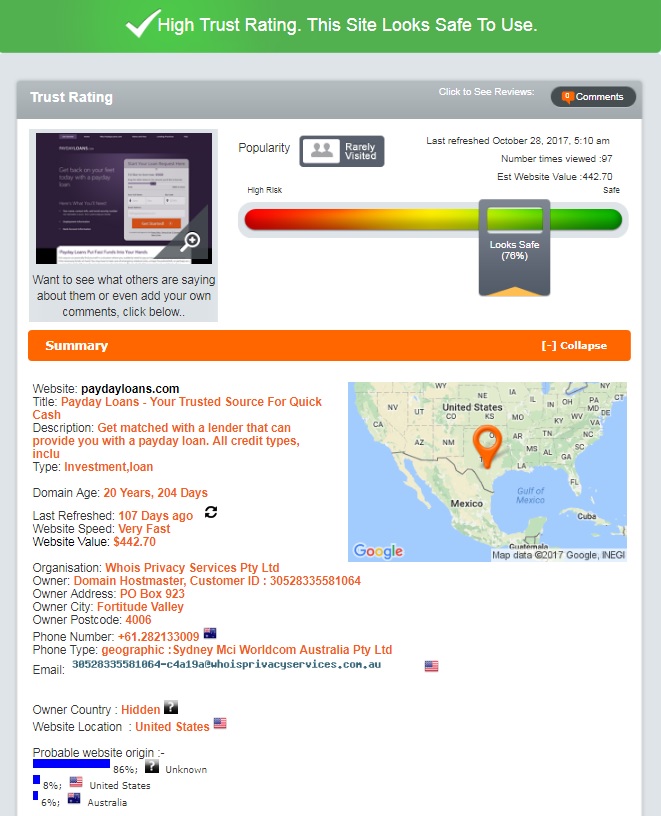

We checked Paydayloans.com’s legitimacy using a verification service – ScamAdviser. The results show that this company’s trust rating is 76% out of 100%. which is a very good indicator:

According to ScamAdviser, Paydayloans.com looks safe to use. The domain age is over 20 years which is really impressive. However, ScamAdviser was not able to identify the origin of the website. The probability that the website is located in the USA is only 8% and the website is located in Australia with the probability of 6%. The online verification service also revealed that the site is rarely visited. So, the main aspect that worries us is the fact that Paydayloans.com is using an anonymous service to hide its identity. However, for some reasons, ScamAdviser gave a high trust rating to this website which means that it’s legitimate.

Paydayloans.com Reviews

On-site Reviews

Customer reviews are always the best evidence that the website is active and popular. We hoped to find a testimonial page on this site but did not exist. So borrowers do not have an opportunity to share their experience (both positive and negative). Was the service convenient and helpful? Did clients use it again? Nothing was mentioned so we had to search for paydayloans.com reviews on independent websites.

Reviews on Other Websites

Unfortunately, we did not find any comments about this website on the net, and this looks suspicious. We can hardly believe that a website with a 20-year-history does not have reviews. So we could not assess the reliability of the company based on customer reviews.

Contact Us section

Contact Information

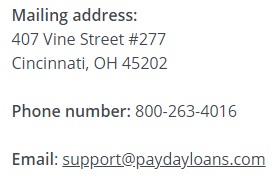

The company provided the following contact details in the “Contact Us” section: paydayloans.com phone number, mailing address, and email number.

Regretfully, the company hides its legal address, which looks suspicious. The mailing address in U.S. based but there is no proof that the company really works from the USA. Due to the absence of the physical address, we can not 100% trust this online lender-matching service.

Getting a Consultation

According to the website, PaydayLoans.com is available around the clock and always ready to answer customers’ questions. For basic questions, the company asks to visit an FAQ page. Borrowers can also email the customer support team and receive a feedback within 24 hours. However, with any questions regarding the loan approval, fees, and terms. Users must directly contact the specific lender since PaydayLoans.com does not have an access to such information.

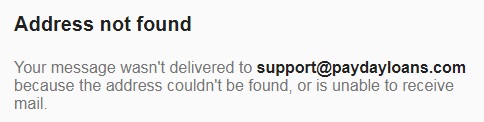

We tried to reach the customer support group via the specified email address [email protected]. Unfortunately, this address could not be found:

This means that customers are unable to get in touch with PaydayLoans.com support group. The fake email address makes us doubt the legitimacy of this service.

Conclusion

PaydayLoans.com seems a convenient service for finding suitable payday loans. ScamAdviser gave this website a high trust-rating, but I still cannot recommend this service to other people for some reasons: the service offers limited loan options, does not specify loan terms and rates, there is no way to contact the customer support online, the website’s location is hidden, no antivirus on the site, the company accepts no responsibility for customers’ data decryption, there are no customer reviews. There are just too many aspects that worry me. I give PaydayLoans.com the rating of 2,7 stars out of 5 and recommend you stay away from this website.

Ready to Apply?

Ready to Apply?