What is Oportun?

Oportun Inc. is a financial technology company based in Redwood City, CA and has been operating for 12 years. The company provides personal loans through oportun.com (or new.oportun.com) in 8 states across the USA. Their mission is to provide affordable loans that help people improve credit score and build a better future. Oportun is proud to provide money even to those individuals who have little or no credit history. According to their official website, they have served over 1,000,000 clients during 12 years. Oportun is proud to be a certified Community Development Financial Institution having values of Service, Care, Innovation, Courage, Excellence, and Empowerment.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Unsecured installment loans | $300 | $8000 | 7 to 42 months | 30%- 39% | Driver’s license, proof of citizenship or residence permit, recent pay stubs, proof of income | Yes |

Oportun Loans

Oportun offers unsecured installment loans that can help people with anything from car repairs to emergencies. They are also called personal or signature loans. Indeed, they can be used for all possible personal expenses, for example, payment for bills, education, or expenses for expensive medications. Unsecured installment loans involve no collateral. Loan terms usually range from 1-5 years.

Oportun guarantees to make a decision on the application (approve or deny) within 24 hours and provide the funds as soon as the next business day. Regretfully, this lender does not offer direct deposit, which might be inconvenient for customers who need the funds urgently.

Terms of Use

The lender provides the loans of the amount ranging between $300 and $8,000. The maximum loan amount you can get depends on a combination of factors, including your salary, existing credit score, and current debts. Oportun’ APRs are affordable and range between 30% and up to 39%. The loan terms range between 7 to 42 months.

To qualify for a loan, applicants must have a credit score of at least 300. The minimum age of application is 18.

Unlike other online lenders, Oportun allows active duty service members and their dependents applying for a loan. Their rates are determined by The Military Lending Act.

Applicants will also have to provide the following documents and verifications: driver’s license, proof of citizenship or residence permit, recent pay stubs, proof of income.

According to the website, loan terms vary by state and customer. Loans exceeding $6,000 are available to return clients only who were able to repay the previous Oportun loans successfully.

Application

Customers can apply for a loan either by visiting one of the 265+ retail offices of the company at one of 9 states or by calling the specified phone number. Or they can fill out an online application, which is accessible from a PC, tablet or smartphone. The lender promises that a loan will be pre-approved in a few minutes.

The application process usually takes no more than 15 minutes. If an applicant provides the correct documentation (identity verification, proofs of income and residence) and true personal information, he can get a decision the same day.

Clients may also submit the necessary documentation at the office of the company. Your original documents will be scanned and reviewed in your presence.

If a user submits documents online, he will receive an e-mail and phone confirmation as soon as the decision is made.

Once a client is approved, Oportun will transfer the required amount of money to a bank account as soon as the next business day.

Unlike many other lenders, Oportun does not require to provide a collateral or any other guarantees.

Loan Repayment

According to the website, the lender offers fixed and affordable payments. They say the loan term depends greatly on loan amount, interest rate, and a monthly payment. The terms of unsecured installment loans range from 7 to 42 months. Smaller loans usually have shorter terms, and the larger loans have longer terms.

The company schedules payments individually for each customer to match his abilities to pay (usually weekly or two times a month) and determine a payment amount a customer can afford to pay based upon his salary and expenses. Clients can also change the loan amount and term, within limited parameters if they would like to have a smaller payment each time. All payments are made in equal installments that don’t change the terms of the loan (however, if you delayed your payments, the last payment may be larger).

Oportun.com gives the detailed payment guidelines for customers to choose the most convenient option.

- If you want to make payment in person, you can use Oportun locations (visit the nearest location and make a one-time installment payment), CheckFree Pay

(make payments at the nearest office of CheckFreePay), MoneyGram Express Payment (make payments at the nearest MoneyGram office, PayNearMe (make payments at 7-Eleven and Family Dollar Stores); - If you want to pay online, you can use bank or credit union;

- If you want to pay by phone, you can make payment from my Ventiva card or your bank or credit union account;

- If you want to mail Oportun a check, you can make payment via Money Order mailed to the specified mailing address;

- Or you can ask someone else make a payment instead of you.

The company asks its clients NEVER miss a loan payment (to avoid late payment penalties) and choose automatic payments – the easiest way to make your payments on time.

Loan Extension

Regretfully, I found no exact information on whether loan extension is possible. The maximum loan period is 42 months, which is quite enough to pay off the debt. For more details, you’d better contact customer support service.

However, I did find the information that Oportun charges no penalties for early payment. This means customers will not have to pay extra money if they decide to repay the loan before the due date.

Oportun.com Bad Credit

According to the website, the lender requires no credit history to approve a loan. They say many of Oportun customers had no credit history at all when they were approved for the first loan.

However, the lender reports customer’s credibility and payment history to 2 major credit reporting agencies: Experian and TransUnion, so it’s important for a client to make payments on time. As a rule, it takes 6 months of favorable payment reporting to establish a positive credit score, although this term may vary depending on a credit reporting agency.

Technical Characteristics of Oportun.com

Checking Encryption

The lender assures customers of using modern and reliable encryption technologies. Indeed, the address bar of my browser demonstrates a green lock at the left side, which means that oportun.com (to be exact, new.oportun.com) is encrypted.

The URL https// testifies that this website is using a secure sockets layer encryption which provides the minimal required protection level. 128-bit encryption is verified by COMODO CA Limited:

In general, the provided encryption might be enough for customers but I’d love to use the website with more advanced SSL technologies.

Checking a Mobile Version

Today, the number of customers using mobile devices for loan application has exceeded the number of customers using PCs. And the number of the mobile audience continues to grow. Oportun.com seems a popular website, that is why it’s important for them to have a mobile version of the official website. The content should be displayed correctly on all devices.

Google tool confirmed that Oportun.com is mobile-friendly:

I like the way the mobile version looks: the menu is right on the top, the content is reduced, the test is readable. This website seems to be adapted to various devices from which it is opened. I also like that customers can easily scroll the pages with just one finger and a mobile version has a more convenient interface. All these nuances make the work with Oportun.com easier.

Checking Antivirus

I noticed that the website does not use any antivirus program which makes Oportun.com vulnerable to various viruses and online malware programs. Even more, some viruses can steal applicants’ sensitive financial and personal details.

I’d recommend the website’s owner to take efforts to improve the customers’ security. They need to feel safe when taking online loans.

The Convenience of Using Oportun.com

The application process seems quite simple and can be completed in a few minutes. To start an application, users do not need to register which may save time. All in all, customers need to complete 3 steps: fill out an online application, provide documentation, and receive the funds:

To be approved for a loan with Oportun.com, clients must provide a state ID, proof of income for the last month and proof of residence. If a client is eligible for an installment loan, the lender offers approval the same day.

As soon as the loan is approved, a customer can choose to get the money in the form of a check or receive it on a prepaid debit card, which he will need to pick up at the nearest location of the lender. This company has many locations throughout 6 states, so finding the nearest location should be easy. Besides, you may find the address of the nearest office using the website: for this, you need to specify the city, zip code or address:

The website offers an opportunity to choose between 2 languages: English and Spanish.

I like that this lender specifies the average loan rates and terms – customers want to know all these details before starting an application process.

Besides, Oportun.com is quite an informative website – the lender provides the details about credit options available, loan repayment options, educational articles. First-time applications can find answers to the most popular questions in FAQs.

Is Oportun.com Legit?

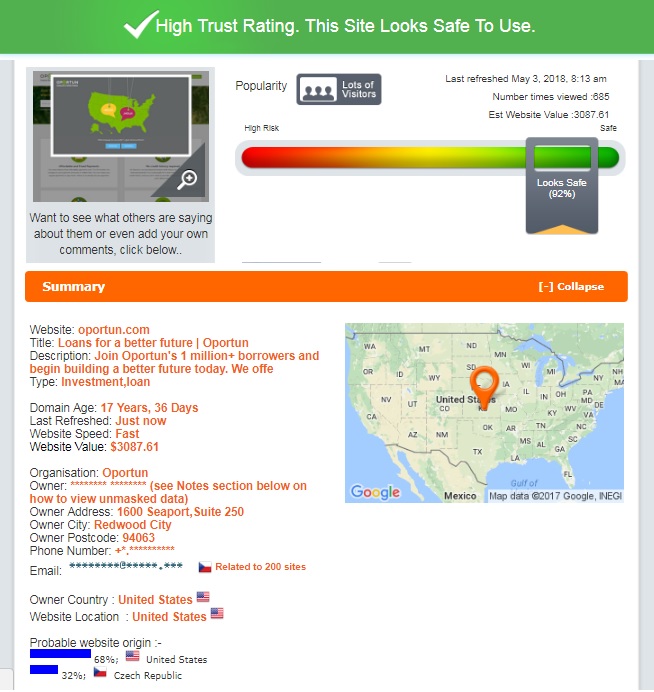

I checked the rating of Oportun.com using given by ScamAdviser – it turned out that it has reached 92% out of 100%, which means that this website is legitimate and reliable.

According to ScamAdviser, the domain age is over 17 years which is a very impressive period. The probable website origin is the United States and it may also be connected to the Czech Republic. The site has a lot of visitors and is regularly refreshed, which means it’s still active. Although ScamAdviser could not give this lender a 100% trust-rating, the revealed details inspire confidence.

Oportun.com Reviews

On-site Reviews

Its’ always nice to come across positive reviews left by previous customers. This is the best evidence that the lender provides good services and terms.There are some testimonials on the front page of Oportun.com. Of course, they all are from happy clients. Anette from Delano said that Oportun helped her when she moved into a new house and also helped her create a better credit score. Mayra from San Diego said that this lender was very helpful when she found herself in the hospital and had to pay for an unexpected surgery. Mary from Compton appreciated that Oportun helped her when she needed money for a car repair urgently:

I cannot be sure that all these reviews are genuine. Besides, they are not dated and look like a common advertisement composed or filtered by the lender. There is no special section devoted to customer reviews which makes me suspect that in fact, people do not have an opportunity to leave testimonials about this lender on its official website.

Oportun Reviews on Other Websites

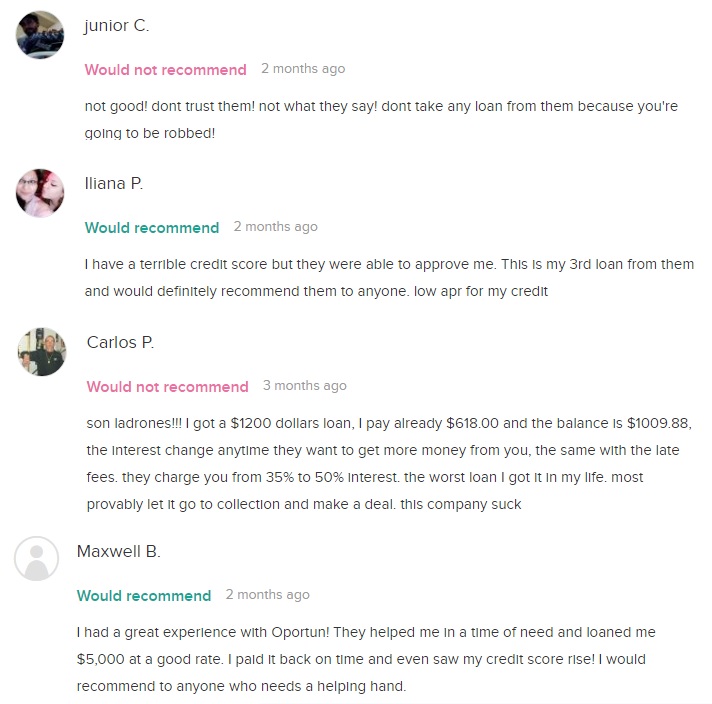

There are hundreds of mixed Oportun reviews on independent websites, which confirms that this lender is old and experienced. There is an equal number of positive and negative comments from previous customers. First of all, I was happy to reveal the fact that Oportun won the Awards of the Best Place to Work, San Francisco in 2015 and 2016.

Some of the customers said that they used the services of Oportun regularly since the lender has good terms, others were approved for a loan even if they had a terrible credit score. They recommend this service to anyone.

However, there are many unsatisfied clients who do not trust Oportun. According to them. This lender changes its interest rates anytime and just wants to get more money from its customers. Some users had problems with the late fees.

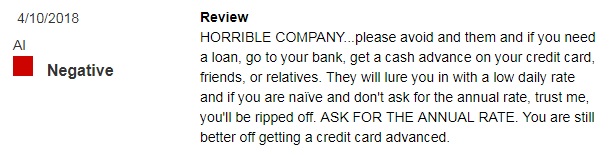

Oportun reputation by BBB was also disappointing. The website contained 33 reviews and all of them were complaints. Customers said that this is a horrible company which should be avoided as it does not specify the exact daily rates.

Others clients did not like this lender because the payment process causes a lot of issues. One user tried to make a payment over the phone and the Oportun staff wasn’t able to process the payment. He later tried to make a payment at their location but their system did not work for several weeks. And so on and so forth. He also complained that the lender does not accept credit cards and it’s just a real trouble trying to pay for a loan on time. He concludes that this business is worthless.

One more review testifies that oportun.com is taking advantage of low-income people and puts them at risk for high APRs and spoils credit scores.

Another client said this lender is abusing private information which was never provided to them. He is also unsatisfied with the customer care department.

Others mentioned that the lender gives customers the wrong loan information. According to them, Oportun will make no effort to help even good customers who ALWAYS make payments on time and NEVER delay one.

Of course, I did not expect to find 100% positive reviews since there are ALWAYS people who are unsatisfied with the services provided, that’s why every lender has a share of negative testimonials. Since there are too many reviews for Oportun.com, I was not able to read all of them and cannot say for sure whether good reviews prevail over bad or not. It seems that the company has an equal number of positive and negative comments.

Customer Support

Contact Information

Oportun provided the detailed contact information, including phone numbers, emails, physical addresses of its locations, mailing address. All of these details can be found in the Contact Us section.

It’s nice to see that the lender does not hide any of its contact information and tries to be as transparent as possible. Not a single detail was missing.

Oportun.com Locations

According to the website. Oportun is currently providing installment loans in over 265 retail locations to people living in 8 states including Arizona, California, Florida, Illinois, Nevada, New Mexico, Texas, and Utah. Though the loan availability is limited, the lender promises to continue expanding to more states in the nearest future and encourages customers to check the available locations from time to time to see if Oportun loans have entered other states.

Getting a Consultation

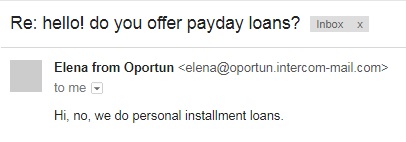

For questions regarding loan details, customers may call 1-866-488-6090 or visit one of Oportun locations. According to the lender, one of its agents will be happy to assist you in-person, via email or over the phone. The website also has a live chat option but it was offline at the moment I wanted to ask a question. I had to ask my question offline and wait for the feedback via email. I was interested in whether Oportun provided payday loans. The answer came in a few hours.

Even though the response came not as quickly as I expected, I am satisfied with the customer care department. Many other online lenders do not ask customers’ question at all.

Conclusion

Oportun seems to be an experienced, legitimate and popular lending service which has many advantages: a high trust-rating, an easy application process, a quick loan approval, loan amounts up to $8000. But customers must provide some verifications and documents to be approved for a loan. Customer reviews confirm the lender’s popularity but also testify that not all customers are happy with the services provided. However, I found no evidence that the company is operating illegally. The majority of the problems described by unhappy clients was a result of the non-timely payment. The drawbacks of this lender are that it does not offer direct deposit, which might be inconvenient in some cases. Since Oportun.com is not a traditional payday lender and has too limited loan options available, I recommend searching for other options before using its services. But if you are interested in personal installment loans, this lender might be a good option for you. However, before signing an agreement, read all the loan details carefully, especially the clauses related to interest rates, and ALWAYS repay your loans on time to avoid penalties. I give this website the rating of 3.9 stars out of 5.

Ready to Apply?

Ready to Apply?