Self-Introduction of NetCredit.com

NetCredit.com is an online lender located in Chicago. NetCredit online institution is an affiliated company of Enova International, Inc., which gives this online lender an opportunity and resources to fulfill plans and improve product offered. NetCredit.com performs in almost all US states cooperating with main credit facility Republic Bank & Trust Company. Netcredit.com has a license to offer loans in the following states: Arkansas, Arizona, District of Columbia, Florida, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Montana, Nebraska, Ohio, Oregon, Texas, Washington, Alabama, California, Delaware, Georgia, Idaho, Missouri, North Dakota, New Mexico, South Carolina, South Dakota, Utah, Virginia and Wisconsin. NetCredit.com is considered to be members of the following list of organizations:

NetCredit.com is an online lender located in Chicago. NetCredit online institution is an affiliated company of Enova International, Inc., which gives this online lender an opportunity and resources to fulfill plans and improve product offered. NetCredit.com performs in almost all US states cooperating with main credit facility Republic Bank & Trust Company. Netcredit.com has a license to offer loans in the following states: Arkansas, Arizona, District of Columbia, Florida, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Montana, Nebraska, Ohio, Oregon, Texas, Washington, Alabama, California, Delaware, Georgia, Idaho, Missouri, North Dakota, New Mexico, South Carolina, South Dakota, Utah, Virginia and Wisconsin. NetCredit.com is considered to be members of the following list of organizations:

- Republic Bank:

- CFSI;

- 2016 Network Member;

- ENVA listed NYSE.

It may serve as the main indicator of licensed and authoritative online lender providing clients with the most affordable conditions. NetCredit.com loans may become a source of better financial health.

| Types of Loans | Min Loan Amount | Max Loan Amount | Period | Interest Rate | Documents | Bad Credit History |

| $ 1 000 | $ 10 000 | agreed individually | agreed individually | Social Security Number | YES |

Types of Loans

NetCredit.com provides clients with the following types of loans:

- quick or personal loans;

- installment loans.

![]() Quick or personal loans have such distinctive features as:

Quick or personal loans have such distinctive features as:

- Quick online process. Quick Loans online can be processed faster considering to be one of the most convenient. Online loans from NetCredit.com deprive you of the necessity to visit bank office and take in-store credit or loan demanding to provide too many documents to be approved.

- Short and fast application. Some bank institutions take several days or weeks to decide whether you are eligible to get a loan. Conversely, NetCredit, as well as many other online lenders, process clients’ application online, implying they may provide you with an immediate decision.

- Quick funding. Once a client has been approved, NetCredit will typically transfer loan amount until the next business day.

Installment loans are loans of greater amount paying back by several installments. Installment loans are given by Republic Bank & Trust Company or by a member of the NetCredit family of companies depending on the state in which you live. Funds as usually is transferred by the next working day to the active bank account with which you provide Net credit in the application form.

Terms of Use

NetCredit.com is not available to people under 18 years old or to persons who are not legal the United States residents.

A borrower is able to arrange a loan in an amount from $ 1 000 up to $ 10 000. It means that a client will get quick loans but at the same time, it looks like installment loans paid back for several months.

As to speak about the interest rate, we have found the following information that there are two types interest rates:

- the simple interest which is calculated only on the remaining unpaid principal amount;

- compound interest adds any interest accumulated to the principal of the loan.

Both types loans are of legal issue, but loans with compound interest are prone to be more expensive, But, fortunately, NetCredit offers its customers quick loans with simple interest to make all the procedure is clear and understandable. As long as a client makes all of the mandatory payments in time, a client will not be accrued any prepayment or non-sufficient funds fees. There is no acute information about the period you are eligible to get a loan for. But making a conclusion from great loan amount, it takes from several months to several years to pay a loan back.

It is not understood whether a client should have a steady working place or a steady source of income. But it is reasonable that a client should have some funds to pay a loan back when the time comes. In general, you may get to know status whether you are eligible to get a loan or not at NetCredit.com, you may fill in an application form. And if declined, it won’t have any effect on your credit score and history. You should look at the following button:

![]()

Application

To apply for a loan online and be eligible to be approved a client should provide such a document as Social Security Number. Of course, you have to fill in the application form including the following information:

- date of birth;

- phone number and second phone number;

- e-mail address;

- address.

According to reviews of NetCredit, an application is processed almost immediately that’s why it takes not so much efforts to file for a loan, especially in NetCredit. While filling in an application form, we won’t be asked to provide any contact persons, that’s why we may come to a conclusion that Netcredit.com makes all the process as hassle-free as possible. You won’t face any troubles preventing you from getting a loan online except if you are not eligible to.

When applying for a loan online, a client are capable to use three main options to understand whether he/she is eligible to get funds. These 3 main options are:

- Find the RightFit – Apply this option to realize personalized loan options and select the terms that are appropriate for you individually.

- Know the ClearCost – This option shows that you will never be embarrassed by an application, origination, prepayment, or non-sufficient funds fee.

- Built-in CreditBuilder – With My CreditBuilder, a client is capable to build a positive credit history by means of two of major credit bureaus by paying timely.

Repayment

NetCredit.com offers clients several ways to pay a loan back among which you may choose by yourself:

- Electronic Fund Transfer (ACH Debits) – it is in the great request repayment means for many clients. ACH (Automated Clearing House) is a kind of electronic debiting. NetCredit administration debits your bank account for the amount you borrow in an electronic way in the day considering to be due.;

- Debit Cards – are accepted for one-time payments. Debit card payments are accepted during the following hours of operation (Monday-Friday 9am-9pm and Saturday-Sunday 10am-6: 30 pm EST) and will be debited on the same day.;

- Paper Check – Before each due date, a client should send a paper check payment to the following address: P.O. Box 206766, Dallas, TX 75320-6766;

- Other Repayment Methods – additional repayment options include money order, MoneyGram or Western Union payment.

NetCredit.com gives a chance for people to pay a loan or installments back earlier. There are three main methods of paying a loan back earlier, they are:

- pay back your loan in full – a client is able to choose to pay back quick, personal loan entirely at any time.

- pay next installment back in advance of planned due date – a client may carry out the next payment early by selecting a date more than two business days before the planned due date.

- pay another amount toward your loan – a client is capable to choose to pay any loan amount at any time considering these aspects:

- if the amount you are going to pay is less than the amount of your next payment, you should the left amount in your due date.

- if the amount is greater than the amount of the next payment, an additional amount will be withheld from the outstanding principal of the loan.

There is no actual information about the delay of payment, but if you have such a problem it is better to contact customer support service not to be involved in additional fees and penalties. But we have found information that Collections Team may help you pay a loan back, and if you know beforehand that you have some financial troubles, you’d better inform NetCredit administration in time.

Extension

The extension is a specific issue for many online lenders that’s why it is hardly possible to find necessary information on the website because they are discussed individually with a borrower. But NetCredit.com provides such an opportunity for clients as refinancing loans. This option is eligible only if a client has a right to make use of it (rights are not described). This option includes two main ways:

- “Lower My Payment” – this option proposes clients capability to decrease stated payment amounts by refinancing existing loan into a new loan signing a new contract and making a new payment plan. Clients having a right to apply this option may be capable to reduce payment by at least 15%! Lower Their Payment is available in the following states: Alabama, California, Delaware, Idaho, Missouri, New Mexico, North Dakota, South Dakota, Utah, and Virginia.

- “Borrow More Money” – Clients who get less than their full approved amount or who have paid off a significant portion of their current loan may be eligible to top off their current loan amount with an additional disbursement amount. The following states are included in the list for whom this option is available: Alabama, California, Delaware, Idaho, Missouri, New Mexico, North Dakota, South Dakota, Utah, and Virginia.

Refinancing is a kind of repeated loan to pay the first one back, so that we may come to a conclusion that NetCredit has a kind of repeated loan if the first one is not paid back yet.

NetCredit.com Bad Credit History

If a client has a bad credit, NetCredit.com will process his application and gives him an opportunity to improve the financial state. In general, credit history plays no role for NetCredit.com and you will get an opportunity to improve your credit score by paying a loan back in time. Such a possibility is the greatest chance for many people to take installment loans for business development, for example.

Technical Data

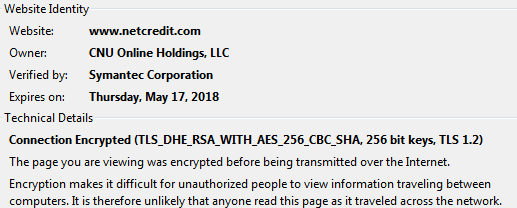

Secure Connection on NetCredit

The connection on NetCredit is absolutely secure. The company owner is CNU Online Holdings, LLC, the security certificate is verified by Symantec Corporation.

![]()

Clients’ personal data is encrypted by 256-bit server which prevents hackers from getting access to banking or employment information. NetCredit.com takes all the efforts to protect clients’ personal data from unlegalized access. Nowadays, the Internet is full of fraudulent activities directed to gain access to banking information of many people going shopping online or getting loans online. NetCredit.com provides the highest level of security for clients.

Mobile Version

Mobile version of NetCredit.com is user-friendly and moreover convenient for people who decide to leave an application by means of the mobile device. Mobile version is created to simplify application procedure for people who prefer to make all activities by means of mobile devices. NetCredit.com makes everything possible when arranging mobile version because everything seems to be clear. Front-page has no “unnecessary” information and pictures to embarrass clients. The application form has not also drawbacks that’s why the main goal can be easily achieved.

Mobile version of NetCredit.com is user-friendly and moreover convenient for people who decide to leave an application by means of the mobile device. Mobile version is created to simplify application procedure for people who prefer to make all activities by means of mobile devices. NetCredit.com makes everything possible when arranging mobile version because everything seems to be clear. Front-page has no “unnecessary” information and pictures to embarrass clients. The application form has not also drawbacks that’s why the main goal can be easily achieved.

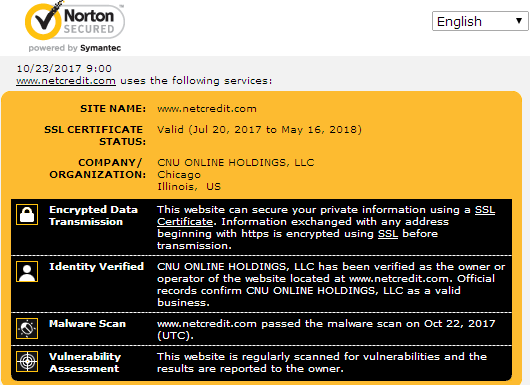

Antivirus Presence on NetCredit.com

Antivirus is one more important thing when commanding online services. NetCredit.com cares about its customers that’s why they have two antiviruses at one and the same time:

- McAfee Secure

- Norton

McAfee Secure provides the guarantee from the following options:

- No Malware or Malicious Links – McAfee Secure try to find any dangerous software on this site but fail;

- No Phishing Detected – NetCredit.com doesn’t attempt to thieve clients’ identity;

- Valid SSL Certificate – Data clients deliver to NetCredit.com is encrypted by industry-standard security protocols;

- $100,000 Identity Protection – Making a purchase from this site qualifies you for 90 days of complimentary identity theft coverage, good for up to $100,000;

- Perimeter Scanning Active – NetCredit.com is constantly scanned for disadvantages that hackers may make use of.

Norton is one more effective antivirus giving people an assurance their personal data is in safe hands. Norton guarantees that NetCredit is able to protect clients’ private information by means of SSL Certificate. Data transmission with any address with https is encrypted by means of SSL before transmission.

Convenience of Applications

When deciding to make use of NetCredit.com, a client should undergo registration procedure. You have to select login and password on NetCredit to check your eligibility. Approval process on Net Credit takes several minutes, you will get it almost immediately.

When entering the website front-page, you will see such a field:

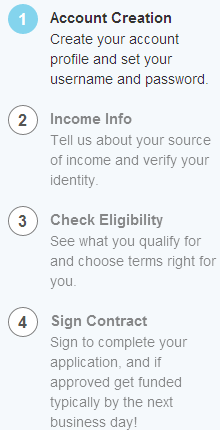

If you are not approved, it won’t have any effect on your credit score that’s why you may check whether you are eligible or not without any troubles. When pressing “Check Your Eligibility” button, you will see an application form containing 4 main steps:

When reaching the third step, you will see a result already. You will understand your status whether you are approved or not. If you met NetCredit requirements, you will get positive status and get money as fast as possible. When filling in the first step information, a client should press the button “Continue to Step 2” and go on the application enrollment.

![]()

If approved, funds will be transferred to the bank account you provide in an application form. Money usually is transferred within 24-hours. There is a possibility of faster transferal, 15 minutes exactly, but it, unfortunately, doesn’t operate right now. In general, all the procedure is as convenient as simple that’s why even registration takes almost 1 minute that’s why you may start right now and after 5 minutes get the approval for the loan online. If you are not approved, you may contact customer support service over the phone: 1-877-392-2014 and try one more time.

Is NetCredit.com Legit and Secure?

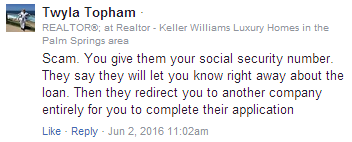

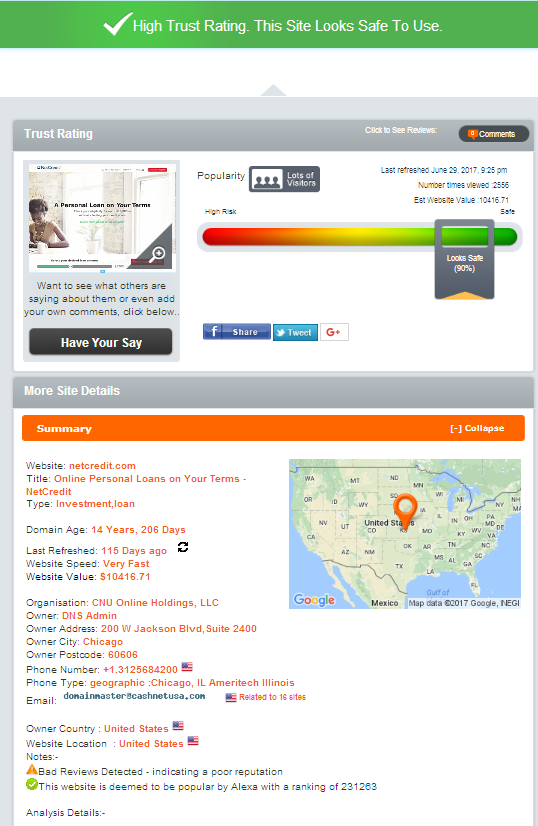

NetCredit.com, according to ScamAdviser.com, has 90-% of security rating which defines this online lender to be safe to use. Company owner and website location are identically located in the United States of America, Chicago. Net Credit has lots of visitors but among them there negative reviews about personal loans detected. One of them is written on ScamAdviser.com characteristic:

Domain age is 14 years, 206 days which shows that NetCredit.com online lender has been for a long time in business. 90-% of security is high rating showing Net Credit reliability, credibility and legitimacy. The main aspect for such a high rating is the absence of hidden information preventing clients from getting more facts about Net Credit performance. But even ScamAdviser.com advises people to search more reviews about this online lender and decide whether it is reliable enough to command its service.

Customer Reviews about NetCredit.com

Reviews on NetCredit.com

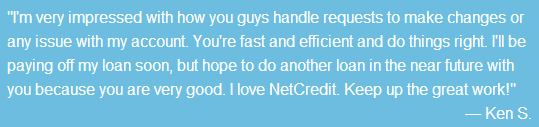

There is a separate page with reviews left by absolutely satisfied customers about NetCredit.com performance but they are not enormous, only 4. Such customers’ reviews left on NetCredit.com is not bearing a date that’s why we cannot understand when they were written by customers. And their quantity provides no concrete information about what experience they have commanding NetCredit.com service online.

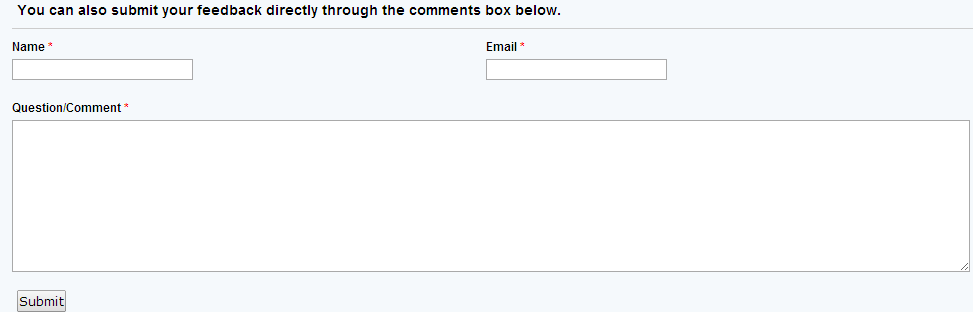

But here there is the greatest advantage, we understand by what means reviews are published on Net Credit, exactly, there is a feedback form offering clients to leave a comment. It looks like:

Such an option makes people believe in the authenticity of reviews left by real people who have command NetCredit service. If you are a client of NetCredit.com, please leave a review here because it may help someone make a choice and improve his financial state.

Reviews on Third-Parties Resources

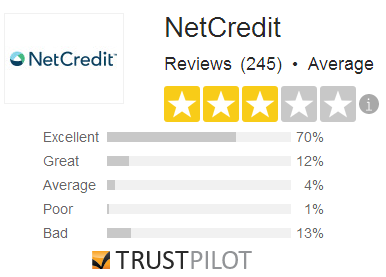

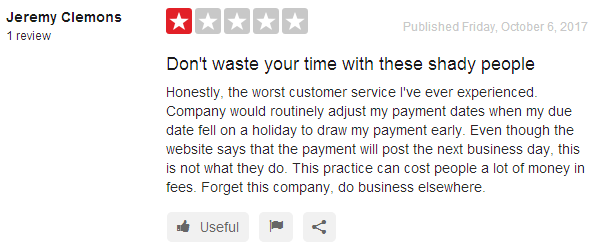

Reviews are the major part of every online service. People before decide to command this or that service, read reviews attentively. Trustpilot.com is rich in reviews about different online lenders and NetCredit.com is not an exception. People may find detailed reviews there showing popularity and trustability of different people when making use of this online lender. Rating on TrustPilot.com is not high – only 3 stars:

There is almost 13-% of bad reviews and ScamAdviser.com attracts our attention to the fact of negative reviews detected.

There is almost 13-% of bad reviews and ScamAdviser.com attracts our attention to the fact of negative reviews detected.

All the reviews are baring “fresh” dates that’s why it becomes possible to estimate the real picture of NetCredit performance. People are not always satisfied with staff and service, in general. It is better to examine and read such reviews attentively then it will be possible to understand whether it is appropriate to command this online lender service or not.

Of course, there are positive reviews, they predominate over negative – almost 70-% of them has a status “Excellent” but they are too short showing almost nothing:

Read attentively all the reviews on TrustPilot about NetCredit loan service and make up a choice.

Contact Information

“Contact Us” Section

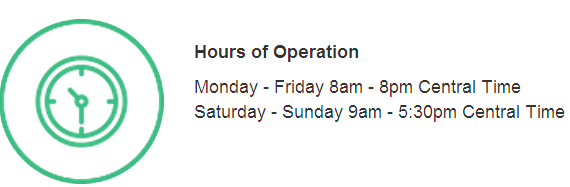

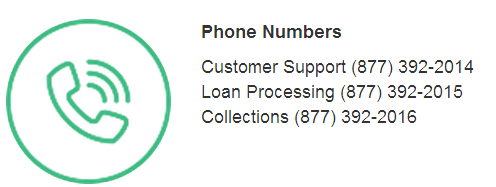

“Contact Us” section contains the following information:

- Hours of Operation

- Phone Numbers

- Fax

- Email

- Mailing Address

All the required contact information is given in “Contact Us” section. Remember: ScamAdviser.com contact data is absolutely similar to given on website itself. If you fail to contact customer support service, you may use one of Net Credit phone numbers and ask bothering you questions.

Locations of NetCredit.com

NetCredit.com has a license to work in the following US states: Arkansas, Arizona, District of Columbia, Florida, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Montana, Nebraska, Ohio, Oregon, Texas, Washington, Alabama, California, Delaware, Georgia, Idaho, Missouri, North Dakota, New Mexico, South Carolina, South Dakota, Utah, Virginia and Wisconsin.

The main difference lies in fact by what kind of banking institution funds are transferred, exactly by Republic Bank & Trust Company, member FDIC or member of the NetCredit family of companies.

| Republic Bank & Trust Company | Member of the NetCredit Family of Companies |

| Arkansas | Alabama |

| Arizona | California |

| District of Columbia | Delaware |

| Florida | Georgia |

| Indiana | Idaho |

| Kansas | Missouri |

| Kentucky | North Dakota |

| Louisiana | New Mexico |

| Michigan | South Carolina |

| Mississippi | South Dakota |

| Montana | Utah |

| Nebraska | Virginia |

| Ohio | Wisconsin |

| Oregon | |

| Texas | |

| Washington |

As you can see, NetCredit.com has a diverse number of states where this online lender has a right to approve loans online. Loan amount is similar in all these states. It means if you are a resident of one of these states you are welcome to leave an application.

Customer Support Service

Unfortunately, there is no live chat or contact form. There are emails by means of which a client is able to contact customer support service.

We have left a message for them to understand properly whether they require to send them any kind of documents or not. Email is not the most convenient means of communication because it takes too much time to get the response. We are hopeful, we will get the response, but still waiting.

![]()

Conclusion: Negative Reviews Detected about NetCredit.com

NetCredit.com is a licensed online lender working in almost 30 states on the territory of America. Loan amount provided by Net Credit is from $ 1 000 to $ 10 000, period and interest rate are calculated individually. There are special options which help people understand what loan amount you are eligible for, how much you have to pay back and improve your credit score, in case of bad credit history which plays no role for NetCredit.com administration.

According to ScamAdviser.com, NetCredit.com has no hidden information which provides high-security rating – 90-%. But ScamAdviser.com requires searching for reviews which may be of negative character. And we follow this advice and examine TrustPilot.com full of customers’ reviews about Net Credit. We have found that there is 13-% of “bad” reviews which become a signal that clients should be attentive while commanding this service.

Of course, there is a great number of excellent reviews but they are not so informative as negative that’s why read them one more time and decide whether this online lender is suitable for you or not.

In general, we are embarrassed by reviews only because this online lender makes everything possible to protect clients’ personal data by means of highest security systems and two antiviruses. It is still up to you to decide but we may recommend you NetCredit.com as a financial online lender.

Ready to Apply?

Ready to Apply?