What is My Canada Payday?

My Canada Payday is a licensed Canadian lender, which claims to work hard to approve every customer for a short-term loan. They are sure that you will find them to be the best lender in Canada. The company eliminated the need to go anywhere to get fast cash. Instead, you can apply for a loan online at home without wasting your time. This lender is operated by Westrock Financial Ltd, which guarantees high approval rates, speedy approval, fast money transfer. Besides, they are proud to be a member of the Canadian Consumer Finance Association.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans | $100 | $1,500 | Up to 60 days | Varies by province | Social insurance number, drivers license or state-issued ID | Unknown |

Types of Loans

My Canada Payday provides payday loans (cash advance, fast cash). These are short-term loans that help you to keep on until you get paid. Such loans are designed to help people solve temporary financial troubles.

Once your loan is approved, the lender can send you the funds via Interac email transfer (if you are an existing customer) or EFT Direct Deposit (if you are a first time client or your bank does not support Interac Email transfer). Existing clients can get their money in 30 minutes, while first-time clients will receive the funds the next business day. If you live in Ontario, you will only be eligible for Interac Email Money Transfer.

Terms of Use

My Canada Payday is ready to lend you from $100 to $1500 for 2-4 weeks.

First-time borrowers are not eligible for the maximum loan amount. If you are a returning client and your financial situation has not changed, you will be able to receive the same loan amount again. But if you are using the services of this lender for the third time, you will be able to borrow more funds. The policy of this company does not allow lending a customer more than 50% of his total paycheque.

To qualify for a loan with My Canada Payday, you need to be employed and have a regular income, which you receive via Direct Deposit or cheque.

If you are self-employed or unemployed but receiving Disability, Employment Insurance, a Pension, you will not be able to get a loan from this company.

My Canada Payday disclosed loan cost for every residence:

- Nova Scotia: 22% of the Principal for each $100 you borrow. For example, a $400 loan means you will have to return $488 on your next payday;

- Manitoba, Saskatchewan, British Columbia: 17% of the Principal for each $100 you borrow. For example, a $400 loan means you will have to return $468 on your next payday;

- Alberta and Ontario: 15% of the Principal for each $100 you borrow. For example, a $400 loan means you will have to return $460 on your next payday.

Application

MyCanadaPayday.com has a simple online application which can be filled out online. Typically, they do not require to fax any documents. However, they review each loan information individually and in some cases a customer may be asked to fax some additional proof of residence or income. When approved/disapproved, a client will be informed by e-mail. This usually happens on the same day.

To be approved, you will need to present proof of your regular income by sending screen captures of your web-banking using a loan application. Besides, you must provide 60 days of your banking history. In some cases, the lender will ask you to fax a void cheque, a recent utility bill, recent paystubs, or a direct deposit authorization form stamped by a bank.

If you applied but did not qualify for a loan, you are welcome to re-apply later when your financial / employment situation changes. For this, you will need to provide a 60-day history of your web banking. You will not have to refill an online application. The lender will update your file and review your new application. Bear in mind, that the company can only review one application per month.

Repayment

You should be ready to return your loan + interest on the day you receive your next wages. (usually 2 weeks). In any way, the due date will be disclosed in your loan documents. The funds will be automatically taken from your banking account. This is convenient because you do not have to leave your home to repay the debt.

If your payment is delayed, My Canada Payday will start sending you e-mails asking you to contact them. Even if you did not receive such e-mails but noticed the delayed payment on your loan, you should contact the lender immediately. If you fail to do this in a timely manner, you will be charged an additional non-payment fee, which may reach $60 per each missed payment). However, if you manage to contact the company on time, they will attempt to agree on a new due date without charging extra fees.

Extension

Unlike other lenders, who demand that you pay off your loan on the day you get paid, My Canada Payday can extend a lending period for a little bit longer. Clients can repay the debt on their next-but- one payday and save lots of money. The maximum loan period is 60 days and it cannot be extended for longer. If you want to extend your loan, you need to call or e-mail the lender and discuss the available options. Usually, this company does not extend loans any further than one more paycheque.

MyCanadaPayday.com Bad Credit

Regretfully, I found no information about lending to customers who have a bad credit or no credit so you will need to find out whether you can be approved for a payday loan if you have credit problems.

Technical Characteristics of the Website

Encryption

The website protects users’ sensitive information by using a 128-bit encryption technology. Suh an encryption is able to provide a minimal protection from identity theft. The security certificate is issued by COMODO CA Limited – a leading certificate authority:

The presence of at least minimum encryption is a good sign which adds some trust to this lender, however, I would recommend the website’s owner to use the strongest encryption with an extended validation SSL.

Mobile Version

MyCanadaPayday.com has a mobile version, which is confirmed by Google:

Using the mobile version is convenient because mobile clients can quickly find the necessary information and apply for a loan using only the basic site’s functions. The mobile version slightly differs from the desktop one. All the buttons, elements, images, phone numbers and links are enlarged and are not so close to each other so you can easily click on them with a finger.

Besides, the mobile version is downloaded faster due to a reduced size of images. If you are not satisfied with this version, you can always return to the desktop version of the website and use the full functionality of the website.

Antivirus

Regretfully, MyCanadaPayday.com does not use any antivirus programs which would have screened this website for viruses and other online threats. As such, you can infect your devices with viruses, Trojans, and other dangers. I would recommend the website’s developers provide the highest security to its clients and get an antivirus installed.

Convenience of the Website

The website seems convenient and simple to use. You only need to fill out a one-page application form, wait for a decision, and get the funds deposited into your banking account. If you are an existing customer, you can complete an express application form.

It’s nice that this lender does not ask borrowers to answer too many questions about the purpose of a loan. Their loan request form is only one short page. You can even apply using your phone.

I appreciate that you neither need to fax documents not visit a lender’s office. The whole process takes less than half an hour.

My Canada Payday provided the detailed application instructions for residents of various provinces.

British Columbia, Alberta, Manitoba, Nova Scotia, Saskatchewan: you need to complete an application online, receive an automated e-mail with instructions and a link for the Inverite screencap application. Using it, you should upload to the lender screenshots of your web banking, log into your web banking and show 60 days of banking history. After that, the company will start to review your application. If they need more information, they will contact you by phone or e-mail and some moments later they will let you know whether you are approved or not. If approved, you will receive a link to download your loan contract. You should carefully read all the terms and rates and agree to them by calling My Canada Payday automated agreement system. After that, the funds will be sent to you either by a Direct Deposit or an Interac E-mail transfer. On the specified date, the company will automatically withdraw the due amount.

The process is a bit different for residents of Ontario: You will need to verify your identity and banking information with Decision Logic. When approved, the money will be sent via Interac E-mail transfer.

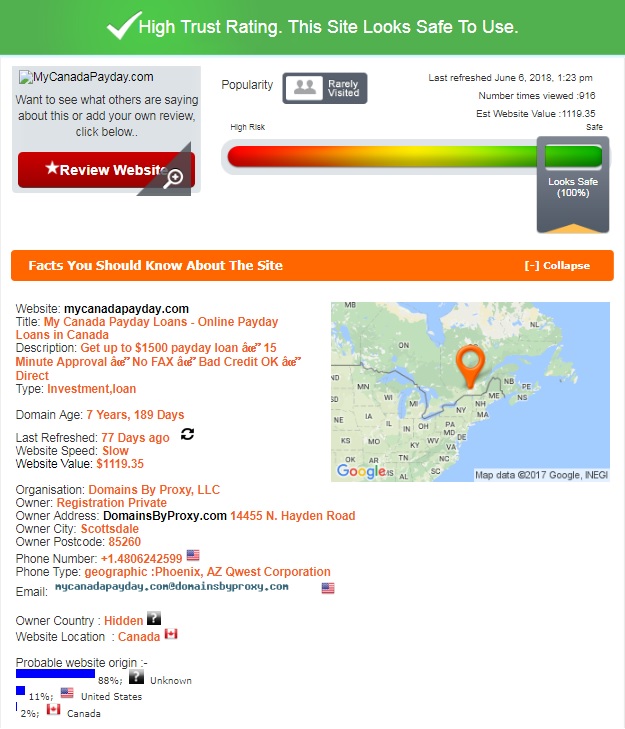

Is MyCanadaPayday.com Legit?

Scam Adviser seems to be confident about MyCanadaPayday legitimacy. The company received the maximum possible trust rating – 100% out of100%, which means this website is safe to use:

The background of the website is satisfying – the domain has been created over 7 years ago. The website seems to be located in Canada or the United States. The owner country is listed as “hidden”. Although the site is legitimate, it has very few visitors. However, this did not prevent ScamAdviser from rating this lender the maximum possible score.

MyCanadaPayday.com Reviews

On-site Reviews

Customer reviews are very useful for online companies. Today, most people read the feedback from former clients before using the services of this or that company. People trust customer reviews more than the information posted by the website’s owner. Placing testimonials on the lender’s site can make people trust a company.

Unfortunately, there are no My Canada Payday reviews on the lender’s website. Instead, they invite visitors to read user comments posted on Trust Pilot’s website.

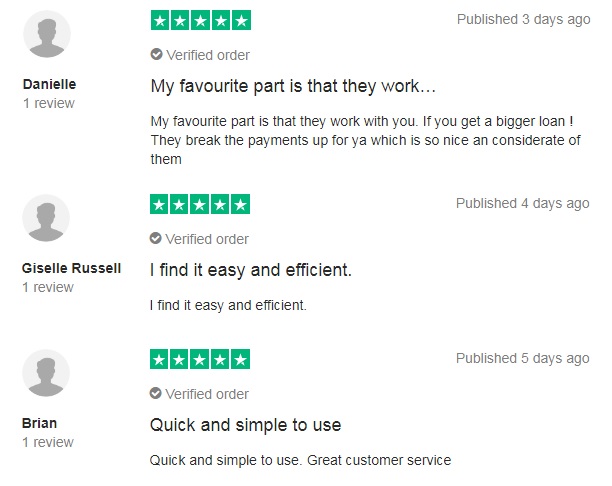

Reviews on Third-Party Websites

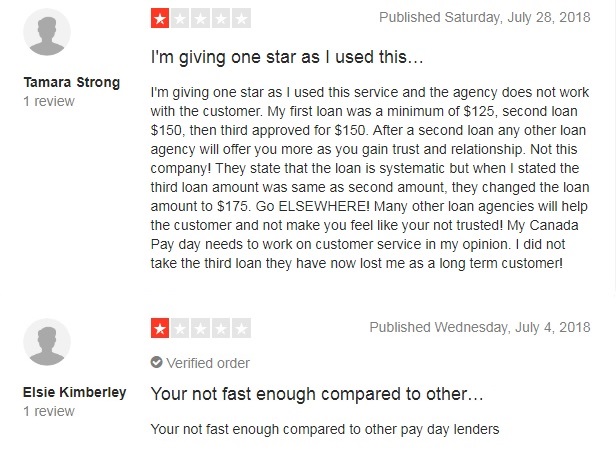

My Canada Payday is rated 9.2 stars by TrustPilot. All in all, 541 previous customers posted comments about this lender. The reviews are mostly positive. New comments are posted every day. Customers appreciate a convenient and simple website, quick funding and application process, helpful customer support, and so on:

My Canada Payday complaints are very limited. The most recent negative comment was posted on July 28, 2018. The user reported that this lender did not work with the customer. He added that this company made empty promises and did not actually offer higher loan amounts with the third loan. He said this lender lost him as a regular client and recommended to find another lender. Another user said this company was not fast enough compared to other payday lenders.

Although some clients had issues with this lender, a huge number of good reviews testifies that most customers are satisfied with this organization and the services provided. The thing is that not a single lender can make 100% of customers happy. It would have been suspicious if I had not found any negative reviews.

Customer Support

Contact Information

My Canada Payday presented the detailed contact information on the Contact Us page. Their call center is located in Surrey, BC. They have several offices across Canada:

Surrey, British Columbia:

- Address: 425 – 15225 104th Avenue, Surrey, BC, V3R 6Y8;

- Hours of Operation: Monday – Friday 8 am — 8 pm; Weekends and Holidays 9 am — 5 pm;

- Phone numbers: 1-604-630-4783, 1-877-730-8406.

You can also see how a typical My Canada Payday office looks like:

Vaughan, Ontario:

Vaughan, Ontario:

- Address: Unit 621 – 92 Caplan Ave, Barrie, ON, L4N 0Z7;

- Hours of Operation: Monday – Friday 8 am — 8 pm;

- Phone number: 1-289-472-5204.

Edmonton, Alberta:

- Address: Unit #7, 12052 Fort Road, Edmonton, AB, T5B 4H1;

- Hours of Operation: Monday -Friday 8 am — 8 pm;

- Phone number: 1-780-652-1419.

Dartmouth, Nova Scotia:

- Address: Unit 301, 77 Alderney Drive, Dartmouth, NS, B2Y 2N7

- Hours of Operation: Monday – Friday 9 am — 5 pm

- Phone number: 1-902-332-3579

MyCanadaPayday.com Locations

My Canada Payday loans are available to residents of Ontario, British Columbia, Saskatchewan, Alberta, Nova Scotia, Manitoba

They also specified the major Canadian cities where you can get a loan: Ottawa, Toronto, Regina, Saskatoon, Surrey, Vancouver

Getting a Consultation

If you have any questions about payday loans or an application process, you can contact the lender by calling at 1-604-630-4783 or emailing at [email protected]. According to the website, their customer support team is always ready to help its clients as soon as possible. You can also get a consultation at one of My Canada Payday in-store locations.

I decided to email the lender and find out whether they can provide a loan to a person with a bad credit. Unfortunately, I waited for too long and did not receive any feedback. Obviously, their customer care department is not as efficient as you can expect.

Conclusion

My Canada Payday is a decent Canadian lender with an extensive experience. The application form is on-page and simple, the lender provides the detailed instructions for all provinces whether its services are available. The loan terms and rates are affordable and 100% disclosed but some aspects still need to be specified, for example, it’s not mentioned anywhere on the site whether customers with bad credit or no credit can be approved for payday loans with the lender. An advantage of this company is that clients can extend their loans for 30 days. Many other lenders do not allow loan extensions. The positive report by Scam Adviser also inspired confidence in the lender’s credibility. There are a lot of positive customer reviews available on third-party websites, which means this organization is popular and can be trusted. However, if you want to get another loan type or live outside Canada, this website is not suitable for you.

Ready to Apply?

Ready to Apply?