What is Mr Payday?

Mr. Payday is an online lender which has been serving Canadians since 2002. They provide online payday loans in British Columbia and claim to have the most competitive rates among lenders. Besides, they are proud to have great reviews from the previous customers. According to the website, the best thing about this lender is that almost every person qualifies. They also advertise minimal and easy to meet requirements and say you can be approved even if you have poor credit or no credit. They guarantee a fast and confidential application process. The company is sure their loans are quick, convenient, and useful in financial emergencies.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans | $200 | $1,500 | 2-4 weeks | 391.07% | SSN, Driver’s License number | Yes |

Types of Loans

Mr. Payday provides payday loans online. These are short-term amounts of money that are to be paid off on the day you get paid. Payday loans are intended to help consumers deal with unexpected financial difficulties.

A borrower can choose to receive money via email money transfer or direct deposit into his bank account. The transfer will take no more than 1 business day.

Terms of Use

At MrPayday.ca, you can receive between $100 and $1,500 for 2-4 weeks.

This lender has not very strict eligibility criteria. To get an approval, you must:

- work at your current job for at least 3 months, or receive CPP;

- have an active bank account with the history for at least 2 months;

- be 19 years old or more;

- earn at least $1,000 per month;

- have a phone number.

Unfortunately, Mr Payday does not lend to Canadians who are self-employed, on social assistance, on worker’s compensation, paid by commission or on disability. Besides, you will not be approved if you have filed for bankruptcy in the last year. The company mentions that the final decision is made by a loan officer.

Besides, this lender does not provide loans against Child Tax Credit, Ontario Disability Support Program, Persons with Disabilities, Assured Income for the Severely Handicapped and Employment Insurance.

The organization charges a maximum 17% of the principal. For example, if you borrow $300 for 14 days, you will have to pay off $351 on the due day. The APR also depends on your location. In general, it is about 390%.

The company cannot guarantee that your loan will be 100% approved. The lender may have different reasons for a rejection, such as income below $1,000, false personal information provided, poor credit history with a bank, etc.

Application

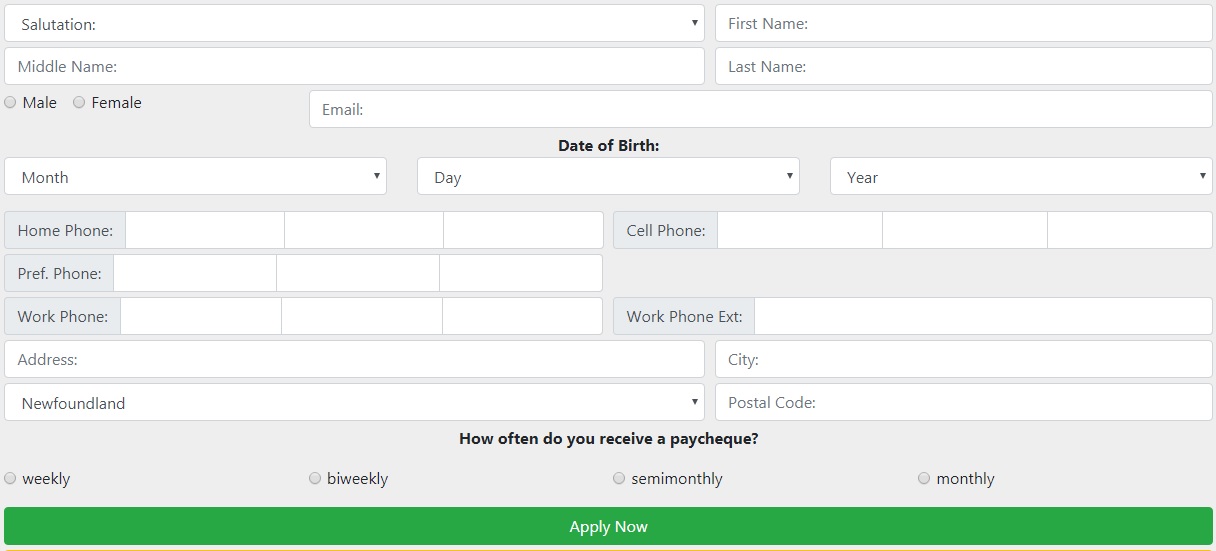

MrPayday.ca has a simple and short online application without can be filled out without leaving your home.

The lender has a faxless application process. Once you submit your request, the lender will send you a link to verify your banking information electronically.

Besides, they do not require any collateral. You only need to fill in your name, phone number, date of birth, home address, e-mail address, social insurance number, employment information, and some more.

Repayment

Payday loans are repaid on the day you get paid (usually within 2 weeks). The lender will disclose the due date in the contract. The original loan + interest will be automatically withdrawn from your banking account. So you do not need to visit the lender’s location but do need to ensure you have enough money on your account.

If you fail with your payment due to any reason, Mr Payday will charge a fee. The exact amount of penalty will be mentioned in the contract and depend on your location. You will be charged interest daily as long as you have a loan. If you feel that you will not be able to repay your payday loan on the due date, you should contact the lender immediately to discuss a loan extension. Besides, non-payment or late payment can affect your credit score.

Collection policies of Mr Payday are not disclosed anywhere on the website. In any way, this company will act within the current law.

Extension

According to the website, the lender can extend payday loans for up to 31 days, or until the borrower’s next payday, whichever comes first.

It’s not mentioned whether you can repay your loan before the due date in order to save on interest, so you should also discuss this issue with your lender.

MrPayday.ca Bad Credit

Even if you have bad credit or no credit, you can still be approved for a loan with Mr Payday. The lender does not make credit checks using major credit bureaus. You only need to have a steady income and comply with some other eligibility requirements (see unit 1.2.) to qualify for a loan. That is why payday loans are sometimes called “bad credit loans”. Bear in mind that this company does not provide loans to clients who are currently in bankruptcy, but any bankruptcies in the past should not be a problem.

Technical Characteristics of the Website

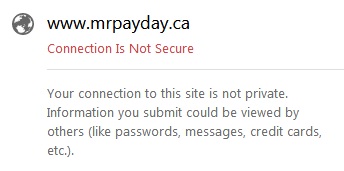

Encryption

Regretfully, MrPayday.ca is a website which is unable to protect customers’ personal details. The browser indicated that this website is not using any encryption technology. This means that users are not protected from identity theft.

The absence of an SSL certificate is a serious disadvantage. I would not recommend user to use websites that are not using encryption technologies.

Mobile Version

Fortunately, MrPayday.ca has a mobile version, which seems convenient. This is confirmed by Google:

This approach is convenient because you do not depend on the desktop version at all. You can completely focus on the convenience of mobile users, using only the most basic functions. The model of the mobile version will be very different from the desktop. All the buttons and links are of a large size so that they can be easily clicked with a finger.

There is also another advantage of a mobile version: fast download speed. Mobile images of medium quality are loaded much faster on mobile devices. Besides, users can always go to the full version of the site, if they decide that mobile functions are not enough.

Antivirus

Unfortunately, MrPayday.ca is not screened for viruses, Trojans and malware, which means you and your computer can easily “catch“ something dangerous. All customers want to be fully protected when applying for a payday loan, so I recommend the website’s owner to pay attention to this drawback.

Convenience of Using the Website

This website seems convenient. The application process is purely online and you can fill out a request form from your home or office.

If you a first-time user, you need to click on the “Apply” button and fill out the basic personal and financial details. If you are a returning user, click the “Reloan” button and all the information will already be filled in the request form. You only need to edit your personal information if it has changed. So if you apply for a payday loan for the second time, it makes the whole process easier.

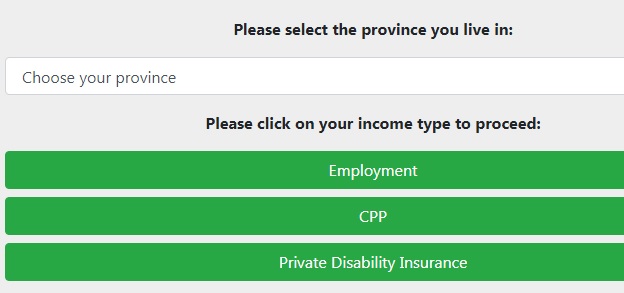

In the beginning, you should choose your province and income type:

Then, you will find yourself on the page of a detailed application form. Just fill in the empty fields. This will take only a few minutes:

The lender will make a decision about your loan in about 30 minutes during Mr Payday working hours. If the decision is positive, you can get the funds within 30 minutes (if you choose e-mail transfer).

In general, I like this website because it’s simple and informative: I found the basic information about loans I wanted to know, however, some details need to be specified by the lender (eg. late payment fees, early loan repayment).

I also appreciate that you do not need to waste time on registration.

Is MrPayday.ca Legit?

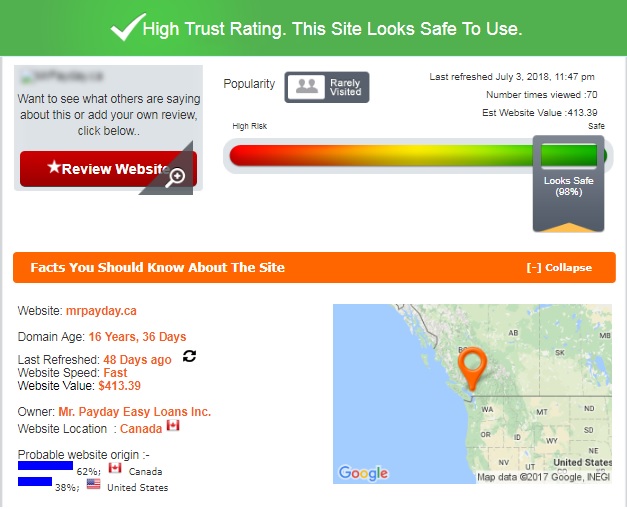

Scam Adviser is satisfied with MrPayday legitimacy and background. The lender has a very high trust rating – 98% out of100%, which means this site is safe to use:

The experience of the website is impressive – the domain has been operating for over 16 years. The site is located in Canada, however, it may also relate to the United States. Besides, the site is rarely visited. These aspects were the reasons why the lender did not deserve the maximum trust-rating from ScamAdviser.

MrPayday.ca Reviews

On-site Reviews

User feedback is very useful for lending websites. According to statistics, more than 60% of users decide whether to use the website based on customer feedback. Other advantages of having customer reviews on the site are a high level of customer trust, high sales, and interested customers. Obviously, people trust the user reviews 12 times more than the description posted by the website’s administration. Another study showed that 30% of visitors think that reviews are fake if they cannot find negative reviews. Placing customer feedback (including both positive and negative) on the lender’s website can convince people to trust your company more. Unfortunately, I found no Mr Payday reviews on the native website of this company. Instead, the lender encourages users to read positive customer reviews on TrustPilot.com, which is an independent third-party website (see unit 4.2).

Reviews on Third-Party Websites

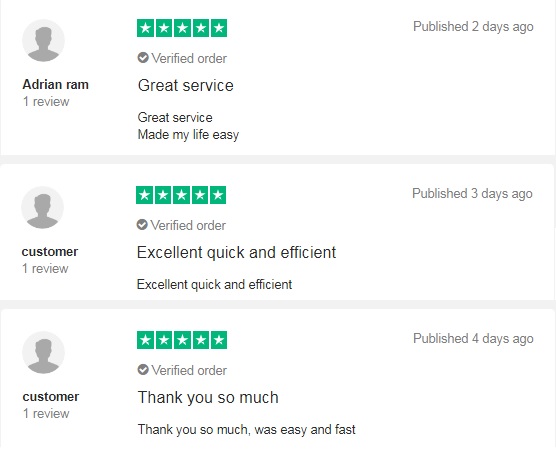

Since this payday loans lender has been active for over 16 years, I hoped to find many user reviews on third-party sources. Indeed, TrustPiloi.com contain 400+ Mr Payday reviews that are mostly positive. There are a lot of fresh testimonials and new commends appear every day. Adrian reported that this lender provides a great service. Another user wrote they are excellent, quickly and efficient. The third client thanked the company for its work. The thing is that Trust Pilot contains too many short reviews consisting of 2-4 words, which seems suspicious. The amount of detailed comments is, however, sufficient.

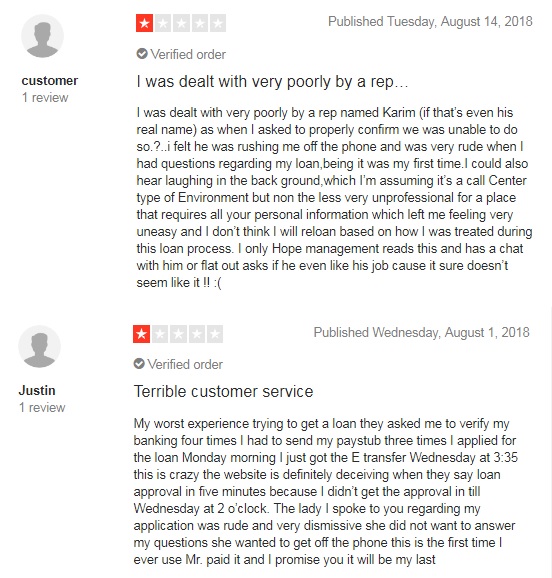

The number of Mr Payday complaints was very limited. The most recent complaint was published on August 14, 2018. The client reported that the company’s representative was very rude and unprofessional. He added that he would never use the services of this lender again based on how he had been treated.

Another user is also dissatisfied with the customer service. He claimed it was his worst experience with a payday loan provider because Mr Payday team had difficulties with confirming his banking information. He had to send his paystub 4 times. Besides, he reported that this lender deceived its clients when they say the transfer time was only 30 minutes. He applied on Monday but received his funds only on Wednesday. He also added that the manager was rude and very dismissive.

That’s a pity that these 2 users had problems with this website but I’m happy that they at least received their loans. Since the overall website’s rating is 8.8 stars out of 10, I conclude most consumers are satisfied with the services provided.

Customer Support

Contact Information

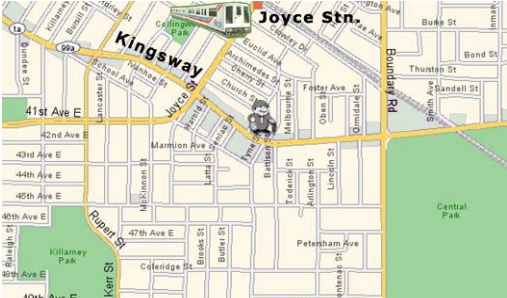

Mr Payday provided a comprehensive contact information. Their corporate office is located at 3421 Kingsway, Vancouver, British Columbia V5R 5L3. Their toll-free phone number is 1-877-432-2274, toll-free fax is 1-866-435-2271. Below you can see Mr Payday operating hours:

The only thing I was not able to find on their site is their email address. I think they should have one.

MrPayday.ca Locations

Mr Payday provides loans in British Columbia, Alberta, and Ontario. Their head office can be seen on the map below:

Getting a Consultation

You can contact Mr Payday customer support during operating hours by phone 1-877-432-2274 or toll-free fax 1-866-435-2271. Obviously, you will not be able to send an e-mail or use a live chat option.

I wanted to find out the information about early loan repayment, so I tried to reach them using the listed phone number. Unfortunately, I had a trouble with contacting the customer care department – nobody answered my call. I conclude that their customer support is not as speedy as you may expect and needs improvement.

Conclusion

Mr Payday is an experienced Canadian lender providing payday loans even to customers with bad credit. The application process is simple and does not take much time. The site is convenient and easy to use. The lender discloses basic loan terms and rates but some issues still need to be clarified. Interest rates are competitive and affordable. I also appreciate that this company allows loan extensions. Scam Adviser confirmed the legitimacy and wide experience of the company. The number of customer reviewsavailable on the web is also impressive, which inspires confidence in its credibility. However, there is one issue that prevents me from recommending this website to other customers – MrPayday.ca is not able to protect your personal information since it does not use any encryption technologies. Besides, if you are interested in other loan types like installment loans or title loans, this website is not the option for you.

Ready to Apply?

Ready to Apply?