What is MoneyTreeInc.com?

Moneytree is an online business providing financial services to people for over 30 years. Their first office was opened in 1983 by brothers Bassford and is still located in Renton, Washington. They added new branches across the US as the business developed. Currently, they are operating in 6 states. Moneytree is proud to be a member of the CFSA and the FISCA and supports laws and the best practices of the lending industry. Their mission is to exceed customers’ expectations by focusing on their needs. They claim to provide a fun and professional working environment for Moneytree team. I noticed that this lender is honored as a Best Company to Work For. Other awards presented on the website include Financial Services Centers of America Awards, San Diego’s Best Places to Work, Best Companies to Work For in Colorado, Idaho and Las Vegas, Seattle Business Magazine’s “100 Best Companies to Work For” and some others.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans, title loans, installment loans, business loans, auto equity loans | $100 | $5,000 | up to 12 months | varies by state and loan type | ID and Social Security Number (or Alien Registration number or ITIN) | Possible |

Types of Money Tree Loans

Moneytree offers online and branch loans. Online options include payday loans and business loans. Branch loan products include payday loans, title loans, installment loans, business loans, and auto equity loans.

The company also provides other services including check cashing, prepaid debit cards, wire transfer, money orders, and bill pay services.

- A payday loan is a short-term loan repaid on your next payday. This product comes with a high interest rate;

- A car title loan is a smaller amount of money provided for a short time. To get such a loan, you will have to give the company the title to your vehicle. You also pay a fee to borrow the funds;

- An installment loan is a type of long-term loan repaid in equal monthly installments that include principal and interest;

- A business loan is a loan designed for business purposes. This debt is also repaid with added interest;

- An auto equity loan resembles a home equity loan, but instead of your home you use the value of your vehicle, then you repay your loan with interest.

Once your loan has been approved, you can pick up the funds immediately at any Moneytree office. If you have a prepaid debit card that you bought at this lender, the funds can be deposited on your card. Or the money can be transferred to your checking account in 1-3 business days.

Terms of Use

Moneytree allows you to borrow the funds if you are at least 18 years of age, have a stable and sufficient income. They also review the information you provide on your application, your credit history with this lender, and your credit score provided by a consumer reporting agency.

Loan amounts range between $100 and $5000. The maximum amount you can borrow will be determined by the lender.

The exact APR for various loan types is not listed anywhere on the site. I only found an example which displays an interest rate for a 14-day payday loan. The average APR for a payday loan is 390% but it may differ, depending on the loan amount you qualify for and your individual repayment plan.

They also mention that the terms and requirements vary by state. In general, to be eligible for a loan with this lender you must provide:

- ID and Social Security Number (or Alien Registration number or ITIN);

- Your address and phone number;

- Verifiable source of income (customers from Nevada need to provide a written verification);

- An active checking account

I conclude that Moneytree terms may seem strict for some customers, especially for those living in Nevada. Besides, I was able to only assess interest rates for payday loans that proved to be affordable. For all other loans details, you will have to contact a lender.

Application

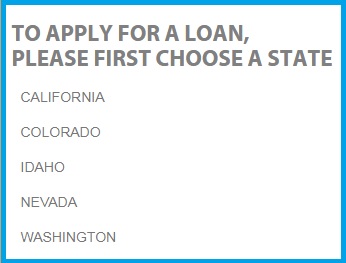

As I have already mentioned, some of the loan products can be obtained online (payday loans and business loans). All the rest product are available at one of the lender’s location.

Moneytree guarantees a fast, simple and secure online application process:

Generally, to be approved for a loan, you must provide the lender with your Social Security Number (or ITIN or Alien Registration number), your address. You must also have a verifiable source of income and a phone number.

Generally, to be approved for a loan, you must provide the lender with your Social Security Number (or ITIN or Alien Registration number), your address. You must also have a verifiable source of income and a phone number.

Moneytree encourages customers to save time: print a loan application and bring it to the lender’s office. The application form can be downloaded from their website.

Application differs a bit for various loan types. Thus, to get payday loans: you must provide your checkbook or account information, ways to contact you, your monthly income, income verification documents (for example, a paystub). To get title or auto equity loans, you must provide your ID and SSN (or Alien Registration Number or ITIN), your address and phone number, income verification documents, and your vehicle title to your car. For installment loans, you will need to provide your ID and SSN (or Alien Registration Number or ITIN), your address and phone number, income verification documents, and verification of an active checking account. If you want to get a business loan, you should bring the following documents with you: proof of your business identity (business license, tax permit, etc.), 3 most recent bank statements, a check from your checking account created for the business.

Loan Repayment

According to the website, Moneytree loans are repaid on the specified due date or in several equal payments (depends on a loan type). Once you’ve been approved, you will be asked to choose a due date to pay off your loan. Payments for some loan types can be made online or at any branch of the lender. Payment options may vary depending on your loan contract.

- Payday loan repayment terms are determined by the frequency of the days you get paid. You will have to repay the borrowed funds with interest upon your next payday;

- Title loan and installment loan due dates are based on your individual schedule with payments due on each day you get paid (usually every month);

- If you applied online for a payday or business loan, you may opt for an electronic withdrawal of funds from your account on the due date. If you applied at an office of the lender, you may opt for an ACH or paper check presented to your bank for payment on the due date, or you can pay in cash at Moneytree office or using your debit card;

- If you were approved for a title or installment loan, you may authorize ACH debit payments or opt for check payments. You may also repay your loan in cash or using your debit card.

You can also get SMS payment reminders from Moneytree if you want to stay informed about your due dates.

If you fail on your loan repayment, the lender will have to collect your debt in a lawful manner. They claim to follow the regulation set in the Fair Debt Collection Practices Act.

If Moneytree does not receive your payment on the specified date, they will contact you and remind that it’s time to make a payment. If you do not take any actions, they may refer your account to an independent collection agency.

Bear in mind that if you miss your payment for a payday loan, you will have to pay a $20 fee. For installment and auto equity loans, there is a 10-day period after the due date during which you are allowed to repay your debt in full at no additional cost. If the debt remains unpaid at the end of these 10 days, you will be charged a $15 fee or 5% of the amount of the outstanding payment. If you miss a payment for a title loan, the lender will repossess the vehicle used as collateral for the loan.

Loan Extension

According to the website, you can be eligible for loan extension in some cases. Currently, they do not allow to extend a loan online. If you need more time on repaying your lown, you should call or visit any Moneytree office to discuss available options for extending your loan.

Bear in mind that any loan extensions are not available in the state of Washington, and California does not allow payday loan renewals.

If you wish to renew your payday loan, you will have to pay an additional fee. You may renew your payday loan a maximum of 3 times.

As for installment loan, they may be extended once you have paid off at least $1,300 or 50% of money lent. Installment loans may be also renewed up to 3 times.

A good thing is that this lender does not charge a pre-payment penalty if you decide to repay your loan before the specified due date. For this, you need to visit any office of the company or log into your personal account to make the payment online.

MoneyTreeInc.com Bad Credit

Moneytree informs its clients that they make inquiries concerning new customers’ credit history with consumer reporting agencies, and they may also report clients’ payment performance (late or missed payments, other defaults) to these credit reporting agencies, which may negatively affect your credit score.

However, it does not mean that you are not eligible for a loan if you have a bad credit score. If can still hope that you will be approved for a loan with this lender.

Technical Characteristics of MoneyTreeInc.com

Encryption

MoneyTreeInc.com uses the advanced 256-bit SSL encryption with an extended verification to protect users’ sensitive data when applying online. This means that your information will not be accessible to others. The certificate is issued by Symantec Corporation and is active till 2019:

Such an encryption is considered the highest security measure and not every lender can boast of having an extended verification. Well done!

Mobile Version

MoneyTreeInc.com has a mobile version which works correctly and looks good. Its availability allows customers to view the website and apply for a loan online trouble-free. Google Mobile-Friendly Test confirmed that this site is mobile friendly and is loading successfully.

I did not notice any bags or scrolling: the elements and images are enlarged, the content is readable, the secondary information is removed from the main page, the links are not so close together, so you can easily use your smartphone or tablet if you decide to take a loan online.

Antivirus

Moneytree claims to take care to preserve their customers’ privacy. I noticed the emblems of Norton and McAfee on the website which means that they use McAfee and McAfee security software that regularly scan the site for vulnerabilities and report the results to the owner.

It’s nice to know that you are using a secure website which will not infect your PC with dangerous online threats.

The Convenience of Using MoneyTreeInc.com

The lender offers two ways to get a loan:

- Visit the nearest Moneytree branch (payday loans, title loans, installment loans, business loans, and auto equity loans);

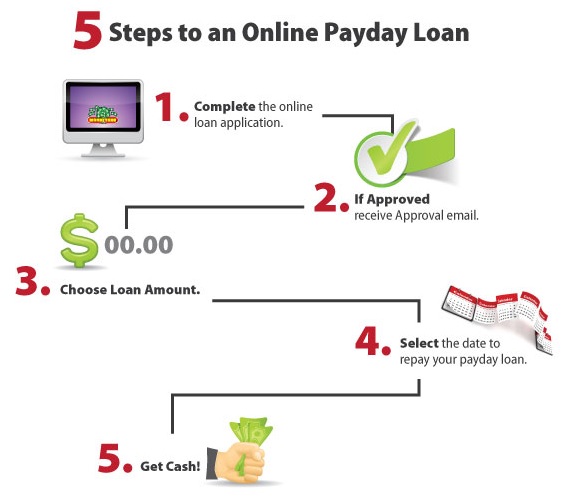

- Apply online (payday loans and business loans). Once you have applied, the lender will send an email notification within 1 hour about your loan status. If approved, you need to choose the desired amount, a due date and how you wish to receive the money.

They provided a picture which illustrates the whole application process:

In general, the website is informative, intuitive and convenient to use, however, it’s a pity that you cannot see approximate APR for business, title, and installment loans anywhere on the website until you complete an online application.

Is MoneyTreeInc.com Legit?

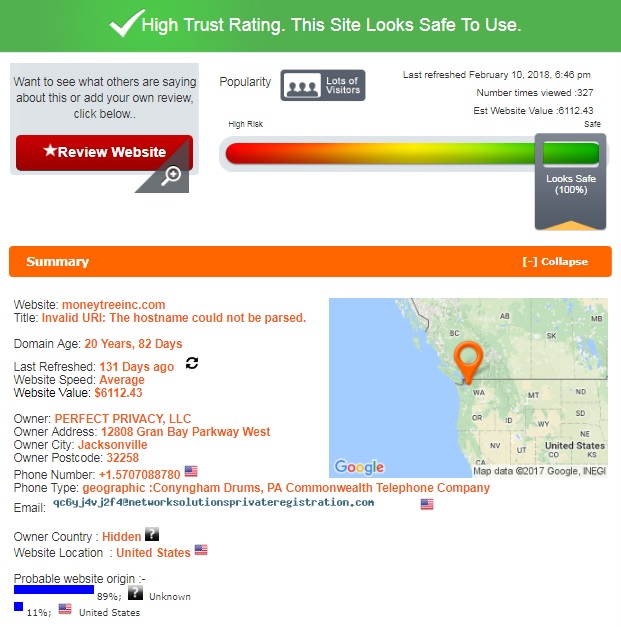

ScamAdviser reported that MoneyTree is a trusted and legit lender with a trust-rating of 100%:

ScamAdviser revealed that the domain age is 20 years. Besides, the site has lots of visitors and is operated from the USA. Regretfully, the owner of the website is listed as Hidden. However, this fact did not confuse ScamAdviser since he gave the maximum possible trust-rating to this lender.

PersonalLoans.com Reviews

On-site Reviews

The official website of MoneyTree contains about 15 reviews from previous customers that say only good words about this lender. One user said that this company has exceeded his expectations and become the only place he would use to get a loan. He added that MoneyTreeis better than other services. Another customer reported that he had always had a good experience with this website, and the customer support group was always helpful and caring. One more former client mentioned that he appreciated this company because they offered a wide range of financial services, had convenient locations and a friendly team.

Unfortunately, these comments are not dated and since they are placed on the lender’s own website, they could be filtered or even composed by the lender itself. I cannot fully rely on these testimonials and I’m going to look for some external MoneyTree reviews.

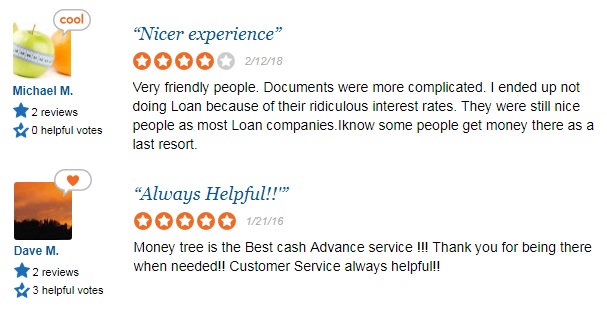

Reviews on Third-Party Websites

I found about 10 positive reviews about this lender on independent online sources. People rated this company 5 stars out of 5. Read some of the comments posted on the net:

Other customers said that their questions were quickly answered, They also appreciated speedy money transfer. Others mentioned that this lender offered Borrowers also more loan types than other lenders. I also found reviews about intelligent staff, great service, excellent and speedy customer service, a pleasure doing business, friendly and informing team, extremely nice and fast service, etc.

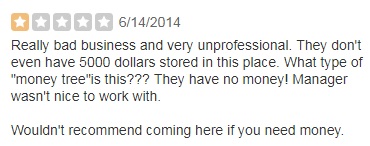

However, there was an equal number of people who were disappointed with Moneytree, Inc. Some of them said this lender was unprofessional and has no money. See a full review below:

Other complaints were about the reinstatement of automatic payments, overcharge and denying loans.

I also managed to find the report that the CFPB took action against Moneytree for misleading clients with false advertisements and collections letters. Besides, it turned out that this lender was making unauthorized electronic transfers from customers’ bank accounts. Eventually, the CFPB has ordered the lender to cease its illegal activity, provide refunds to customers and pay a civil penalty.

Customer reviews about Moneytree are controversial. Many people called them “unprofessional” or “bad” while others reported a successful experience. This makes it difficult to assess the reputation and real performance of this lender.

Customer Support

Contact Information

The website contains a very detailed information about Moneytree, Inc. Their headquarter address is 6720 Fort Dent Way, Suite 230, Tukwila, WA 98188-2589 and they operate throughout Colorado, Idaho, Nevada, Southern California, Washington and British Columbia (Canada). Money Tree has extended operating hours including evenings, weekends and holidays. The details can be found on their “Branch near you” page.

It’s nice to see Moneytree phone number but regretfully I was not able to find their email address. In all other aspects, the company is as transparent as possible.

MoneyTreeInc.com Locations

Currently, Moneytree has offices located in California (San Diego and near Los Angeles), Washington, Colorado, Idaho, Nevada, and British Columbia, Canada. To find the nearest location, you should visit their “Locations» page and fill in your city, state or zip code.

I also noticed that there are licenses posted in each their location. They also claim that they can provide customers with each state’s licensing contact information, if necessary.

Bear in mind that all these states have different terms and loan types available. For example, customers from Nevada must provide a written verification of income source, while clients from the state of Washington are not allowed to extend a loan.

Getting a Consultation

If you have questions related to Moneytree loans, you can contact the customer support team by calling at +1-877-613-6669 and filling out a contact form. According to the website, the lender strives to provide top quality assistance and satisfy customers.

There are only 2 ways to reach a representative of the company but I would like to see a Live Chat option on the website. I decided to send my question via a contact form. I was interested in installment loans interest rates for Nevada. I waited for 4 hours but did not get a reply. Obviously, you’d better try to reach them over the phone. Otherwise, you will have to wait an eternity for the response.

Conclusion

MoneyTreeInc.com is an experienced and popular lender which provides loans and other financial services, both online and in branches. It’s nice that this service has been operating for over 30 years and seems transparent. They offer more loan types than any other lenders and their loan amounts range from $100 to $5000. Besides, they provide an opportunity to get the funds in cash immediately. The lender has numerous awards and a perfect trust-rating from ScamAdviser. On the other hand, the company did not provide APR details for each state and loan type – to learn them, you will need to complete an application online or visit a branch. MoneyTree received mixed customer reviews and I was greatly disturbed by the report stating that the CFPB took action against this lender because the latter was engaged in an illegal activity. There are some issues that undermine my trust in this company and make it difficult to recommend its services to other customers. I advise you to search for other lenders who have no history of previous crimes.

Ready to Apply?

Ready to Apply?