What is King of Kash?

King of Kash is a lender providing US consumers with low-risk personal loans for almost 40 years. They claim to be one of the best lenders dedicated to helping people cope with their financial needs without a traditional credit check. The company is based in Kansas City, Missouri and was founded in 1978. The lender operates in several states and claims to fully comply with the laws and regulations of each state. The company advertises more affordable loans than many banks or other lending companies. According to the website, the company has earned a reputation as an honest, legit and convenient lending service. With an approval rate of 77%, including those having poor credit, King of Kash strives to be a top-quality and fair financial organization which always focuses on the client.

| Loan types | Min. amount | Max. amount | Period | APR | Items required | Bad credit |

| Personal loans, signature loans, lines of credit, title loans, installment loans | $100 | $20,000 | 6 months to 5 years | Depends on a state, loan type and term | Government issued ID, Social Security card, proof of income (current pay stubs) | Yes |

Types of King of Kash Loans

Kingofkash.com provides personal, signature, installment loans and lines of credit.

Signature loans are unsecured loans which do not require any collateral or credit check. A user only is required to provide his signature as a promise to pay back the loan. Signature loans can be used for anniversaries, vacations, education, car or home repairs, medical bills or other emergencies:

Signature loans are unsecured loans which do not require any collateral or credit check. A user only is required to provide his signature as a promise to pay back the loan. Signature loans can be used for anniversaries, vacations, education, car or home repairs, medical bills or other emergencies:

Signature loans are very popular since they come with a bigger amount at a lower interest rate, which makes them more manageable and budget-friendly. Besides, they do not require a collateral.

You can apply for a personal loan ranging from $100 to $3,000 for a 12-month term, with equal monthly payments. Bear in mind that such loans have higher interest rates than traditional loans.

Personal loan amounts vary from $500 to $20,000 while terms vary from 6 months to 5 years or even more.

A line of credit is a loan that is similar to a credit card. King of Kash may approve you for a definite amount and you can use the funds until they don’t overdraw the banking account. People prefer to use lines of credit to pay for a wedding, anniversary, vacation, education, home repair, medical bills and so on. Such loans are less expensive than traditional loans, credit cards, or cash advances.

An installment loan is a loan that is to be repaid in smaller monthly installments. They are considered flexible and manageable. Your payments will be the same all throughout the credit period. Such loans are perfect for large expenses (major home repairs, debt consolidation). The user can use the loan at his own discretion. These loans come with longer terms (from 6 months to a few years) and bigger loan amounts (from $1000).

A title loan is a secured loan where a lender puts a lien on your car in exchange for a requested loan amount. Once you pay off the loan, you receive your car back. However, if you fail with your payment, the lender can repossess your car and sell it to make up for the money lost. Title loans are usually short-term and come with high interest rates. King of Kash considers the value of the car (collateral) to determine whether to approve or decline the loan request.

According to the website, once a user is approved for a loan, the lender is ready to issue the funds via several methods:

- Physical check – you can pick it up at any convenient King of Kash location;

- Wire transfer – the funds are sent to your bank the same day or the next day;

- ACH transfer – the funds are deposited to your banking account the next day.

Terms of Use

Using this website, you can request for loan amounts that typically range from $100 to $3,000 (personal loan amounts may reach $20,000). However, if you are the first-time user, the first loan cannot exceed $800. All of your future loans (when paid successfully) may increase up to $3000 and more.

To qualify for a King of Kash loan, customers must comply with the following requirements:

To qualify for a King of Kash loan, customers must comply with the following requirements:

- have a state-issued ID;

- be at least 18 years of age;

- have a Social Security number;

- be a US citizen;

- provide a proof of income (pay stub);

- have an active checking or savings account;

- have a personal debit or credit card.

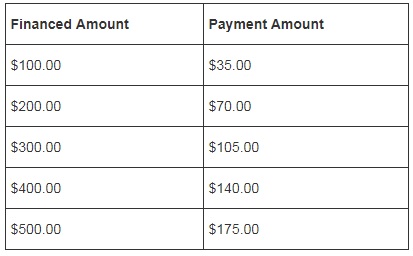

King of Kash interest rates, terms and payment dates depend on several factors such as the location, personal and financial details provided. For example, if you are new customer living in Delaware and apply for an installment loan of $100 with payments every 2 weeks, you will need to pay $32 as interest + fees. If you are an existing client, the amount will be only $22. The APR and rates vary in each state. You can find the details of loan rates on the website. Look at the loan costs for first-time customers living in Delaware based on semi-monthly payment schedule:

A distinctive feature of a line of credit is that you’re only charged interest on the funds you use. For example, if you’re approved for a $3,000 loan, but you only use $400, you will only have to pay interest on $400 and not on $3,000.

Besides, King of Kash offers a 24 hour grace period on all types of loans. If you repay the full debt within 24 hours then you will not be charged any interest.

The lender also mentions that regular borrowers can get discounts or benefits: a lower fee, a lower interest rate, or a higher loan amount.

Application

Depending on your location, you can apply for a loan online at Kingofkash.com, or visit the store.

The online application process seems fast and easy. During application, you must provide basic personal details, such as name, address, email, phone number, employment type, income, account number, Social Security number state-issued I.D. Number.

The approval process is based on the customer’s ability to pay off the debt.

Application for personal loans, signature loans, lines of credit, and installment loans is arranged in a similar way: you fill out a simple online application and wait for the funds to be transferred, or you may pick them up in the lender’s office.

But if you need a title loan, the requirements will be the following:

- Bring your car’s lien-free title to the lender’s location.

- Fill out the loan application.

- The lender will assess the value of the car.

- If approved, you’ll get the funds and the company will keep your car.

- Once the debt is cleared, you will get your car back.

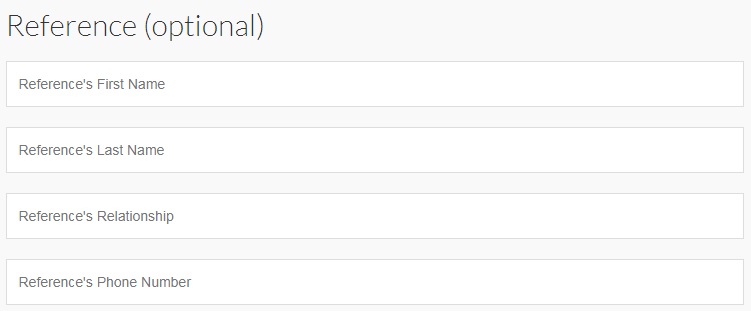

You only require a collateral with title loans (your car serves as a collateral and you should be its legal owner). For all other loan types, you may provide a reference in the application but this is not obligatory:

According to King of Kash, all types of loans can be approved without faxing any information.

Loan Repayment

The company offers to make payments bi-weekly or monthly. You can make payments in the following ways:

- using a debit or credit card (by phone 800-892-3006 or in person).

- by money order at any of the lender’s offices

- via ACH

- automatical withdrawal from a checking account.

If you are late with your payment, you will be charged a fine that would prevent you from getting benefits and discounts in the future. If you feel that you will be late with your payment, contact Kings of Kash customer support to clarify issues related to payment delay. Paying your loan on time helps you build a good credit history which will allow you to get a larger loan amount for future loans.

King of Kash does not charge any penalties for repaying your loan early.

Loan Extension

If you have difficulty repaying your loan, you may qualify for an extension. For this, you need to contact the lender as soon as possible and discuss a new payment schedule. You will be allowed to repay the debt into smaller amounts until it’s repaid in full. Each payment will include the interest and the principal amount.

They also mention that they do not allow multiple loans at the same time, so a borrower must pay off the current loan before he can request for another one.

KingOfKash.com Bad Credit

The lender doesn’t perform traditional credit checks to verify your credit status. Instead, they make a decision based on the personal information collected from a client. They also mention that every person deserves a fair shake and shouldn’t be judged based on his previous mistakes.

So you can apply for a loan even if you have a bad score or no credit history at all. Bankruptcy is not an obstacle to King of Kash loans as well.

Technical Characteristics of the Website

Encryption

King of Kash website is secured with a 256-bit SSL certificate which helps them protect the transmission of user personal information. This security level provides the confidentiality of data when it is transmitted. The secure connection is verified by GoDaddy.com, Inc.:

However, the site does not have an Extended Validation certificate. Such certificates can be found of the most trusted websites.

Mobile Version

A mobile website version is not only a means of improving the site’s functionality but a necessity. A mobile version is always a pleasant and functional addition.

Kingofkash.com owner provided visitors with the ability to view information with maximum comfort for their fingers because they no longer need to move endlessly to the right and left to read a short article, and the eyes that do not get tired of visual perception of text and pictures that are not adapted for a smartphone.

In addition, the download time of a mobile version does not take much time. More and more people apply for loans online from a mobile phone, which is understandable – it’s much more convenient to do it lying on a sofa.

Antivirus

Regretfully, there is no antivirus installed on this website. Online lenders like Kingofkash must fully protect their clients from all kinds of Internet threats. Using this service, you risk losing your personal and banking information. Modern viruses can easily hack your account and steal the sensitive data you provided. I would recommend the site’s owner to upgrade the safety of Kingofkash.com since people prefer to apply for loans using secure websites.

The Convenience of Use

The online application process seems easy and does not require registration. You only need to follow 3 simple: complete an application online, get an approves, receive the funds.

Using this website, you don’t have to spend much time filling out a request form. All you need is to provide your state-issued ID card, proof of employment, Social Security number, phone number, and an account with a debit or credit card.

The company makes a loan decision in a matter of minutes so you can get the necessary funds as soon as possible.

Once you’re approved for a loan, you can pick up the cash at the nearest lender’s office or have the funds transferred into your banking account.

It’s nice that existing clients can get the benefits and discounts that reward their loyalty.

The company provided an informative FAQ section and adequate information about all types of loans. I appreciate that they disclose the exact loan terms and rates for each state in advance

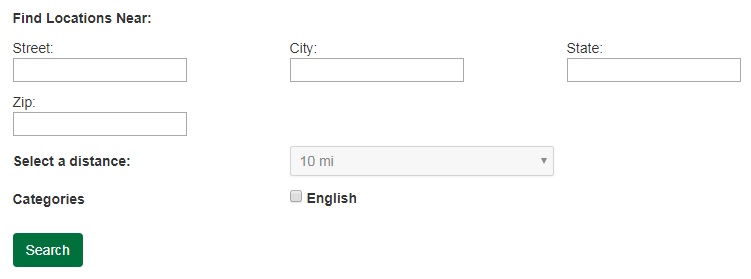

Using the “Service Area” page, you can quickly find the nearest branch of the lender in your city:

If you have already used the services of v, you can apply for a new loan quickly without filling out the new request form, no matter whether your request was approved or rejected.

Besides, they offer a great deal – you can refer your friend to this website, and if he/she is approved, you and your friend will earn each $20.

I conclude that this website is informative and convenient to use.

Is King of Kash Legit?

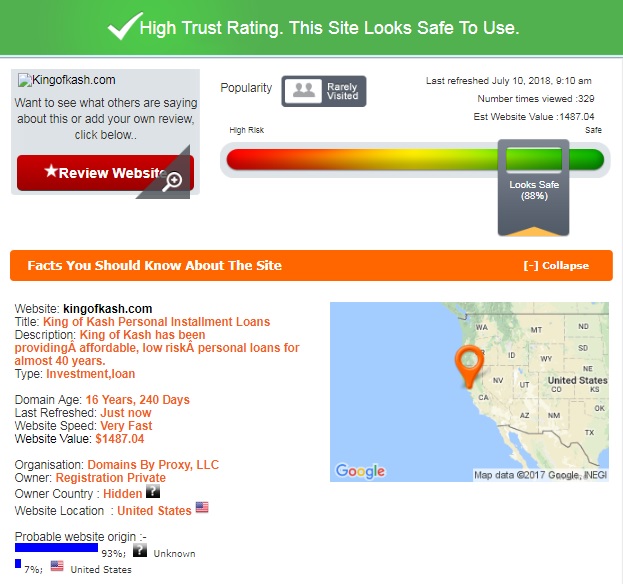

To ensure that Kingofkash.com is legit, I checked its background and reputation on ScamAdviser.com. It turned out that the website has a high trust rating of 88% out of 100%, which means that this lender looks safe to use.

According to ScamAdviser, the domain was created over 16 years ago, which is a relevant aspect. It’s nice that the domain was no banned over such a long period. The website is located in the United States but the owner country is hidden. For this reason, ScamAdviser gave only 88% of trust to this online lender. Hiding the website’s owner means that the company has something to hide, but nothing indicates that King of Kash is a scam.

KingOfKash.com Reviews

On-site Reviews

I always check what previous clients say about lending companies they used. Unfortunately, there are no KingofKash reviews of the lender’s official website. Moreover, you will not have an opportunity to leave a common even if you wish so. For this reason, I had to search for some external customer reviews for this lender.

Reviews on Third-Party Websites

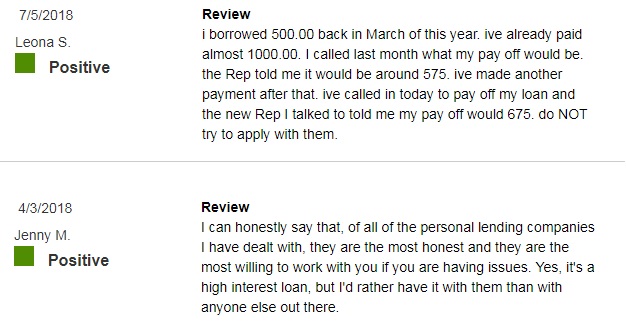

I was able to find about 15 reviews left by previous borrowers. The most recent reviews were published in Jule 5, 2018. Although it was “Positive, it’s a complaint. The user reported that this company had already taken too much money from him and still required for more. He recommends all other people to stay away from this lender.

Another “Positive” review was from a happy customer. He claims that King of Kash is the most honest lender he had ever dealt with although their interest rates were high. Look at the most recent comments:

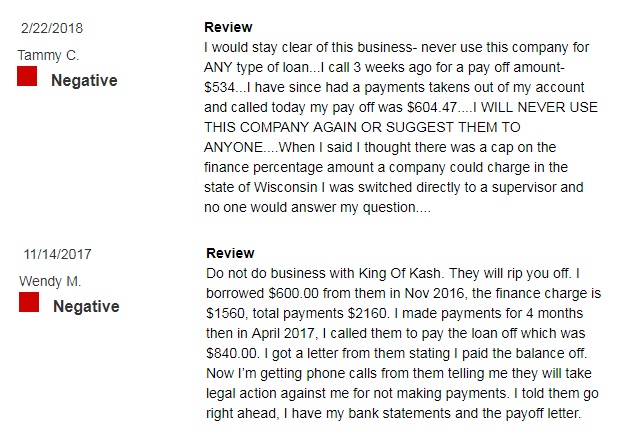

All other testimonials were from unsatisfied customers. One user repaid his loan in full but the lender did not cancel the debt and continued to take money from his account. He tried to call them but nobody answered.

Another customer paid off his loan but still received phone calls from the lender telling him King of Kash would take legal action against him for non-payment:

Tammy B. said he applied for a loan and was approved, however, he never received his money. After 7 days he asked the company to cancel the loan because he needed funds urgently and could not wait any longer. A month later the lender took a payment for a loan he never received. He contacted them and they promised to call him back but this never happened. Finally, they refunded him the money they took out from his account but didn’t even apologize for that. He still owed them late charges. He concluded that King of Kash was not a nice company.

Rosemary R. reported that they charged “predatory” interest rates. She borrowed $1,300 for a year and had to repay nearly $5,000, which is three times more what she borrowed.

One more former borrower had multiple loans through this website and also had repayment issues – he borrowed $2,000 and have repaid over $3,000 and they still wanted $4,000, so he had to close his banking account.

Since all King of Kash complaints are published on independent websites and are very detailed, I think I can rely on them. Regretfully, they undermined my trust in this company and proved that not everything can be as you expect.

Customer Support

Contact Information

King of Kash address and phone number are listed on the Contact Us page. Their phone number operates in certain hours. Email address is not specified on the website but you can still email the customer care department from their website. Or you can visit the lender’s nearest location if it’s more convenient for you. The address and phone number of their branches are available on the site.

The website looks as transparent as possible.

King of Kash Locations

The lender provides loans to people living in Delaware, Kansas, Mississippi, Missouri, New Mexico, Texas, Utah, and Wisconsin.

They also mention that they will be available soon in Alabama, Illinois, and Tennessee.

Getting a Consultation

You can contact King of Kash customer support by calling 1-800-892-3006 or visiting one of their locations during regular business hours. You can find a To find the nearest office using a locations guide presented on the website. You can also send them an email by filling out a contact form available on the Contact Us page.

Since there was no live chat available, I had to fill out a contact form. I asked whether the lender allowed loan extensions in Delaware. I received no answer even 10 hours after my email had been sent. I recommend this company to provide a faster assistance to its clients. You may also try to call them to get a faster response.

Conclusion

Kingofkash.com seems a legit, experienced and convenient lender which can help you get the necessary money in the shortest possible time on your banking account or in cash. Here you will not have to deal with a complicated loan application and once approved, you will be able to get am immediate funding. I appreciate that they offer fixed and flexible monthly payments, which allows you to plan your budget carefully. Unlike many other lenders, King of Kash provides users with higher loan amounts—up to $3000 (or even more) and has lower interest rates. The company has a high trust rating, offers discounts and benefits to regular clients and works with bad credit customers. Besides, they have no hidden fees – loan rates and terms for each state are listed on the website and you can review them before starting an application process. The drawback is that the lender has a limited availability – their loans are only available in 8 states but they announced that they would be soon available in 3 more states. There are 2 more things that worry me – their customer support is poorly organized and I found too many complaints on the web reporting that this lender takes extra money from its clients, so if you decide to apply for a loan through this website, be cautious and read the loan documents attentively.

Ready to Apply?

Ready to Apply?