What is iSpeedy Loans?

iSpeedy Loans is an Illinois-based licensed lender which provides customers with installment loans, both online and in-store.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Poor credit |

| Instalment loans (online and in-store) | $100 | $2500 | 12 months | About 99% | Driver’s Licence, SSN | Yes |

Types of iSpeedy Online Loans

iSpeedy Loans offers installment loans only (online and in-store). This is a very popular type of loans which are especially suitable for those who need a large sum of money. The lender predetermines the number of payments with their size depending on the loan period and interest rate. Installment loans are considered not expensive loans, unlike payday loans.

As mentioned on the website, customers can get the needed money in the shortest time – the lender generally approves a loan application in a few minutes and then refers the loan documents for e-signing. If a customer signs his documents by 6:00 pm, the money is usually transferred to his banking account the next business day.

Terms of Use

The lender provides customers with 12-month loans ranging from $100 to $2,500. iSpeedyLoans determines the amount of loan basing on the state laws.

An APR for iSpeedy Online Loans is about 99%. If borrowers do not fail on loan repayment, there are no additional fees.

In order to get a loan from iSpeedyLoans, customers should meet the following criteria:

- Have a regular weekly income over $300;

- Be at least 18 years of age;

- Have a valid checking account which has been active for at least 3 months;

- Have a valid email address;

- Be a US citizen and reside in Illinois.

Unfortunately, this lender does not approve loans to active or other military personnel, as well as their dependents.

Application Process on iSpeedyLoans.com

Customers can get iSpeedy Online Loans in the office of the lender by filling out an online application on iSpeedyLoans.com. Applicators will have to provide the lender with the basic personal information such as name, city, SSN, Driver’s Licence number, kind of income, employer’s name and contact information, loan amount money needed, etc. This kind of information will help the company understand whether the customer is able to repay an installment loan.

When applying for a loan with iSpeedyLoans.com, customers follow a few simple steps:

- Fill out an online application;

- Wait for an approval via email;

- Once approved, log in to a personal account and e-sign the loan documents;

- Get the money deposited into a bank account the next business day!

The lender mentions that in some cases he may require some additional supporting information.

Customers can also print and review their loan documents any time they want, but they do not need to fax any documents.

Loan Repayment

iSpeedy installment loans, customers get an opportunity to have payments withdrawn from their checking account automatically each month. There are also alternative payment options: personal check, money order, cashier’s check.

According to the website, borrowers can repay their loans before the specified date without penalty.

Thus customers can save on the interest. They should contact iSpeedyLoans customer service department at least several days before the due date if they want to repay the loan early.

Loan Extension

Nothing is said about the opportunity of extending an iSpeedy loan. However, it’s stated that a client can NOT have more than one Loan at a time. As soon as a customer successfully repays his loan, he may apply for another loan with iSpeedyLoans.com.

iSpeedyLoans.com Bad Credit

According to the information placed on the website, customers with poor credit score can still receive a loan from this lender. Unlike many other lenders, they do not check credit history, however, they assess the customer’s paying capacity.

Technical Characteristics of the Website

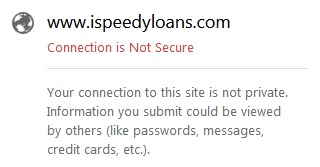

Checking Encryption

iSpeedyLoans guarantees that users’ personal information is safe and that they use a secure SSL server and the highest standard of encryption. However, we found out that iSpeedyLoans.com website does not use any SSL software at all. We advise you to treat this online service with caution because your private information (passwords, credit card details, messages, etc.) can easily get to third-party organizations.

So, when using the services of this online lender, bear in mind that iSpeedyLoans.com connection is NOT secure!

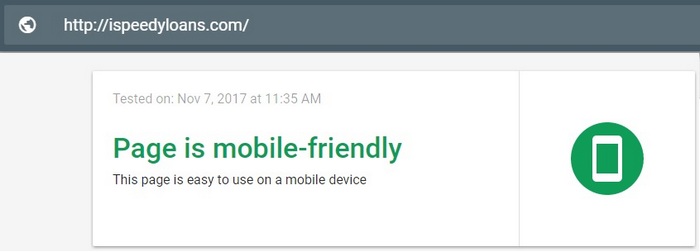

iSpeedyLoans.com Mobile Version

The mobile version is a vital part of any online lending service. Google Search Console informed us that iSpeedyLoans.com website is mobile-friendly:

In general, the website’s mobile version has the same functionality and does not differ much from the desktop version. However, we consider that both desktop and mobile versions have design problems and are not convenient to use. Due to this, clients may have difficulties applying for an iSpeedy loan.

Checking Antivirus

Regretfully, iSpeedyLoans.com does not use any antivirus, which means this website is not safe and not scanned for various viruses and other vulnerabilities, so you can easily get “unpleasant infections” on your computer. The website seems vulnerable and cannot prevent attackers from hacking your personal information you shared on the website. So, this online lending service can not guarantee the safety and success of online transactions.

The Convenience of Using iSpeedyLoans.com

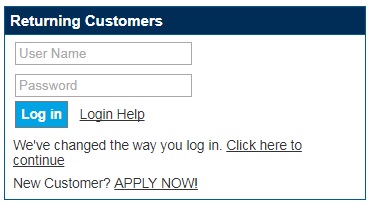

First-time users have to create a username and password for iSpeedyLoans.com.

These items will be required when completing the loan application online. The username will be the email address of the customer he provided. Subsequently, the user may use this name for viewing his loan documents and e-signing the loan agreement. Besides, the user will be able to get a quick access to his personal account if he decides to take another iSpeedy online loan or check his loan status:

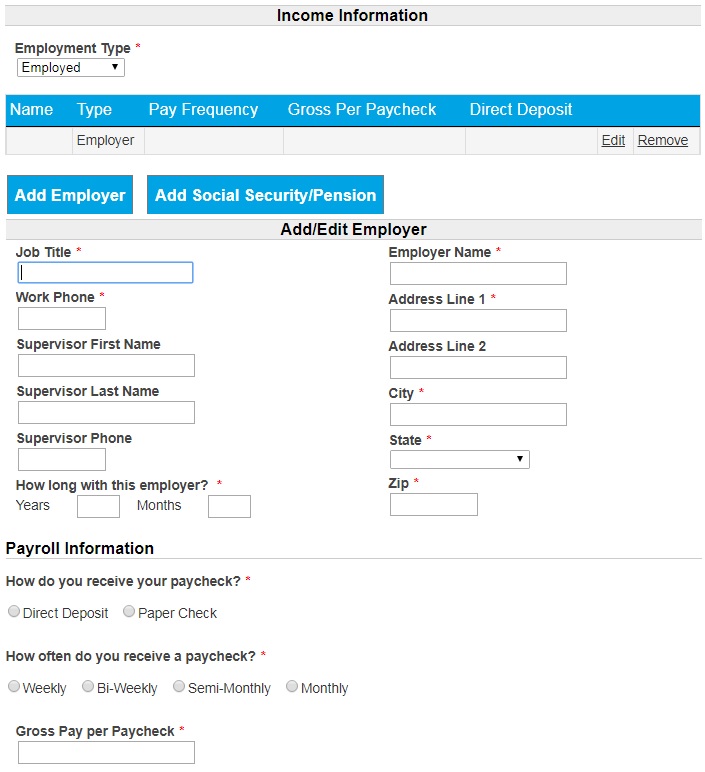

The loan application process can be started by clicking an Apply Now button on the front page. All applicants are required to fill in some personal information: loan amount needed, address, name, phone, SSN, driver’s license number and so on. The next step is devoted to income information: here the applicant will be required to provide the detailed information about his employer (not only the name of the company, but also the name of the supervisor):

The website lists a special offer which might interest some people: customers can receive $50 if he refers a friend to iSpeedyLoans. The more people he refers, the more dollar he will receive.

For that, a customer needs to:

- copy the link in his customer portal and share it with his friends;

- the friends apply for a loan with iSpeedyLoans.com using his portal link or by mentioning his name or Referral ID number;

- when approved, a customer receives $50 and his friends get up to $25 credit towards their further loans.

In general, the website is rather informative: however, there was some misunderstanding with loans periods. One page of the website listed 7 months, another – 12 months. There were some other confusing moments while applying for a loan (for example, some links would direct us to the wrong pages). We may conclude that iSpeedyLoans.com requires further development. So far, the website can be considered convenient.

Is iSpeedyLoans.com Legit?

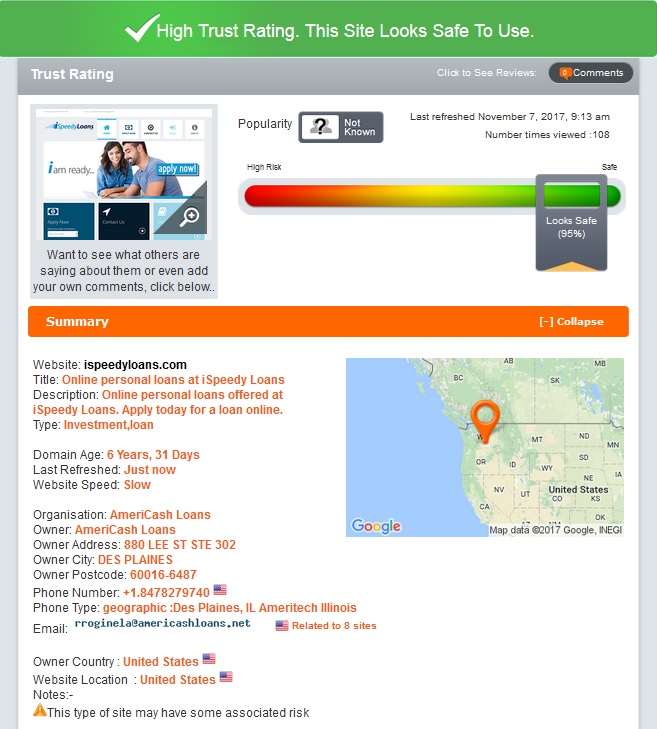

Before using the services of an online lender, it’s important to ensure that this service can be trusted. We checked iSpeedyLoans.com legitimacy and background information using Scam Adviser. The online service reported that iSpeedy Loans has a 95% trust rating (out of 100%):

According to Scam Adviser, the website is safe to use. The owner country and the website location is the United States. The domain age is over 6 years. The website’s popularity is unknown but the content is regularly refreshed. Scam Adviser did not manage to find anything suspicious about iSpeedyLoans.co activity. For this reason, the website receives a very high score.

iSpeedyLoans.com Reviews

On-site iSpeedyLoans.com Reviews

Customer reviews is an important aspect of any online service. We hoped to find some testimonials left by iSpeedyLoans’s first-time and repeat clients. They would be the best proof of the company’s credibility. Unfortunately. The website did not have a separate section devoted to testimonials. The owner of the website did not provide its customers with the opportunity to share their personal experience with other people.

Since we found no iSpeedyLoans.com reviews on the website, we had to search for at least some reviews on independent third-party services, which would throw light on this credibility issue.

iSpeedyLoans.com Reviews on Third-Party Websites

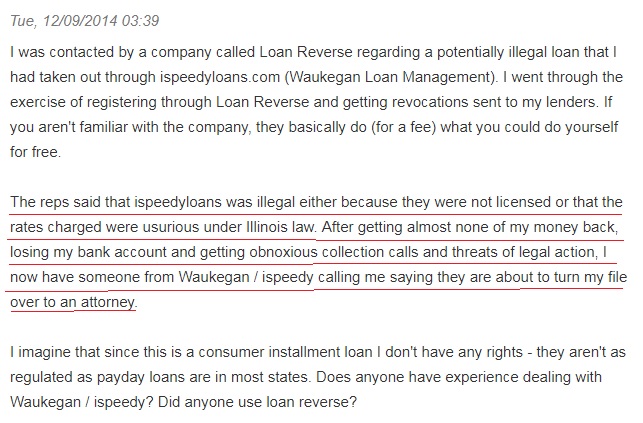

Regretfully, customer reviews on independent websites did not improve the image of the company. All we were able to find were 2 iSpeedyLoans.com complaints. Obviously, this lender has failed to gain a good reputation over these years. There 2 frustrating messages show a “real face of the company”. Once customer claims that iSpeedyLoans are an illegal company, which has no license for such activity. The client lost his money, his bank account and began to receive threatening collection calls: the lender threatened to turn his file over to an attorney. See the full contents of the complaint:

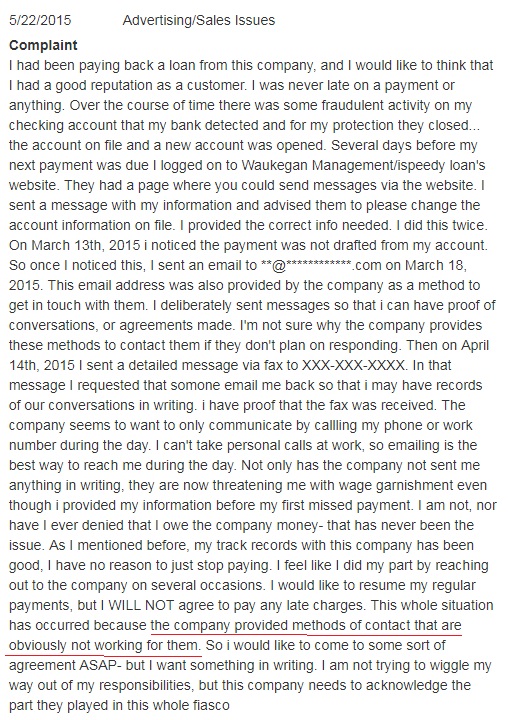

The second complaint was also very detailed. In 2015 the customer wrote a review according to which the lender provided contact methods that are not working for them. For this reason, he was in a mess with late repayment fees. Read the whole message:

Unfortunately, we found no positive reviews at all. These complaints undermine the lender’s reputation and may indicate that iSpeedyLoans.com is not legit.

Customer Support

Contact Information

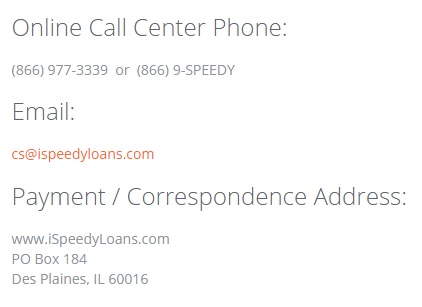

iSpeedy Loans are fully US based. However, we lender does not specify the physical address of iSpeedy Loans Waukegan Il. The Contact Us section contains the following details: call center phone number, email, mailing address:

It looks strange that the lender did not specify its physical address, because iSpeedy loans are also available in-store. The provided contact information is not enough for the customer. We suggest that “Contact Us” section requires improvement.

Locations

This service is available in Illinois only, which means customers must reside in Illinois to get a loan from iSpeedy Loans. This information is placed on the main page of the website, and we appreciate that. Customers do not need to waste their time searching for the information on the loans availability.

How to Get a Consultation?

iSpeedy Loans welcomes any questions its customers might have. The customer support service can be reached by calling at (866) 977-3339 or sending email to [email protected].

Unfortunately, there is no Live Chat on the website, so we decided to send email to find out the minimal loan amount we could apply for. Regretfully, the customer support service did not answer. So you should not expect a speedy reply from this lender. If you still use the services of this lender, choose to contact them via iSpeedy Loans phone number (866) 977-3339.

People in a desperate situation are not ready to wait for hours. iSpeedyLoans.com customer support service also requires further development.

Conclusion

iSpeedy Loans is an online lender which provides customers with speedy installment loans. We appreciate that the lender clearly specifies rates and terms of iSpeedy online loans. The extended repayment schedule will allow clients to plan their budget correctly and take as much time as they need. However, we did not find any information about late repayment fees. And that is a very important information for the customer. The website has some aspects that make it suspicious: no encryption, no antivirus, no positive reviews, no physical address, complaints on third-party websites, a poor design of the website, bad customer support service. Scam Adviser seems satisfied with the activities of iSpeedy Loans, but we found no proof of the lender’s credibility. Considering all these drawbacks, we can NOT recommend people using iSpeedy Loans services. If you, however, decide to take a loan with this lender, we strongly advise you to contact the company representative and confirm iSpeedy Loans address before signing the loan documents. My verdict is 2,9 stars for this unit.

Ready to Apply?

Ready to Apply?