What is GoDay?

GoDay.ca is a Canadian lender that offers payday loans online. The company was founded in 2012 and is known for its fast, simple, and convenient small loans. Unlike many online lenders, we do not exist on the Internet alone, but have physical offices in Toronto, Ontario (headquarter), Vancouver, British Columbia, and Regina, Saskatchewan. According to the information placed on the website, GoDay is among the most trusted online payday lenders in Canada. The lender prides itself on being 100% Canadian, unlike their online competitors from either the US or the UK with different lending rules. Their business is licensed by Consumer Protection BC, a not-for-profit corporation that protects consumers and encourages a fair marketplace in British Columbia. GoDay Canada is also accredited by Better Business Bureau (BBB) and regulated by the Canadian Consumer Finance Association (CCFA). GoDay.ca claims to utilize the best industry tools to help customers solve their financial troubles quickly, efficiently and professionally. The lender also has an established social media presence and can be found on Facebook, Twitter, Pinterest, and Google.

GoDay.ca is a Canadian lender that offers payday loans online. The company was founded in 2012 and is known for its fast, simple, and convenient small loans. Unlike many online lenders, we do not exist on the Internet alone, but have physical offices in Toronto, Ontario (headquarter), Vancouver, British Columbia, and Regina, Saskatchewan. According to the information placed on the website, GoDay is among the most trusted online payday lenders in Canada. The lender prides itself on being 100% Canadian, unlike their online competitors from either the US or the UK with different lending rules. Their business is licensed by Consumer Protection BC, a not-for-profit corporation that protects consumers and encourages a fair marketplace in British Columbia. GoDay Canada is also accredited by Better Business Bureau (BBB) and regulated by the Canadian Consumer Finance Association (CCFA). GoDay.ca claims to utilize the best industry tools to help customers solve their financial troubles quickly, efficiently and professionally. The lender also has an established social media presence and can be found on Facebook, Twitter, Pinterest, and Google.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Poor credit history |

| Short-term loans, payday loans, cash advances | $100 | $1500 | Up to 2 weeks | Depends on the loan amount and loan period | SIN (no faxing), account number | Possible |

GoDay Loans

GoDay provides payday loans online – small, unsecured loans that have a high interest rate and should be repaid on a single date. The lender specifies that these loans are not intended to provide a long-term financial solution but to solve urgent and temporary cash-flow needs.

Once a customer has been approved and all of his requested documents have been submitted, his loan is literally on it’s way to him once he receives an email from GoDay confirming it is in transit. GoDay prefers a direct deposit into a customer’s bank account, however, he can also purchase a prepaid credit card from this lender and get the funds onto the card even faster. This seems a very convenient and professional approach since the lender tries to speed up the process. GoDay.ca offers one more innovative option to deposit the funds – via Email Money Transfer.

The company wants clients to know that the actual time to receive the funds depends on a customer’s financial institution, but typically ranges from one hour to a couple of hours. GoDay offers to get acquainted with their funding chart for more details:

Terms of Use

To get approved for a payday loan with GoDay, customers need to meet the following requirements:

- Be a Canadian resident;

- Be at least 18 years of age;

- Have a active bank account with a Canadian bank or credit union;

- Have a valid email account;

- Have a home or mobile number;

- Be employed and working in Canada

The company emphasizes that to get a loan with GoDay, a customer must be actively employed or receiving a private pension or income from CPP. They do not currently lend on employment insurance (EI), disability, child tax benefits, welfare, old age security, or social assistance, but welcomes renters. As soon as a customer provides a current address, details of his regular income, and a guarantee to repay his payday loan, the lender is happy to review his application.

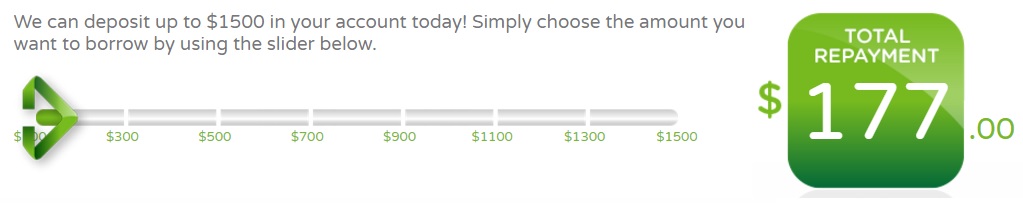

First-time customers can borrow a maximum of $500 with GoDay. But repeat customers who proved they can be trusted can apply for an increased loan amount of up to $1500.

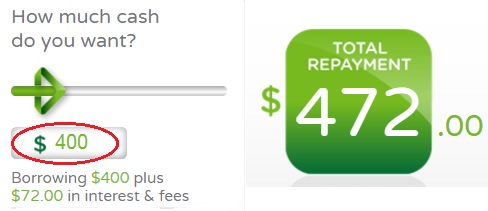

The lender charges 17% of the principal for every loan. The actual loan cost will be shown after a customer submits his application.

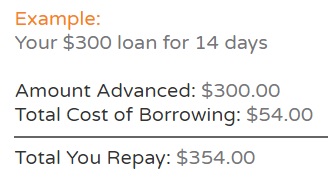

GoDay claims to be totally transparent and disclose all fees up-front, including those customers will have to pay if they default on their loan repayment. Customers can always disclose the exact fees with GoDay by using a loan calculator on the main page:

The company insists that their service is not intended to be a long-term financial solution and should not be used to repay existing debts. They ask customers to apply for a GoDay payday loan only they are confident in their ability to repay it within the specified time period, without making another debt.

Application Process on GoDay.ca

GoDay borrowers can apply for a loan on their computer, smartphone or tablet. The company receive and review applications 24/7, but processes them during business hours.

GoDay does not need to know how customers plan to use the money.

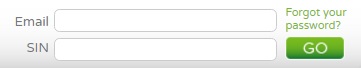

The lender promises to let a customer know if he has been approved within seconds of submitting an application. The lender requires NO faxing of the documents, but customers should be ready to provide a Social Insurance Number (SIN) and a bank account in the application form. Should GoDay need any additional information from its clients, its system will let them know and they will contact a customer promptly by phone or email. If approved, the lender will use the industry’s fastest tools to transfer money as soon as possible.

The company promises to disclose the full terms of a loan, including loan interest and fees, and any penalties a customer will be required to pay in case he defaults on his payday loan.

Loan Repayment on GoDay.ca

If a customer borrows money with GoDay, he will be required to repay his loan on the next regularly scheduled pay date unless his next pay date is in the next two days – in this case, the loan is extended to the following pay date.

Should a customer fail to repay his loan within the due term, he will incur a one time missed payment fee and interest will continue to accumulate on his balance until paid in full. Missed repayment will affect his GoDay Trust Rating. If a client wants to make alternative payment arrangements, he should use GoDay phone number to get in touch with the Customer Service at least two business days prior to his repayment date:

If the lender will not receive the funds on the specified date, it will contact the customer to arrange payment. If the customer is still unable to repay his loan, his account will be handled by GoDay collections team that will do its best to help the customer manage repayment. If their collections team is unable to recover the customer’s past due balance within a reasonable period, they will have to transfer his account to an external collections agency. However, they claim they do their best to help their customers figure out a solution. If, however, the customer fails to cooperate, his credit score and relationship with GoDay will be impacted for up to six years.

Loan Extension

GoDay notes that some Canadian provinces have extended payment plans available based on the customers’ borrowing history with GoDay. If this option is available in the particular province, the lender will disclose it during the loan approval process.

The FAQ page of the website specifies that their policy is that a customer must repay his current loan with GoDay in full before applying for another. Once his payment clears, he is free to apply again!

If customers wish to repay their loan early, they should contact GoDay customer service at least two business days prior to the repayment date.

GoDay.ca Bad Credit History

GoDay may conduct a credit check before making a decision, so an approval partially depends on the customer’s credit history. Borrowers should keep in mind that the lender considers much more than just their credit when reviewing an application. To give GoDay.ca the best chance of acceptance, customers must provide accurate information on their online applications. If they are existing customers, they can always update their information with the lender by emailing GoDay Customer Service at customerservice@goday.ca.

So, GoDay will not necessarily decline a loan, if a customer has poor credit. Besides, borrowers should note that if they have any items in collections with other payday or short-term lenders, GoDay system will probably not accept their loan applications.

Technical Characteristics of the Website

Checking Encryption

GoDay.ca uses a 128-bit SSL encryption which secures the personal information of the website’s users. The security certificate is verified by COMODO CA Limited. The left corner of the address indicates no name of the website’s owner:

Unfortunately, a 128-bit SSL encryption is not enough for a website providing online lending services, and customer’s security level still remains minimal despite this encryption.

GoDay.ca Mobile Version

For such institutions like GoDay, a mobile website version is vital. Fortunately, the lender has made its website mobile-friendly, so borrowers can easily apply for a loan at any place that has an access to the Internet. The application process is the same, the text is readable. There is no unnecessary scrolling. All the secondary information is removed from the main page. The website has also successfully passed a mobile version check by Google, though the tool was not able to load 8-page resources:

In general, we found no errors in GoDay mobile version functioning and it looks good Obviously, customers will not have any troubles when visiting the website from their mobile devices, however, there are some little things which could have been done better.

Checking Antivirus

GoDay.ca uses Norton antivirus, that covers all customers’ transactions, prevents unwanted pop-ups from appearing when browsing, keeps users’ personal data safe from hackers and thieves, keeps malware programs from attacking you online.

Using Norton is a big advantage, as trusted and respectful online lenders usually use such like programs. Borrowers can feel safe when surfing GoDay.ca.

The Convenience of Using GoDay.ca

Customers can apply for a GoDay payday loan by completing an online application 24/7 without registration, however, customers are encouraged to create a personal GoDay account and log in to get a full control over their short-term loans. To log in, they will need to enter an email address and a SIN number:

When users visit the website for the first time, they need to choose their province of residence. After that, they will see on the homepage the 1st step of their submission form – choose the needed loan amount and will see how much to repay:

After that, it’s time to click on the button ‘Apply Now’ and submit the personal details. It looks very simple and fast.

GoDay requires filling in the personal information, income information, payroll information, bank information, and reference information All these details are collected in strict confidence in accordance with security guidelines:

The application form seems standard and does not differ much from other lending websites, however, the applicants may be sent a verification PIN by text message:

Within seconds of submitting a loan application, the lender will let the customer know if he has been approved. GoDay loan applications are processed instantly by the automated system 24/7. If the lender needs any additional information from the user, it will contact him promptly by phone or email. If approved, the company will fund money as soon as possible.

Before giving borrowers cash, the lender promises to disclose the full terms of each particular loan, including interest, fees, and penalties customers will be required to pay in the case they default on their loans.

Once the customer is approved, GoDay will transfer cash. They will collect funds owing directly from the customer’s bank account on the agreed repayment date.

The company tries to make their policies as clear as possible by giving many representative examples. For example, the screen below shows that the total cost of a $300 loan will be $354:

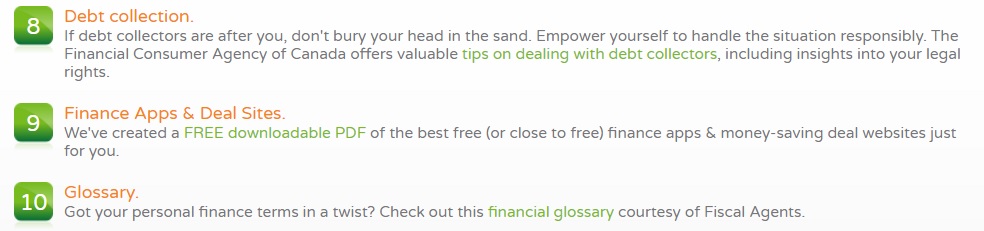

One of the advantages of GoDay.ca is its learning center called “Finance 101”. As the lender is dedicated to financial issues, they are providing tools, tips, and tricks that every borrower can use. People don’t even need to get a payday loan with GoDay or create a personal account to take advantage of the useful information. It was developed just to help people and give them a better understanding of the borrowing process, their financial health, smart budgeting and even more.

All these recommendations can become a long-term solution for users’ short-term money problems. GoDay.ca also has an entire blog which is refreshed weekly. It’s called the GoDay Cafe:

In this blog, customers can find valuable information about payday loans, budgeting, credit counseling, free webinars, practical savings advice, debt collection, finance apps, and deals. All of these topics are explained in simple language and are FREE:

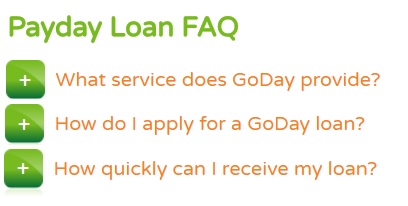

Customers can also check out their answers to GoDay Frequently Asked Questions and find even more useful information:

Considering all the above facts, we can say that GoDay.ca has done its best to provide borrowers with convenient short-term loans online.

Is GoDay.ca Legit?

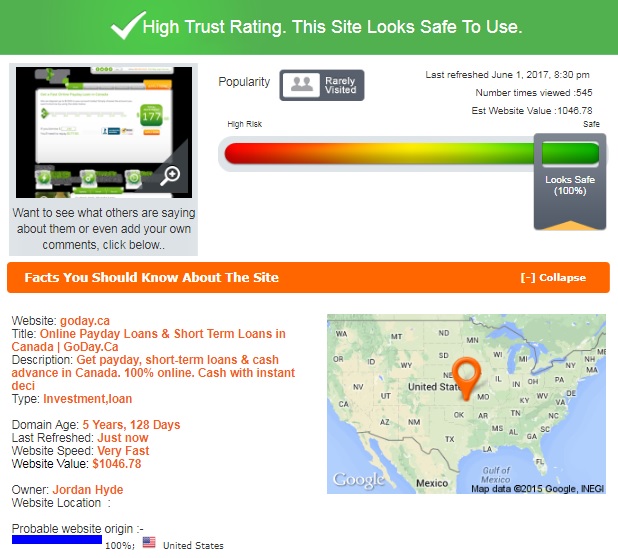

As we wanted to ensure the company is legitimate, we checked GoDay.ca rating using ScamAdviser.com, and were happy to see that the lender has a perfect reputation: a 100% trust rating out of 100:

According to ScamAdviser, the website seems safe to borrow money from. The domain age is 3,5 years. However, this perfect rating was not clear to us since the online service determined GoDay origin as the USA, while the company is proud of being fully Canadian. Besides, the website has a few customers. We suspect the lender was rated so high due to the detailed contact information provided particularly the website’ owner and founder – Jordan Hyde. Though there are some aspects we were skeptical about, a 100% trust rating on ScamAdviser confirms that GoDay.ca is a legitimate lender, and borrowers can most likely have a good experience with its services.

GoDay.ca Reviews

On-site GoDay Reviews

The best way to check the lender’s reputation is to read customers reviews. Unfortunately, GoDay.ca has no testimonials and no page where people can leave feedback. Instead, the company invites customers to trustpilot.com which contains numerous GoDay.ca reviews. So we had no choice other than visiting the review website advertised.

GoDay.ca Reviews on Other Websites

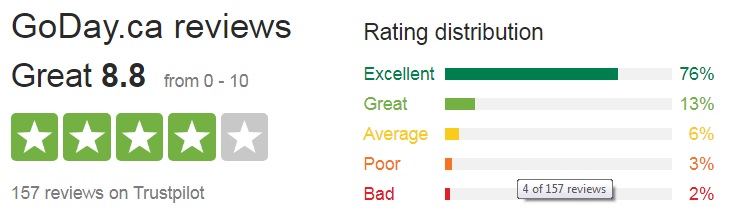

Trustpilot.com was the first independent website we visited to read GoDay.ca reviews. It turned out that the lender has a good reputation and is rated 8.8 stars out of 10 based on 157 customer reviews:

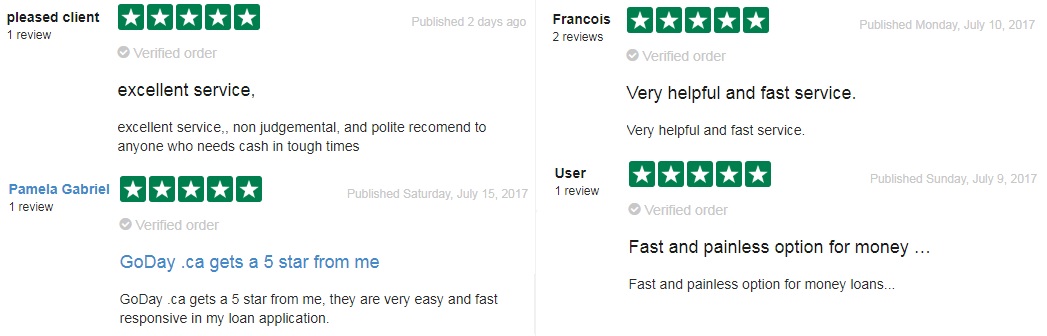

New GoDay reviews 2017 are being posted on the website every day. Most customers are completely satisfied with the services provided: they point out an excellent and easy to use service, very fast response and funding, and more:

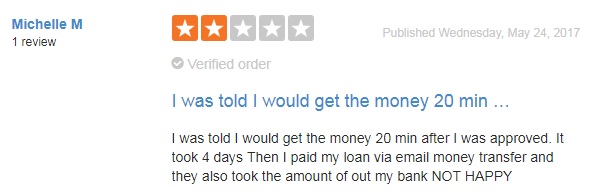

Negative GoDay reviews 2017 are also available on the website. One user is not happy with the services since it took them 4 days to transfer money to his account, though he was promised 20 minutes. This was not the only negative aspect: the lender took a loan amount from the client when it was the due date: via email money transfer and the bank account:

Negative GoDay reviews 2017 are also available on the website. One user is not happy with the services since it took them 4 days to transfer money to his account, though he was promised 20 minutes. This was not the only negative aspect: the lender took a loan amount from the client when it was the due date: via email money transfer and the bank account:

One more user is completely disappointed with GoDay customer support service. He calls it “rudest” and “most useless”. No further details were provided:

Read more GoDay reviews here: http://trustpilot.com/review/www.goday.ca.

Other third-party websites also contained customer reviews. One of the regular customers in 2015 was unhappy that the lender declined his application, though he had a good experience with loan repayment:

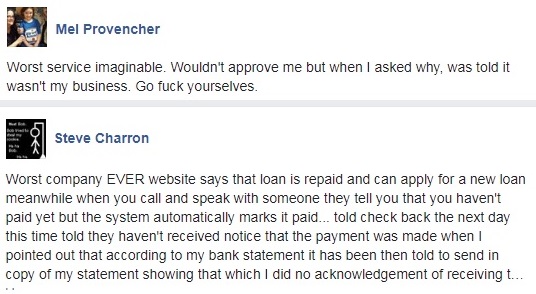

Two more customers posted GoDay complaints on facebook.com. The first one was declined for no reason and he left a very rude message to the company’s team. The second borrower would never deal with this “worst company” again since their system error put him in a so big mess:

We also found some more positive reviews posted 2 years ago. One customer said the application process and funding were quick, and what he especially appreciated is a caring customer support service:

Another client is happy with GoDay services since they are “speedy, smart and secure”, and customer support service is very helpful too:

We were upset on discovering negative GoDay reviews, however, we can’t say they indicate the company has a poor service: most complaints are about loan declining, but it may simply mean that the applicant did not qualify for a payday loan. All other comments indicate that the company provides good services. We may suggest that clients rarely have problems with this lender if approved.

Contact Us section

GoDay Contact Information

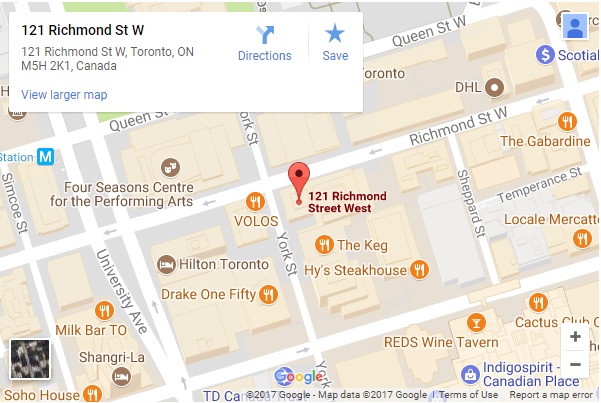

GoDay.ca website contains a very detailed contact information, not a single issue was left unclear. The company’s headquarter address is 121 Richmond Street West, Suite 602, Toronto, Ontario, Canada, M5H 2K1. Borrowers can even see a map indicating the exact GoDay office location:

Besides. The lender has offices at 550 Burrard Street, Suite 2300, Bentall 5, Vancouver, British Columbia, Canada, V6C 2B5 and 1500-1881 Scarth Street, Regina, Saskatchewan, Canada, S4P 4K9.

The lender also provided 3 email address dealing with various issues:

- General inquiries: customerservice@goday.ca

- Job opportunities: careers@goday.ca

- Loan applications: apply@goday.ca

GoDay phone number is 1-888-984-6329, and fax 1-855-674-6329.

GoDay business hours are also can be found on the website: the customer service is available to help customers between 8:30 am and 8 pm Monday – Friday, as well as between 10 am and 6 pm on Saturdays, with the exception of a bank and statutory holidays.

GoDay.ca Locations

GoDay services locations across Canada including Toronto, Vancouver, Regina, Ajax, Kingston, Oakville, Saskatoon, Pickering. Before starting an application process, customers are required to choose the province they are living in:

![]()

All locations have the same loans types, loans terms, and fees.

Getting a Consultation from GoDay.ca

If customers need any help, they are encouraged to contact GoDay customer support service by completing the feedback form or contacting by phone. If, after speaking with one of the company’s representatives, their concerns are unresolved, they may submit a formal complaint via email, after which GoDay senior management team will handle the concern personally. The lender reviews any feedback in its business hours only.

Customers also have an opportunity to use a Live Chat option to get answers to any questions immediately:

Regretfully, the Live Chat was offline when we visited the website, though it was during GoDay working hours. So we left a message offline asking them to specify the exact percentage rate. We waited for about 2 hours but received no reply. Not every customer in a desperate situation is ready to wait for that long, so do not expect to get a speedy answer from this lender.

Conclusion

No doubt, GoDay.ca has many advantages that make it stand out from all other Canadian lenders: 24/7 Instant decision, funding within 1 hour of approval, flexible repayment plan and various payment options including E-mail money transfers, no paperwork or faxing required, a wide range of short-term loans. A CCFA membership and a Consumer Protection BC license testify that GoDay provides legitimate and reliable services. The disclosed address and contact information make it seem secure and safe to use. Besides, the scam analyzing website gave the lender the highest rating. We also appreciate the online lender specifies the exact cash amount the customer will be required to repay. We can not but mention the website’ informativeness – it’s a true database of borrowing information. GoDay has good user comments, even though they cannot be admitted as 100% perfect. We would recommend using this website for solving your temporary financial difficulties, but with care.

Ready to Apply?

Ready to Apply?