What is Fast Auto and Payday Loans?

![]()

FastAutoandPaydayLoans.com is an online lender operating all across the state of California. This service is designed specifically to help people in need of emergency get the funds in 30 minutes. They claim to be experienced and professional enough to help you get fast loans in an extended network of convenient locations right in your neighborhood.

| Loan types | Min. amount | Max.amount | Period | APR | Items required | Bad credit |

| Payday loans | $100 | $255 | Not specified | Not specified |

| Yes |

| Title loans | $2,501 | $15,000 | Not specified | Not specified |

| Yes |

| Signature installment loans | $2,600 | $2,600 | Not specified | Not specified |

| Possible |

Loan Types

FastAutoandPaydayLoans.com specializes in payday loans, title loans, and signature installment loans.

- A payday loan is a small loan that is repaid in one lump on your next payday. This type of loan is suitable for people who have some expenses that cannot wait until their next day they get paidж

- A title loan is is a type of a loan where borrowers can use their car title as collateralж

- A signature installment loan is a loan of a larger amount that is repaid in several equal monthly payments.

According to the website, approved clients can get their money at the nearest location of FastAutoandPaydayLoans in already 30 minutes.

Terms of Use

You must be at least 18 years of age to qualify for a loan with Fast Auto and Payday Loans.

The lender offers payday loans up to $255, installment loans at $2,600. and car title loans up to $15,000. The amount you could be eligible for will depend on your ability to repay a loan.

Regretfully, there are no exact terms and fees specified on the website. All the details will be disclosed before you sign the agreement.

So, to be approved for a loan, you must be at least 18, live in California, have a vehicle (for a title loan), the proof of income, and photo ID. You need to bring all these items to the nearest location

The lender states that borrowers do not need to have a checking account to qualify for a car title loan. They do not need a driver’s license as well. However, borrowers who want to get a signature installment loan DO need to have an active bank account.

Application

You do not need to provide a collateral for payday loans or signature installment loan. However, your car serves as a collateral if you are approved for a title loan. The application process is started online but completed at a store location. The whole process takes about 30 minutes.

The lender presented a list of the required items for each loan type available at Fast Auto and Payday Loans:

- Required items for a title loan: drivers license or state issued I.D., your vehicle for inspection, proof of your solvency, lien-free title to your vehicle;

- Required items for a signature installment loan: your driver’s license or a valid state I.D.), a proof of income, checking account statement;

- Required items for a payday loan: driver’s license or state issued I.D., most recent paystub and proof of your solvency, a blank check from your open checking account.

Repayment

According to the website, loan repayment terms may vary. Generally, you pay off your payday loan when you receive your next paycheck. The exact terms and conditions for title loans and installment loans will be specified in your loan agreement.

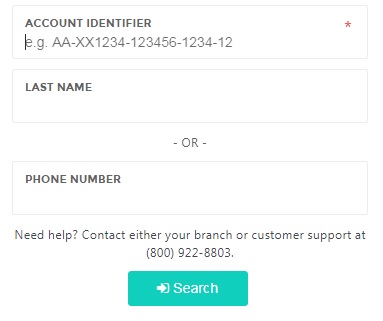

The lender offers to make payment online using ePayMyLoan. For this, you need to enter your account number and your last name or phone number to log into your personal account.

If you feel that you cannot make a payment on time, the staff member of Fast Auto and Payday Loans will work with you to arrange a new payment schedule in accordance with California regulations.

If you have a title loan, your vehicle will be pledged to the lender as collateral, so if you do not make timely payments, your vehicle may be repossessed by Fast Auto and Payday Loans, Inc.and sold. You may also have to pay additional penalties.

Loan Extension

In most cases, you can extend your loan and re-apply for a new loan as soon as you have repaid your existing loan. However, some locations in California mandate a waiting period prior to being able to get a new loan. You need to check this information with the lender.

I have not found any information about a possibility to pay a loan before the specified date.

FastAutoandPaydayLoans.com Bad Credit

This lender does not check your credit before issuing a payday or title loan, which means that any credit is welcome for these types of loans. However, they DO CHECK your credit before issuing a signature installment loan. The company may also report your poor performance to credit agencies. For complete details, you need to contact your nearest store location.

Technical Characteristics of the Website

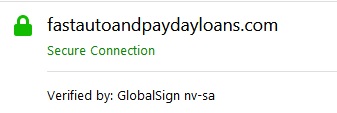

Secure Сonnection

FastAutoandPaydayLoans.com protects customers’ sensitive data by using a 128 bit SSL encryption protocol. The lender claims that clients may not fear that their personal or financial information will be stolen. Indeed, I found a green lock symbol and an “https” before the domain name at the left corner of my browser which means that this site is secured. However, I’m not quite satisfied with such an encryption since it provides a medium security. I would prefer to use online services that use a 256 bit SSL encryption protocol.

In general, 128 bit may be enough to protect users’ sensitive details they submit online but I think the lender should do its best to provide a better security level.

Mobile Version

FastAutoandPaydayLoans.com has successfully passed a Mobile-Friendly Test from Google:

A mobile version makes the life of mobile users easier. There is no need for scrolling, the text is displayed correctly, the menu is at the top of the page. Using the mobile website, it was more convenient for me to view the catalog of financial products. The text count is shortened, there is no unimportant information. The structure and functionality are a bit different but the style is the same.

I conclude that this mobile version can fully satisfy the needs of a customer.

Antivirus

Websites like FastAutoandPaydayLoans.com must use up-to-date antivirus technologies to protect customers who are visiting this website. However, I noticed that this lender does not use an antivirus. This prevents me from feeling secure because my computer could be easily infected with warms, malware programs, and other online threats. Antivirus would have made this website more reliable. I recommend this company to think over it.

The Convenience of Using FastAutoandPaydayLoans.com

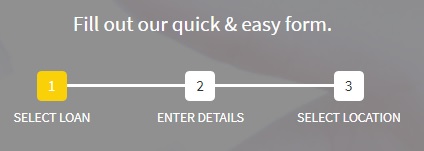

The lender claims that it’s easy and quick to get a signature installment loan, a title loan or a payday loan using this website. It’s nice that the website has a locator which helps customers find the nearest office of Fast Auto and Payday Loans.

The whole process consists of 3 steps: select the desired loan type and amount, enter personal details, select a location where you prefer to get money.

Shortly after providing your basic personal information in the online form, you will get a call back from a store manager to begin the process remotely. You may also directly call one of their locations. The store representative will confirm your information. To be approved for a signature installment loan with Fast Auto and Payday Loans, you will need to provide your driver’s license (or a state-issued I.D.) your most recent pay stub and a checking account statement. To get a car title loan, you will have to own your vehicle, provide its lien-free title and show your driver’s license (or a state-issued I.D.). If you wish to receive a payday loan you will need to have to show your government-issued photo ID, your most recent paystub, and a blank check from your checking account.

For signature installment loans, you need to visit the lender at one of its stores, a manager will review your information and check your credit to complete the process. You will also get all the details about your loan rates and terms before you leave. For title loans, you also need to visit the lender’s store and a manager will inspect your vehicle to assess the loan amount you could get. After that, a manager will explain the whole terms and rates and answer any questions. For payday loans, you need to come at the company’s store to confirm your information and complete the application process.

According to the website, you can get the cash in about 30 minutes.

In general, the application process is simple and intuitive. However, I do not really like that the lender does not offer an opportunity to get funds online – you will need to complete the application process in person at their nearest location.

Is FastAutoandPaydayLoans.com Legit?

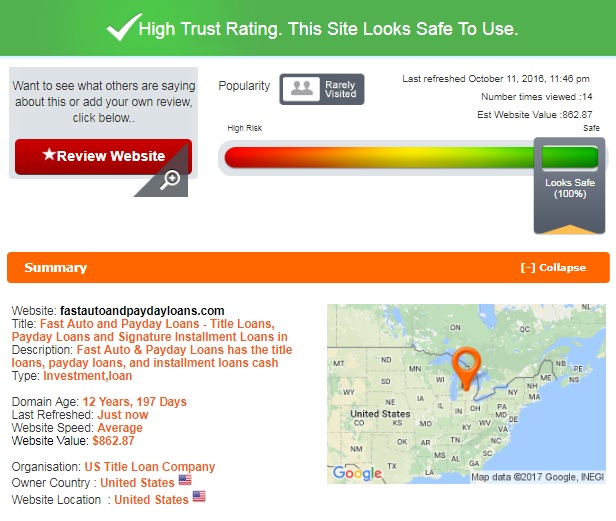

ScamAdviser.com check a trust-rating of Fast Auto and Payday Loans. It was very important for me to be sure that this site is legit especially when you have to submit your personal details. ScamAdviser reported that this lender has a maximum trust rating – 100% out of 100% and looks safe to use:

The domain age is almost 13 years which means that this company is very experienced. Customers can feel calm knowing that this website was not banned during this period. The website is operated by Us Title Loan company located in the United States. The only confusing issue is that this site has a few visitors but this does not mean that this lender is a scam. I suggest that you might have a successful experience with this company.

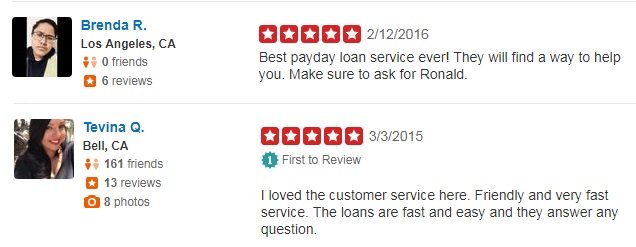

FastAutoandPaydayLoans Reviews

On-site Testimonials

Regretfully, the lender’s native website does not have any customer reviews. I suspect this does not mean that this service is unpopular – the thing is that they do not even have a testimonials page where clients can share their experience with Fast Auto and Payday Loans. For obvious reasons, I had to search for any reviews on third-party websites.

Reviews on Independent Websites

I found many positive Fast Auto and Payday Loans reviews (including recent comments) on independent reviewing websites. A user from 2018 reported that this lender did its best for the customers. He used its services to get a title loan and it was fine. The lender helped him set up payments and he had no prepayment penalty.

Reviews from other websites reported that Fast Auto and Payday Loans provided the best payday loans ever and had an excellent customer service.

There are also some negative reviews on the web. A few people left complaints about a deceptive activity of this lender. In general, this company has a good online reputation but negative reviews from different periods made me a bit concerned.

Customer Support

Contact Information

FastAutoandPaydayLoans.com is a lender working in numerous in-store locations in across California. As such, you can find the address and phone number for each of the stores. Their basic phone number is 1-800-922-8803. There is a picture of a typical in-store location of this company:

I managed to find all the contact details every customer wants to know. I also found the story of the company’s creation. They seem to be as transparent as possible.

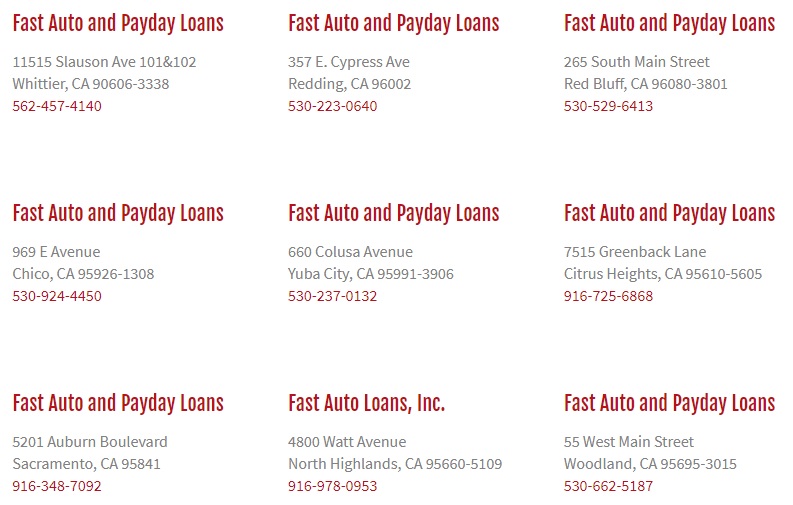

FastAutoandPaydayLoans.com Locations

As I have already mentioned, this lender provides loans only to people living in California. The company has numerous in-store locations. Their address and phone numbers can be found on a corresponding “Locations” page:

Getting a Consultation

You can contact a particular Fast Auto and Payday Loans location by sending email, over the phone or filling a contact form. The lender states that their email is monitored Monday – Friday 9 am to 5 pm by the Customer Support Group. They provide a basic email for general questions. For questions regarding your loan fees and terms, you need to contact the location directly.

Unfortunately, Live Chat option was not available on the website at the time I visited it, so I decided to reach the staff member using a contact form. I wanted to figure out whether borrowers are allowed to pay off their loans before the specified date without any penalties.

I waited for 5 hours but nobody answered. It seems that their customer support required optimization.

Conclusion

FastAutoandPaydayLoans.com seems to be a legit and reliable lender providing 3 types of loans. The company has some advantages you may like: they have a high trust-rating from ScamAdviser, high maximum loan amounts, easy repayment options, numerous locations across California, numerous feedback from former customers, a convenient and informative website. It’s nice that they work with any credit score and provide the cash in only 30 minutes. However, you should be ready to provide some additional documents if you want to be approved for a loan, such as a proof of income and a blank check from your checking account. When using this website, you do not know exactly what you are getting into until you complete an application form – the lender did not specify loan rates and terms anywhere on the website, so there is a chance that you might be disappointed with too high interest rates. Of course, the main disadvantage of FastAutoandPaydayLoans is that they are only available in California, so if you live outside of this state, you will have to look for other online lenders that have a good reputation and operate legally. If you still decide to apply for a loan through this website, bear in mind that you will not be able to get the cash transfer – for this, you will have to go to the lender’s office. On the one hand, it’s nice that you can see the company’s representative in person but on the other hand, not all customers like the idea of going anywhere to get payday loans – many lenders offer purely online application and fast money transfer.

Ready to Apply?

Ready to Apply?