What is Easy Financial?

EasyFinancial.com is a lender with more than 11 years of experience and with 200+ branches all across Canada. During these years, the company has helped over 230 thousand customers cope with financial difficulties. According to the website, the lender is able to satisfy 97% customers out of 100%. The company encourages consumers to rebuild their credit with the help of their services and get back to lower rates. They strive to improve the lives of people by providing quick, simple and accessible loans. The priorities of their business are respect and integrity. They guarantee to treat all clients with respect.

| Loan types | Min.amount | Max.amount | APR | Period | Items required | Bad credit |

| Unsecured personal loans, secured saving loans, secured personal loans | $500 | $25,000 | 19.99% – 46.96% | 9-120 months |

| Yes |

Easy Financial Loans

The lender offers 3 credit solutions to consumers: unsecured personal loans, secured personal loans, and secured saving loans.

A secured personal loan is the most popular credit option which allows a borrower to use the equity in his home to qualify for low rates starting from 19.99% and big loan amounts over $25,000.

The company mentions the top reasons why people come to Easy Financial: bill payment and expenses, payday loan, debt consolidation, car repair, home repair, and unexpected expenses.

According to the lender, a user can apply for a loan in a few minutes and get the money the same day.

Terms of Use

Using this website, you can be approved for loan amounts ranging from $500 to $25,000 with interest rates from 29.99% for a term ranging from 9 to 60 months. The decision of the lender is based on several factors, such as a borrower’s credibility and regular income.

For example, you will be able to get a 12-month $1000 unsecured personal loan at 29.99%: The monthly payment will make $125.09. The total amount to be repaid is $1501.

You must not necessarily to be officially employed, however, you must prove that you will be able to repay the debt. Besides, you will not be able to receive a loan if you are under 18 years of age.

If you own a house, you can apply for 2 loan products at the same time using an application form on the website. However, you can only have one Easy Financial loan at a time.

Unlike other lenders, Easy Financial has a loan protection plan, which guarantees that the client will be protected in case of illness, job loss, injury, and death:

- If you lose your job, your payments are covered up to 6 months;

- If you are injured or ill, your payments are covered up to 6 months;

- If you are seriously ill, your payments are covered 100%;

- If you pass away, your payments are covered 100%.

Application

You can apply for a loan online or at one of the lender’s locations in Canada. All you need is to fill out a short loan application, submit your documents and wait for the approval. If approved, you can get your funds the same day.

- If you apply for an unsecured personal loan, you will be asked to provide the following documents: state-issued photo ID, proof of income (pay stubs), bank statement, void cheque or pre-authorized debit form, and proof of address;

- If you want to get a secured personal loan, you will need to provide the following papers: state-issued photo ID, proof of income (pay stubs), bank statement, void cheque or pre-authorized debit form, annual mortgage statement, annual property tax statement.

This means that you will have to do a lot of paperwork to get a loan with Easy Financial.

Repayment

The lender guarantees affordable and flexible payment options. Using this website, you can get personal loans with terms of up to 60 months. The pre-authorized payment schedule will be individual – all the details will be disclosed in your contract. The funds will be automatically taken from your bank account each due date.

If you miss a payment, this may incur additional fees and penalties but in general, Easy Financial works closely with its clients and helps find suitable solutions that will not ruin their credit.

Extension

Regretfully it’s not mentioned anywhere on the website whether Easy Financial allows loan extending. You should specify these details before their signing the contract. If you need a loan renewal, we recommend you contacting the lender as soon as possible to discuss the solutions available.

EasyFinancial.com Bad Credit

You can be approved for a secured savings loan even if you have a bad credit or no credit. This loan type is designed to help everyone. Besides, this lender can help you improve your credit score. They had many clients with past credit issues and were able to help them improve their credit history. If you make timely payments each time, your credit score will improve.

The lender mentions that 92% of clients rebuilt their credit, 95% of applicants were approved for a loan, and 50% of them rebuilt credit history after bankruptcy.

The company does not check your credit using major credit reporting agencies. They make a decision based on their discretion. They also mention that applications for loans with bad credit for up to $5000 can be reviewed in a couple of minutes!

Of course, if you have a good credit, you will qualify for bigger loan amounts and lower interest rates.

Technical Characteristics of the Website

Connection

EasyFinancial.com uses a 128-bit SSL encryption which is considered an average encryption technology. This means that all sensitive details submitted to this website (name, address, bank account, state-issued ID) will be secured. The security certificate is provided by COMODO CA Limited.

Regretfully, there is no information about the website’s owner in the left corner of the browser. This means that the site does not use an Extended Verification certificate, which would have provided a better encryption. I recommend this lender to upgrade the website’s security level.

Mobile Version

EasyFinancial.com has successfully passed a Mobile-Friendly Test from Google, which means that this website is easy to use on mobile devices:

However, the analysis indicated that not all page resources could be loaded. Obviously, the site has some availability problems that can affect the users’ experience.

Antivirus

Regretfully, the website is not screened for viruses and vulnerabilities. The absence of an antivirus program makes this resource insecure – you can easily catch something unpleasant on your computer. I would recommend the lender to fix this problem so that the company could have a better reputation.

Convenience of Use

Easy Financial guarantees an easy, and fast online application. The process does not differ much from other websites that offer online loans. It’s nice that you can start filling out an application right away, without the need to register on the website.

First of all, you will be required to enter a valid email address and the desired amount between $500 and $25,000 and specify the purpose of the loan: bills and expenses, education expenses, debt consolidation, travel and leisure, home repair, some purchase, automobile repair, healthcare expenses, other

After that, you will be asked to tell the lender about yourself: your name, birthday, address, employment status (full time, maternity leave, part-time, disability, self-employed, social assistance, seasonal (E.I), unemployed, retired (pension).

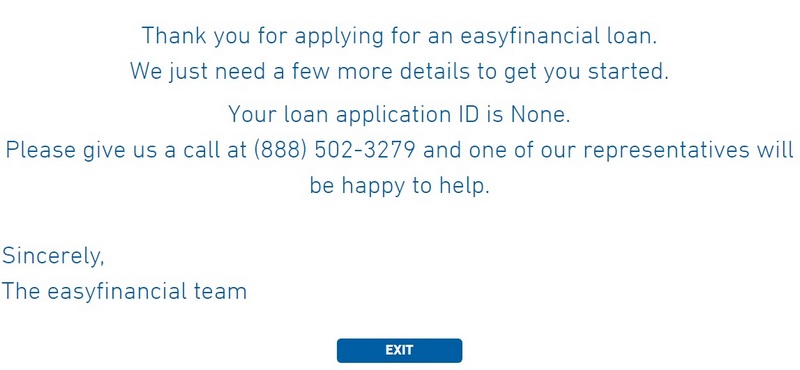

Once you have completed all these steps, you will see a message that the lender needs a few more details to get you started. For this, you will need to call at Easy Financial contact number (888)-502-32-79 and one of their managers will be happy to help you.

This means that the application process is not purely online. Not every borrower will find this procedure convenient. I know that too many lenders advertise a trouble-free online application.

I like that the company disclosed all loans rates and terms on the website. However, there are still some details that need to be specified.

The website has a separate FAQ page but it lacks some important information, for example, penalties and extension policies.

However, I appreciate that the lender provided a convenient loan calculator. Using it, you can easily find out your percentage rate and the amount to be repaid:

I conclude that EasyFinancial.com is a convenient website but it has some drawbacks that should be eliminated.

Is EasyFinancial.com Legit?

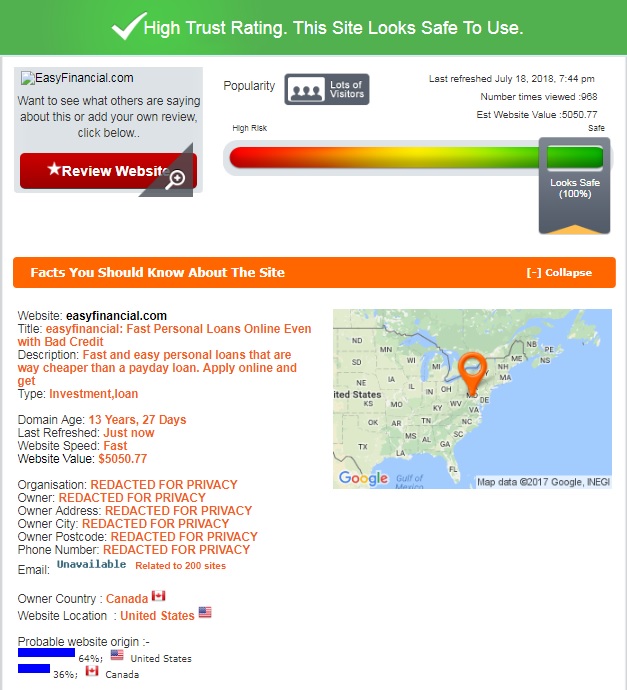

Easy Financial has the excellent reputation on ScamAdviser.com, and this fact added more trust to this lender. The website has received 100% out of 100:

According to ScamAdviser, the lender is safe to use. The website is either operated form the United States or Canada, the domain age is over 13 years. The site has lots of visitors and is popular by Alexa. The revealed details testify that this lender is legitimate.

EasyFinancial.com Reviews

Easy Financial Loan Reviews on the Native Website

There are no reviews on the lender’s own website and there is no section where consumers can leave their comments, wishes or complaints. I consider this a real drawback since large and trusted online companies always provide their clients with an opportunity to leave feedback. Websites without reviews seem untrustworthy.

However, the lender encourages all users of the website to read numerous Easy Financial Loan reviews on Feefo – a third-party reviewer. Of course, all of the comments are positive since they are advertised by the lender itself:

However, I can hardly believe that people leave comments about this lender EVERY SINGLE DAY – Feefo website has thousands of reviews that are posted daily.

Reviews on Third-Party Websites

To clarify the reputation of the lender, I decided to look for any EasyFinancial.com reviews on third-party websites. There are several sites that contain comments about this company. Many people were satisfied with the services provided. Consumers appreciate an excellent and helpful staff, quick funding and flexible repayment terms:

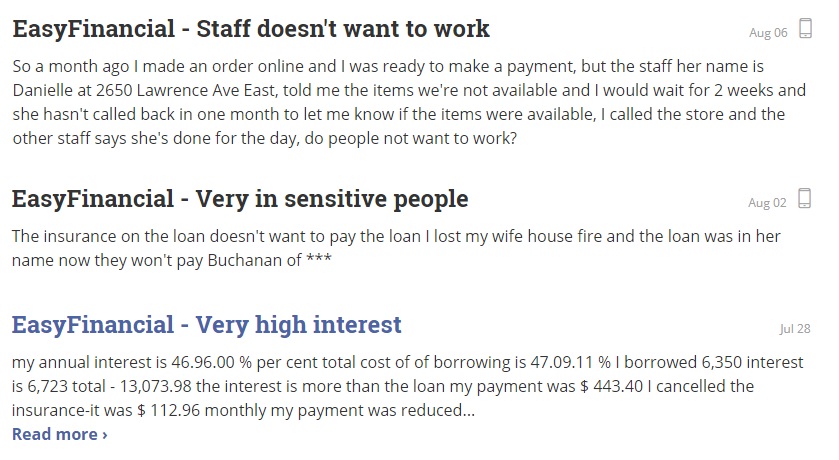

However, I have found an abundance of Easy Financial complaints. Many users were disappointed with the unhelpful staff, others mentioned very high interest rates.

So, the company has a mixed reputation on the web, however, I found not a single comment reporting that this lender is operating illegally.

Customer Support

Contact Information

The lender specified the most relevant contract details: Easy Financial phone number is 1-866-327-9597. Users can see all 200+locations of the company on the map.

They also mentioned the year when they started its business – 2006. This information is very important to clients. I conclude that this online lender is as transparent as possible.

Easy Financial Locations

The company has more than 200 branches across Canada. You can find the nearest office searching by street, city or postal code:

Getting a Consultation

There are 4 ways to contact Easy Financial customer support team: you can email them via a contact form, visit their office, call at 1-866-327-9597, and use a Live Chat option.

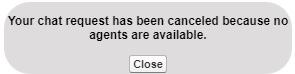

I decided to reach their representative by using a live chat. Regretfully, there were no agents available. Even 5 hours later the chat was still offline:

Of course, the chat might be active at the time you visit the website but I cannot guarantee it. You may also try to get feedback from the company by using another contact option. I conclude that their customer support team required optimization.

Conclusion

EasyFinancial.com is an experienced online lender providing 3 different loan types. The main advantages of the company is a broad availability with 200+ location across Canada. They are able to offer different loan amounts, affordable payment options, a loan protection plan, and cheaper interest rates. Another thing that makes them stand out is that this company helps you to rebuild your credit. The lender has an excellent reputation on ScamAdviser.com and secures the borrowers’ personal data. Regretfully, there are some things I dislike about this organization: it has mixed customer reviews, lack an antivirus program, requires too much paperwork, and has a poor customer support. Considering this, I suggest you need to use this website with caution.

Ready to Apply?

Ready to Apply?