What is EasyFinance.com?

EasyFinance.com is an online service that links customers with potential reliable financial service providers that offer a wide selection of financial products such as personal loans, credit cards, mortgages, tax relief, auto loans, home loans, student loans, life insurance, and many other financial services. They have two main goals: 1) to connect customers to lenders; 2) educate them and help make right financial decisions. The online portal aims at providing customers with high-quality financial products and education in one marketplace.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Poor credit |

| Personal Loans, Student Loans, Home Loans, Cash Loans, Payday Loans, Auto Loans, Cash Advance | $100 | $50,000 | Depends on the loan type and the lender | Depends on the loan type and the lender | SSN, Drivers License | Yes |

Types of Easy Finance Loans

Easy Finance offers a wide selection of financial products like Mortgages, Loans, Credit Cards, Credit Score, Credit Monitoring, Insurance, and so on.

Since we are interested in loans, we will review their types available on the website. The loan solutions include Personal Loans, Home Loans, Cash Loans, Payday Loans, Auto Loans, Cash Advance, Student Loans.

Below, we will review the most popular loan solutions offered by EasyFinance.com

- Personal Loans: these are unsecured loans that must be repaid in fixed payments within the fixed schedule. Such loans can be used for any emergency from car repair to debt consolidation and vacation. This is the fastest and easiest loan type. To get a personal loan, you don’t need to provide any collateral or security. You also do not need paperwork, which makes an application process very fast and easy;

- Home Loans: The website offers a good selection of home loan products. These are long-term products which you may use to buy or build a new house or purchase land. It’s considered a convenient way to buy a house – instead of waiting and saving for years, you can get the necessary amount of money right now. These loans can be given to anyone who is employed and has a stable income which guarantees that the loan will be successfully repaid in the future. A borrower can also adjust the loan term to his financial capabilities;

- Auto Loans: Easy Finance has a wide assortment of options for buying a new car. They say that auto loans are a very beneficial credit solution and guarantee the best solutions for your personal needs, the lowest interest rates, affordable payments, flexible repayment terms, a quick loan approval;

- Student Loans: According to EasyFinance.com, a student loan is a very popular financial product which allows students to cover the total cost of their education. These loans can be used for any purpose-related to education, including the purchase books and notebooks. However, these loans can be used for educational authorized purposes only.

The online portal mentions that a loan approval and money transfer usually takes 24 hours but do not exceeds 48 hours.

Terms of Use

All Easy Finance loan types have different terms, rates, and conditions. They depend on a loan type and the lender. We will review the common terms and rates of personal, home, auto and student loans mentioned on the website.

Personal loans: these loans have a fixed rate of interest which does not depend on the loan amount and does not change during the loan period. Interest rates are also determined by a customer’s credit score. In other words, if a borrower has a good credit score, he is likely to have a lower interest rate, and if a borrower has a poor credit rating, he is likely to have a higher rate of interest. It’s also mentioned that some personal loans come up with an interest rate, which changes over time. No more details were specified. The amount of a personal loan can range between $100 and $50,000 and depends on a customer’s credit score. If a borrower has a bad credit, he is most likely to be approved for a small loan only. Most personal loans offered by Easy Finance com have a fixed repayment period. Most popular repayment terms are 12 months, 24 months, 36 months, 48 months, 60 months. You can also opt for a longer payment term – it will reduce a monthly amount you need to repay, but you will need to pay a higher interest rate. So, long-term personal loans usually come up with a higher rate of interest.

Personal loans: these loans have a fixed rate of interest which does not depend on the loan amount and does not change during the loan period. Interest rates are also determined by a customer’s credit score. In other words, if a borrower has a good credit score, he is likely to have a lower interest rate, and if a borrower has a poor credit rating, he is likely to have a higher rate of interest. It’s also mentioned that some personal loans come up with an interest rate, which changes over time. No more details were specified. The amount of a personal loan can range between $100 and $50,000 and depends on a customer’s credit score. If a borrower has a bad credit, he is most likely to be approved for a small loan only. Most personal loans offered by Easy Finance com have a fixed repayment period. Most popular repayment terms are 12 months, 24 months, 36 months, 48 months, 60 months. You can also opt for a longer payment term – it will reduce a monthly amount you need to repay, but you will need to pay a higher interest rate. So, long-term personal loans usually come up with a higher rate of interest.

Home loans: In this case, customer eligibility depends on several factors, such as repayment capacity, credit history, occupation, income, cost of the house you want to buy, assets or liabilities. The maximum loan amount also depends on the lender. This amount is usually between 75% and 85% of the asset value.

Home loans: In this case, customer eligibility depends on several factors, such as repayment capacity, credit history, occupation, income, cost of the house you want to buy, assets or liabilities. The maximum loan amount also depends on the lender. This amount is usually between 75% and 85% of the asset value.

Payday loans: Below you will see a list of things verified by the lenders when reviewing an online application for a payday loan:

- Income verification – a borrower must have a specific monthly income in order to be eligible a payday loan;

- Bank checking account – a lender checks a borrower’s checking account before approving a loan;

- Social Security number – A borrower has to provide his Social Security number. This way the lender ensures that a person isn’t taking out more loans than he can afford to repay;

- Tracking system – Lenders use a tracking system to check whether or not the client has outstanding debts. Lenders from the network of Easy Finance also check if the client has ever failed on repayment of payday loans.

Auto loans: The type of required documentation for auto loans may vary from lender to lender, but the common documents a customer has to provide is specified on the website: a copy of state-issued identification, proof of residence, proof of a stable income. An auto loan obtained through Easyfinance.com can usually cover up to 100% of a new car’s cost. However, some lenders have a limit. Exact terms of auto loans are not specified since different lenders have different offers – they are determined by a car model.

Auto loans: The type of required documentation for auto loans may vary from lender to lender, but the common documents a customer has to provide is specified on the website: a copy of state-issued identification, proof of residence, proof of a stable income. An auto loan obtained through Easyfinance.com can usually cover up to 100% of a new car’s cost. However, some lenders have a limit. Exact terms of auto loans are not specified since different lenders have different offers – they are determined by a car model.

Student loans: The factors of eligibility for a student loan vary from lender to lender. The most important thing is that a student has to be admitted to a college or institute. Another factor is the age of a borrower: it usually ranges between 16 and 26. In addition, a student has to have a good academic record and a stable parents’ income. The lender will ask a proof of residence, a resume of the student’s performance, a proof of age and a proof of stable income of student’s parents.

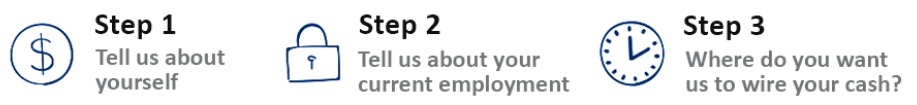

Application Process on Easyfinance.com

Easyfinance.com seems to have an easy and quick application process. It will take no more than 5 minutes and a borrower has to make it within 15 minutes until approval expires. Users can start an application on the front page by choosing a loan type and the requested amount.

A customer needs to fill in an online application form in a form of questionnaire answering to all the questions accurately and correctly. The application will be processed within a few minutes. Then he will be connected to a suitable lender who will contact a borrower by phone or email for the confirmation of personal details provided. If a client is approved for a loan, he gets money on his bank account as soon as the next business day. The funding period depends on the lender.

The online application requires filling in some essential personal details such as name, address, Drivers License Number, phone number, Social Security Number, date of birth, employment and banking details.

Most loans obtained through EasyFinance.com usually do not require collateral which makes the application process much easier. However, some lenders from EasyFinance network may require some kind of assurance to protect themselves in case you non-payment.

As we have already mentioned, you cannot see precise loan rates and terms on this website since Easy Finance is just an intermediate online tool between a customer and a lender.

Loan Repayment

Different lenders offer different loan repayment terms and methods. In general, personal loans are flexible. Payday loans are repaid in one lump sum. Installment loans are repaid in equated monthly installments. Customers can choose the due date, the way and the amount of repayment. Sometimes lenders allow borrowers to make an early repayment without any fees.

Home loan repayment is also made through equated monthly installments. In most cases, the repayment term of home loans obtained through EasyFinance.com ranges from 5 to 40 years. The term depends on a client’s repayment capacity, the loan amount, the interest rate and the loan period. If you want to repay the loan before the specified due date, the lender may welcome it. However, some lenders may charge an additional fee of 1-2%.

Loan Extension

Nothing was mentioned about loan extensions. However, EasyFinance says its lenders have flexible loan repayment policies. So we suppose some of the lenders may allow a loan extension, and others may not welcome it. Customers should consult the lender in advance whether or not a loan extension is possible. We also suspect that a loan extension may incur penalties

Easyfinance.com Bad Credit

EasyFinance.com offers a wide assortment of bad credit loan options. In most cases, the lenders from its network do not do any credit check, but the lender has the right to review your credit score, when necessary. Borrowers with a bad score are to meet the same eligibility criteria: a client must be at least 18 years of age, be a legal US resident, and have a stable monthly income of at least $800.

According to the website, clients with poor credit is not likely to get large amounts exceeding $1500. Loans up to $500 can be approved any credit check. What you should be aware of is that bad credit loans obtained through Easy Finance service come with larger fees and interest rates. Some online lenders may also charge pre-payment fees.

Auto loans and home loans require a credit profile review. It’s important for a lender to know that you will be able to pay off a large amount of money.

Considering these, a borrower with bad credit score must fully understand the terms and the costs of a loan before signing an agreement.

Technical Characteristics of the Website

Checking Encryption

EasyFinance.com takes some measures to secure customers’ sensitive data like passwords or account number details. The website uses a standard 128-bit SSL encryption technology. A green lock at the address bar indicates that you may type in personal details without any risks. The secure connection is verified by GeoTrust Inc:

In general, we are satisfied with the website’s security. However, we’d love to discover more advanced security measures like a 256-bit SSL encryption with an Extended Verification.

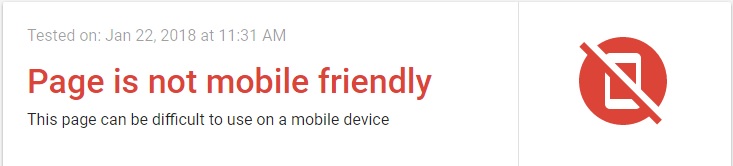

Checking Mobile Version

Online portals like EasyFinance.com are often visited by mobile users, so the website’s mobile version should be of a great importance.

Regretfully, this website is NOT mobile-friendly and cannot fully satisfy all the needs of people who prefer using mobile devices. According to Google tool, EasyFinance.com is difficult to use on a mobile device.

The Google online service noticed two main problems: the content is wider than the screen and the clickable elements are too close together.

So, there is NO mobile version of this online-matching service. If you want to get a loan using a mobile device, you’d better search for other more convenient options.

Checking Antivirus

Websites providing financial services must do their best to provide customers with a high level of security. Regretfully, EasyFinance.com is not protected from online threats. Using this service, you run risks of infecting your computer with viruses. Risks for online thefts and hacking are also not excluded.

We think an antivirus program is essential for such service. The website’s owner should install a virus protection program to gain more trust from customers.

Convenience of Using Easyfinance.com

At EasyFinance.com, you do not need to create a personal account and register. You can start an application right from the front page by clicking a corresponding button.

After clicking on the “Get Your Offer” button, you are asked to provide some personal details required for the lender: name, address, phone number, SSN number, Driver License number, an employer, income, bank account number. These details are required by any online service providing loans online.

Once you fill in all the field, the online-matching service will pre-approve your loan application and connect you to a suitable financial services provider. In rare cases, the lender may ask for some additional information. When a customer is approved, he gets money within 24-48 hours.

The online service cannot disclose the definite terms and rates of any financial product offered on the website since EasyFinance is a just a link between a borrower and a lending institution So you need to have some patience – all the necessary information will be provided by a lender.

EasyFinance is a very informative website. Here you can compare all loan types and choose the best one:

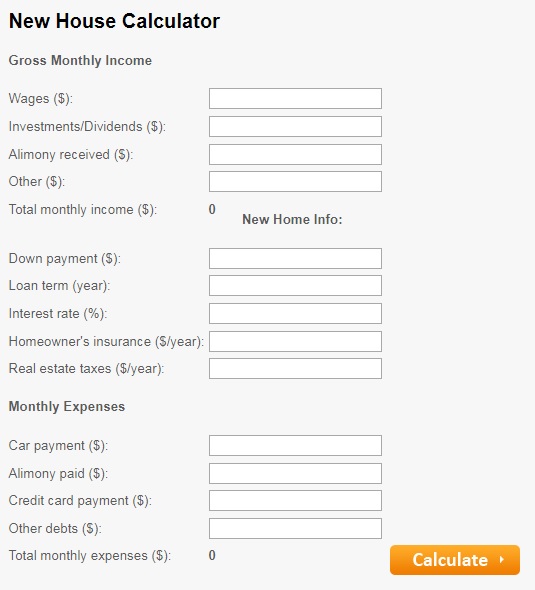

They also offer different tools, articles and other information that can make every person better financially educated. Also, the website has two blogs that will help users make smart financial decisions.

We also found here many tips to make well-informed financial decisions and advice to save money every month.

We also appreciate that the website provides several calculators. For example, below you can see a New House Calculator which help you to find you for which period you need to take a loan:

Considering all these advantages, we conclude that EasyFinance.com is a very convenient and informative online-matching tool.

Is Easy Finance com Legit?

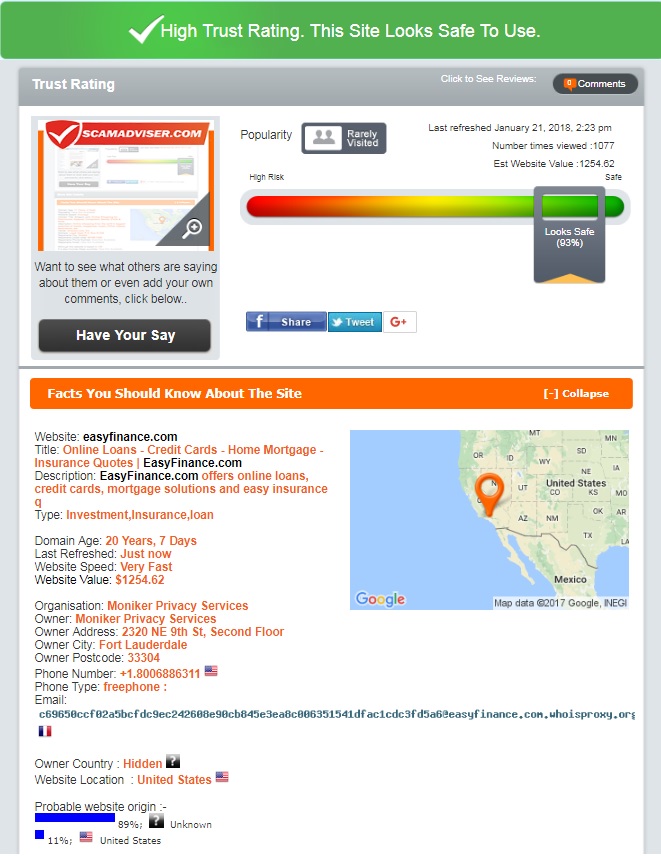

Before using any website related to financial services and products, we recommend you to check its reputation and background using a verification service ScamAdviser. The analysis results were inspiring: EasyFinance.com trust rating reached 93%% out of 100%! It’s a very good rating!

According to ScamAdviser, the website looks safe to use. The domain age is 20 years, however, its’ only 7 years according to the information placed on the website (which is also a relevant term). Regretfully, ScamAdviser could not determine the website owner country since the website’s owner is using an anonymous service to hide its identity. However, the website location is clearly specified – the USA. In addition, the website has a few visitors. No doubt, there are some suspicious and unclear aspects of this company but nothing indicates that this service is a scam. Scam Adviser is sure that EasyFinance is legitimate.

Easyfinance.com Reviews

On-site Reviews

We’d love to see at least some Easyfinance.com reviews on the website – this would be the best way to ensure we deal with a reliable and trusted lender. Regretfully, we found no testimonials page. It’s bad that users do not have an opportunity to write about their personal experience with this service. So we had to search for any reviews from customers on independent websites.

Reviews on Independent Websites

Unfortunately, we did not find any Easyfinance.com reviews on independent websites either. That could indicate that this online service is not popular. But we found out that the domain age if 20 years! How is it possible that the company did not get any reviews over such a long period? If you ever come across any comments about Easy Finance, please let us know!

Contact Us section

Contact Information

The website’s Contact page contains the following EasyFinance contain information:

USA Office:

3450 Sacramento Street, Suite 142

San Francisco, CA 94118

Phone: 415-358-22-30

Fax: 415-358-22-31

There was a confusion with Easy Finance phone number: the website listed two more phone numbers customers can use to get a loan, and it’s not clear for us which number it’s better to call:

We were happy to see the photos of Easy Finance management team with a detailed description of each member:

Regretfully, we found no EasyFinance.com email which could complicate contacting to customer support service.

Easyfinance.com Locations

Unfortunately, the information of about Easyfinance locations was not found on the website so it’s not clear in which states this service is available. Customers would like to know this information from the very beginning in order not to waste time. This kind of information will let potential clients know that they will not be refused a loan only because they live in a location where Easy Finance products are unavailable.

Getting a Consultation

The company offers too limited ways of contacting EasyFinance customer support team. Customers can reach a manager only calling at one of three specified phone numbers. It’s will be impossible to reach a customer support through live chat, email, or contact form – none of these options is available. For this reason, we were not able to check the customer support of this online-matching service. There are many things this company needs to improve.

Conclusion

EasyFinance.com helps customers to find the best financial services and products, being a link between a client and a financial institution. The preapproval online application seems easy, the tool is able to find a suitable solution for your financial needs within a few minutes. The website contains general details about all loans types but cannot reveal the exact terms and rates of a loan. There are many aspects we like: a wide network of lenders, fast preapproval process, a rich selection of sums, numerous loan options, users’ data protection, a good trust-rating from Scam Adviser, numerous articles and tips available on the website. But we cannot give Easy Finance a high score since there are some things that need to be corrected: the company offers too limited ways for contacting its customer support, no antivirus, no mobile version, no information about locations, no precise information about loan rates and periods. In general, EasyFinance.com is a useful service for people who want to get fast loans online. 2,8 stars out of 5 is a reasonable rating for this company.

Ready to Apply?

Ready to Apply?