What is DirectPaydayLoans.net?

DirectPaydayLoans.net is an online matching service which connects consumers with its network of direct lenders. This website is not a lender and does not make any credit decisions. It does not control the actions of any lender from its network. The company claims to be dedicated to protecting its consumer’s from unreliable and illegal lenders. The portal provides consumers with the knowledge that is required for making a responsible and informed financial decision.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans | $100 | $1,000 | 7-30 days | 391% | SSN, bank statement, pay stub, driver’s license | Yes |

Types of Loans

The company helps consumers find payday loans (cash advances). These are short-term loans are given to individuals until their next paydays. Such loans are designed to provide the person a temporary financial relief. A payday loan is not a long-term financial solution and should not be requested by people who have outstanding debts and credit difficulties.

After you have been approved for a loan, the funds will be transferred to your checking account. Money transfer times may vary between lenders and may depend on your bank but typically clients receive their funds within 1 or 2 business days.

Terms of Use

Applicants are not obliged to use the services of this website. They will not be charged any fees for using this online matching service.

DirectPaydayLoans.net will transfer your information to direct lenders from its network who are able to make a suitable offer. This portal does not guarantee that all applicants will be matched with a lender, be offered a loan with desirable rates or terms, or be approved for a loan.

Using this website, you can borrow anywhere from $100 to $1,000. The approved amount will be determined by your lender. Bear in mind that not all locations can offer high loan amounts. For example, residents of California can be currently only offered loans in the maximum amount of $255 because that is the maximum legal amount in this state.

Most lenders from the network of Direct Payday Loans have the following requirements to be approved:

- be at least 18 years of age;

- have an income of around $1000 each month (after tax deductions);

- be employed at your present job for at least 3 months;

- be a legal US resident;

- have an active checking account in your name;

- provide work and home phone numbers;

- provide an active email address.

You may be approved for a loan even if you have a current loan with another lender. But you’ll need to disclose this loan to the company.

Average APR for a payday loan is 391%. For example, if you want to borrow $100 for 14 days, you will be charged $15. On the due date, you will need to repay $115.

Repayment terms vary by lenders and states, and not every client will be able to get 90-day terms. In some cases, the lender may ask you fax some documents.

Application

To get a loan through Direct Payday Loans, you will need to complete a short application form. The web portal will try to connect you with a suitable lender within seconds. The lender will soon contact you and will ask to fax some additional information such as your pay stub and bank statement, so applicants should have a fax machine at home or they can use ones available at Kinkos, Mail Boxes, Stables etc.

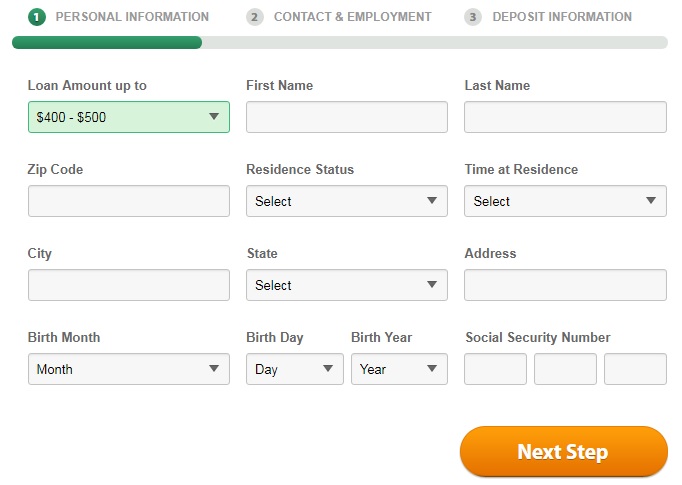

The requested data includes your SSN (social security number), full name, zip code, living address, driver’s license number, work, and personal phone numbers, date of birth, job title, employer’s address and name, ABA/ routing number, pay dates, name of your bank, net income per month, and some others

You do not need any collateral and can be approved within 10 minutes.

Repayment

Payday loans must be usually returned on the day you receive your next paycheck. The original loan + fees will be withdrawn automatically from your checking account.

Non-payment might incur additional fees and penalties and negatively affect your credit score.

Lenders may initiate collections to the legal extent. Your debt may be sold to independent collection agencies if you do not pay off your loan on time.

Extension

According to the website, extension policies vary by lender and location. Some lenders may automatically extend your loan for another 14 days if you don’t return it on time, while others do not allow extensions at all. You should find out if your lender allows rollovers/extensions. If you need an extension, you should contact your lender prior to the due date in order to discuss the available solutions. If you do not contact the lender on time, you will be charged additional fees.

For example, residents of Alabama may be offered an extended repayment option of 4 monthly installments of the remaining due balance. In Montana, a lender may extend your loan for no additional charges. In Virginia, payday lenders cannot extend any loan.

To find out extension policies in your location, you can visit a “Rules in Your State” page.

Once you’ve paid off the debt, you can usually apply again. after 2 hours.

DirectPaydayLoans.net Bad Credit

All lenders from the network review your credit history in national databases, such as Equifax, Transunion, Teletrack, DP Bureau, or Experian to determine your solvency and credit capacity. They will typically not use the three major credit reporting bureaus: Experian, Equifax, or Trans Union. Lenders will typically NOT report your repayment history to credit bureaus so your credit score will not be affected. So the answer is YES, you can be approved for a payday loan even if you have bankruptcy and also credit related issues.

Technical Characteristics of the Website

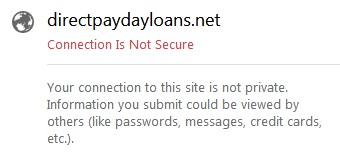

Secure Сonnection

DirectPaydayLoans.net claims to use secure technology to protect users’ personal information. However, it turned out that the website’s connection is NOT secure, which means your information can be intercepted or decrypted by others.

I recommend the site’s owner to use reasonable security measures and take responsibility for the users’ safety. Besides, since this web portal is an intermediate party, it contains links to third-party websites and their security is also under a big question.

Mobile Version

Fortunately, the website has a mobile version, This was confirmed by Google Mobile-Friendly test:

According to the report, this website is easy to use on a mobile device. The content is enlarged, links are not close together, there is no scrolling, no secondary information. If you prefer to use your smartphone instead of a PC, you will like this web portal.

Antivirus

DirectPaydayLoans.net utilizes a Secure Site Pass safeguard to protect your personal information from all unauthorized access of third parties.

The Secure Site Past trustmark guarantees that the website passes intensive security scan every day. The antivirus checks the website for possible personal data access, links to unreliable sites, phishing, and other dangers. This daily testing helps the company to protect your sensitive information from hackers.

Convenience of Use

Requesting a loan through this website is easy. You do not need to register. All you need is to fill out a short application form and your request will be directed to the network of direct lenders. To begin with, you should select the requested amount, enter your zip code and email:

After that, you should fill in the empty fields in 3 blocks including Personal, Contact and Employment, and Deposit Information.

Once approved, you will be redirected to a direct lender’s page, where you will find the exact terms and rates of the loan. You should be matched with a suitable company in a few seconds. The lender will soon contact you and will ask to provide some additional information (such as your fax number and recent pay stub). If you like the terms of your loan, you will come into an agreement and get the funds deposited to your banking account.

The whole application is easy, the online portal has a comprehensive FAQ section, however, bear in mind that DirectPaydayLoans.net is NOT a direct lender and the application will be completed on a website of a third-party organization.

Is DirectPaydayLoans.net Legit?

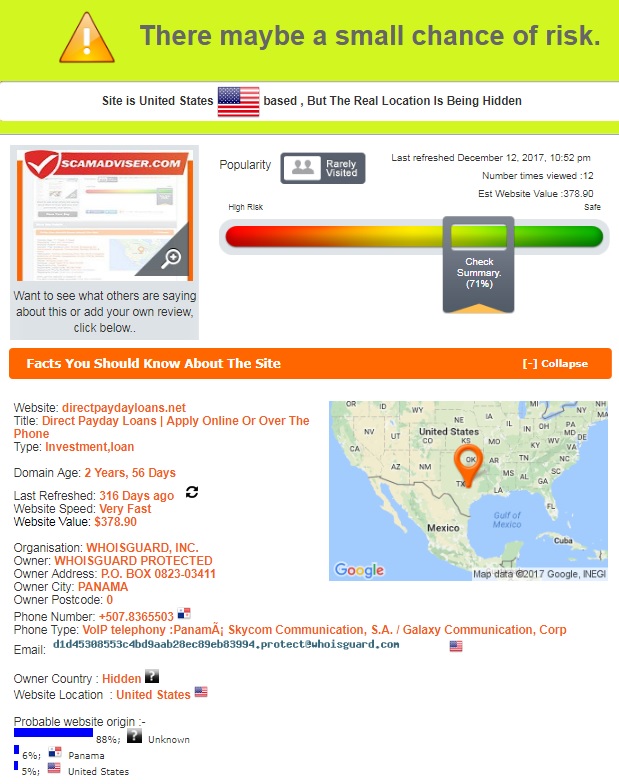

ScamAdviser gave Direct Payday Loans a 71% trust rating, which means that there may be a small chance of risk.

According to ScamAdviser testing, the domain has been operating for only 2 years. The site is based in the United States but its real location is being hidden. Obviously, it can relate to Panama. Another concerning aspect is that the website is rarely visited, and you should consider this information before applying for a payday loan via this portal.

DirectPaydayLoans.net Reviews

On-site Reviews

Before using online services, people want to read about a company and get acquainted with the opinions of those who have already used it.

Customer feedback is an important component for any online company. Positive reviews can dispel doubts that keep you from making a purchase. They can also help determine the choice.

Openness to user comments and even criticism is also an important part of the marketing strategy of any online company. Surely, users want to share their impressions and be heard. It may be very important for them to be able to express any opinion about the services provided, show their discontent and share positive experiences. By providing this opportunity, the company can become closer to the customers and establish a more trusting relationship with them.

Unfortunately, I found no DirectPaydayLoans.net reviews on their own website. The complete lack of testimonials on a site can be a stop-signal for many potential customers. I recommend the company’s owner to begin with creating a Testimonial page, where their clients will able to share their opinions.

Reviews on Third-Party Websites

Regretfully, external Direct Payday Loans reviews are also unavailable. Not a single client shared his experience of using this website. I think the company has no reviews because it’s rather “young” and has not yet gained popularity. So far, I cannot assess their reputation based on customer testimonials. If you ever come across any comments about this online portal, please let us know – just leave a feedback below!

Customer Support

Contact Information

I found no Direct Payday Loans address, however, they provided their phone number 1-866-971-7538 and email address: [email protected].

![]()

It’s nice to see these contact details but I’d have been more satisfied if they had provided their physical address. It’s important to know that you are using a transparent company.

DirectPaydayLoans.net Locations

This service is not available in all states. They have locations in the following cities: Antioch, Bountiful, Chattanooga, Chicago, Cincinnati, Clarksville, Clemson, Colorado Springs, Columbus, Crown Point, Denver, Fitchburg, Fort Gratiot, Grand Junction, Greenville, Hampton, Hawthorne, Houston, Humble, Kearns, La Porte, Lafayette, Lake Orion, Lancaster, Leesville, Lorain, Los Angeles, Louisville, Memphis, Mobile, Mount Pleasant, Nashville 37207, Nashville 37211, Omaha, Roanoke, Rock Hill, Saint Joseph, Tulsa, Virginia Beach, Waterloo, West Jordan, Houston, San Antonio, Dallas, Austin, Fort Worth, El Paso, Arlington, Corpus Christi, Plano, Laredo, Lubbock,, Garland, Irving, Amarillo, Grand Prairie, Brownsville, McKinney, Pasadena, Frisco, Mesquite, Killeen, McAllen, Waco, Carrollton, Los Angeles, San Diego, San Jose, San Francisco, Fresno, Sacramento, Long Beach, Oakland, Bakersfield, Anaheim, Santa Ana, Riverside, Stockton, Irvine, Chula Vista, Fremont, San Bernardino, Modesto, Fontana, Santa Clarita, Oxnard, Moreno Valley, Glendale, Huntington Beach, Rancho Cucamonga, Oceanside, Ontario, Santa Rosa, Garden Grove, Elk Grove, Corona, Hayward, Lancaster, Salinas, Palmdale, Sunnyvale, Pomona, Escondido, Torrance, Pasadena, Orange, Fullerton, Roseville, Visalia, Concord, Thousand Oaks, Santa Clara, Simi Valley, East Los Angeles, Victorville, Berkeley, Vallejo, Fairfield, El Monte, Carlsbad, Temecula, Costa Mesa, Murrieta, Downey, Antioch, San Buenaventura (Ventura), Inglewood, Richmond, Clovis, West Covina, Daly City, Santa Maria, Norwalk, Jurupa Valley, Burbank city, San Mateo, El Cajon, Rialto, Vista, Vacaville, Compton, Arden-Arcade, San Marcos, Mission Viejo, South Gate, Hesperia, Chico, Carson, Santa Monica, Santa Barbara, Redding, Westminster, Tracy, Menifee, San Leandro, Livermore, Chino, Indio, Citrus Heights, Hawthorne, Whittier, Redwood City, Newport Beach, Alhambra, Hemet, Lake Forest, Merced, Buena Park, Pleasanton, Mountain View city, Lakewood, Tustin, Chino Hills, Napa, Manteca, Alameda, Milpitas, Folsom, Perris, Bellflower, Upland, Baldwin Park, San Ramon, Union City, Rancho Cordova, Turlock, Apple Valley, Pittsburg, Redlands, Lynwood, Walnut Creek, Davis, Yorba Linda, Redondo Beach, Camarillo, South San Francisco, Palo Alto, Yuba City, Lake Elsinore, Laguna Niguel, Lodi, Madera, San Clemente, Santa Cruz, Rocklin, Tulare, Carmichael, Pico Rivera, Florence-Graham, Eastvale, Montebello, Encinitas, Castro Valley, La Habra, Brentwood, National City, Monterey Park, Dublin, Petaluma, Cupertino, Gardena, La Mesa, Woodland, South Whittier, Porterville, San Rafael, Huntington Park, Arcadia, Santee, Gilroy, Diamond Bar, Hanford, Fountain Valley, NovatoHighland, Paramount, Colton, Cathedral City, Rosemead, Watsonville, Hacienda Heights, Yucaipa, West Sacramento, Delano, Palm Desert, Glendora, Placentia, Aliso Viejo, Cerritos, Rowland Heights, Poway, Azusa, Florin, La Mirada, Cypress, Rancho Santa, Margarita, Ceres, Covina, Antelope, San Jacinto, Palm Springs, Lincoln, San Luis Obispo, Newark, Beaumont.

Each city may have its own policies, rates and terms, so you should carefully review current laws and regulations in your particular state. The company mentioned that the list of cities may change from time to time. In addition, they want clients to know that all transactions on this website will take place in the state of Nevada, regardless of your location.

Getting a Consultation

If you have any questions related to your loan rates and fees, payment, status and extension, you need to contact your lender directly because DirectPaydayLoans.net has no knowledge of loan details. But if you have any general questions about payday loans or service provided by the intermediate party, you can contact the customer support team by sending an email to [email protected] or calling 1-866-971-7538.

I attempted to contact the representatives of this company via email but they did not respond to my request within 12 hours. Regretfully, I conclude that their customer care department is far from perfect.

Conclusion

DirectPaydayLoans.net is a matching service which helps customers to find reliable payday loan companies. Loan amounts cannot exceed $1,000 and only reach $255 in some states. It’s nice that the lenders from the network do not require collateral and approve clients with bad credit. Using this web portal, you can avoid visiting numerous website and completing endless online application forms – the service will find a suitable lender in a few seconds. I also like that the website is utilizing an antivirus program that daily screens it for online vulnerabilities and access by unauthorized third parties. In general, Direct Payday Loans seem to be a good online service for finding a direct lender, however, this website is only 2 years old and has not received any online reputation yet. Scam Adviser reported that there may be some risk so you should be careful when using this company. I think there are better online referral services and lenders on the net and you should review them all.

Ready to Apply?

Ready to Apply?