Checkngo.com Introducing Itself

Checkngo.com is financial organization providing payday loans to US customers. The company runs its activity since 1994 and during all this time Checkngo.com does its best to provide high-quality services and satisfy customers’ need in full at the shortest time. The main goal of the company is to help people solve their financial problems in no time when other lenders refuse them. As the company claims their conditions are the most attractive and the service is one of the most reliable in the business. Checkngo.com offers loans for all people that are interested in taking them, but depending on place of residence terms may vary. The company constantly takes measures to improve its performance and services and takes part in different charity events.

Checkngo.com is financial organization providing payday loans to US customers. The company runs its activity since 1994 and during all this time Checkngo.com does its best to provide high-quality services and satisfy customers’ need in full at the shortest time. The main goal of the company is to help people solve their financial problems in no time when other lenders refuse them. As the company claims their conditions are the most attractive and the service is one of the most reliable in the business. Checkngo.com offers loans for all people that are interested in taking them, but depending on place of residence terms may vary. The company constantly takes measures to improve its performance and services and takes part in different charity events.

| Type of loan | Min amount | Max amount | Interest rate | Terms | Documents required | Bad credit history |

| payday loans; installment loans; cash advance; check cashing; netSpend prepaid MasterCard | $100 | $1500 | Should be agreed | Should be agreed | valid ID number, checking account number | No |

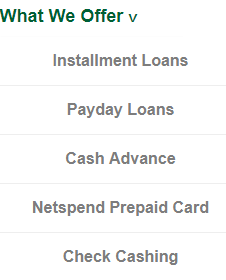

Types of Loans

Check ‘n Go offers its customers several types of loans:

- payday loans – easy way to get small amount of money if you urgently need it to your next payday;

- installment loans – larger amounts of money repaid in several payments according to pay schedule;

- cash advance – help you need without hassle of credit cards or credit rating approval;

- check cashing – get access to your money in your neighborhood and on your schedule, when the bank is closed;

- netSpend prepaid MasterCard – more flexibility and convenience than just having cash in hand.

Detailed information about services provided on the website can be found in the head menu in «What We Offer» tab. Each page contains decryption of the chosen type of loan and its advantages over others. Also you can find our available services for your residence.

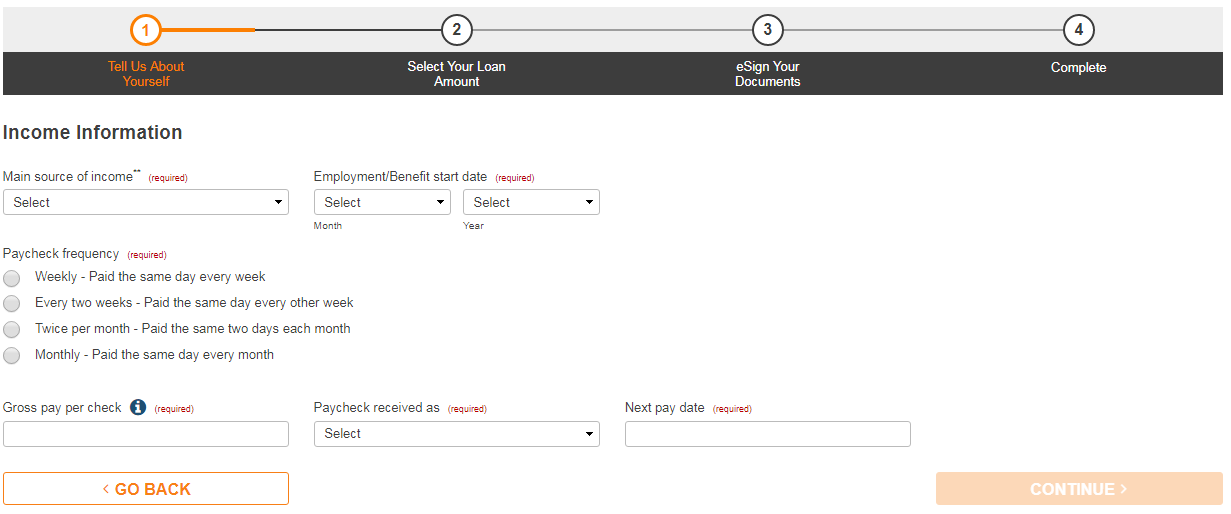

Amount of loans and conditions are determined in each case individually. These issues depend on many factors, that are considered when you apply for a loan (location, income, employment, etc.).

After the application is approved, money will be issued during 1 business day, as company claims, but again, this depends on how fast the application is approved and conditions applied in your state. You can get funds transferred to your bank account or by mail.

Do I Qualify?

To get a payday loan in Checkngo.com you need to meet several requirement of the company:

- steady source of income;

- a form of identification;

- an active address and phone number;

- a valid check for an in-store loan.

For applying for installment loans make sure that you satisfy the following requirements:

- a verifiable form of income. This can include: your most recent pay stub, SSI award letter, or retirement benefits (including pension and alimony). We do not accept beneficiary income.

- an active checking account that allows direct deposit.

As you can see different services have different requirements, so if you are not employed there are little chances to get a loan; installment loans are not issued to unemployed customers at all. For other services there are no special requirements, except for general ones applied in each financial institution.

As you can see on the website, you can lend from $100 to $1500. Terms of loan are determined by your lender, as well as interest rate and available amount for you. All these questions are discussed with you lender accounting several factors that prove your solvency for claimed conditions of the loan.

Application

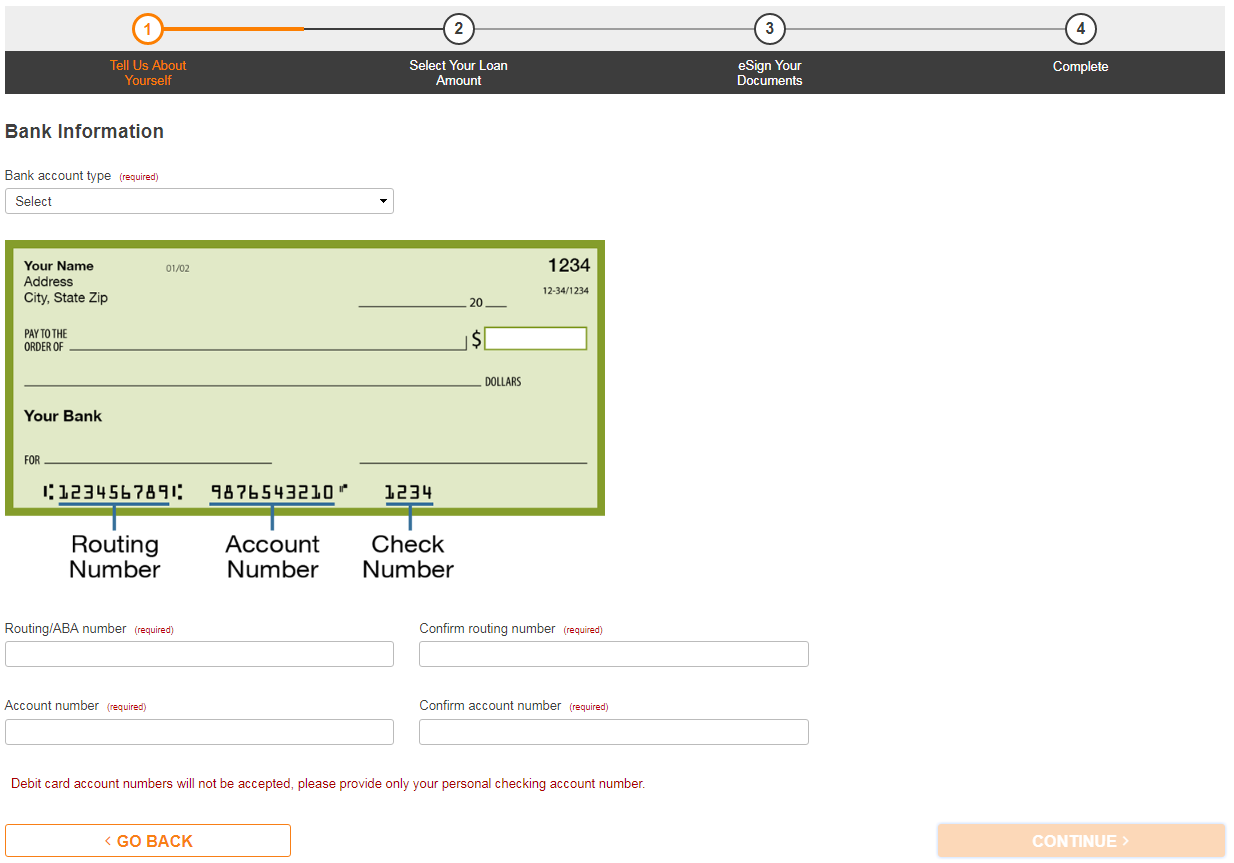

For applying for a loan you actually don’t need to show or send any documents as the company claims. Now they offer faxless loans, that save you time on sending faxes with your documents copies. You only need some banking information about your account when filling in application form, but there is no need to send proof. However this conditions may change in you take a loan in-store, beside different lenders have specific requirements for different types of loans. You anyway need to ask your lender for details.

According to information on the website, you don’t need any proof of your income and employments, but there is no information about guarantors. We can assume that customers also don’t need to provide guarantors for taking a short-term loan.

Applications are claimed to be considered during several minutes, but still bear in mind that in make take longer as you credit worthiness may be doubtful and lenders will need to check your solvency and other information. But usually this process doesn’t take long and after you get approval, money will be transferred to you during 1 business day or period specified by a particular lender.

Repayment

To pay back your loan you have several options:

- automatic withdrawal – money are taken from your banking account at the due date. This is the most preferable way to payback. Besides for online loans this is the only available option. That’s why when applying you need to have a valid checking account in the bank;

- in-store cash exchange – some payday lenders will provide possibility of in-store payday loan repayment before due date, in exchange for return of post-dated check. Remember that not all lenders allow this possibility, so make sure to ask your lender about it.

All this information is provided in the «FAQ» section, there is no special page for pay back options, which is quite inconvenient.

There is no information on early pay back, so we think that this question should be specified at your lender, as terms may vary. In case of late or non-payment, it will be sent to collections, so you are advised to consider your possibilities to pay back your loan before you take it. Amount of penalties is not specified.

Loan Extension

In the «FAQ» section you can find detailed description of «Renewal, rollover and refinancing» policy, with definitions and explanations of all terms. You can extend and postpone payment, but to do that you need to consult your lender and find out about additional fees.

To find out if you are eligible to refinance or rollover you loan you need to visit your account and look for a special button. It is only visible if you were approved for these options.

It is clearly stated that you can have only 1 loan at a time at one lender. You can ty to get another loan at another lender, but there is little chance you will manage to get it. All legal and licensed lender check their clients’ credit history and do not approve application if there is not paid off loan present.

Checkngo.com Bad Credit History

On the website you can find information that for installment loans Check ‘n Go checks credit history of the customer in Experian, a global credit information service used to determine credit worthiness. A client must have minimum FICO score of 500 in order to qualify, although this is condition may be changed.

There is no clear information on this subject about payday loans, but we guess that if you have to provide your financial information, this rule applies to all kinds of loans. Anyway, it is necessary to clarify this issue at your lender.

Technical Data of Checkngo.com

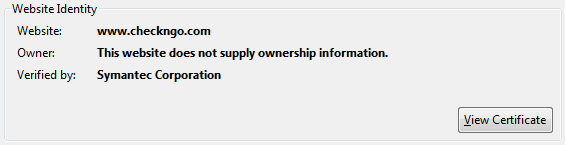

Secure Connection on the Website

For most customers issue of data security is the mist important. And you can also find a question concerning security of personal data provided on the website in the «FAQ» section. So to protect customers information from unauthorized access and use, most websites use secure connection with data encryption. It is very easy to check if the website you are using has the secure connection – in the upper left corner near the address you can see «https://» instead of «http://» and a green lock. This means that the company uses special protocol to protect sensitive data of customers from theft.![]()

You can find all details about certificate of safety on the website, it is at free access to each customer. As we can see the Check ‘n Go provides the highest level of protection with 256-bit encryption, but unfortunately there is no information about this certificate owner, which prevents customer from getting clear idea of protection level on the website.

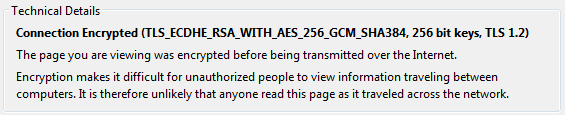

Mobile Version

The website has a very well organized mobile version. The website is completely adapted to the mobile screen and everything is organized in such a way, so that customer were comfortable to use it. All function remain the same, you can easily apply for a loan via mobile device. The text is readable and all links are clickable. There are no flaws and the mobile version functions really effectively.

According to Mobile-friendly test the mobile version of Checkngo.com website is user-friendly, which proves our conclusion about the website functionality in mobile version.

Antivirus Protection

As it is said on the website, the company provides antivirus protection for its customer. You can click the icon in the bottom of the main page and read details of the certificate.

We can assume that Check ‘n Go care bout its customers and does its best to provide necessary level of protection on the website. Customers can not only be sure that the company will help them to solve financial difficulties, but also protect them from various malwares.

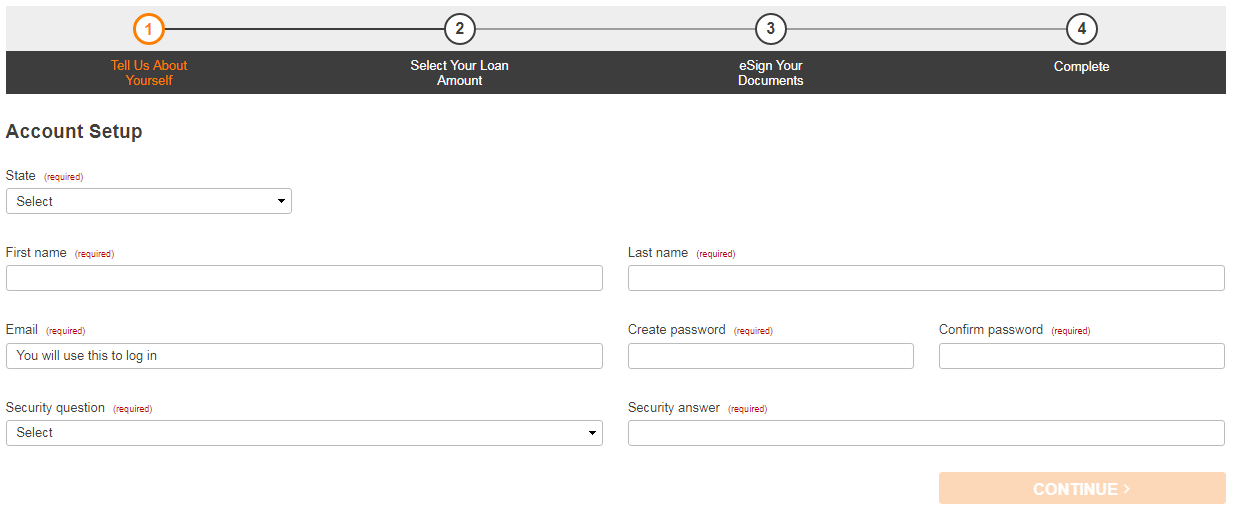

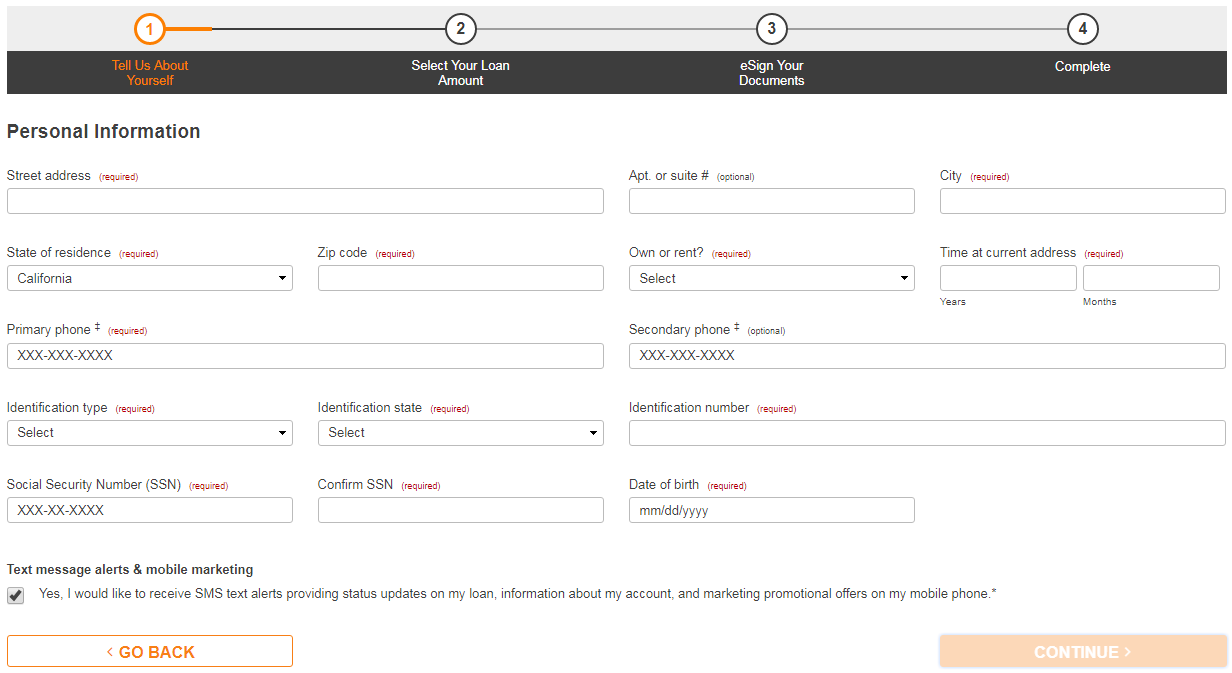

Convenience of Application

Filing an application for a loan is quite complicate on this website. First of all, you need to create an account, but this procedure is included in application. On the main page of the website you can find a link to application. After you clock the button, you are directed to page with the special form. You have to provide lots of personal information, including bank account data, information about your employer and other similar data. All this information is provided at the first step and it can take about 15 minutes to fill it in.

After you provide all necessary information, for some reason your application is already sent for approval. You don’t choose amount of money needed or period for which you want to take a loan. As we couldn’t complete the process we can’t say how long exactly it will take to apply for a loan. All we can claim is that the process is too difficult and time-consuming. There are lots of other companies offering to grant a loan without asking for all this information.

It can be concluded that many customers may face difficulties while filling in application, so they will have to ask the support group for help and guidance.

Is Checkngo.com Legit?

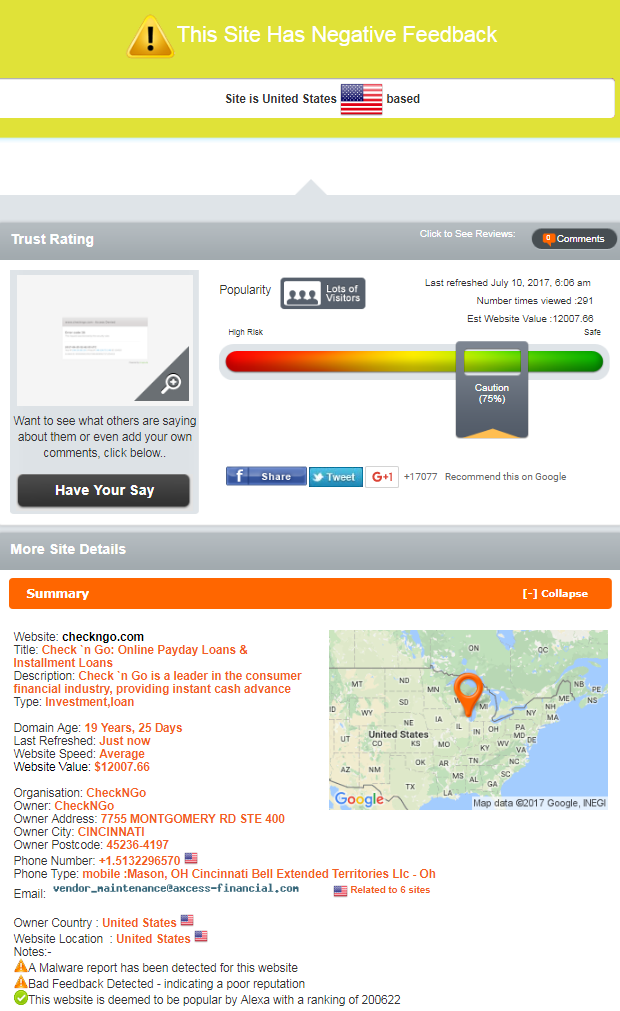

According to ScamAdviser.com the website has some problems with legitimacy. Though Check ‘n Go has 75% is safety rate, there is data that there are many negative feedback about work of the website. The website is popular as it has lots of visitors and there are no controversial information about its location.

Besides the address indicated in contact information on the website is the same as stated in the report, which proves that administration of the website doesn’t try to hide something from its customers. Its activity is legal and the company is a reliable source to get money when you urgently need it.

However the report says that there were malware reports detected on this website, which is a great drawback. Although there is antivirus program on the website it turns out that it is not effective at all. So you should be very careful while using this website, and make sure that you take all necessary measures to protect your device and yourself from some unpleasant situation.

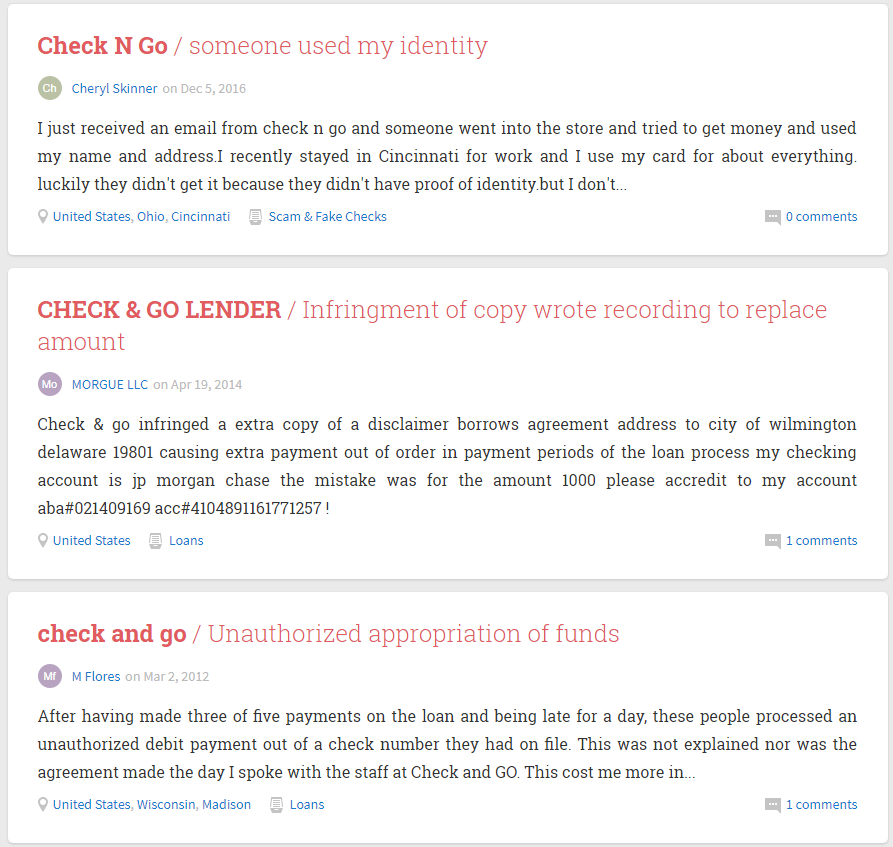

Checkngo.com Reviews

Reviews on the Website Itself

There is no page with reviews of customers left on the website itself. There is no special form for sending feedback to the company. There is a special page with «Customers Reviews» but when you visit it you can see that all comments are taken from another website – TrustPilot.com.

It is very inconvenient that there is no comments, and customers can’t share their experience on the website as there is no special form. At least the company provides comments from other reliable websites, and customers read them right on the website.

Comments on Other Websites

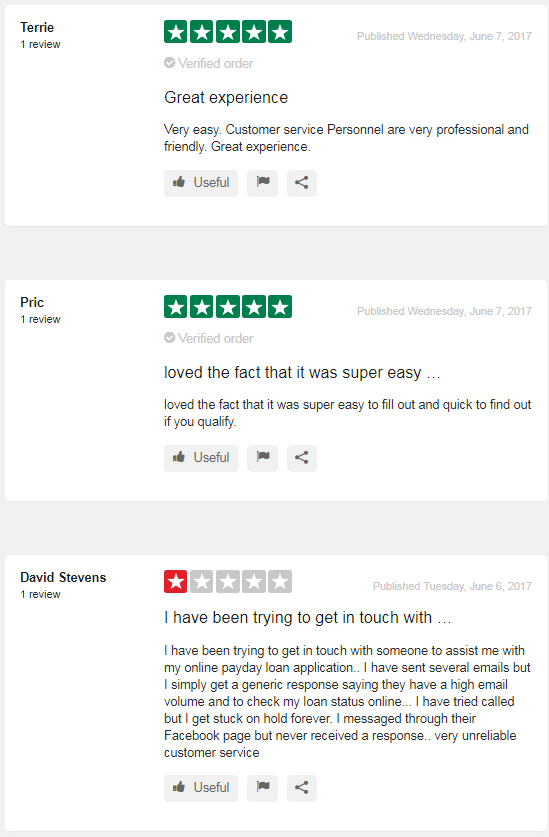

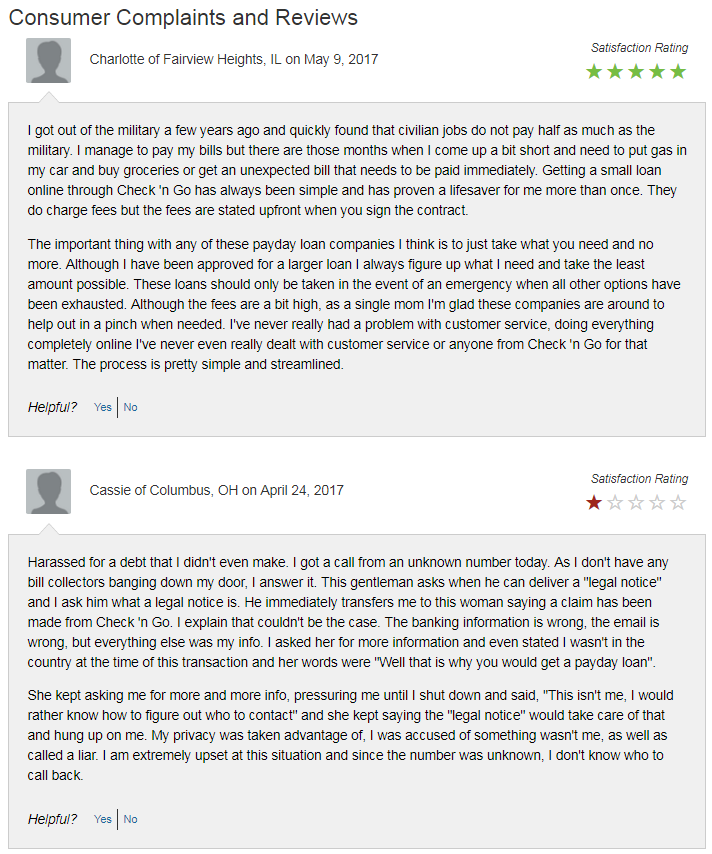

If you look in the Internet for comments about Checkngo.com service, you will find lots of different forums. There are both positive and negative comments, as it should be with any real company.

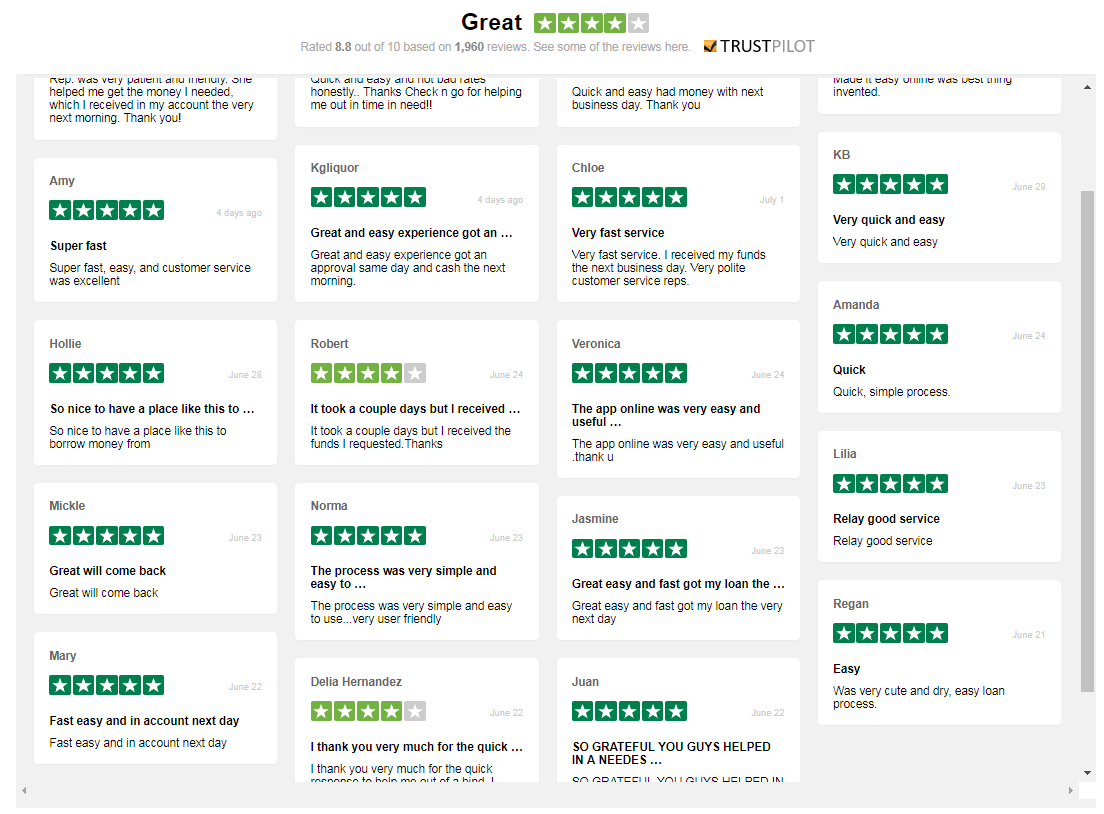

Negative comments in majority concern customer service and speed of money issuing. But in general customers are satisfied with the service. As it was said earlier the website gives customers feedback from TrustPilot.com. There the company got 8.8 out of a 10 star rating which is a great result.

Also there are other forums containing lots of feedback about Check ‘n Go. They give us a pretty good idea about how the company runs its activity. Also we found a forum with complaints only, and found out that there are troubles with data protection on the website. Although these comments were left a year ago, so probably the situation has changed. Besides we so the certificate of security showing that level of safety here is high.

Customer Service on Checkngo.com

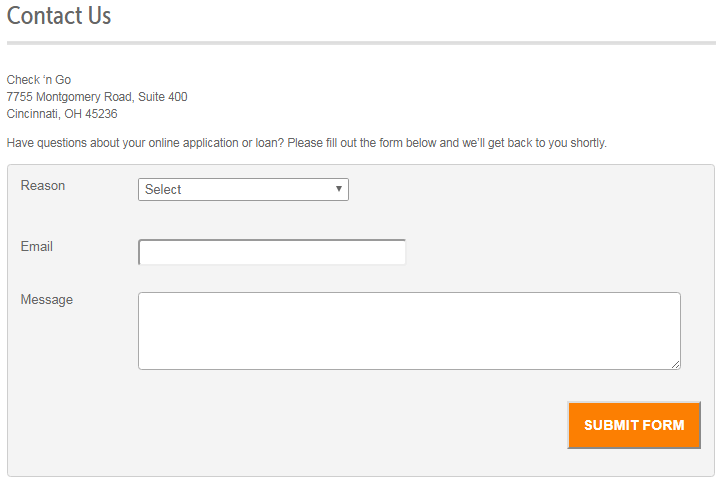

Contact Information

In the header you can always find telephone number of the support group no matter what page you visit. Also there you can find «Contact Us» button. By clicking it you will go the page with contact details of the company.![]()

Unfortunately on this page you won’t find full information – only mailing address and contact form. Hours of operating are indicated in the footer. So basically you get necessary information but it is very inconveniently organized.

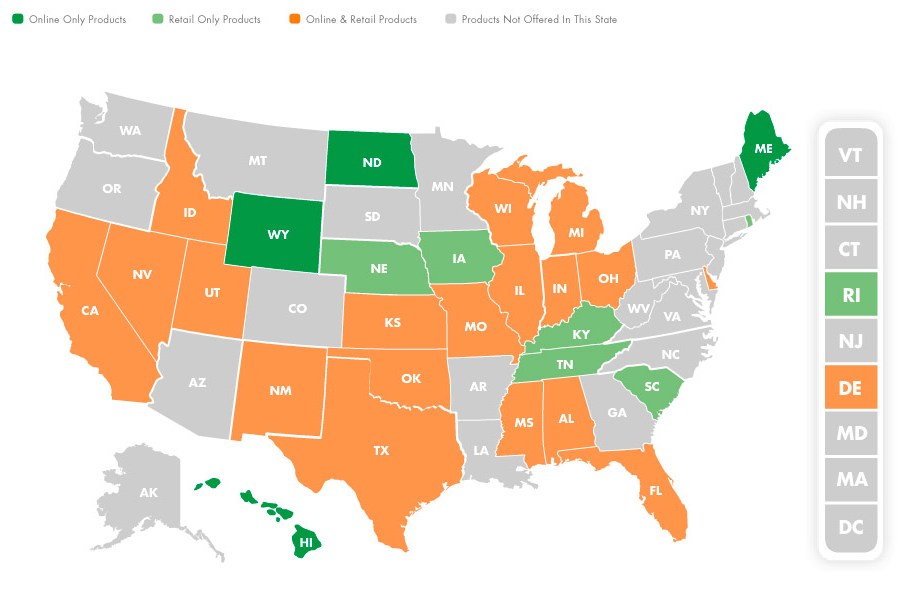

Locations

Check ‘n Go provides customer with the map of its offices locations and services available in each state. This information is provided in the special section «State Center». This page will be very useful for all customer to quickly find office in you state.

Analysis of this map shows that in general Checkngo.com offers its services in 28 states. The table below presents the list of states divided according to services provided there.

| Online Only Products | Retail Only Products | Online & Retail Products |

| North Dakota Maine Wyoming Hawaii | Nebraska Iowa Kentucky Tennessee South Carolina Rhode Island | Idaho California Nevada Utah New Mexico Kansas Oklahoma Texas Missouri Wisconsin Illinois Mississippi Indiana Michigan Alabama Florida Ohio Delaware |

Support Group Service

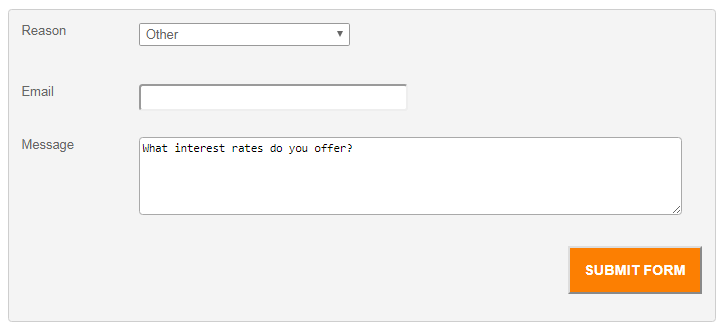

There is no information about interest rates offered on the website, so we decided to ask the support group to give us information. Since there is no live chat option to get instant answers, we have only 2 options: phone call and contact form. We filled in necessary field in the contact form and tried to send a request.

Unfortunately we didn’t manage to do that. After you press the submit button you are directed to a blank page and nothing else happens, so the support group is ineffective. We didn’t manage to contact the company and get answers to our questions. Probably their phone numbers are working and you will get to managers.

Conclusion

In general it can be said that Checkngo.com service is quite reliable. Among lots of other similar companies this website can prove its reliability. It has various certificates and positive comments from thousands of people. Technical indicators are also very high with speaks in favor of the company. We can see that administration tries to work out every aspect of the website functioning.

In the Internet you may find lots of positive reviews form satisfied customers. Though there are some negative comments, the general rating of the website is very high. However the support group is ineffective, since it is impossible to contact them via contact form. Those customer that have managed to contact them, say that the service is really bad. So the company should work better to satisfy and attract more and more clients.

Ready to Apply?

Ready to Apply?