What is CashNetUSA?

CashNetUSA.com is a direct online lender, dedicated to helping people get access to easy funds. The company has been operating since 2005 and was owned by Cash America (the leader in short-term lending) before becoming an independent organization. They claim that over the last years, they have worked with more than 3 million clients, providing them with loans for emergency expenses. CashNetUSA is an online-only lender, so it does not have any in-store locations. The company offers loans in 30 states, but CashNetUSA loan amounts, types and APR vary from state-to-state. They recommend looking at their website to make sure that they lend in your state and what terms they offer before applying for a fast loan online.

| Loan Types | Min. | Max. | Period | APR | Documents and information required | Bad credit |

| Payday Loan, Installment Loan, Line of Credit, Flex Loan, Brokered Payday Loan, Credit Availability Loan | $100 | $3400 | 2 weeks – 15 months | 150% – 800% | Email, phone, address, work details, driver’s license, Social Security number, checking account | Possible |

CashNetUSA Loan Types

CashNetUSA.com provides a good selection of credit solutions to their clients. The loan types available vary depending on the state. The company offers the following loan types:

- Standard paydays loan online;

- Installment loans online;

- Lines of credit;

- Brokered payday loans;

- Flex loans;

- Credit availability loans.

An installment loan is for a larger amount than a payday loan, has a long-term and repaid with a set number of scheduled payments. A line of credit is an amount of credit extended to a borrower. A brokered payday loan is a short-term loan given by one of the lenders the company works with and repaid upon the next payday. A flex loan gives clients more flexible funding and repayment options than other CashNetUSA credit products. A credit availability loan is a medium-term installment loan repaid monthly in installments over 5 to 10 months. CashNetUSA primary product is payday loans, which are short-term. The main page of the website provides a detailed information about loan types, limits, interest rates, repayment terms, and other policies for each state.

Once the client applied for a loan, he should receive an approval that same day. When he signs the contract he’ll receive his money by direct deposit within 1-2 business days. However, some customers may be required to provide some additional information and verifications, or may not get an instant approval.

According to the information placed on the website, the company also offer special discount and promotions via email and phone to their clients.

Terms of Use

It seems that applying for an online payday loan is a quite simple process. The company illustrates the requirements for getting a loan:

To get a loan from CashNetUSA clients need to:

To get a loan from CashNetUSA clients need to:

- Be at least 18 years old (but 21 years old for Mississippi and 19 years old for Alabama and Delaware);

- Be a US citizen or a permanent resident;

- Have an active checking account;

- Have a driver’s license;

- Have a permanent job for at least one month.

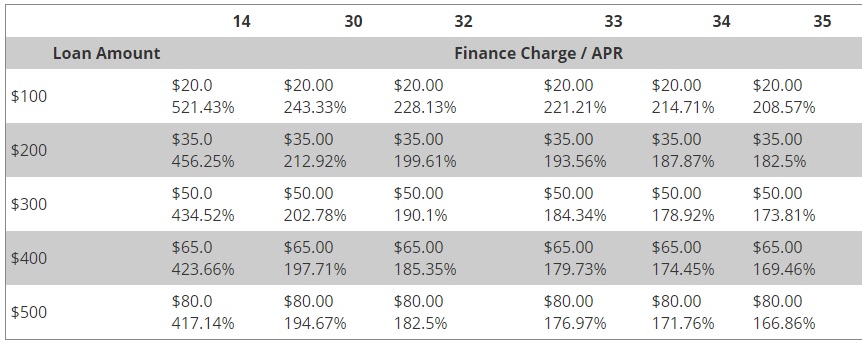

The usual term for CashNetUSA online payday loan is 14 days, but it can vary depending on the state and when the client gets paid (from between 8 to 35 days).

In some US states, the maximum loan amount is a percentage of your income per month. The maximum payday loan amounts range from $100 to $2,250. CashNetUSA installment loans may reach $3400. Interest rates also vary from state to state and go from 150% to 800%.

For instance, look at the funding terms for Alaska. The minimal APR is 166.86% here, while the maximum APR is 521.43%:

Because CashNetUSA loan terms vary from state to state, clients should read the terms of use for their specific loan very carefully before signing a contract.

Application Process on CashNetUSA.com

The application process on CashNetUSA.com is entirely online and, according to the company, it only takes a few minutes to get a reply.

They say that clients can apply for a payday loan online and receive an instant approval via email even if they’ve been refused by other lenders. In order to start an application process, clients will need to provide his name, address, phone number, email, work details, date of birth, and Social Security number. A big advantage is that the client does not have to ask his friends to stand surety for their loans. As a rule, a client of CashNetUSA does not need to fax or email any documents to get a loan. However, in some specific cases, the company may require a proof-of-income prior to the application being approved, namely:

1. If the client receives social security benefits;

2. If the client receives alimony;

3. If the client receives disability benefits;

4. If the client is self-employed;

5. If the client resides in NM, NV, RI, IL, or WA.

The client can also prove his income by a government benefits award letter or a bank statement of regular deposits.

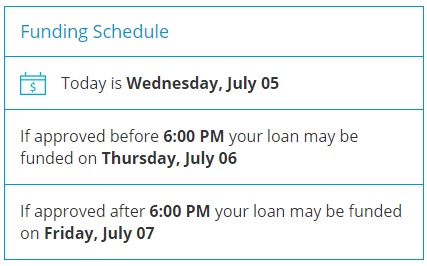

Once the application has been approved, CashNetUSA sends the funds to the bank of the client via Automated Clearing House the next business day on condition the application is approved by 9 p.m.

Loan Repayment on CashNetUSA.com

For most payday CashNetUSA loans, the full amount must be repaid on the next payday date that ranges between 8 and 30 days, this range may vary depending on the location of the client. If the next payday date is outside of the state’s specified range, the payoff is generally done in 14 days.

CashNetUsa loan funding schedule is listed on the website, so the whole picture get as clear as possible – the client can see how soon he will be funded if applies for a loan today:

Installment loans are paid monthly, and lines of credit are paid according to the frequency of the paychecks.

According to CashNetUSA.com website, the clients can pay their loan back early, which may provide a refund for his loan fees. If the client wants to process an early repayment, he’ll need to contact CashNetUSA’s customer support. A delay in payment is allowed but should be agreed with the company in advance.

We found no details about the ways a customer can repay their loans.

Does CashNetUSA Offer Loan Extension?

If clients have trouble paying their loans, they can get CashNetUsa extended payment plan it using the online portal of CashNetUSA. They say they understand that sometimes life happens. The company is ready to meet the client halfway. All he needs is to call CashNetUsa customer service via phone or email at least 2 business days before his due payment to inquire whether he can postpone his payoff. CashNetUSA clients should be aware that some states allow for extensions, while others do not. If the client does not agree his delayed payment with the company, it may start collecting late fees. All late payment fees and other fee amounts for each state are listed on CashNetUSA Rates & Terms page. If extensions are not allowed in a particular state or if the client has no more extensions allowed and he still can’t repay his loan, CashNetUSA can initiate collection procedures immediately.

According to the information placed on the website, the company only issues one payday loan per customer at a time.

When the client repays his loan, he can receive another loan from the company, but the timing of reapplication depends on his state.

Once the client’s reapplication is approved, he will receive your funds within 1-2 business days. However, the company warns that he may be required to wait a few additional days if he resides in a state that cools off the period between CashNetUSA loans.

CashNetUSA.com Bad Credit History

Even if the client has have been refused by other lenders, he may try applying to CashNetUSA for obtaining a credit option that fits his needs. This does not mean that the company offers payday loans for all customers with bad credit history. However, the exceptions are possible if the client had past credit problems but have worked hard to improve his financial situation. CashNetUSA is proud by itself on helping people get the funds they need, even if they have not perfect credit history.

CashNetUSA claims that they do not base exclusively on the client’s credit score but look at other aspects of his financial history when making a decision. Not honoring debts and making late payments on bills may be the reasons to decline an application.

Technical Characteristics of the Website

Secure Connection

CashNetUSA.com seems to take care of the users’ security and keeps their transaction and personal data secure (login, password, name, address, credit card details and so on). The website uses a 256-bit SSL encryption, the security certificate is verified by Symantec Corporation. The left corner of the address bar indicates a green lock + the name of the website’s owner – CNU Online Holdings, LLC.

This means that this website uses the Extended Verification Certificate – a special type of certificate for a website, which requires much more careful verification of who owns this site, unlike other types of certificates. So, CashNetUSA.com provides the best security level for its customers.

Mobile Version

CashNetUSA.com has successfully passed a Mobile-Friendly Test:

And really, the icons and images are enlarged, the customers can easily find the necessary information they are looking for. The text is readable and organized in such a manner that users can easily click on the necessary loan type. There are no errors in the functioning of the mobile version and it looks pretty good. Customers will not probably have any difficulties when visiting CashNetUSA.com from their mobile devices.

Antivirus

In addition to the best encryption level, the company uses different technologies such as Norton antivirus and McAfee to protect its clients’ data.

So users of the website can feel calm when surfing the pages: their computer won’t catch unwanted viruses or other online threats. This aspect adds more trust to CashNetUSA and improves its reputation. Probably, this website could be considered a safe place to apply for a loan.

The Convenience of Application on CashNetUSA.com

The company advertises an easy, fast and convenient applying procedure on the website. And it really is. The procedure is standard and does not differ much from other online lender websites.

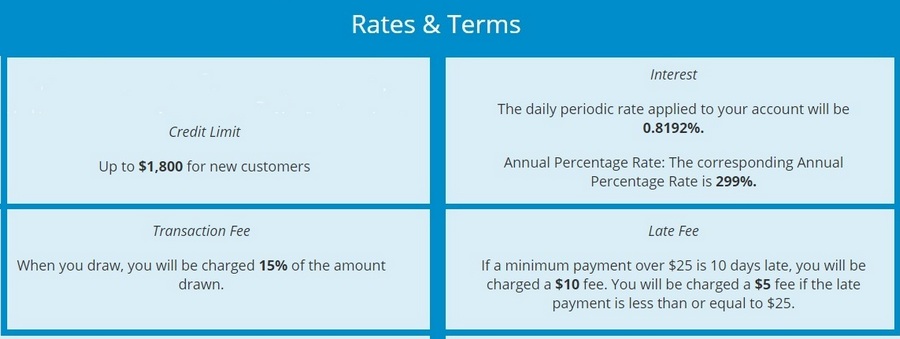

The client needs to invent CashNetUsa.com login and password, choose his state and see the detailed description rates and terms offered in this area, including credit limit, transaction fee, interest rate, late fee. The screen below illustrates the rates and terms for Kansas:

CashNetUSA clearly explains the features and difference between all loan types it offers. Besides, the client can also easily find the information about account balance, billing period, principal balance, minimum / maximum payment for a particular state.

The client can also find the necessary information in the FAQ section, including such details as penalties, loan extension, repayment info and many others.

So, we may conclude that the applying procedure is easy on CashNetUSA.com – the company requires only the necessary information specified in the table above, and the user can hardly have any problems with registration.

Is CashNetUsa.com Legit?

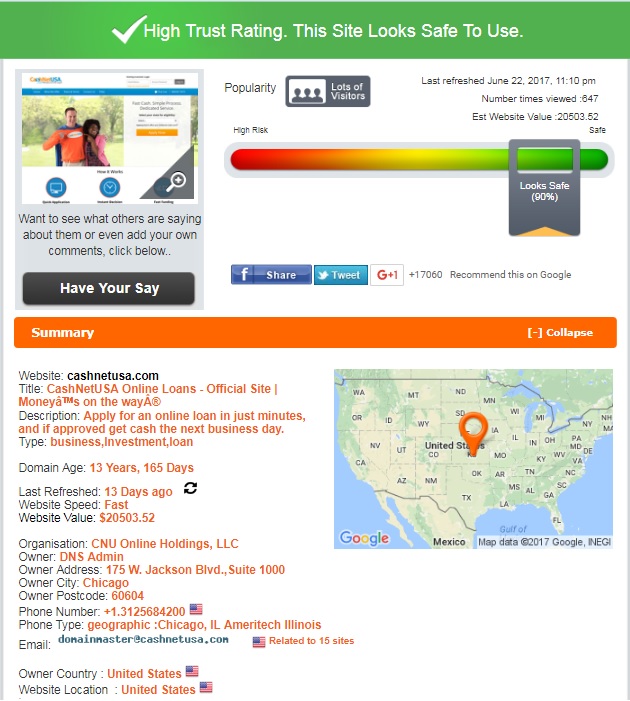

We checked the rating of CashNetUsa.com on ScamAdviser.com, and the received data improved the reputation of the online lender thousandfold. CashNetUsa has a very high trust rating – 90% out of 100:

ScamAdviser claims that the website looks safe to use. The owner of the website and website location is the United States. The domain age is more than 13 years. The site has lots of customers, is constantly refreshed and popular by Alexa. However, ScamAdviser can’t give a 100% trust rating to the online company, since there are bad feedback detected and the risk that this website may be related to a number of high-risk websites. Still, 90% trust rating is a good indicator, and we may suggest that users can have a positive experience with CashNetUsa.

CashNetUSA.com Reviews

On-site CashNetUsa.com Reviews

The company has posted several client reviews on its website. All of them are purely positive, and there was not a single person was disappointed with the services provided. Look at some reviews below:

Though these clients say that CashNetUsa.com provides excellent services, we can’t rely on these reviews, as they are not dated and can be easily composed by the website’s administration. We found no section where clients could share their experience, so we have no idea how these testimonials have appeared on this website. There is no way the company would place negative reviews on the site, so we can’t have a clear image of the company so far.

CashNetUSA Reviews on Third-Party Websites

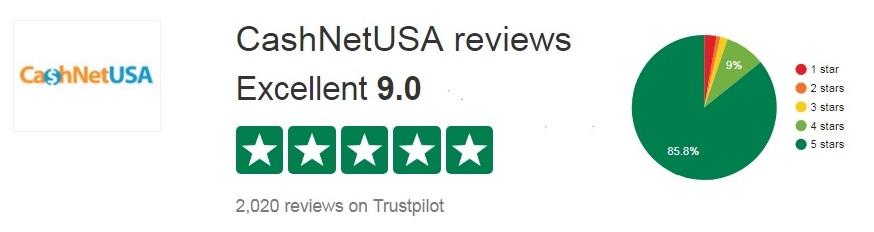

To get a better understanding of the company’s services, we had to search for CashNetUSA.com reviews on independent websites and forums. We used Trustpilot.com — an online scoring system that allows verified clients leave ratings and feedback. It turned out that the website contained more than 2000 reviews about CashNetUSA, and the majority of them were positive. The company has a total score of 9 stars out of 10 on Trustpilot.com:

It seems that the website is extremely popular, as new 2017 reviews are being posted on Trustpilot every day.

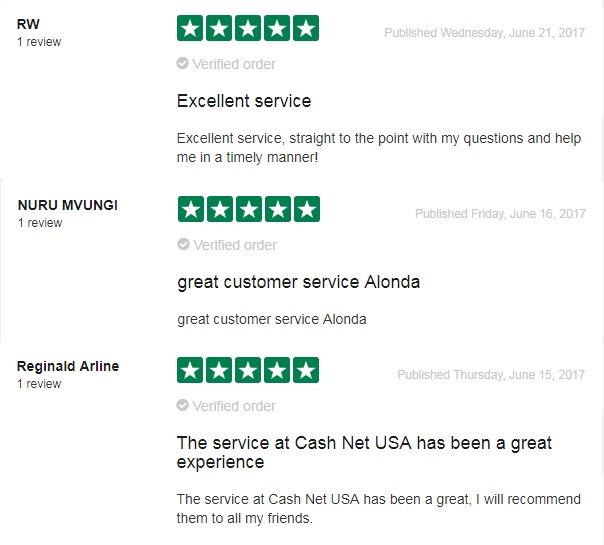

We have selected some reviews written by happy clients. They call CashNetUSA.com an excellent service and appreciate timely funding and response:

However, recent negative reviews indicate that sometimes CashNetUSA.com fails to meet the clients’ expectations. One user is completely dissatisfied with the services, since the company refused to work with him after he had successfully repaid 2 of his loans, and provided no explanation. Another client applied for a loan, successfully got through the whole process, CashNetUsa.com approved his application, but he never received his money:

One more user said CashNetUSA was threatening him. Such CashNetUsa complaints spoiled the reputation of the company. You can get acquainted with more reviews at https://www.trustpilot.com/review/www.cashnetusa.com.

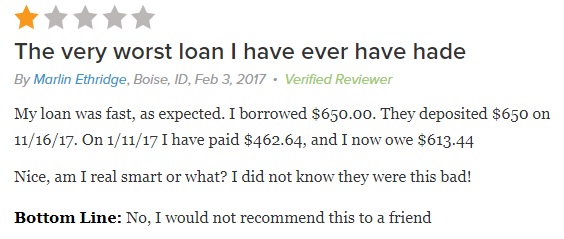

We did not expect to find such a GREAT number of CashNetUSA consumer complaints on other websites. A small percentage of testimonials was positive, but the majority confirmed that CashNetUSA services are far from perfect.

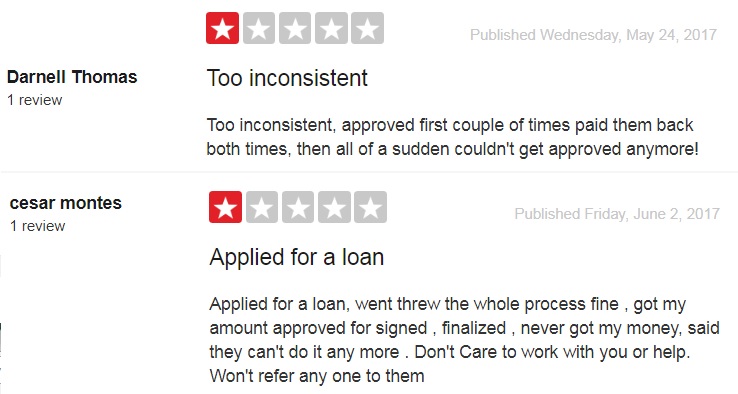

Some clients claim that although certain interest rates or terms are advertised on the website, they are not fully disclosed and the actual rates or terms are not as beneficial as they may seem. Others say that the company continues taking money out of their accounts even after the loan was repaid. The clients recommend avoiding this “shady company“:

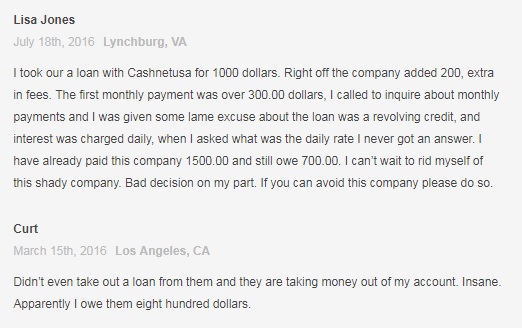

Some more clients claim that the company deserves 0 stars out of 5, since it is the worst lender ever and takes a full advantage of desperate people, setting an unbelievably high interest rate for loans, and some even say they bear a lawsuit against CashNetUSA.

It looks quite strange that the company has a good reputation ONLY on Trustpilot.com. Since CashNetUSA has a mostly negative online customer reputation on other outside websites, with the most common complaints about extremely high interest rates, we may suggest that CashNetUSA loans can cost you twice as much (or much more) as your original loan amount.

Contact Us section

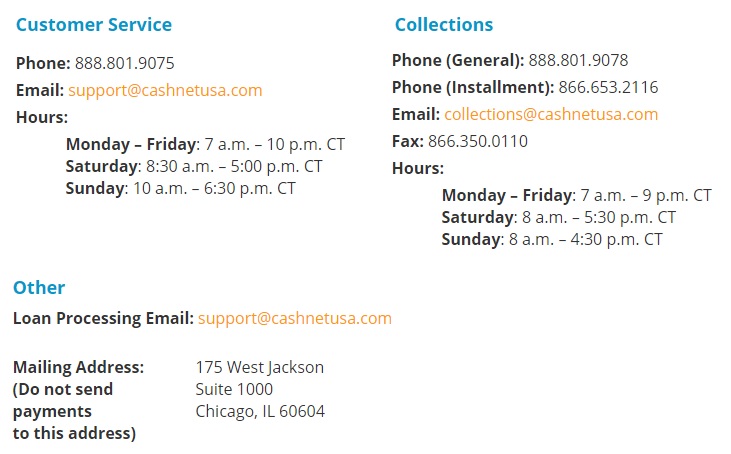

CashNetUSA Contact Information

The company provided a comprehensive contact information on the website. There are CashNetUsa customer service numbers, emails, and faxes for 3 departments that can solve all clients’ problems. The mailing address is also indicated.

The detailed contact information is a good indicator – the company tries to be as transparent as possible and provides clients with all information they want to know to get an informed loan.

CashNetUSA Locations

CashNetUSA has a broad availability across the USA. They provide loans in 30 states. The clients need to select the state to see the options they are offered:

Look at the table which indicates services available in a particular state:

| State | Loan types | State | Loan types | State | Loan types |

| 1. CashNetUSA Alabama | Payday Loan, Line of Credit | 11. CashNetUSA Maine | Payday Loan | 21. CashNetUSA Oregon | Payday Loan |

| 2. CashNetUSA Alaska | Payday Loan | 12. CashNetUSA Michigan | Payday Loan | 22. CashNetUSA Rhode Island | Payday Loan |

| 3. CashNetUSA California | Payday Loan, Installment Loan | 13. CashNetUSA Minnesota | Payday Loan | 23. CashNetUSA South Carolina | Installment Loan |

| 4. CashNetUSA Delaware | Installment Loan | 14. CashNetUSA Mississippi | Credit Availability Loan | 24. CashNetUSA Tennessee | Flex Loan |

| 5. CashNetUSA Florida | Payday Loan | 15. CashNetUSA Missouri | Installment Loan | 25. CashNetUSA Texas | Payday Loan |

| 6. CashNetUSA Hawaii | Payday Loan | 16. CashNetUSA Nevada | Payday Loan | 26. CashNetUSA Utah | Line of Credit |

| 7. CashNetUSA Idaho | Line of Credit | 17. CashNetUSA New Mexico | Installment Loan | 27. CashNetUSA Virginia | Line of Credit |

| 8. CashNetUSA Illinios | Installment-Payday Loan | 18. CashNetUSA North Dakota | Payday Loan | 28. CashNetUSA Washington | Payday Loan |

| 9. CashNetUSA Kansas | Line of Credit | 19. CashNetUSA Ohio | Brokered Payday Loan | 29. CashNetUSA Wisconsin | Installment Loan |

| 10. CashNetUSA Louisiana | Payday Loan | 20. CashNetUSA Oklahoma | Payday Loan | 30. CashNetUSA Wyoming | Payday Loan |

Customer Support Service

CashNetUSA advertises that its support service works 24 hours a day and 7 days a week and provides customers with several methods of contacting them:

- Phone numbers for different departments;

- Email addresses for different departments;

- Mailing address;

- Fax number;

- Live chat option

We decided to use the most easy and speedy option – Live Chat – to specify the minimal and maximum amount we can borrow from this company. Unfortunately, Live Chat was offline, so it does not seem that they work day-and-night for their clients.

We sent them an email on the specified address with the same question, waited to some hours but did not get any feedback. Obviously, customer support service is poorly organized at CashNetUSA.com

Conclusion

CashNetUSA.com is a loan company that primarily provides payday loans. The main advantages of the lender are its flexible criteria for eligibility and availability in 30 states. Loan types, limits, additional fees, repayment and extension terms vary from state to state. The website has a high trust rating on ScamAdviser.com which means the company is legit. The highest encryption level secures the clients’ personal data to the maximum, which is also appreciated. CashNetUSA has many positive aspects, but we can’t ignore its disadvantages. First of all, interest rates are generally very high, so potential clients should review the rates and terms very carefully before signing a contract. Numerous negative reviews from clients also undermined CashNetUSA reputation. Though they offer many methods for contacting them, they failed to provide a speedy answer. While CashNetUSA may seem a good option for a payday loan, it may turn out too costly in the long-run. This means that you should avoid using this lending service unless that is the only option left for you. If you decide to take out a loan from CashNetUSA, make sure you can repay it as quickly as possible.

Ready to Apply?

Ready to Apply?