What is CashMax Ohio?

CashMaxOhio.com is a credit services organization which has been providing loans to residents of Ohio since 2012. This company is not a lender and does not provide any loans. All loans will be issued by an independent third-party lender. Thay claim to be a local solution for your emergency cash needs. Their main difference from all other lending companies in Ohio is the commitment to customers. The experienced employees have made the loan application as simple as possible. The company claims to comply with the Ohio Credit Services Organization Act. According to the website, CashMax offers easy, trouble-free financial services and always finds a solution that meets the needs of a particular client.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans | $100 | $1,000 | 14 days – 30 days | Agreed individually | Driver’s license or a state ID, current paystub, current personal checking account bank statement, verification of street address (utility bill), a voided check for verification of routing number and account number | Yes |

| Title loans | $300 | $10,000 | Agreed individually | Agreed individually | Bill with name and address, driver’s license or a state ID, current paystub, vehicle | Yes |

Types of Loans

CashMax Ohio provides 2 credit types: payday loans (cash advance, instant loans) and title loans.

- Payday loans are short-term loans of a small amount (usually up to $1000) that are paid off on the day you get paid. People apply for such loans to cover unexpected expenses, such as bill payment, car repays, medical bills, the purchase of a gift, and so on. When compared to other short-term bank loans, payday loans are a more transparent and affordable alternativeж

- A title loan is a short-term loan, the amount of which is based upon the value of your car used as collateral. When you are approved for a title loan, you can continue driving your car.

Both loans types provided by CashMax Ohio are not intended to cope with long-term financial difficulties. These loans should only be taken to meet short-term cash needs.

You are not able to get the funds online. To be approved for a CashMax loan, you will have to visit one of the nearest in-store locations of the company.

Terms of Use

Payday loan amounts range from $100 to $1,000. Title loan amounts start from $1,000 and may reach $10,000. The loan amount you will be approved for will depend on the current value of your car. However, the lender cannot guarantee that a customer will be approved for a loan. Besides, not all clients will qualify for the maximum loan amount.

CashMax does not make any loan decision. Instead, they try to connect an applicant to a third-party lender. The decision will be made by a direct lender based on the information you provide in your loan request. If you are unable to provide the requested documentation and information, this will delay the approval process and may terminate your application.

To get a payday loan, you need to bring with you:

- driver’s license or a state ID;

- recent paystub or another proof of income;

- current checking account statement (last 30 days of transactions);

- a voided check for verification of your routing number and account number;

- verification of your address (for example, utility bill).

To be approved for a title loan with CashMax Ohio, you need to provide:

- clear title in your name;

- proof of your address (for example, utility bill);

- driver’s license or state-issued ID;

- proof of income (recent paystub);

- your own vehicle as collateral.

Unlike many other lenders, CashMax Ohio asks to provide too many documents. Using this website, it is not enough to only have an active checking account and a regular income.

Interest rates and fees are not disclosed anywhere on the website. Obviously, they vary from lender to lender and depend on a loan type and term.

Application

Using the website, you will not be able to apply for a loan online. The website does not have an online application – you will have to visit the lender’s office and bring the requested documents with you (see the unit 1.2).

This may delay the whole process. Many other lenders allow filling out an online application, signing the documents electronically and receiving the money without leaving your house. Some lending companies also allow faxing the requested documents without visiting their in-store locations. But if you use CashMax Ohio, you should have free time to come to their office in person.

A payday loan can be obtained without collateral. In title loans, you use your vehicle as collateral as long as you use a loan.

Loan Repayment

Payday loans are typically paid off within 2-4 weeks on the day you receive your wages. The funds will be withdrawn from your checking account you specify during application.

Title loan due dates are discussed individually. Such type of a loan can be repaid in several installments each consisting of the principal and interest. The lender recommends borrowers to pay more than the minimum installment amount to save on interest rate.

CashMax encourages its clients to repay a loan on time to avoid non-payment fees. Each third-party lender has its own fees and penalties for missing a payment.

Loan Extension

If an unexpected situation occurs and you feel you will not be able to repay a loan, you may request an extension. The lender will try to offer an alternative payment schedule under emergency circumstances. To ask for a loan renewal, you need to contact the company at [email protected] or call 1-800-777-7777. Bear in mind that extending the loan will incur additional charges.

You are not allowed to have 2 CashMax loans at a time but as soon as you cancel your debt, you can apply for a new loan.

CashMaxOhio.com Bad Credit

According to the website, you can be approved for a loan even if you have a poor credit. CashMax Ohio does not use traditional credit bureaus to check your credit score. However, the company reserves the right to verify your credit history through national databases, such as Clarity, DataX, Factor Trust, etc. The lender can perform a credit check to verify your eligibility and ability to pay off a debt.

Technical Characteristics of the Website

Encryption

The lender claims to respect the clients’ security and protects their personal information with a 256 bit SSL encryption. This means that all transactions with this website are kept confidential. The secure connection is verified by Let’s Encrypt:

In general, I’m satisfied with the security level provided, however, I would feel more confident if the website’s owner was shown at the top left corner of my browser.

Mobile Version

CashMaxOhio.com has a mobile version, which simplifies the work with the website from mobile devices. The mobile pages have the same content but optimized for various mobile screens. Google report confirmed that this website is mobile-friendly:

The pages do not contain any secondary information or unnecessary links. There is no need for scrolling the pages. The images and font are enlarged. I conclude that CashMaxOhio.com has a convenient mobile version.

Antivirus

The website does not use any security guards, which makes your safety vulnerable. Be careful when using this site because you may get your PC infected with various dangerous viruses, worms, and other online threats. Your personal account may also be hacked. The company does not provide a 100% guarantee that their users’ information will not get into the hands of third parties.

Convenience of Using the Website

As I’ve already mentioned, you will not be able to apply for CashMax Ohio loans online. However, you can create a personal online account which will display the details of your previous and current loans.

The website is purely informative and helps users learn how payday and title loans work. Here you can also get tips on gaining financial freedom and find guides to how to cope with unexpected financial emergencies.

The site also contains a special section which cab used to find the nearest CashMax in-store location in your city:

I guess not every customer will find this way of getting payday loans convenient – too many lenders provide such loans online without seeing you in person.

So if you decide to apply for a CashMax payday loan, you should have time to visit their in-store location.

Is CashMaxOhio.com Legit?

CashMax Ohio seems a legit and safe lender since ScamAdviser gave this company a 100% trust-rating:

According to the report, the site is located in the United States and has been operating for over 6 years. It has a very few visitors, still, ScamAdviser does not have any doubts about the legitimacy of this company.

CashMaxOhio.com Reviews

On-site Reviews

There are no CashMax Ohio reviews on their native website. This prevented me from assessing their online reputation. I hope I will be able to find any testimonials / commends / complaints on third-party websites.

Reviews on Other Websites

Regretfully, I did not find a single customer review about CashMax Ohio services. Lack of reviews for the period of 6 years concerns me. I can hardly believe that not a single borrower wanted to leave a comment about this financial organization.

Customer Support

Contact Information

CashMax Ohio general phone number is 1-800-777-7777, their general email address is [email protected].

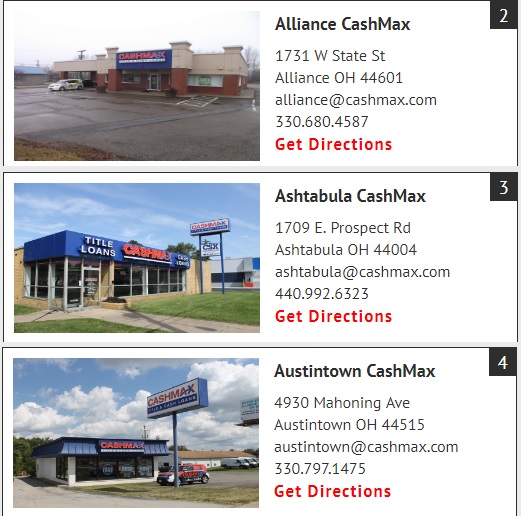

The page “Locations” also contains contact information for each of their in-store location across Ohio: address, phone number, location on a map. You can see the details about each store which is close to your house.

CashMaxOhio.com Locations

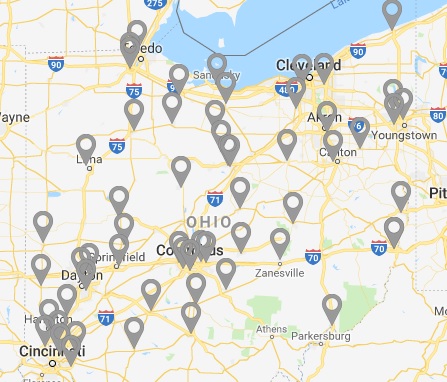

CashMaxOhio services are only available to residents of Ohio. The lender has over 55 locations all across this state (Austintown, Ashtabula, Alliance, and many other cities). They mention that finding their store is as easy as walking down the street. So if you are not a resident of Ohio, you will have to find another lender. You can see all CashMax in-store locations in the map available on the website:

They also mention that certain products and services may not be available at all their locations. You need to contact the nearest store to specify the products and services they offer.

Getting a Consultation

If you have any general questions about CashMax services, you can contact their customer support team via [email protected] or 1-800-777-7777.

You can also reach the customer care department by filling out a contact form. If you have comments, questions or concerns about their particular store, you need to use its contact details specified on the website.

I tried to reach the customer service department via [email protected]. I asked them to specify whether it was possible to get a payday loan online. I waited for a response for 6 hours but nobody answered. I conclude that CashMax customer support team is not as speedy as you may expect.

Conclusion

CashMaxOhio.com is a financial organization which has some advantages: the highest trust-rating from Scam Adviser, loan amounts up to $10,000, bad credit is ok. The main disadvantage of this lender that their payday and title loans are only available to customers from Ohio. There are some other drawbacks that prevent me from recommending this company to other customers: their services are not available online, rates and terms are not specified, too much paperwork, no reviews on the web, and their customer care department is not always ready to assist customers. Considering all these details, I rate this organization 3.2 stars out of 5 and advise you to search a more convenient lender.

Ready to Apply?

Ready to Apply?