What is CashBackLoans.com?

Cashback Loans is a licensed direct lender from California. The claim to be passionate about helping their clients to get fast cash and provide a hassle-free loan service. The company was founded in 2003 for the purpose of helping Southern California residents. Today they have 29 locations across the state. They guarantee to provide customers with the best customer service and want them to feel comfortable in the company’s inviting in-store locations. The lender is licensed by the Department of Corporations and operates under California law.

| Loan types | Min.amount | Max.amount | Period | Average APR | Documents | Bad credit |

| Payday loans | $100 | $300 | 2-4 weeks | 460% | Valid state-issued ID (Driver’s License), paystub | Yes |

| Title loans | $2,510 | $50,000 | 12 to 36 months | Agreed individually (+ $75 administration fee and a $15 DMV fee) | Vehicle in driving condition, clear car title, proof of insurance, valid driver’s license, paystub | Yes |

| Signature loans | $2,510 | $3,600 | 12 to 36 months | Agreed individually (+ $75 administration fee) | Valid government issued identification, paystub | Yes |

Types of CashBack Loans

Cashback provides payday loans, title loans, and signature loans. Besides, the company provides deferred deposits, wire transfers, money orders, check cashing and other financial services.

- A payday loan is a small amount of money which comes with a high-interest rate and is repaid when the borrower receives his next salary;

- A signature loan a personal loan that only requires a borrower’s signature as collateral;

- A title loan is a secured loan where a borrower uses his vehicle title as collateral.

With payday loans, you have an opportunity to get the cash deposited into your bank account that same afternoon. The time of deposit will depend on the time you apply. If you submit a request before 10:30 am on business days, the funds will be transferred to your bank account that same afternoon. If you apply for a loan after 10:13 am, you will receive the money on the next business day. If you apply for a payday loan in one of the CashBack in-store locations, you can receive money in cash within a couple of minutes.

With title and signature loans, you can receive your money within an hour or two but the application process may vary.

Terms of Use

Terms and rates for payday loans, title loans, and signature loans provided by CashBack differ but the lender specifies all the details on its website. The approval is based on meeting the eligibility criteria and your ability to pay off a loan.

Payday loans: The maximum amount for CashBack payday loans is $300 (up to $255 in cash and $45 loan fee). The exact amount you can qualify for may be less than $300, based on your income. The repayment term may range from 1 to 31 days.

To get a payday loan with CashBack, you need to have an open checking account, a verifiable and stable source of income (paystub), and a government-issued ID (for example, driver’s license).

APR for a 2-week payday loan is 460%. The exact rates and fees for a typical, 14-day or 30-day payday loan are presented on the website:

Title loans: The minimum amount of a title loan is $2,510, and the maximum amount is $50,000. The amount you can qualify for is based on the value of your vehicle. The terms of such loans range from 12 to 36 months.

Title loans: The minimum amount of a title loan is $2,510, and the maximum amount is $50,000. The amount you can qualify for is based on the value of your vehicle. The terms of such loans range from 12 to 36 months.

To get a title loan with CashBack, you need to have a car or truck in driving condition, clear car title, proof of insurance, driver’s license, a verifiable and stable source of income, an active checking account, proof of address, age at least 18.

When you are approved for a title loan, you can continue using your car while you repay your loan in installments.

To get a title loan, you need to pay a $75 administration fee and a $15 DMV fee. The lender mentions that some loans exceeding $5,000 come with an additional 10% prepaid interest fee, based on your credit history. The exact interest will be based on the unpaid principal balance of your title loan.

Signature loans: Loans amounts range from $2,510 to $3,600 and must be repaid between 12 to 36 months.

To get a signature loan with CashBack, you need to have an active checking account, a verifiable and regular income, a state-issued ID number, be at least 18 years old. There are no application fees for a signature loan but you need to pay a $75 fee on all funded loans.

The interest rate will be agreed individually but and will be based on the unpaid principal balance of your signature loan.

Application

You can apply for a loan in one of the company’s locations in California or online. The online application will make the process even faster. For many of CashBack services, you may not even leave your house.

To get a payday loan or a signature loan, you need to either fill out a simple online application, contact CashBack customer support or come to their nearest location.

When you need a title loan, you will have to visit the lender’s office. However, you may fill out and submit your application online in order to speed up the process.

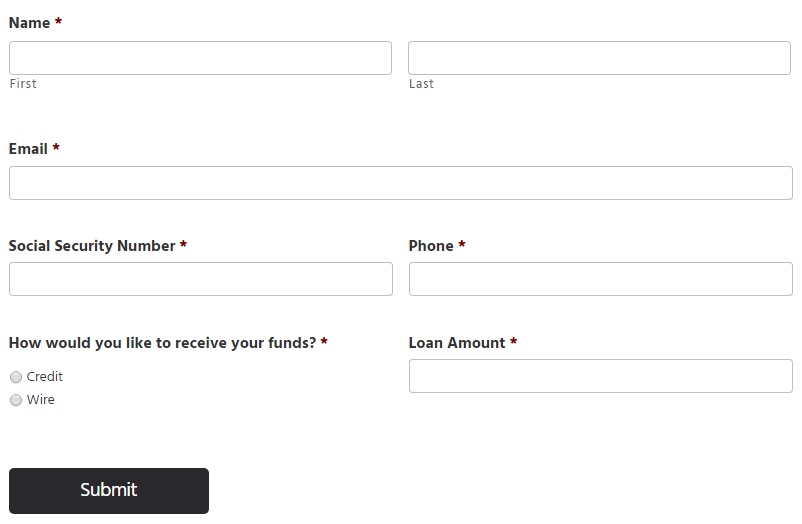

When applying online, you will be required to provide the following details: Social Security number, employment information, your monthly income, checking account balances, transactions and payment history, credit history and score, address, reference, car information (for a title loan).

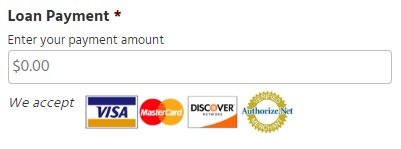

Loan Repayment

Customers can make payments online at cashbackloans.com, in-store, or by phone. An example below shows which online payment methods are accepted by the lender:

Payday loans: A payday loan is due on your next payday. If you are making a late payment t or unable to make it at all, you need contact the lender’s office as soon as possible. Once you pay off your payday loan, you will have a good reputation in this company.

Payday loans: A payday loan is due on your next payday. If you are making a late payment t or unable to make it at all, you need contact the lender’s office as soon as possible. Once you pay off your payday loan, you will have a good reputation in this company.

Title loans: The first payment for a title loan is usually made 30 days after the agreement is signed. You may also opt for electronic money withdrawal from your account on the due date. The typical loan term is 24 months but the period may be extended to 36 months. The lender allows a 15-day grace period to make a payment from the due date. But if you are 16 days late, you will be charged a $15 fee.

Signature loans: The payment terms will be determined individually and specified in your loan agreement. The loan is to be paid off in several monthly installments within 12 – 36 months.

If you are very late with your payment, CaskBack reserves the right to turn your account over to an independent collection agency which will negatively affect your credit score and credit history.

There are no pre-payment penalties for repaying your loan early. If you repay the loan before the due date, the interest charge will be reduced.

Loan Extension

Regretfully, CaskBack is unable to offer loan renewal. You must pay off your loan before a new loan application can be submitted. The fees will be the same for a new loan.

CashBackLoans.com Bad Credit

You do not need to have a good credit to get a payday/signature/title loan. The qualification process is mainly based upon your application, transactions and payment history, the ability to repay a loan, and vehicle value (title loans). Therefore, CashBack loans are a good option for people with bad credit or no credit. However, if your credit score is good, you will have a lower interest.

Technical Characteristics of the Website

Encryption

CashBack claim that they do not sell customers’ private information to any third parties. According to them, when applying for a loan online, your sensitive personal and financial details will only be viewed by the lenders’ employees. The website uses a 128-bit SSL encryption verified by COMODO CA Limited:

This encryption level may secure your personal information, however, you’d better use website with advanced encryption (a 256-bit SSL and extended verification certificate).

Mobile Version

Today, many people use mobile devides to apply for a loan. Therefore, each site needs a mobile version. CashBackLoans.com mobile version duplicates the basic information, this is a “cut down” version in relation to the full version of the site. The content is the most important aspect. All the additional functionality that is present on the desktop website’s version is removed. Therefore, such a stripped down version is convenient to view on a small screen.

Navigation is adapted for the touchscreen and it’s much more convenient. The mobile version is loading faster. The design is simple. The mobile site is correctly displayed on the most popular mobile screens. The pictures and buttons are small and well-optimized.

Antivirus

Websites like CashBackLoans.com must have up-to-date antivirus programs that would protect users from viruses, Trojans, and malware programs. Regretfully, this website does not use an antivirus. I think it’s a serious drawback and customers should be aware of the risks of hacking.

Convenience of Using CashBackLoans.com

Using this website, you can be pre-approved for a loan in a minute. The full application takes 5-8 minutes to complete and CashBack customer support group will contact you the same day to verify your personal information and request some documents. When your loan is approved, you need to come to one of the lender’s offices in California and get the cash. You may also have the funds funded electronically. For this, you need to sign the documents and return them prior to 11:00 am for immediate funding.

The website has a special page, which you can visit in order to find the nearest CashBack location:

If you a return customer, the lender can make it easy to apply for a new loan through this website by filling out a simple request form which has a limited number of fields:

You can also subscribe to CashBack newsletter and get $10 off your first loan.

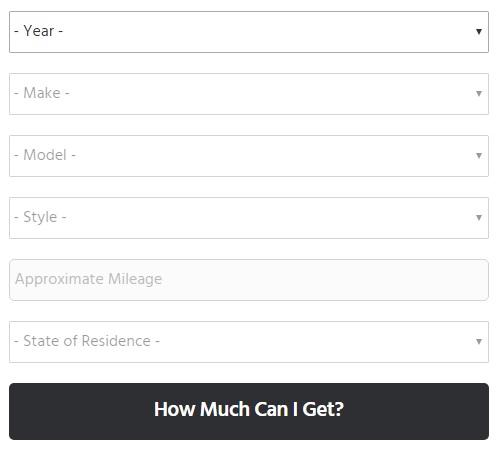

Applying for CashBack title loans is convenient and easy. If you do not know the amount you will be eligible for, the lender can estimate the value of your vehicle within a few minutes. For this you need to fill out a short application specifying your state of residence a year, model, style, and approximate mileage of your vehicle:

I also appreciate that the lender disclosed the exact rates and terms for different types of loans, which makes the CashBack website very informative. No information remained hidden.

Is CashBackLoans.com Legit?

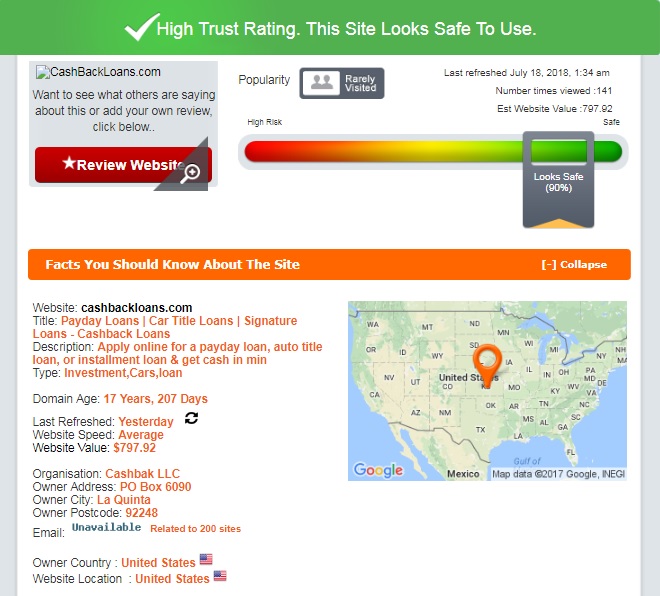

ScamAdviser gave this lender a high trust-rating of 90% out of 100%: which makes this website safe to use:

According to the report, CashBackLoans.com domain was created more than 17 years ago. The website is located in the United States and owned by CashBack LLC. It has a few visitors each day but nothing indicates that it’s operating illegally.

CashBackLoans.com Reviews

CashBackLoans Reviews on the Native Website

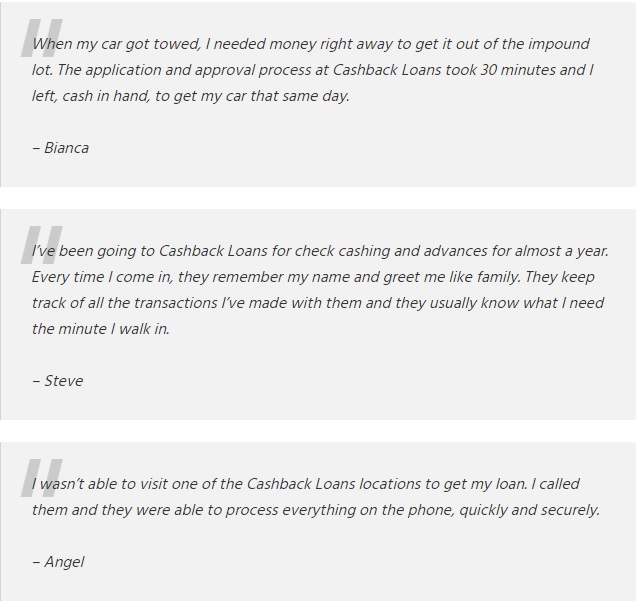

The native website of the lender has a separate testimonial page which contains only 3 customer reviews. All of them are positive.

Bianca reported that the application process took only 30 minutes to complete and she received the cash in hand the same day. Steve has been using the in-store services of this lender for a year. He appreciates that CashBack employees remember his name every time and greet him like a family. Angel was not able to visit the lender’s location so she called them and the company was able to process the application on the phone. She added it was quick and secure.

The thing is that these reviews are not dated and too limited. Besides, there were selected and posted by the website’s owner (there is no feedback form which allows messages being posted on the site immediately) so I cannot fully trust these comments.

Reviews on Third-Party Websites

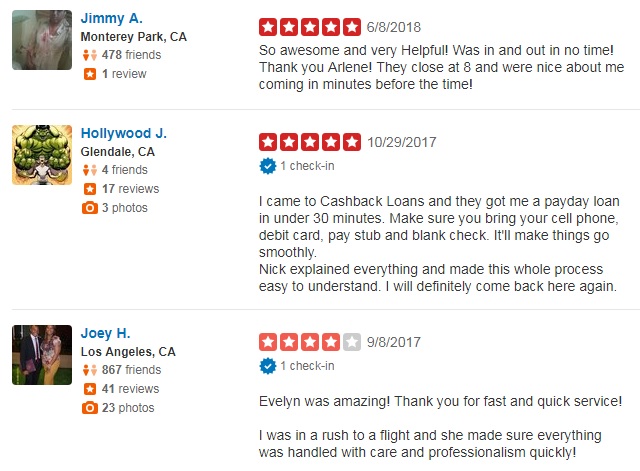

I found numerous CashBackloans.com reviews on an independent reviewing website. All of them were left by happy clients who gave the lender 4 or 5 stars.

Jimmy left a review in June 2018. He reported that this lender was awesome and very helpful. He was able to get the cash in no time.

Hollywood J. also took a payday loan in 2018 and the whole process took only 30 minutes. He mentioned that the staff was very helpful. He recommends other clients to take a cell phone, debit card, pay stub and a blank check with them because this will accelerate the process. He added that he would definitely return in CashBack for more loans.

Joey H. had an amazing experience with this company in 2017. He appreciated fast, quick and professional service.

It seems that this company has a very good online reputation since I found not a single complaint relating to its services.

Customer Support

Contact Information

The website contains all the necessary background and contact information of CashBack Loans.

Their in-store locations are open 7 days a week and we have extended hours for customers’ convenience.

Contact details of Cashback corporate office:

- mailing address – PO Box 6090 La Quinta CA 92253,

- phone number – 1-888-668-8114,

- email – [email protected]

The company has numerous offices across the state and you can find the address and phone number of a particular CashBack in-store location using a search tool.

CashBackLoans.com Locations

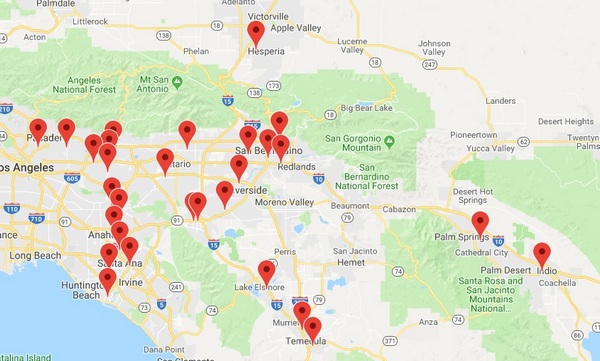

Currently, Cashback is only licensed in the State of California and is unable to provide loans in other states. They have 29 in-store locations across Southern California:

Getting a Consultation

According to the website, the lender has friendly employees who are always available at one of their 29 in-store locations, online or by phone to assist customers with any issue, question or concern. You can also reach the customer support by filling out a contact form on the Contact Us page.

I tried to contact the customer support staff by using a contact form. I asked whether payday loans could be extended. I waited for 6 hours but nobody responded. Their customer service team should provide a faster assistance, otherwise, a customer will simply find another lender.

Conclusion

CashBackLoans.com is a legit and experience lender providing 3 types of loans. Customers can apply for a loan in in-store locations, over the phone, and online, even if you have a bad credit or no credit. The company discloses rates and terms and has standard eligibility requirements, the website is very informative and convenient to use. ScamAdviser and previous customers rated this lender very high and I was not able to find a single complaint on the web. This website deserves a rating of 3.8 stars out of 5. I think it’s worth giving CashBack a try, however, you will not able to get a loan if you live outside the state of California. If you decide to apply for a loan online, remember that their customer support is not speedy as you may expect and they do not offer a loan extension. Also, make sure you have a reliable antivirus on your computer!

Ready to Apply?

Ready to Apply?