What is Cash1Loans.com?

CASH 1 is a lender which has been operating since 1997. The company provides hassle-free loans to people who got a refusal by usual banks and other lenders. The lender has many locations throughout 2 states – Arizona and Nevada. The company focuses on the needs of a client and excellent customer service. The lender consists of 200+ skilled employees having the mission of providing people the best experience and the company is proud to have good the reviews to prove it. CASH 1 strives to provide convenient terms and follows the best practices as stated by the Community Financial Services Association (CFSA).

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Installment loans, title loans | $100 | $50,000 | up to 6 months | no greater than 35.99% | Proof of Income, Government Issued I.D. | Yes |

Types of Loans

CASH 1 offers short-term loans that can help customers relieve their financial problems. The borrowed funds can be used for any purpose, for example, car or home repair, education, utility bills, traveling, medical expenses and bills, and so on.

Using this website, citizens of Nevada can get personal installment loans ranging from $100 to $1,500 in a few minutes using their employment as a proof of income with more time to pay off the debt.

People living in Arizona and Nevada can be approved for title loans ranging from $100 to $50,000 using their car/truck/motorcycle title as collateral. Citizens of Arizona can also get title equity loans ranging from $50 to $2,500 using the equity they have in their currently financed vehicle.

Unlike payday loans, installment loan repayment is carried out over a definite period making it possible to borrow as much money as you need and pay it off over an extended period with a lower interest rate. An installment loan can be provided for a period of up to 90 days. Customers are never required to pay a prepayment penalty, so they can repay their loans as soon as they are able to, before the specified date. In most cases, money is transferred the same day the loan is approved. Often this process does not exceed 15 minutes.

Title Loans are secured by the title on a car, truck, or motorcycle in which CASH 1 becomes the lienholder until the debt is canceled. The vehicle has to be in the personal property of the borrower. Title loans repayment period cannot exceed 6 months. Once the loan is canceled, the lien is released and the client is reissued a clear title. Once a loan application is received and reviewed by the lender, a speedy assessment of the vehicle will help determine the amount the company is ready to lend. According to the website, the whole process takes about 15 minutes or less to complete. Clients are also allowed to use multiple vehicles to get a greater amount as long as their income is enough to repay the loan amount. Even when a lien is placed on the vehicle, the client still owns it can use it any time.

Currently, CASH 1 is 2 promotions: 60 days No Payments for first-time title loans for Arizona applicants and 30 days No Payments for first-time title loans for Nevada.

Terms of Use

As we have already mentioned, the lender offers installment loans from $50 to $1500 and title loans from $50 to $50,000 to customers from Nevada, based on their salary and ability to pay off the debt. Installment loan amounts cannot exceed $1500 since there is no collateral to secure the loan. However, with a title loan, the lender can approve up to $50,000 in the case when the customer’s income is large enough to support the loan and when a client has an adequate equity in the vehicle. The loan amount is determined by the vehicle’s value and the client’s ability to repay that loan. Other factors, including net income, will influence the maximum loan amount and payment terms.

Title loan term depends on the state of residence but usually, it is 30 days or more (in some cases up to 210 days).

The interest rate depends on the customer’ credit history, loan amount required, loan term and type, and will be individually determined by the lender. As mentioned on the website, CASH 1 interest rate cannot exceed 35.99%.

- The lender can also get acquainted with the requirements for title loans: having a vehicle, proof of Income, state issued I.D., clear car title, being not on duty in the military;

- Installment loans requirements are the following: having an open checking account, proof of income, state issued I.D., being not on duty in the military, be at least 18 years of age. Besides, residents of Arizona must have a vehicle with equity.

With this company, usually the higher the loan amount, the lower the interest rate.

Unlike other lenders, CASH 1 requires proof of income instead of proof of employment, therefore you can be approved for a loan using your retirement, disability, and SSI income.

While some customers prefer to borrow funds in person, they can visit one of the lender;’s locations instead of filling out an online application.

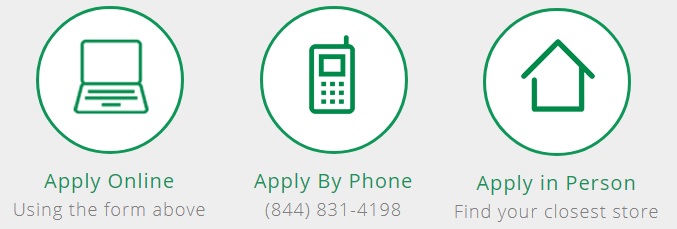

Application

CASH 1 guarantees a hassle-free, safe and secure application. There are 3 ways to fill out the application and get a preapproval for the loan. You can complete the online application, contact the call center or visit one of the store locations. Regardless of the method you choose, CASH 1 promises to provide a loan in as little as 30 minutes.

To get a loan, customers can simply start the quick loan application at cash1loans.com or by calling 1-844-831-4198. Once you get a preapproval, you should go to the nearest lender’s office in Nevada or Arizona to sign your loan agreement and receive the money. A complete list of locations is presented on the website.

According to CASH 1, the pre-approval process will take as little as 25 minutes. To be approved, the applicant must provide proof of income (latest bank statement or last two paystubs), a state-issued ID, checking account or direct deposit card. To get a title loan, a customer must have a vehicle.

Loan Repayment

Installment and title loans are to be repaid over the specified period in equal payments. Clients are allowed to pay larger amounts, saving themselves interest. All CASH 1 loans have no early repayment penalty. The loan term depends on the loan type. Installment loans have a term of up to 3 months, and title installment loans have a term of up to 6 months.

The lender claims that they understand that sometimes a person may need some more time to repay all the funds and they will do their best to work with this client. In the event of an emergency that would prevent a client from making the due payment, he must immediately call or visit the lender’s office to discuss possible changes and arrangements. The lender recommends reviewing the contract carefully to understand all terms and possible outcomes you can expect.

Payments can be made personally at the location, through credit/debit cards, or over the phone. No matter which payment option you choose, the lender never charges extra fees for the mentioned payment options.

Loan Extension

Payments may be made some days later than the due date, but CASH 1 warns that loan extension increases the amount of the due payment. Loan extension terms are regulated by state so applications must read the contract carefully before signing the loan contract.

According to the lender, customers can repay the loan earlier without any penalties.

Cash1Loans.com Bad Credit

CASH 1 does not pay attention to your credit score when deciding on installment loan approval. If you have proof of income, a state-issued ID, a checking account or deposit card, you have high chances of being approved for a loan.

![]()

The situation with title loans is the same. You may have bad credit or no credit at all. The approval will be based on your car’s value and your ability to pay off the debt.

Technical Characteristics of Cash1Loans.com

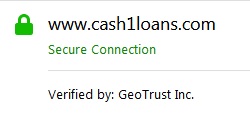

Checking Encryption

CASH 1 claims to be committed to protecting their customers’ privacy and using modern technologies that can give users a safe online experience. They guarantee to maintain all the best safeguards to transmit and store data about customers. They also claim to permit only authorized members of staff who are trained in the correct handling of clients’ data to have access to their personal and financial information.

I figured out that the website uses a 256-bit Secure Socket Layer protocol verified by GeoTrust Inc., which is considered an advanced encryption technology for protecting sensitive personal information.

Checking Mobile Version

According to Google, cash1loans.com is mobile friendly, which means that the website is adapted for mobile devices and can easily be used on them:

Using the mobile version seems intuitive and easy. For me, it’s even more convenient because the menu is filtered – all the secondary items are removed, only the key ones are presented. The application via a smartphone or a tablet does not seem to differ from that via a traditional computer. The mobile version does not have scrolling, other problems were not detected either. Everything seems to work and display on the screen correctly.

Checking Antivirus

The lender claims that its website is protected and monitored by Mcafee which helps keep customers’ safe from viruses, spyware, identity theft, and other threats. Regretfully, I noticed no Mcafee icon on the website which means that it currently is not having an antivirus installed. So I think you risk getting some unexpected viruses and your sensitive data can be stolen.

I would strongly recommend cash1loans.com’s owner to install an antivirus to provide safety during online transactions.

The Convenience of Using Cash1Loans.com

The website is available 24 hours a day, 7 days a week. The application process includes 3 steps but differs from other online lenders at one point – customers can apply for a loan online but they will have to visit the lender’s nearest location to get the cash. The fact that CASH 1 does not offer a direct deposit may seem inconvenient to some applications because many others lenders offer to get money without leaving the house or office.

You can complete an online application at cash1loans.com or by calling CASH 1 toll-free number. You will be pre-approved in 15 minutes. As soon as you are approved, you can go to the location of the company and receive your funds.

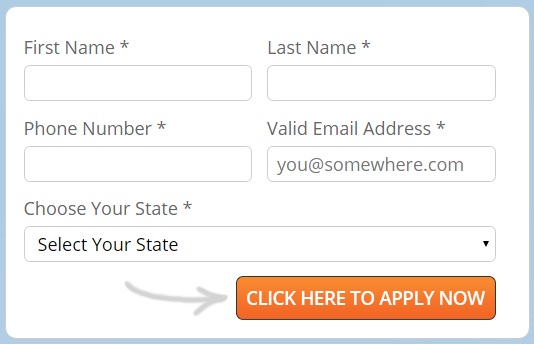

That’s how a short online application form looks like:

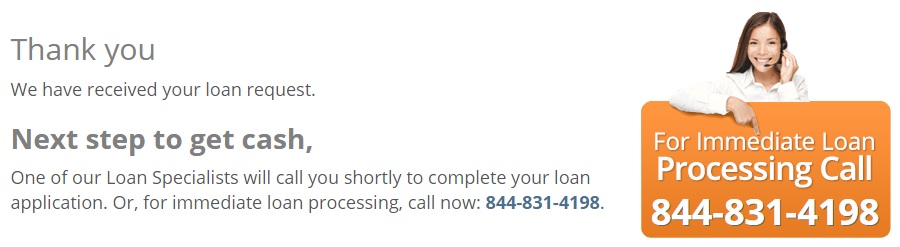

After providing the required details, you will see the confirmation of receiving a request from the lender. The message informs you that a manager will call you back in a few minutes, or you may call the specified phone number for quicker processing:

Call-center representatives can help you get the information about the nearest location where you can get the cash, its phone number and working hours.

Cash1Loans.com has posted all the details on interest, repayment options, terms and so on. Indeed, the website is very informative – here you can find all the necessary information you may need to know before applying for a loan.

Is Cash1Loans.com Legit?

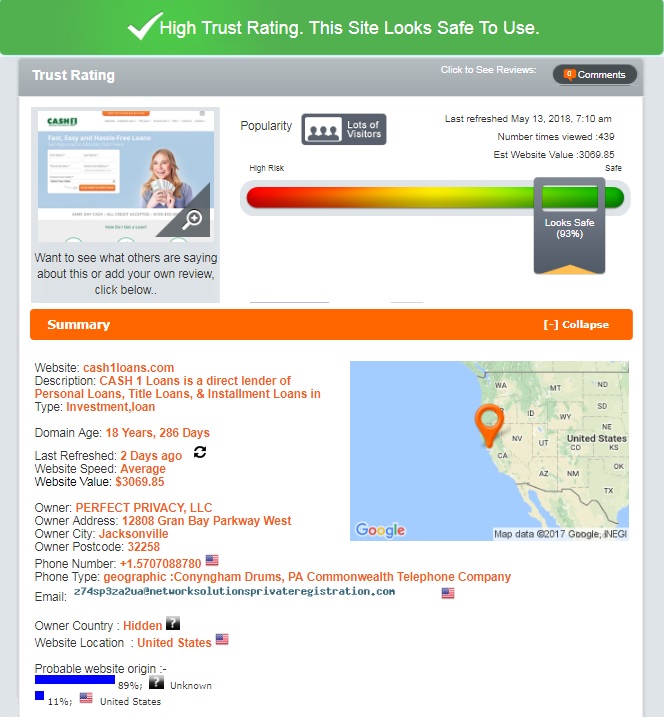

To learn the reputation and genuine background of Cash 1 Loans. I used a verification service ScamAdviser.com. The results were impressive: it turned out that this website has a trust rating of 93% out of 100%:

According to ScamAdviser, Cash1Loans.com is safe to use. The domain age is also impressive: almost 19 years. The site is regularly refreshed and has lots of visitors. However, ScamAdviser took off 7% of the trust rating because the website’s owner is using an anonymous service which hides its identity. The probable website origin is the United States (namely, Jacksonville, Florida). The service seems to be legitimate and nothing indicates that it’s operating illegally.

Cash1Loans.com Reviews

On-site Reviews

Customer reviews are the best way of checking the lender’s performance and real reputation. Regretfully, the official website of this company does not have a testimonial page. Clients cannot share their experiences on the native website of the lender. I would recommend this service arrange a special section devoted to customer comments.

Reviews on Other Websites

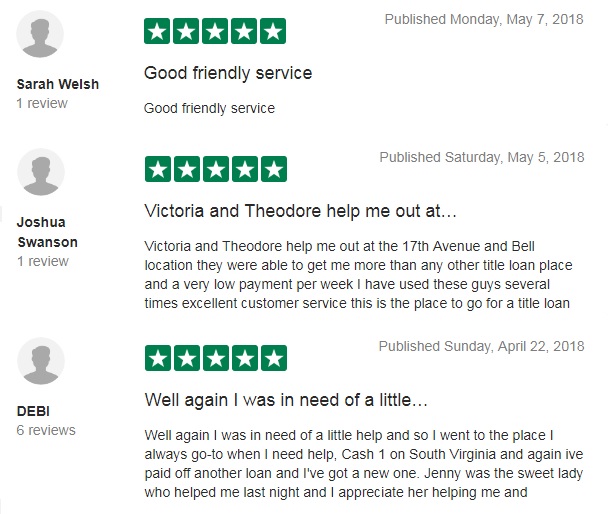

Searching for customer reviews on independent websites was much more fruitful – there are LOTS of testimonials about CASH 1 loans on the net. Trustpilot.com contains 4,140 reviews with 87% of them being positive, 5% – average, and 8% – poor. Almost all users are satisfied with this service and do not mind to use it again. People mentioned friendly customer support department, acceptable interest rates, flexible payment policy, speedy service, and so on. Below you can see the recent feedback from customers who used this lender in 2018:

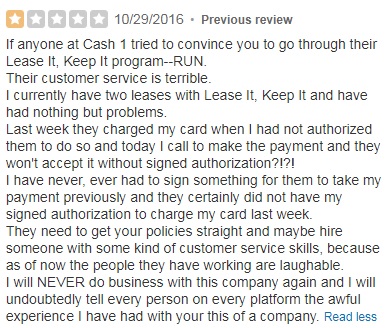

The number of CASH 1 loans complaints was very small. Actually, I am even glad that this lender has at least some negative reviews, because the absence of any would seem suspicious – there is NO lender that would satisfy all of its customers. Clients mentioned “terrible customer service” and loan denials. Here you can see an example of a complaint:

I conclude that this website is VERY popular. Sometimes people have troubles with this lender but there is no evidence that CASH 1 is a scam.

Customer Support

Contact Information

The website lists the detailed contact information, including:

- Customer Service: 844-831-4198;

- Fax: 775-852-6411;

- Automated Customer Support; 24 hours a day;

- Live Customer Care: Mon-Fri 9am-7pm, Sat-Sun 10am-5pm;

- Customer Support Email: [email protected]

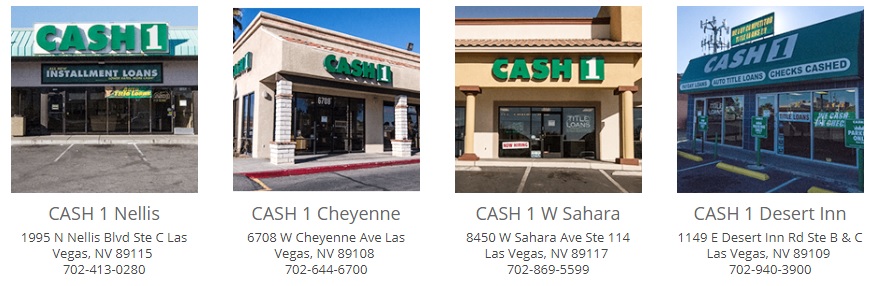

Besides, you can see the physical address and phone number of all CASH 1 locations where you can receive the cash. Some of the offices are presented below:

Cash 1 Loans Locations

Regretfully, the lender has a limited availability. CASH 1 is currently providing loans to residents of Arizona and Nevada. There are 6 store locations in Las Vegas and 1 store location in Reno (Nevada). There are also 7 locations in Phoenix, 4 stores in Mesa and Tempe, and 2 stores in Glendale (Arizona)

Getting a Consultation

If customers have any questions about loans or online application, they may call the call center at (844) 831-4198. They may also call the phone number of a particular store location they are interested in. All the contact details are mentioned on the website. There is also a live chat option, but it was offline at the time visited the website so I had to leave my question offline. Unfortunately, nobody answered within the specified time. This means that the customer care department is unable to provide speedy assistance. You may try calling the specified phone number to ask all of your questions. Maybe you will be luckier than I.

Conclusion

Cash1Loans.com seems to be a legal and popular lender providing installment and title loans. Customers are offered acceptable interest rates and flexible payment terms. Besides, the store has a very high trust-rating at ScamAdviser and a huge number of positive customer reviews. Some people may find this service inconvenient for some reasons: limited availability (2 states only), limited loan types, no opportunity to receive cash online. But if you are ok it, CASH 1 will be a good option for getting cash regardless of your credit score. My verdict is 4 stars out of 5.

Ready to Apply?

Ready to Apply?