What is Castle Payday?

Big Picture Loans (former Castle Payday) is an online lender providing installment loans online. This company is owned by a federally recognized tribe, Lake Superior Chippewa Indians, and headquartered in Watersmeet, Michigan. The company is a member of OLA and Native American Financial Services Association.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Installment loans | $200 | $1,000 | Up to 32 months | From 780% to 788% | SSN, Driver’s License number, State ID | Possible |

Types of Loans

This lender offers installment loans online – these loans are similar to payday loans but can be paid off in smaller payments over a definite period instead of paying the whole amoгnt on the day you get paid.

Installment loans can be used for any legal needs, including home improvement, family emergencies, large purchases, car repairs and so on:

According to the website, customers receive the money the same day into their banking account via ACH. However, most clients get the funds the next business day on working days.

Terms of Use

To qualify for Big Picture loan, you will need to meet the following requirements: have a regular source of income of $700+ per month, have an open bank account in your name, have active email and phone number, be 18 years of age or more, and be a legal resident of the United States.

Loan amounts range from $200 to $1,000 and can be taken for approximately 22 months. Each time you will repay the balance of a loan + interest and bear in mind that you will only start to repay the balance by your sixth payment. The lender charges no penalties if a client decides to pay off his installment loan before the due date, this will help save the interest rate.

The loan amount you are eligible for will be based on your income, credit rating, and the personal details you provided when filling out an application.

Although Big Picture Loans doesn’t require you to repay your loan on the day you reсeive your wages, your interest rate will be similar to that of payday loans. The APR typically ranges from 780% to 788% based on your credit score and some other relevant factors. However, as I already mentioned, you can reduce the interest rate by repaying your loans early. A good thing is the APR does not vary by state because Big Picture Loans is a tribally owned lender.

There is an example of approximate loan rates and terms on the website: the cost of a $1,000 installment loan in some cases will reach $9,900, which means this type of a loan can be very expensive.

Application

Big Picture Loans application process seems simple and purely online. The request can be completed in a few minutes. They do not accept loan requests over the phone. To apply for a loan, you should visit their website and click on the “Apply Now” button.

After you submit your application, the lender will call you within 10-15 minutes (provided that you applied within working hours) to confirm your personal information and make a lending decision.

In general, to get the funds, you only need to go through 3 simple steps: apply online, choose the desired loan, and get an approval:

During the application process, be ready to provide your name, address, birth date, email address, driver’s license number or SSN.

Repayment

Clients of Big Picture Loans may choose a repayment schedule that may vary from 12 to 32 months depending on the requested loan amount. You can choose to make installments bi-weekly. During the 5 first payments, you will only repay the loan interest.

Bear in mind that late, missed or failed payments may incur additional fees and penalties. The company may also start collection activities within the Tribal federal law.

Extension

You can extend your installment loan for up to 32 months. However, a loan extension can make your loan very expensive – the longer you pay off your loan, the more interest you have to pay to the company. It’s not recommended to use Big Picture loans for long-term financial troubles.

According to the website, you can only have one loan with this lender at a time. Once you’ve canceled your debt successfully, you can request another loan. Besides, regular customers with a good reputation may get better loan terms and lower interest rates.

BigPictureLoans.com Bad Credit

The lender does credit checks in all cases and looks at your credit history from the three major credit bureaus but this does not mean that bad credit score will cause a loan denial all cases. All situations are reviewed individually. However, bear in mind that bad credit or bankruptcy may affect the loan amount you are eligible for and your interest rate.

Technical Characteristics of the Website

Encryption

The company claims that they use the best technologies to provide 100% safety and privacy to all customers. The website of Big Picture Loans has a green lock at the left side of the address line which proves that this website can provide a secure connection. The URL https// testifies that the website is using an SSL encryption technology (128-bit) which can provide security. The secure connection is verified by CloudFlare, Inc.:

In general, a 128-bit SSL encryption technology is considered average and it may be enough to provide safety to customers, however, I’d recommend you using online lenders who use a 256-bit SSL encryption and an Extended Verification Certificate. They are considered the most reliable options.

Mobile Version

BigPictureLoans.com can be used from both PCs and mobile phones / tablets. The site has a friendly mobile version which can satisfy all your needs if you prefer to apply for a loan being far from home.

This mobile version is similar to the regular version of the site but its functionality differs a bit. Some pictures, elements and blocks are smaller, links and buttons, on the contrary, have an increased size. I like that this site can be easily used from various devices and from anywhere.

Antivirus

The website is sealed by Norton, which is the most popular antivirus on the web. This testifies that clients of Big Picture Loans can feel calm and not worry that they will catch some viruses when surfing the site.

The Norton seal also indicates that this site is checked for viruses and unwanted malware programs every day, and the results of the check are reported to the site’s administration.

Convenience of Ordering

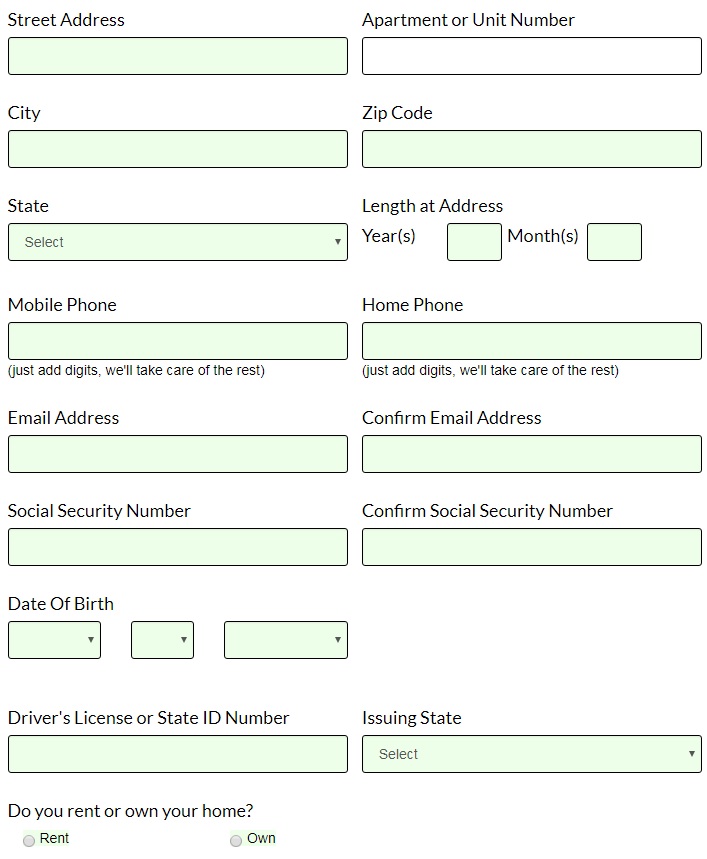

At BigPictureLoans.com, you can apply for a loan 24 hours a day 7 days a week. You can start an application process without creating a personal account and logging into it. You should press the “Apply” button and enter the required personal information, such as name, birth date, phone number, address, driver’s license, social security number, name and phone of your employer, your income and payday frequency, and so on. Below you find the first application block looks like:

Once you finish with your online application, you will receive a call from the lender’s representative within -10-15 minutes to verify your personal data. Of course, not all customers will like this verification issue – most applicants prefer a 100% online process. But in general, applying for a loan is easy and fast.

The loan terms and rates are fully disclosed on the site, however, they will be influenced by some factors. I like that second-time applicants have an opportunity to get a loan with better terms and rates.

First-time customers can visit an FAQ page which contains the detailed answers to popular questions about Big Picture Loans, loan terms and policies.

Is BigPictureLoans.com Legit?

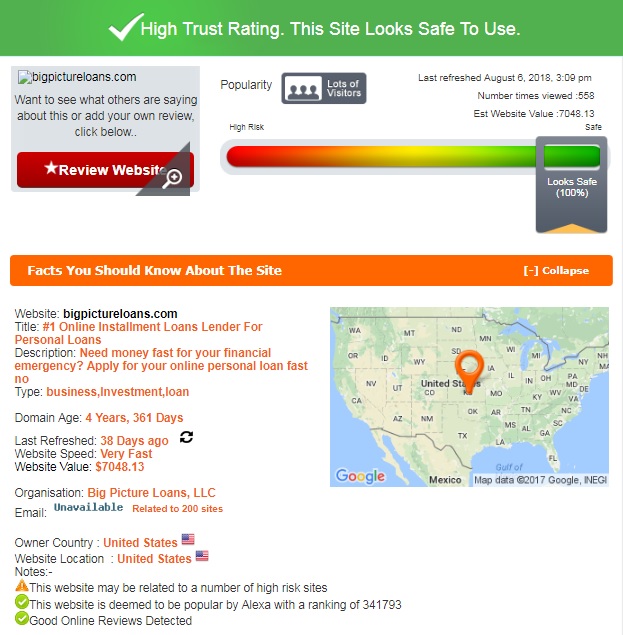

ScamAdviser is fully satisfied with the legitimacy and background of Big Picture Loans. The report indicated that the site’s trust-rating has reached 100%, which means that this lender is legit.

According to ScamAdviser, this website has been active for 5 years, it’s owned by Big Pictured Loans, LLC and located in the United States. Besides, there are good reviews detected. Although ScamAdviser reported that this site could be related to a number of high-risk websites, its trust-rating was the maximum possible.

BigPictureLoans.com Reviews

On-site Reviews

Good customer reviews are always a good sign and a reason to trust the company. Regretfully, there are no Big Picture Loans reviews on their own website. They do not even have a testimonial page where customers could have shared heir experience with this lender. For this reason, I continued looking for user reviews on the web.

Reviews on Other Websites

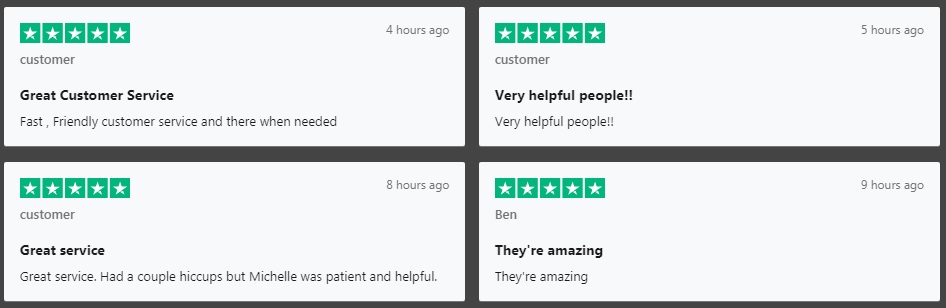

I found a huge number of BigPictureLoans.com reviews on third-party independent websites. Most of the comments are posted on TrustPilot.com. Customers like this lender for its “fast and friendly customer service”, “fast funding”, “effortless application process”, “relaxed eligibility criteria”, and so on.

However, some of the customers were dissatisfied with the services provided by this lender. Users rated this company 1 star out of 5 and recommended to stay away from them. Complaints were about “misleading terms”, “very high interest rates”, «poor customer service”. Mark B. posted a complaint in January 2018 and said that Big Picture Loans was the worst company he had ever interacted with because they had a terrible customer service. He also mentioned that they were careless about people. Another user, Linda A., posted a negative review in September 2017 reporting that this company was “shady”. According to her, people cannot make payments online and the rate is more than the lender shows. She recommended staying away from this company. Other customers mentioned that this lender never answers phone and company was “fake”:

I became really concerned after reading all these complaints but their amount is very small if compared to positive reviews. In general, it seems that this lender is able to provide good services but obviously, it’s not always as perfect as you may expect.

Customer Support

Contact Information

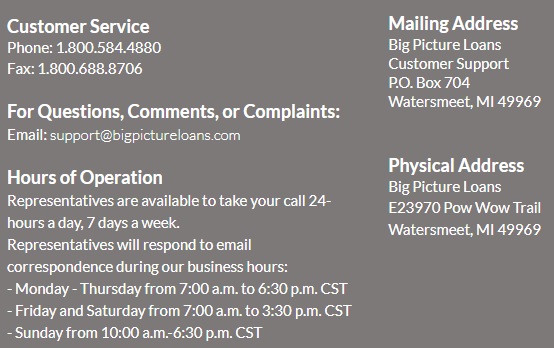

Fortunately, the «Contact Us” section was comprehensive and not a single detail remained hidden:

I also appreciate that Big Picture Loans working hours are also disclosed: Monday – Thursday from 7 a.m. to 6:30 p.m., Friday – Saturday from 7 a.m. to 3:30 p.m., Sunday from 10 a.m. to 6:30 p.m.

BigPictureLoans.com Locations

Big Picture Loans are available in all 50 states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.

Getting a Consultation

If you have any questions, suggestions, concerns or complaints, you can contact the customer support by calling at 1-800-584-4880, sending a fax to 1-800-688-8706 or e-mail to [email protected]. You can even send a letter to P.O. Box 704, Watersmeet, MI 49969 or visit E23970 Pow Wow Trail, Watersmeet, MI 49969. They say the customer care department is 24 hours a day 365 days a year.

I tried to reach the company’s representative via email to find out whether borrowers can make payments online. Regretfully, the reply did not come within the specified time, which means that this lender either has a bad customer service or users have to wait too long for a reply.

Conclusion

Big Picture Loans provide installment loans of small amounts to residents of all states and regardless of credit scores. The application process is quick and paperless and applicants can get their funds in a short time. The site is sealed by OLA, protected by Norton antivirus, verified by ScamAdviser. I appreciate that this lender allows repaying before the due date without any penalties, which can help cut down the interest. Besides, I found many positive reviews from previous customers. However, I cannot recommend this website to other users since Big Picture Loans charges a very high interest rate, which can make an installment incredibly expensive in a long run. Besides, customer complaints evidence that this lender sometimes fails. I think you should look for another lending company that offers better rates and has a better reputation.

Ready to Apply?

Ready to Apply?