What is BadCreditLoans.com?

BadCreditLoans.com is not a direct lender, the service connects customers and available lenders designed specifically for people with bad credit score. BadCreditLoans is owned by the USA and has been created in 1998. Over these years, the company has managed to gain a good reputation as a service that helps people with poor credit history to find a reliable lender with suitable loan option.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Poor credit history |

| Personal Loans, Business Loans, Credit Cards, Mortgage Loans, Home Loans, Student Loans, Auto Loans | $500 | $2500 | 3 to 36 months | Defined by the lender | Driver;s license or state ID, SSN number | Yes |

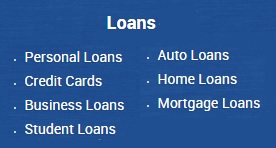

BadCreditLoans Credit Options

The company works with numerous lenders, which means that they may offer different credit options: Personal Loans, Business Loans, Credit Cards, Mortgage Loans, Home Loans, Student Loans, Auto Loans.

- Personal loans: this option is suitable for coping with emergency car repair, covering of unexpected bills. People with poor credit may request up to $1000. Customers should bear in mind that each lender has its own rates and terms that range from 3 to 36 months, depending on the loan amount requested and the income of the borrower. Interest rates may also range between 6% and 36%;

- Business Loans: these loans can provide customers with the funds needed to solve emergency money problems. People usually use these funds for paying payroll, make emergency repairs, buy materials, buy equipment, pay taxes, insurance, and other bills;

- Credit Cards: (prepaid credit cards, secured credit cards, debit cards) – help people with bad or no credit score to buy goods and services. Bad credit cards from BadCreditLoans.com allow people the get to necessary credit without any damage to their credit score;

- Mortgage Loans: this credit solution is available to people to buy a house they have never owned before;

- Home Loans: this option also helps people buy a new home;

- Student Loans: with the help of these loans, people can continue their education or take additional lessons to improve their skills. This credit option is available even to older individuals who have decided to return to school. Student Bad Credit Loans are designed for all students, not for those who have just graduated from school;

- Auto Loans: these loans allow customers to buy a new or used car easily.

Most of these credit options are short-term financial solutions, not intended for long-term use. BadCreditLoans recommends using these loans only for short-term emergencies, and not for large purchases like a vacation, TV or computer.

The company is also a sponsor of several charitable US organizations.

The company understands that customers do not want to wait weeks for the cash. According to the website, people can use using the electronic loan request service, and the company will be able to transfer funds within 24 hours.

Terms of Use

The company can offer between $100 and $2500. The available amount will depend on the state of residence and the current financial situation of the customer. They connect the borrower with a suitable lender from the network based on the application details. Usually, clients have 14 to 30 days to repay the loan without any fees, but these terms vary from lender to lender.

- To apply for a loan through BadCreditLoans.com, clients must:

- Be at least 18 years of age;

- Be a citizen of the USA (should be confirmed with the help of a Social Security number);

- Have a steady income (or disability or Social Security benefits).

- Have an active checking account;

- Have work and home phone numbers.

- Have an active email address.

These requirements seem standard and do not differ from other lenders. So, the company needs to understand the client’s financial situation and assess his ability to repay a loan. In some cases, BadCreditLoans can ask some additional cases.

The APR will depend on the lender but usually, ranges from 230% to 2,330%.

Loan fees also depend on the lender. The average fee is $15 for a $100 loan. The company does not charge any fees for the online application process.

Late penalties depend on the lender. The customer will be able to see all details in his loan agreement.

Usually, customers do not need to fax any documents, however, in some cases, the lender may require faxing documents to verify the identity and income.

On BadCreditLoans.com, you will get an immediate decision as soon as you fill in an online application, the service will offer you a suitable lender in a few seconds. The lender promises to send the money to the user’s account via direct deposit as soon as he e-signs the loan contract. The speed of money transfer depends on the lender and his deposit process. But, generally, the funds appear in the checking account within one day.

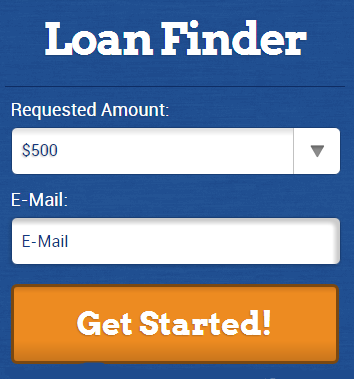

Application Process on BadCreditLoans.com

On BadCreditLoans.com, the application process is entirely online and free. First of all, the client selects the desired loan amount on the main page and fill in a personal e-mail address. This information is required to start the application process.

The process seems quite simple and speedy. First, customers will have to fill in some basic personal details, like a phone number, a bank account, an SSN number and so on. One the application is finished, the service starts connecting you with the lender. If a suitable lender is found, your loan application is reviewed in more detail. Some lenders may use credit bureaus to check your credit score.

Once the application is verified, the lender makes an offer. Before accepting it, the customer can review all details, such as rates, fees, and terms.

If the client accepts the offer, he can sign the loan contract online with an electronic signature. After that, the money is sent to the client’s account via direct deposit. Generally, they appear on the account the next business day, depending on the lender’s deposit process.

Customers should bear in mind that borrower does not have to accept any offer if the offered rates and terms do not meet his needs.

What we like especially about BadCreditLoans.com is that BadCreditLoans.com lenders do not require any collateral to get a loan.

Loan Repayment on BadCreditLoans.com

Bad Credit Loans are to be repaid within short time periods – 1 to 3 months.

A precise repayment schedule will be indicated in the loan agreement. So the customers can see all monthly installments they will need to pay.

Late payments and fees are also individual and depend on the lender. The company recommends borrowers to contact the lender if they are unable to make a payment on time. Most lenders from the system of BadCreditLoans.com charge a late fee for delayed payments, but the exact penalty amount may vary.

If the client misses a payment, the lender may refer his loan to a collection agency and he will not be allowed to apply for another loan with BadCreditLoans.com.

Loan Extension

Loan extension option varies from lender to lender and also depends on the state. Some lender from the network will require the client to repay his loan on the due date, while others may allow him to extend the loan term. Bear in mind that loan extension is not always free of charge, in some cases, this implies additional fees. And short-term loans can quickly become VERY expensive, so you’d better avoid loan extensions and use this option only in extreme cases.

BadCreditLoans.com Bad Credit

From the website’s title it becomes clear that with BadCreditLoans.com, customers do not need to have an excellent credit history to be approved for a loan. Even clients with a bad credit score can be eligible.

However, the lenders from the system do not usually provide loan amounts exceeding $1000 to people with a poor credit score.

Technical Characteristics of the Website

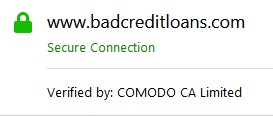

Is BadCreditLoans.com Safe in Terms of Connection?

BadCreditLoans.com required customers to provide may personal details such as an SSN number, email address, home address, a checking account number, so it’s very important for us to know that this website is encrypted properly. Our browser shows a green lock in the address bar, which means the connection is secure, however, it turned out that the security level is minimal – the website uses only a 128-bit SSL encryption. This may be enough to protect customers’ information from online theft. Regretfully, the website’s owner is not indicated, but we can see that the secure connection is verified by COMODO CA Limited:

So, we may conclude that the encryption level of BadCreditLoans.com is satisfactory, but we would give this company a higher rating if they had a higher encryption, such as 256-bit SSL.

Checking BadCreditLoans.com Mobile Version

BadCreditLoans.com services are also available for mobile users. The website is adapted for mobile devices, tablets, and smartphones. The website seems to function correctly, has no scrolling, the text is displayed correctly. We even like this mobile version more than a desktop one. Besides, the website has successfully passed a mobile-friendly Google test:

No doubt, a good mobile version is very important for users since today many people use mobile devices for getting loans online.

Checking Antivirus

The website uses no antivirus program, which is frustrating, since in some cases computers may be infected with dangerous malware and viruses. It’s important for users to feel secure when surfing the net, so it would be better for the website’s owner to install an antivirus program. Today, BadCreditLoans.com is not the safest place to apply for a loan.

Convenience of Using BadCreditLoans.com

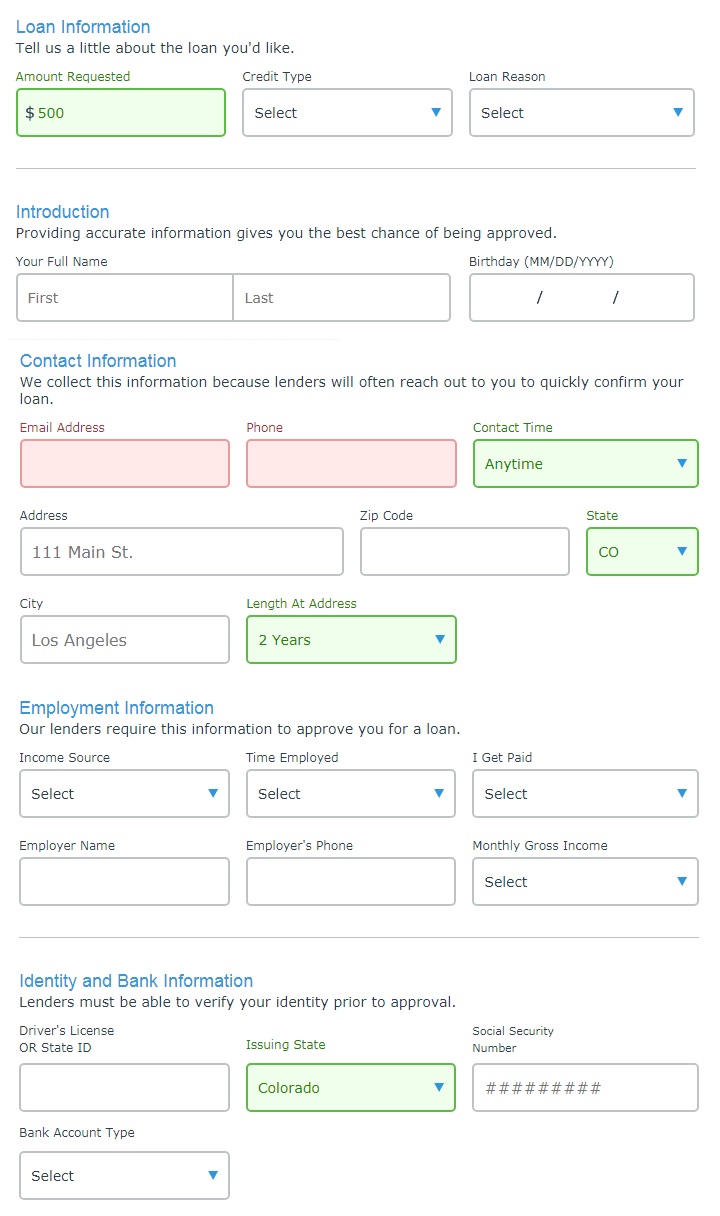

As we have already mentioned, the website has a prety simple online aplication, which consists of 3 major sections: Loan Information (amount requested, credit score type, loan reason), Introduction (name, birthday), Contact Introduction (email address, phone number, living address), Employoment Information (income sourse, time employed, employer’s name and phone number, how often you get paid, monthly gross income), Identity and Bank Information (driver’s lisence or state ID, bank account type, Social Security Number).

On BadCreditLoans.com, customers do not need to register to start an application process, which greatly accelerates the procedure.

The loan application is standard and convenient and requires only the necessary details. You can see the way it looks in the screenshot below:

We also appreciate that the website contains many articles that may help customers to become more financially educated. The company writes about how to receive a loan, how to plan a budget, how to spend your money, how to repay your loan quickly.

The website has one more informative section – Scam Alert. This section includes the latest scams affecting people and tips on avoiding them. Here you can read about debt collection scams, wire transfer scams, government-job scams, and many other things. You should definitely take a look at these sections, probably you will find something useful here.

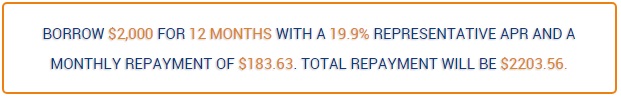

Although the company does not provide precise loan details, (being not a direct lender), it gives a few representative examples which can help us understand quick personal loans better:

Is BadCreditLoans.com Legit?

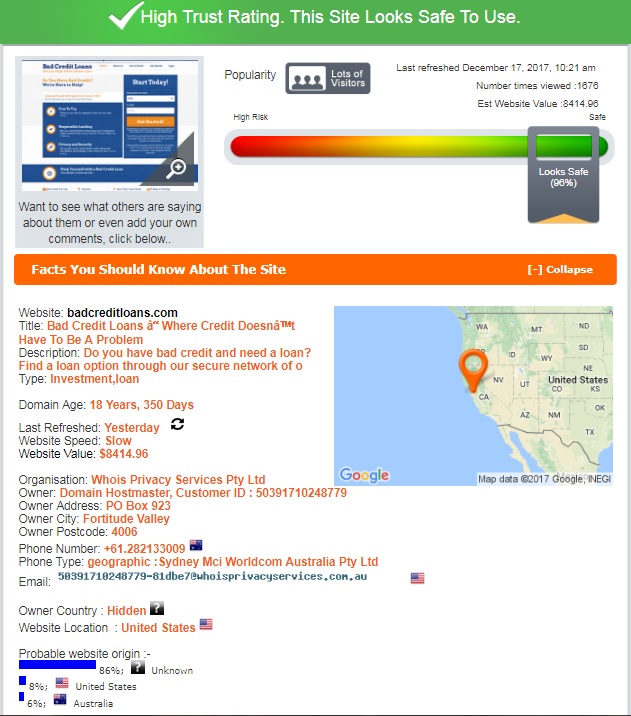

To check BadCreditLoans.com’s legibility, we used Scam Adviser – a reliable online checking service – to determine the history and other facts about this company. According to this service, BadCreditLoans.com has a high trust rating – 96% out 100% and looks safe to use:

We were satisfied with the company’s background revealed: the domain age is 19 years, the website is located in the USA. Besides, it has lots of visitors and shows a healthy activity. However, Scam Adviser was skeptical about the owner country, since the website’s owner uses an anonymous program to hide its identity. In addition, the site somehow related to Australia. Obviously, this was the reason for Scam Adviser to take 4% off the trust-rating.

BadCreditLoans.com Customer Reviews

On-site BadCreditLoans Reviews

Lenders like BadCreditLoans.com often suffer from a bad reputation because such credit options usually come with very high interest rates and are often declined. So we decided to search for some BadCreditLoans customer reviews. Unfortunately, we did not find a special section where clients could share their experience with this lender-matching tool.

So we could not assess the reputation of the company based on on-site user reviews and had to search for reviews on independent websites and forums. We will review them in the following unit.

BadCreditLoans.com Reviews on Third-Party Websites

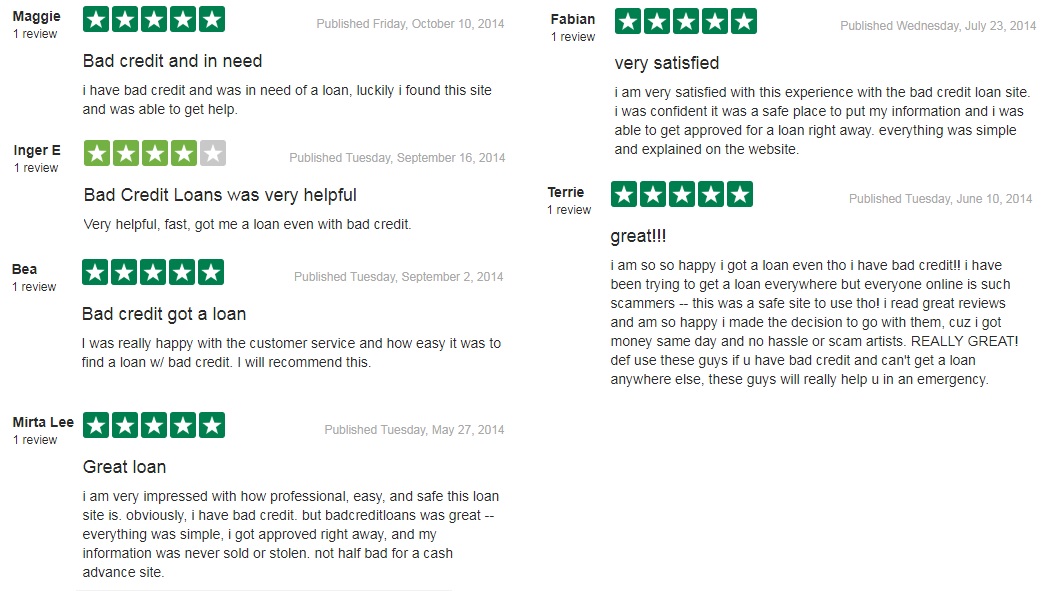

Since this service has been functioning for about 19 years, we expected to find plenty of customer reviews. However, we managed to find only 7 reviews: trustpilot.com contained only positives reviews about BadCreditLoans, and BBB listed only 1 negative comment.

All positive testimonials from Trust Pilot are dated 2014, which may mean that the service has lost its popularity by 2017. People how left good reviews pointed out a good customer service, a fast application, a possibility to get a loan with bad credit score, safe transactions, a quick loan approval. They also say that BadCreditLoans.com is the only place that can help you get a loan even if all other credit institutions declined your application. You can see these 6 reviews below:

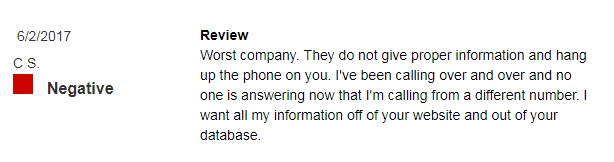

But not all customers were happy with BadCreditLoans.com services. One user is greatly disappointed with this company. He says BadCreditLoans is the worst company which does not provide a proper information on the site and does not answer phone calls. This sounds alarming because this review is dated 2017, unlike customer testimonials from Trust Pilot.

Although we came across one complaint about the company, we did not find any information testifying that Bad Credit Loans are illegal. BadCreditLoans.com seems to be a real company even though they do not always work well for all customers.

Contact Us Section

Contact Information

The Contact Us section of this website contains the major information borrowers need to know to reach the representative of the company: badcreditloans.com phone number, email address, legal address:

Many other online lender-matching services do not see the need to provide contact information on the website since they expect customers to contact the lender directly. We appreciate that Bad Credit Loans are trying to be as transparent as possible.

BadCreditLoans Locations

According to the website, Bad Credit Loans are currently available in the following states: Alabama, California, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Maine, Michigan, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Wisconsin, Wyoming.

BadCreditLoans.com is NOT available in Alaska, Arizona, Arkansas, Colorado, Connecticut, Georgia, Louisiana, Maryland, Massachusetts, Minnesota, New Hampshire, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Vermont, Virginia, Washington, West Virginia.

Customer Support Service

The service processes loan applications 24 hours 7 days a week and they also have a phone number that is active from 6 am until 7 pm. We also appreciate that they have created a detailed FAQ’s section on the website that answers the more common questions about Bad Credit Loans, lenders from its network and short-term loans in general.

We decided to check the customer service of this company and tried to reach a manager via email address specified on the website. We wanted to know the ways of loan repayment. The answer did not come during 6 hours and people in need will not be ready to wait any longer. The company’s customer support service needs to be improved.

Conclusion

BadCreditLoans.com offers a good chance to for people with bad credit score to get a quick loan by filling in an easy application form online. This service will connect you with a reputable lender who will be ready to borrow you up to $2500. There were many aspects we like about Bad Credit Loans: they borrow money even to borrowers with poor credit history, give multiple loan offers, provide approximate loan terms and rates, give an instant decision, the service is free and transparent and has a very good trust rating on ScamAdviser. At the same time, some aspects seem confusing: customers can only get up to $2500, interest rates can be very high, the website is not properly encrypted.

In general, this company is worth the experience. Probably, this is one of the few companies that can help you get fast cash even if you have been declined by all other credit organizations and online lenders. The company deserves 3,8 stars out of 5.

Ready to Apply?

Ready to Apply?