Ace Cash Express Self-Introduction

![]() ACE Cash Express, Inc. is a financial provider, having specialization in short-term loans, bill pay, and prepaid debit card services, as well as the largest owner-operator of check cashing stores in the United States. 1968 is the year of ACE Cash Express establishment. It focuses on serving consumers trying to find alternatives to conventional banking relationships by gaining convenient, immediate access to financial services.

ACE Cash Express, Inc. is a financial provider, having specialization in short-term loans, bill pay, and prepaid debit card services, as well as the largest owner-operator of check cashing stores in the United States. 1968 is the year of ACE Cash Express establishment. It focuses on serving consumers trying to find alternatives to conventional banking relationships by gaining convenient, immediate access to financial services.

Ace Cash Express is a proved member of United States Hispanic Chamber of Commerce (USHCC) and Financial Services Centers of America (FISCA).

![]() Depending on the state, Ace Cash Express may be considered:

Depending on the state, Ace Cash Express may be considered:

- a lender itself;

- Credit Services Organization (CSO) – gains compensation helping clients get loans from a lender;

- Credit Access Business (CAB) – helps people get payday and title loans from a lender.

| Types of Loans | Min Loan Amount | Max Loan Amount | Interest Rates | Periods | Documents | Bad Credit History |

| $ 50 | $ 5000 | agreed individually | agreed individually |

| unknown |

Types of Loans

Acecashexpress.com offers its customers the following list of available loans online:

- Payday Loans – are short-term loans designed to help you pay for immediate expenses;

- Cash Advance – is devoted to waive financial expenses until your next payday or sooner;

- Installment Loans – are devoted to clients who are required more time to pay their loan off than offered by a single-payment payday loan;

- Prepaid Debit Cards – Acecashexpress prepares debit cards to pay for different purchases.

There is also a possibility to get in-store services such as:

There is also a possibility to get in-store services such as:

- Title Loans – is a loan where a vehicle title is applied as collateral in exchange for a loan amount;

- Tax Services – is a service offering clients an opportunity to cash tax refunds;

- Check Cashing – is service offering to get money when cashing a check;

- Bill Payments – a service where clients are able to pay for any kind of bills online;

- Money Transfers – a service offering customers an opportunity to transfer cash;

- Money Orders – a transference of money by means of MoneyGram;

- MoneyGram – universal system of money orders;

- Business Services – are service providing immediate access to your business funds independently of your place of location.

Depending on the type of loans, clients may get cash on a credit card (if an application is filled in online) and on hand (if – in-store). Acecashexpress.com provides a simplified application form. Approval takes from several minutes to some hours and money is transferred to 72-hours maximum.

Terms of Use

To arrange a loan by means of ACE, it is necessary to meet the following requirements:

- valid social security number or individual taxpayer identification number;

- bank account;

- steady source of recurring income payments.

There is no concrete information about the age of borrow but in the majority of cases, different types of loans are available for people over 18 years old. Acecashexpress.com provides, as mentioned above, various types of loans and depending on type and state, min and max sums of money and interest rates may vary. To get to know more about this information you have to choose a state and find what you need.

Payday Loan available sum of money:

| Online Service | In-store Service |

| California: $100 – $255 | California: $100 – $255 |

| Florida: $200 – $500 | Florida: $100 – $500 |

| Idaho: $100 – $1,000 | Indiana: $50 – $605 |

| Kansas: $200 – $500 | Kansas: $100 – $500 |

| Louisiana: $300 | Louisiana: $100 – $300 |

| Minnesota: $200 – $500 | Minnesota: $100 – $500 |

| Ohio: $200 – $1,250 | Missouri: $100 – $500 |

| Texas: $200 – $1,500 | New Mexico: $100 – $300 |

| Ohio: $100 – $1,000 | |

| Oregon: $100 – $300 | |

| South Carolina: $100 – $550 | |

| Tennessee: $100 – $425 | |

| Texas: $100 – $1,500 | |

| Virginia: $100 – $500 |

Minimum and maximum installement loan amounts vary by state:

| $2,500 – $5,000 | $200 – $2,000 |

| California | Delaware |

| Texas | |

| Ohio | |

| New Mexico | |

| Missouri |

Title loans available sums of money are:

| Arizona | $100 – $2,500 |

| Georgia | $100 – $2,000 |

| Louisiana | $500 – $1,000 |

| New Mexico | $100 – $2,500 |

| Ohio | $200 – $300, or $500, or $1,000 |

| Oregon | $100 – $300 |

| Tennessee | $100 -$2,500 |

| Texas | $100 – $5,000 |

So that, we may come to a conclusion relating to min and max loan amounts that min amount is $50 and max – $500. Interest rates and period are calculated individually depending on several factors. When providing information about your income, managers of AceCashExpress will provide you with a period of time for which you are able to take a loan. It is a fact that short-term loans are given for 14 days, a month-maximum.

There is logic whether a customer should be employed for a certain period of time to take a loan. The answer is NO, clients should confirm their paying capacity which may have no connection with working place. So that, customers should have a source of income to pay for a loan off.

Application

Documents required for may vary depending on the method you take a loan:

- online;

- in-store.

If a client applies for a loan online:

- a client must have a valid Social Security Number or Individual Taxpayer Identification Number;

- a client must have a checking or savings account that has been open for at least one month;

- a client must be capable to be contacted by means of the phone if application information verification is necessary.

If applying in-store:

- a client must bring a valid government-issued photo ID. A Social Security Number is not required;

- a client must bring proof of income and proof of a bank checking account. Debit cards or pre-printed checks may be accepted in your state as proof of bank checking account; contact your local store for details.

Acceptable documents may vary by state. There is no need to provide guarantees or contact persons to take a loan, in such a case a process of getting cash is shortened for several times.

Acecashexpress.com application is processed for several minutes and clients gets to know loan status immediately. Money is transferred within maximum 72 hours.

Re-payment

There are two types of loan re-payment, exactly:

- online;

- in-store.

If you are going to pay your loan off online, then you should hit your bank account and money will be written off on your due date.

If you are going to pay for a loan off in-store then you need to come and pay on the due date or earlier. It means that clients are able to pay a loan off earlier. In Texas and Ohio, paying early will not reduce your CSO charge. However, it may reduce the interest rate that falls to a lender. In states other than Texas and Ohio, early repayment may reduce the interest rate that accrues on your loan.

There is no prepayment penalty in any state where Ace Cash Express performs.

Clients are able to extend or refinance loans online or visiting in-store. To refinance a loan you are welcome to visit acecashexpress.com and choose the option “Refinance”. If you are not eligible, you will not have access to this option. Acecashexpress will write off required fees from your bank account and you will be approved for refinancing.

There are the following ways of solving a problem if a client doesn’t pay for a loan off timely:

- financial implications – a client may be assessed a late fee if he fails to pay off by a defined period following its due date, and a client may be assessed with a returned item fee if any check or electronic payment we submit on your behalf is returned unpaid;

- collection activity – Acecashexpress may try to collect any delinquent amount by means of standard collection practices, which contain contacting a client by phone, mail, or email.;

- impact on your credit score – failure to pay timely off a loan may reduce a client’s score with such agencies as FactorTrust, and prevent a client from getting credit or other services from a provider that utilizes such agencies;

- refinancing a loan – a client may refinance a loan or credit services transaction by logging in as a returning client prior to due date and applying for a refinance.

Extension

There is such an option on ACEcashexpress.com as the extension or refinance of money. Acecashexpress.com provides no information relating to how much times a client is able to refinance a loan. Everything depends on individual case. It is also left unknown whether a client is able to take a loan when the first one is not paid off completely.

1.6. Acecashexpress.com Bad Credit History

The majority of online speedy loan services are giving loans independently of bad credit history or its absence but Acecashexpress.com provides no information relating to it. For people having a bad credit history, such online services are the greatest opportunity to solve financial problems.

Technical Data

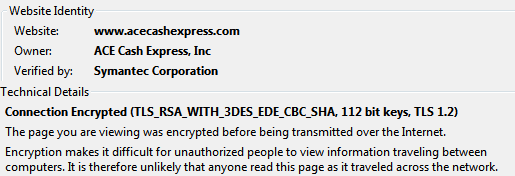

Secure Connection on Ace Cash Express

The connection is secure on Ace Cash Express. Site administration names company owner – ACE Cash Express, Inc (US).

![]()

The certificate is verified by Symantec Corporation. They use 112-bit encryption by means of which clients’ personal data is protected.

112-bit is not the most effective means of protection that’s why clients should be worried about it. There are more efficient methods of clients’ personal data protection. But the major role here is played by the fact that site administration doesn’t hide company owner given the safety certificate.

Mobile Version

There is a mobile version of acecashexpress.com. Mobile version is user-friendly and has no drawbacks about. Each page is arranged in a convenient way adapted to different mobile devices. Mobile version makes it possible for clients to leave an application and wait for the approval. Clients may save money using such an innovative idea as a mobile app. There are mobile apps available in App Store and Google Play.

There are three mobile apps by means of which clients are able to fill in the application form and get a loan:

| ACE Elite Mobile Banking | ACE Cash Express Mobile Loans | ACE Mobile Loads |

|  |  |

| by NetSpend Corporation | by ACE Cash Express, Inc. | by Ingo Money, Inc. |

| The ACE Elite app provides you with an opportunity to manage your account on the move. Never worry about whether or not you’ve got enough cash to buy lunch. When you get the app, you’ll be able to check your balance in just a few seconds. You can also see your recent transactions, find the closest load location, and call Customer Service with one tap. | Apply for and manage your online loan and find over 1,000 ACE Cash Express locations. Download our free mobile app for your Android and iPhone devices. | Cash paychecks, business checks, personal checks—almost any type of check. Get your money in minutes – as good as cash and safe to spend – in your bank account or on your prepaid card. |

Antivirus Presence on Acecashexpress.com

Acecashexpress.com protects clients from unwanted online threats and viruses by means of McAfee antivirus. It means that it becomes absolutely impossible to “catch” viruses. When you visit the page with application form there is one more antivirus known as Norton which also encourages clients’ protection. These are proved to be two most effective antiviruses which are devoted to improve online service performance because customers will not find any inconveniences.

Convenience of Application

To get a get a loan on Acecashexpress.com, clients need to log in as a returned client or if – a newcomer, clients should undergo registration.

There are three steps exactly:

- personal information;

- financial information;

- sign loan docs.

Here you should choose state and loan amount will be seen automatically because the loan amount is dependent on the state you live in.

Everything you need is to fill in the following personal information:

- first name;

- last name;

- street address;

- apt. number or suite (if applicable);

- date of birth (mm/dd/yyyy);

- social security number.

Financial information includes the following facts:

- source of income;

- income payment method;

- pay frequency;

- gross pay per check;

- bank account type;

- ABA/Routing number;

- account number;

- confirm your account number;

- bank name;

- bank address;

- bank city;

- bank zip;

- bank phone;

- promo code (optional).

The third step is comprised of methods to sign loan documents, it means you need an electronic signature to complete the agreement.

It seems that a client won’t spend too much time filling in an application form. Only necessary information is required to get a loan. Moreover, it is very convenient that when you choose a state you see available sums of money in a state you choose. In general, this procedure takes 10-15 minutes to be completed. Get started and approved within several minutes with Ace Cash Express.

Is AceCashExpress.com Legit and Safe?

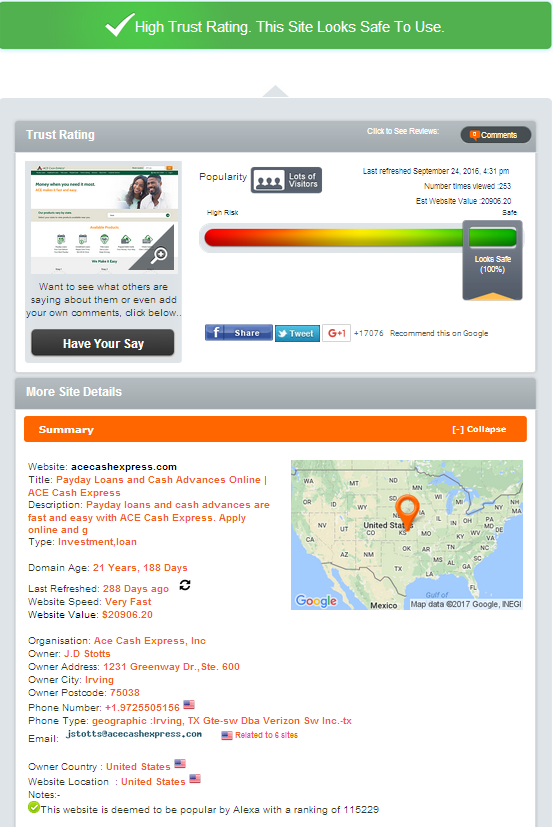

AceCashExpress.com legitimacy and safety are examined by security service – ScamAdviser.com. We find the following data on scamadviser.com:

Scamadviser.com gives 100-% safety to Acecashexpress.com. It means that this online service is high trust and there is no any kind of suspicious activity connected to this online service. Acecashexpress.com has a lot of visitors which proves its popularity and presence of high trust rating. The company owner is the United States of America based and website location is also in the United States. Contact information is identical to information provided in “Contact Us” section on the website itself. Telephone numbers are defined and also coincide with given by Acecashexpress.com.

Domain age is 21 years, 188 days which also improves Ace Cash Express rating. There is a list of websites related to this company owner but they are predominantly based in the USA that’s why ScamAdviser.com doesn’t hesitate their safety and it has no influence on the overall rating of Acecashexpress.com.

To our mind, 100-% safety is given by ScamAdviser.com because there is no hidden information at all. Everything is clear and transparent. Maybe it is really safe to get a loan by means of Ace Cash Express in all states including Washington, DC.

Reviews about Acecashexpress.com

Reviews on Acecashexpress.com

There are reviews on Acecashexpress.com but taken already from TrustPilot.com. It means that clients do not leave reviews about Acecashexpress.com performance. There is no opportunity for customers to leave a feedback because there is no contact form. We do not really know how to estimate this unit.

Reviews on Acecashexpress.com are distinguished according to types of loans:

payday loans:

installment loans:

installment loans:

All the reviews are dated 2017 what shows how many people leave reviews on TrustPilot.

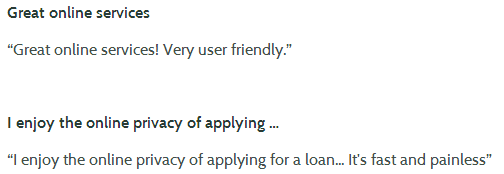

Reviews about Acecashexpress.com on Third Parties Recourses

The main recourses of reviews about Acecashexpress.com are TrustPilot.com where people may find comments about this online service performance. It also helps estimate the number of satisfied and unsatisfied clients. The majority of reviews are positive what makes the Acecashexpress.com rating great – 8,9 out of 10.

This diagram shows how many points are given by each client and their percentage. As you can see, the majority of reviews about Acecashexpress.com has a 5-star rating and amount of satisfied customers is 74,5 %. They write that they are absolutely satisfied with the ACE performance and will come again to take a short-term or installment loans.

We’d like to provide you with negative review proving that not everything is so well-organized on acecashexpress. There are drawbacks to its performance:

Of course, such negative reviews are not enormous – 4,8 percent but they exist and should be taken into account.

As a whole, reviews about Acecashexpress.com help draw a real picture of what is going on in this online payday loan service. It may help people decide to take a loan or not.

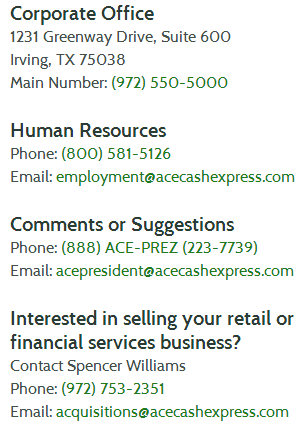

“Contact Us” Information

“Contact Us” Section

There is complete contact information provided by Acecashexpress.com. The Corporate Office is located in Irving, Texas. There are telephone numbers and e-mails. But we come across with the problem that e-mails are not workable.

Telephone numbers and e-mails distinguish according to types of service provided:

Telephone numbers and e-mails distinguish according to types of service provided:

Internet Loans:

- Payday Loans

Phone: (866) 355-6815

Email: [email protected]; - Installment Loans

Phone: (877) 876-2274

Email: [email protected]; - Title Loans

Phone: (877) 769-2172

Email: [email protected].

Collections:

- Loans

Phone: (888) 753-2355

Email: [email protected]; - Title Loan Collections

Phone: (800) 817-5106

Email: [email protected]; - Returned Checks

Phone: (888) 753-2367

Email: [email protected]; - Store Loans

Phone: (877) ACE-CASH

Email: [email protected]; - ACE Prepaid Debit Card Customers

Phone: (866) 387-7363

URL: www.aceelitecard.com.

But here there is the same problem with e-mails which are clickable and give clients no opportunity to come in contact with a support group.

Locations

The following service is available in the following states:

| Payday Loans | Cash Advance | Installment Loans | Title Loans |

| California | California | California | Arizona |

| Idaho | Florida | Delaware | Louisiana |

| Kansas | Idaho | Missouri | New Mexico |

| Louisiana | Kansas | New Mexico | Ohio |

| Minnesota | Louisiana | Ohio | Oregon |

| Ohio | Minnesota | Texas | Tennessee |

| Texas | Ohio | Texas | |

| Texas | Georgia (title pawn in-store) |

Depending on the state, Ace Cash Express may consider as:

- lender itself;

- Credit Services Organization (CSO);

- Credit Access Business (CAB).

Description of these online services is given in the top of this review.

The following states are subject to the following service provided:

| Ace Cash Express | ||

| A lender Itself | Credit Services Organization | Credit Access Business |

| Arizona | Texas | Texas |

| California | Ohio | |

| Colorado | ||

| Delaware | ||

| Florida | ||

| Georgia | ||

| Idaho | ||

| Indiana | ||

| Kansas | ||

| Louisiana | ||

| Minnesota | ||

| Missouri | ||

| New Mexico | ||

| Oklahoma | ||

| Oregon | ||

| South Carolina | ||

| Tennessee | ||

| Virginia | ||

Customer Support Service

There is no live chat as well as a contact form which give clients an opportunity to contact customer support service as fast as possible. Site administration offers to contact customer support service by means of e-mail which doesn’t work. So that we are deprived of all possibilities to contact support group to solve problems which may occur during taking loan process. There is only one method to contact customer support group – by phone.

Conclusion: Reliable Online Service with Various Services Provided

Acecashexpress.com is a lending institution which provides customers with the most popular services:

- payday loans;

- installment loans;

- title loans;

- cash advance.

This facility offers customers online and in-store services in 20 states of the US. At one and the same time, Ace Cash Express may pose itself as a lender itself, Credit Services Organization (CSO) and Credit Access Business (CAB). ScamAdviser.com grants 100-% security for Ace Cash Express because all the contact information is clear and there are no hidden aspects. Moreover, TrustPilot.com provides us with an enormous number of reviews about AceCashExpress.com having 8,9 rating out of 10. There are negative reviews but its percentage is 4,8 only.

As for the service, Ace Cash Express offers clients min loan amount – $50 and max – $5000 depending on the state you live in. Interest rates are calculated individually together with a period. There is an opportunity to extend and refinance a loan. There is no information about bad credit history because for the majority of people online loans are the only one opportunity to cope with financial problems.

So we may come to a conclusion that Ace Cash Express is a reliable online service with diverse products provided online and in-store. If you meet three main requirements, you will be approved in several minutes and money will be transferred with 72 hours.

Ready to Apply?

Ready to Apply?