What are 12 Months Loans?

12MonthsLoansBadCredit.com is not a lender, but a lender-matching service which connects borrowers with payday loan lenders when difficult financial situations occur. As per the website, they can successfully match most of their customers who with the suitable lender who approves them. The main feature of this service that it’s available to borrowers regardless of their bad credit history or its absence and even to those people who have been rejected by all other lending institutions. As mentioned on the website, their main goal is to ensure that each person gets financial help in the shortest term.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Poor credit history |

| Payday Loans | $100 | $5000 | 30 days | From 472% to 841% | SSN number, driver’s license, ABA Routing Number, Account number | Yes |

12MonthsLoansBadCredit.com Loans Types

This lender offers payday loans only. These are short-term loans that are usually small — between $100 and $1000. The main page of the website indicates that despite they are called “12MonthsLoansBadCredit”, they do not provide 12 months loans, but only payday loans that should be repaid on the day you get paid. The main page also lists other names for payday loans: guaranteed approval loans, no credit check loans, personal loans, payday loans direct lender, online payday loans, 1-hour loans, quick payday loans:

Once the user was approved for a loan, the lender usually deposits the funds into the user’s checking account as soon as tomorrow.

Terms of Use

12 Months Loans has the following eligibility criteria for approving payday loans online:

- Be at least 18 years of age;

- Be a resident of the United States;

- Be employed for a minimum of 90 days;

- Have an active bank account;

- Have an active email address and telephone number;

- Meet minimum income requirements of the lender.

The company mentions that lenders usually pay a special attention to the borrower’s income. A steady income is the guarantee that the user can pay off the loan without any problems. Another important aspect: a customer cannot get an amount higher than his current income.

With 12 Months Loans, customers can usually borrow up to $1000, but some lender may provide $1500 and even $5000! The loan amount available will depend on several factors, including the state in which you live and your current financial situation.

Since the company provides customers with payday loans only, they should be repaid within 30 days.

Unfortunately, 12 Months Loans is unable to determine an exact APR that a customer will be charged. Interest rate varies depending on the information you have provided and a lender. Borrowers can only see the APR, fees, and other loans term when redirected to the loan agreement in the application process. However, the company let us know that the minimal APR is 200% and can not exceed 2,290%. Customers should understand that the APR is not their finance charge, the later will be disclosed later on.

Application Process on 12MonthsLoansBadCredit.com

The entire application process with 12MonthsLoansBadCredit takes one business day. All in all, the customer will have to complete three steps to get a loan:

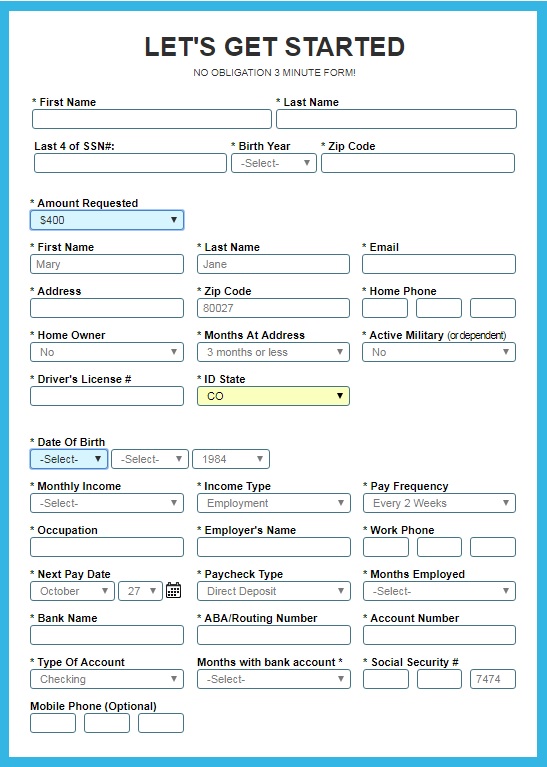

First of all, customers will have to fill out a short online form – it will take a few minutes. They have to provide the lender with some personal, employment and banking information such as name, birth date, address, phone number, the loan amount, employer name, income, SSN number, driver’s license, ABA Routing Number, Account number and some more details. Once they have submitted the application, it will be forwarded to various lenders. In a couple of minutes, they will be matched with a lender from 12MonthsLoans network who will be able to offer a loan according to the user’s requirements. This lender will contact the user immediately to verify the details. In some cases, borrowers may be required to provide some additional information as a proof of their regular income. When applying for a short-term loan with 12MonthsLoansBadCredit, there is a chance that customers may be required to fax some documents for verification, for example, bank statements.

Finally, the lender will make a loan offer which includes the amount the user will get, APR, fees, repayment due date, and all other terms that apply to this particular loan. Customers are fully responsible when reviewing all the terms and conditions offered by 12MonthsLoans. After that, the user will have to provide an electronic signature, and the lender is ready to deposit the funds directly into the user’s bank account as soon as tomorrow in most cases.

As indicated on the website, the money is usually transferred within a few hours or at most one day. However, some users manage to get their funds on the same day.

Loan Repayment on 12MonthsLoansBadCredit.com

Some of 12MonthsLoansBadCredit lenders offer a very simple loan repayment process. Customers can choose the direct withdrawal of money in a loan agreement, or opt for electronic repayment. Most clients choose the direct withdrawal on the due date. This way, they do not need to mail any checks or money orders and do not need to visit an office of the lender. This way of loan repayment also helps to reduce the risk of late repayment and customers can even save some money.

If customers have difficulty repaying a loan on the due date, they need to contact the lender as soon as possible. The lender will add late payment fees which vary by state. He also has several actions available for late loan repayment. To get more information about the lender’s specific actions related to loan late repayments, customers will need to review the loan agreement or contact the lender. Customers should pay attention to the fact that the lender may also charge them for non-sufficient funds. That’s why borrowers should review the loan agreement carefully before providing an electronic signature.

It’s important that the majority of the lenders in 12 Months Loans base do not sell the users’ debts to third-party collection agencies. They promise to be as loyal as possible and try to collect the debt via telephone, email, or text message. Unlike other online lenders, they do not threaten criminal charges. Instead, they usually offer an extended repayment plan. Every lender in the network of 12MonthsLoansBadCredit adheres to the Fair Debt Collection Practices Act to protect borrowers from being harassed by debt collection agencies.

Does 12 Months Loans Offer Loan Extension?

As specified on the website, most lenders in the network of 12 Months Loans are able to offer borrowers a loan extension if they for some reason cannot repay it. Bear in mind that the number of loan extensions is limited and varies by state and lender. However, the company does not recommends such extensions, because they are associated with high late fees and interest rate. So borrowers should always ensure that they will be able to repay a loan before e-signing the loan agreement with 12 Months Loans.

Customers should direct any questions related to a loan extension to the lender.

Customers can have more than one loan with 12 Months Loans at once if their state allows it. However, when trying to get an additional loan through this online service, customers must disclose information about all other payday loans in the application.

12MonthsLoansBadCredit.com Bad Credit

12MonthsLoansBadCredit differs from other lenders in bad credit policy. With this online service, customers with bad credit history or no credit history at all are likely to be approved, even if they have been declined by other banks and microcredit companies. The company can successfully match 90% of the borrowers via its online service.

However, this does not mean that 12 Months Loans Bad Credit does not perform any credit checks. The lenders may also perform additional credit checks with TeleTrack or DP. This is necessary to ensure the client is currently not in bankruptcy and does not have any loans with other lenders.

Technical Characteristics of the Website

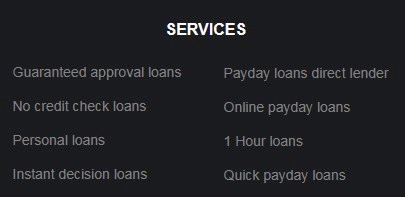

Is 12MonthsLoansBadCredit.com Safe in Terms of Connection?

An encrypted connection is always the guarantee that personal data of users will not be stolen. You can easily check whether the connection is secure or not by looking at the website’s address bar. If a website is encrypted, it will display a green lock. We checked 12MonthsLoansBadCredit.com website using Firefox security tool: it turned out that the website uses a 128-bit SSL encryption – a minimal encryption used by millions of websites all around the world for the protection of personal data such as login, password, banking information and so on. The security certificate of 12MonthsLoansBadCredit.com is verified by COMODO CA Limited:

In addition, the website’s main page displays a seal of Positive SSL Certificate, which is supposed to provide secure online transactions on the website. However, this seal is not clickable, so there is no proof that it’s working properly:

In general, a 128-bit SSL encryption could be enough to protect the users’ data, but it can not be considered the most reliable protection.

12MonthsLoansBadCredit.com Mobile Version

For many clients, the availability of a mobile version makes a big difference. More than half of users prefer using mobile phones or tablets to order drugs online. We decided to check 12MonthsLoansBadCredit.com mobile version, and it has successfully passed a Mobile-Friendly Test:

All page resources were loaded successfully and there are no errors in the website’s functioning, which mean users will not have any problems when using the website’s mobile version. There is no scrolling, everything is displayed correctly. We even suggest that using the mobile version is more convenient than using the full-sized website’s version.

Checking Antivirus

12MonthsLoansBadCredit.com does not use any antivirus protection, which means customers can catch viruses or other “unpleasant surprises” when visiting this website. We consider it a relevant shortage which should be fixed. Reliable online services use antivirus program, and this aspect adds more trust to the company. For now, 12 Months Loans is definitely not the safest place for a loan application.

The Convenience of Using 12MonthsLoansBadCredit.com

To get a loan with 12 Months Loans, borrowers do not need to register, which allows saving time. Instead, they can start an application process right on the main page by clicking the Get Started Now button:

The application form does not differ much from other online lending services and it takes a couple of minutes to fill it out. All that is required to provide some basic information as a social security number, driver’s license, banking information and proof of income.

Customers do not need to provide personal references. Faxing documents is also not required.

An online lender promise provides funds in the user’s account within 2 hours after approval.

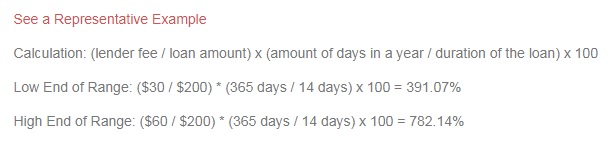

The website has no loan calculator which would help to determine the exact loan cost in a short time. Customers can get details about their loans only after they submit an application form since each lender from the network of 12MonthsLoans has its own rates and terms. And this may seem extremely inconvenient to some borrowers. But that is how this online service works. At least, they provide some representative examples on the website:

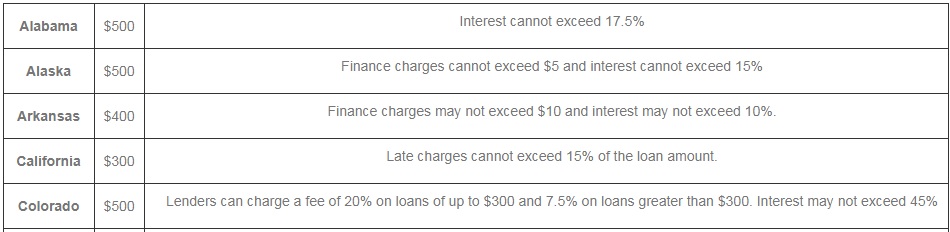

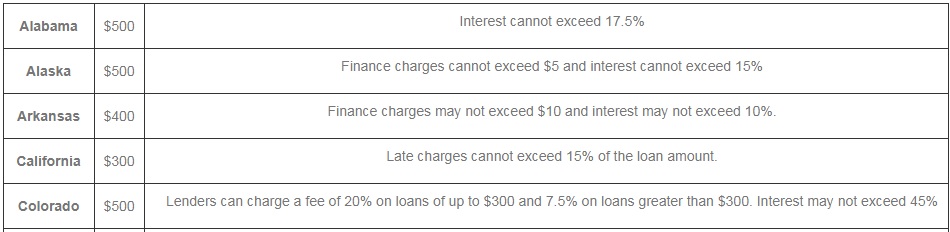

In addition, the website has a table which lists the maximum loan amount in each state, but still, it’s not enough for a user. Below you can see an example – approximate 12MonthsLoansBadCredit interest rates for Alabama, Alaska, Arkansas, California and Colorado:

In general, 12 Month Loans Bad Credit has created a quick and short loan application with an instant decision, so it will not take much time to apply for a payday loan. However, the inability to see the exact rates and fees makes this service not very convenient.

Is 12MonthsLoansBadCredit.com Legit?

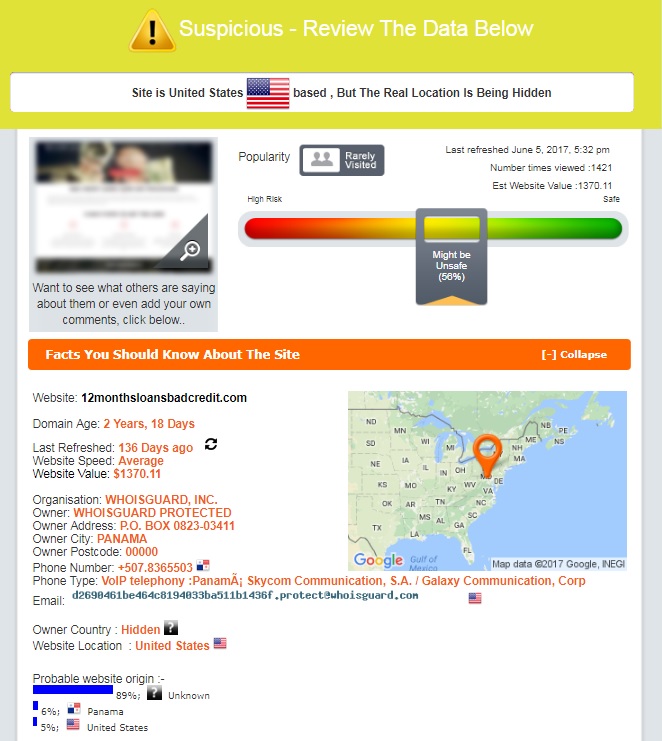

Before taking payday loans online, it’s important to know that the website is reputable. We checked the trust rating and the background of 12MonthsLoansBadCredit.com using Scam Adviser – a third-party checking service online. It turned out that the website has a medium trust-rating – 56% out of 100%. The service has received a status of “Suspicious”:

According to ScamAdviser, 12MonthsLoansBadCredit.com seems safe to use. The domain age is only 2 years. The website is rarely visited and is rarely refreshed. Although the website appears to be based in the USA, its own country is hidden and there are other countries involved, so you should review this information very carefully.

We do not know the exact reason for using an anonymous service which prevents borrowers from identifying the owner of the website, but we suggest it was the main reason why ScamAdviser gave a 56% rating to the company. The website seems legitimate, but we would suggest you contact the website’s owner using a phone number before taking payday loans online.

12MonthsLoansBadCredit.com Reviews

On-site 12 Months Loans Bad Credit reviews

The only “borrower’s reviews” we could find on the website were located on the main page and were placed here by the website’s administration. Of course, all of them are purely positive. Users appreciate 12 Months Loans excellent customer support, an easy application process, quick funding, low and reasonable fees. One of the users says he received his funds within an hour:

No doubt, such comments look more like advertisement, not like real borrowers’ reviews, besides they are purely positive and have no dates. In addition, three reviews are just not enough to assess the credibility of the company. We can trust these reviews and strongly recommend you to search for 12MonthsLoans reviews on independent websites and forums. The results of our research will be described in the nest unit.

12MonthsLoansBadCredit.com Reviews on Third-Party Websites

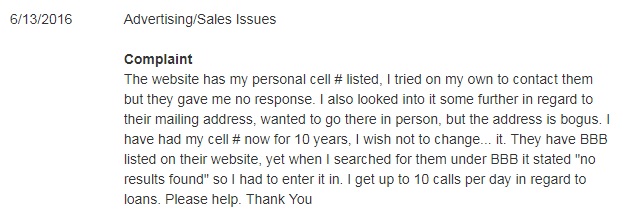

Regretfully, we found only 2 12MonthsLoansBadCredit.com reviews on the net, and all of them were negative. The complaint on bbb.org was dated 2016. The user had an experience with this online lender in the past and now receives up to 10 calls per day. No matter how he tried, he could not stop these annoying calls. However, nothing was mentioned about the services 12MonthsLoans provided:

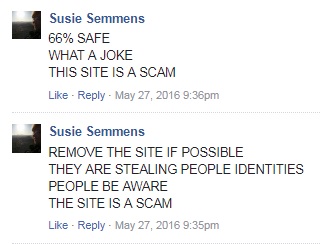

There is one more negative review on ScamAdviser.com dated 2016 which undermines the reputation of the company. The user said this lender is a total scam and can’t have a 56% trust rating. He asked to remove this website from the base of Scam Adviser, since they are stealing people identities:

These complains made us very distrustful of 12 Months Loans services. And it seems suspicious that the lender-matching service has received 2 reviews over 2 years (and both negative). We found no reason to trust this company.

Contact Us section

12MonthsLoansBadCredit.com Contact Information

12 Months Loans provided the following contact information: phone number and email address. These data can be found in a “Contact Us” section:

For some reason, the company mentioned neither physical address nor mailing address, but this information is vital for many customers. However, 12 Months Loans Bad Credit is not a direct lender, which binds the customers with real lenders that might have mailing and physical addresses. However, it’s desirable for the company to be as transparent as possible.

12 Months Loans Locations

12MonthsLoansBadCredit loans are available in 37 US states: Alabama, Alaska, Arkansas, California, Colorado, Delaware, Florida, Hawaii, Idaho, Illinois Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana Nebraska, Nevada, New Hampshire, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, Wyoming.

The loans are not available in Arizona, Connecticut, Georgia, Maryland, Massachusetts, New Jersey, New York, North Carolina, Pennsylvania, Vermont and West Virginia. However, the list of states is subject to changes.

Customer Support Service

As indicated on the website, 12 Months Loans service is always available to answer any general questions about loans the customers might have. Clients should keep in mind that this lender-matching service does not have any access to the specific information and is not authorized to have details about loan agreement customers have entered. The questions about loans rates, fees, terms, and interest should be forwarded directly to the lender.

A customer can reach 12MonthsLoansBadCredit representative by calling 1-888-272-8566, sending an email at [email protected] or using a contact form in the Contact Us section. We used the last option to find out whether borrowers are allowed to repay their loans early. We waited 7 hours but did not get any reply. We suggest there is not a single customer should be ready to wait 48 hours waiting for the answer from a lending service. We conclude that 12 Months Loans customer support is poorly organized.

Conclusion

12MonthsLoansBadCredit.com is not a direct lender that matches customers with payday lenders. The application process requires customers to send this service much personal information, which can be very stressful. Besides, this makes it difficult to know in advance important details that might be easier to understand with a direct lending institution. However, we suggest using 12MonthsLoansBadCredit.com to save time and effort by reviewing multiple payday loans offers at once from numerous 12 Months Loans Bad Credit lenders. What made this online service look a bit suspicious is the absence of positive reviews on the net and the fact that the company uses an anonymous service to hide its identity, which means the risk of unsuccessful experience cannot be excluded.

Ready to Apply?

Ready to Apply?